How can this accounting question be solved?

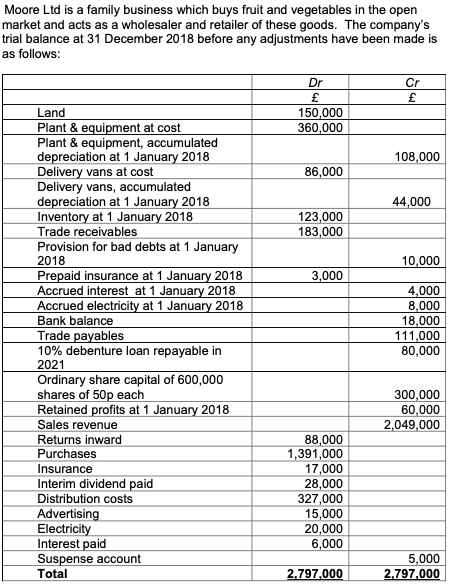

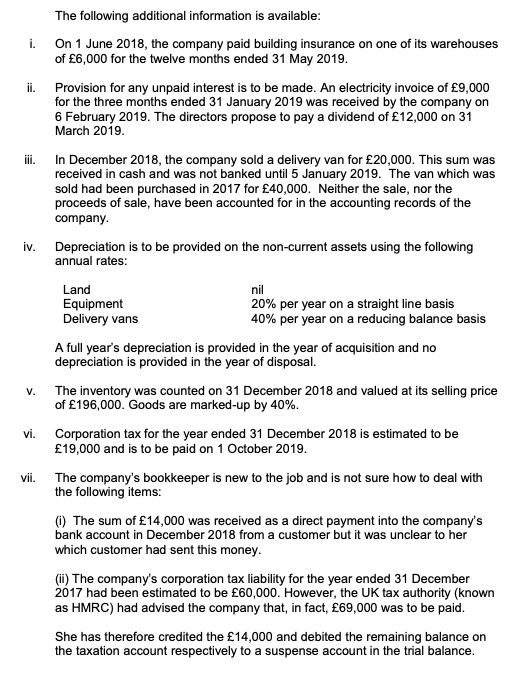

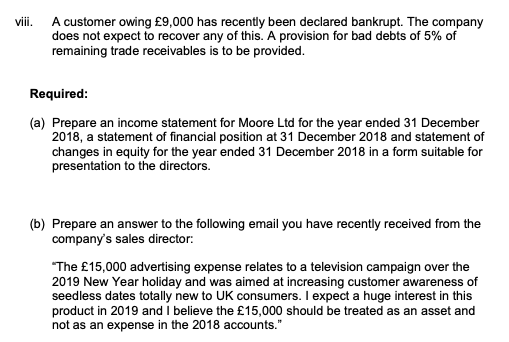

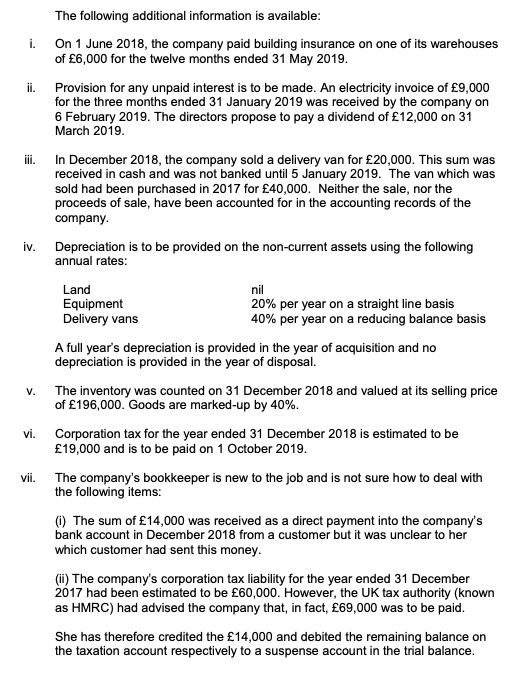

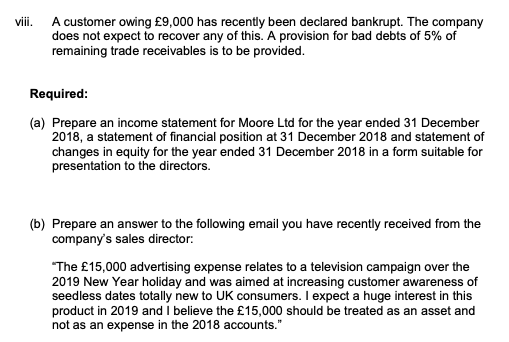

Moore Ltd is a family business which buys fruit and vegetables in the open market and acts as a wholesaler and retailer of these goods. The company's trial balance at 31 December 2018 before any adjustments have been made is as follows: Cr Dr 150,000 360,000 108,000 86,000 44,000 123,000 183,000 10,000 3,000 Land Plant & equipment at cost Plant & equipment, accumulated depreciation at 1 January 2018 Delivery vans at cost Delivery vans, accumulated depreciation at 1 January 2018 Inventory at 1 January 2018 Trade receivables Provision for bad debts at 1 January 2018 Prepaid insurance at 1 January 2018 Accrued interest at 1 January 2018 Accrued electricity at 1 January 2018 Bank balance Trade payables 10% debenture loan repayable in 2021 Ordinary share capital of 600,000 shares of 50p each Retained profits at 1 January 2018 Sales revenue Returns inward Purchases Insurance Interim dividend paid Distribution costs Advertising Electricity Interest paid Suspense account Total 4,000 8,000 18,000 111,000 80,000 300,000 60,000 2,049,000 88,000 1,391,000 17,000 28,000 327,000 15,000 20,000 6,000 2.797,000 5,000 2.797,000 i. ii. The following additional information is available: On 1 June 2018, the company paid building insurance on one of its warehouses of 6,000 for the twelve months ended 31 May 2019. Provision for any unpaid interest is to be made. An electricity invoice of 9,000 for the three months ended 31 January 2019 was received by the company on 6 February 2019. The directors propose to pay a dividend of 12,000 on 31 March 2019. In December 2018, the company sold a delivery van for 20,000. This sum was received in cash and was not banked until 5 January 2019. The van which was sold had been purchased in 2017 for 40,000. Neither the sale, nor the proceeds of sale, have been accounted for in the accounting records of the company Depreciation is to