Question: How did Renault customize the Duster for the Indian consumer? Why did Renault choose to manufacture the car in India, and not just import it?

- How did Renault customize the Duster for the Indian consumer?

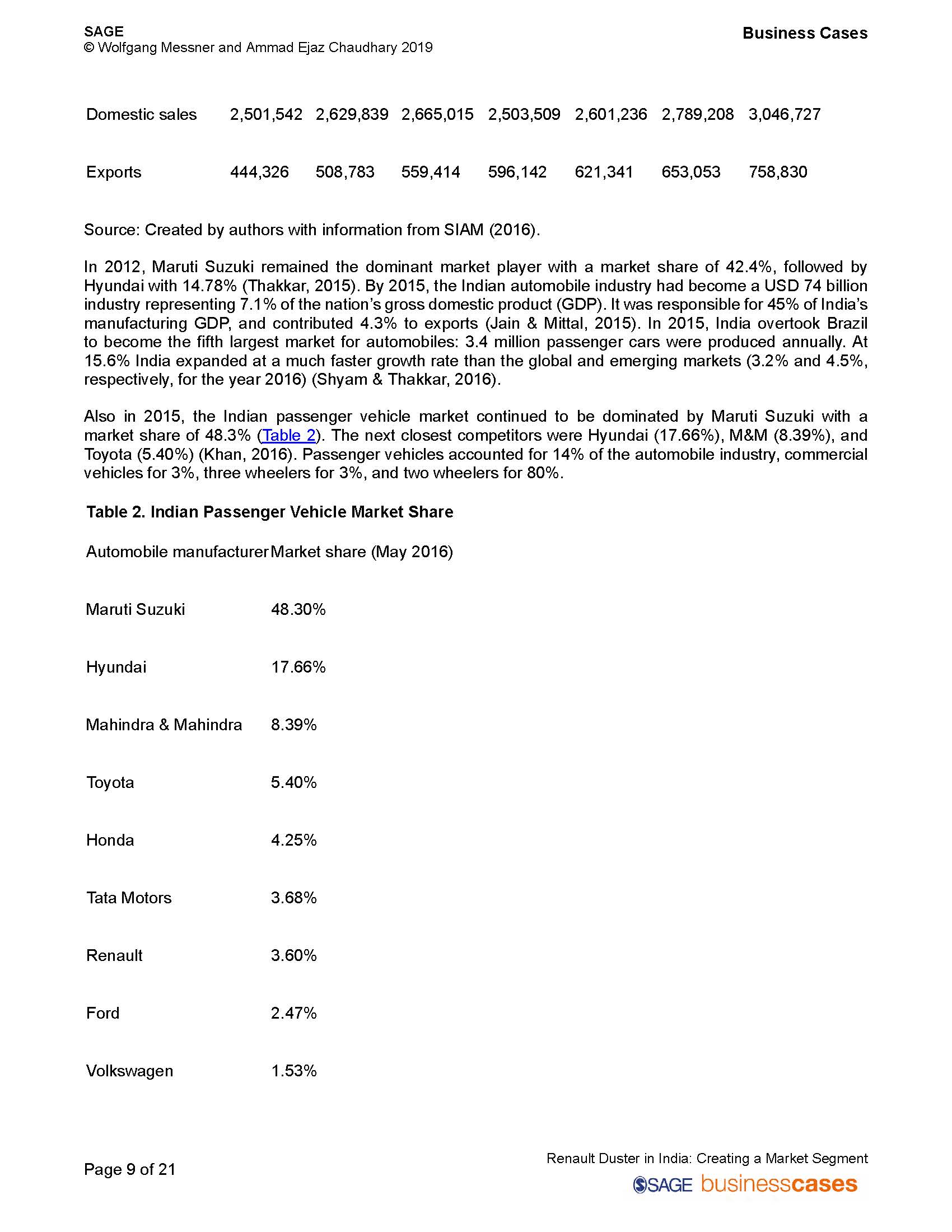

- Why did Renault choose to manufacture the car in India, and not just import it?