be provided on the non-current assets using the following annual rates: iii. iv. V. vi. Land nil Equipment 20% per year on a straight line basis Delivery vans 40% per year on a reducing balance basis A full year's depreciation is provided in the year of acquisition and no depreciation is provided in the year of disposal. The inventory was counted on 31 December 2018 and valued at its selling price of 196,000. Goods are marked-up by 40%. Corporation tax for the year ended 31 December 2018 is estimated to be 19,000 and is to be paid on 1 October 2019. The company's bookkeeper is new to the job and is not sure how to deal with the following items: () The sum of 14,000 was received as a direct payment into the company's bank account in December 2018 from a customer but it was unclear to her which customer had sent this money. (ii) The company's corporation tax liability for the year ended 31 December 2017 had been estimated to be 60,000. However, the UK tax authority (known as HMRC) had advised the company that, in fact, 69,000 was to be paid. She has therefore credited the 14,000 and debited the remaining balance on the taxation account respectively to a suspense account in the trial balance. vii. viii. A customer owing 9,000 has recently been declared bankrupt. The company does not expect to recover any of this. A provision for bad debts of 5% of remaining trade receivables is to be provided. Required: (a) Prepare an income statement for Moore Ltd for the year ended 31 December 2018, a statement of financial position at 31 December 2018 and statement of changes in equity for the year ended 31 December 2018 in a form suitable for presentation to the directors. (b) Prepare an answer to the following email you have recently received from the company's sales director: "The 15,000 advertising expense relates to a television campaign over the 2019 New Year holiday and was aimed at increasing customer awareness of seedless dates totally new to UK consumers. I expect a huge interest in this product in 2019 and I believe the 15,000 should be treated as an asset and not as an expense in the 2018 accounts