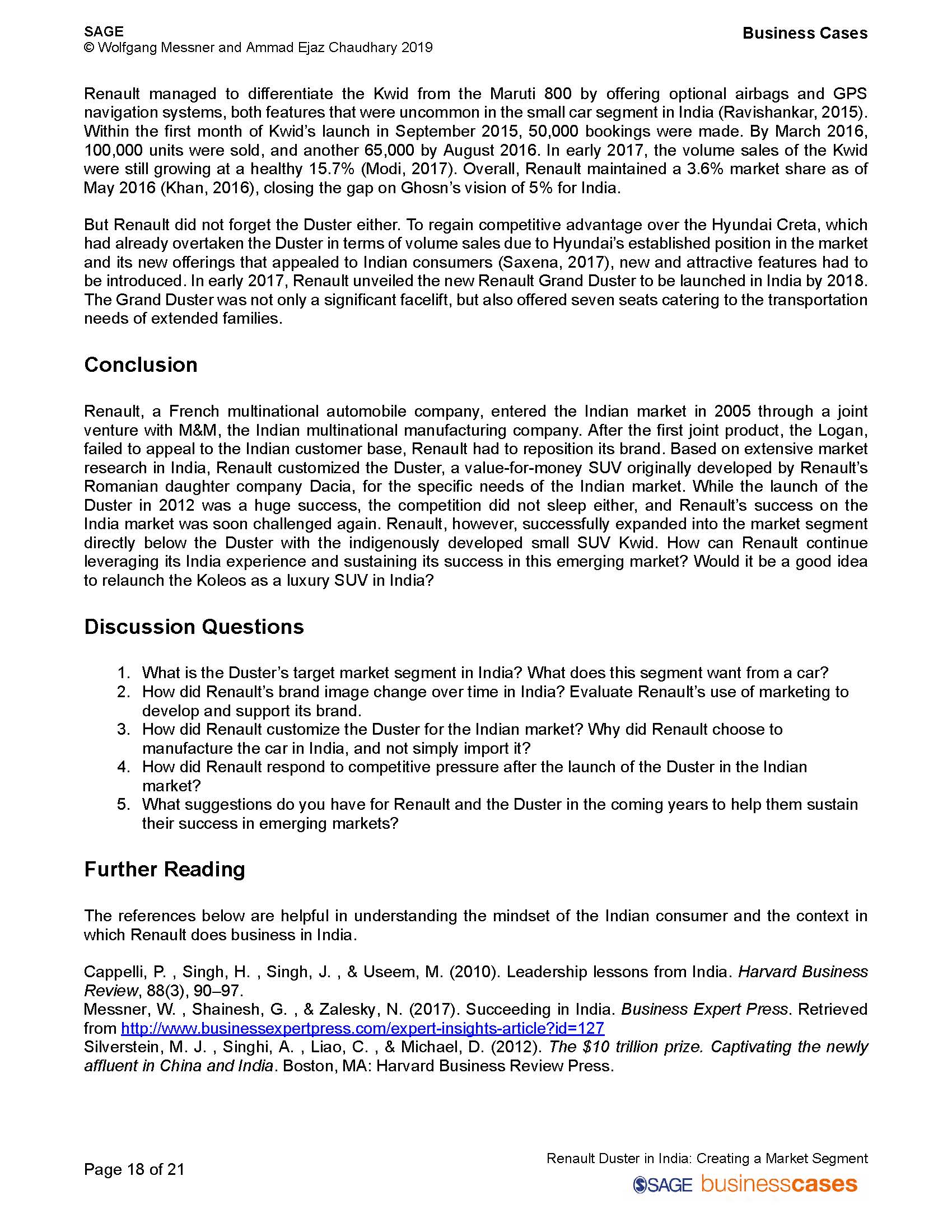

OSAGE businesscases Global Marketing Renault Duster in India: Creating a Market Segment Case Author: Wolfgang Messner & Ammad Ejaz Chaudhary Online Pub Date: January 02, 2019 | Original Pub. Date: 2019 Subject: Emerging Markets, Brand Management & Strategy , Consumer Marketing Level: | Type: Indirect case | Length: 7553 Copyright: @Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Organization: Renault| Dacial Mahindra & Mahindra | Organization size: Large Region: Southern Asia, Eastern Europe, Western Europe | State: Industry: Manufacture of motor vehicles, trailers and semi-trailers Publisher: SAGE Publications: SAGE Business Cases Originals DOI: https://dx.doi. org/10.4135/9781526467836 | Online ISBN: 9781526467836SAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Wolfgang Messner and Ammad Ejaz Chaudhary 2019 This case was prepared for inclusion in SAGE Business Cases primarily as a basis for classroom discussion or self-study, and is not meant to illustrate either effective or ineffective management styles. Nothing herein shall be deemed to be an endorsement of any kind. This case is for scholarly, educational, or personal use only within your university, and cannot be forwarded outside the university or used for other commercial purposes. 2022 SAGE Publications Lid. All Rights Reserved. The case studies on SAGE Business Cases are designed and optimized for online learning. Please refer to the online version of this case to fully experience any video, data embeds, spreadsheets, slides, or other resources that may be included. This content may only be distributed for use within Univ of Maryland Global Campus. https://dx.doi.org/10.4135/9781526467836 Page 2 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Abstract Since India opened herself to global trade in 1991, the country's automobile industry has experienced tremendous growth. Multinational car manufacturers had to acclimate to the local market environment and make an effort to understand the needs of their new customers. The experience of Renault, the French multinational car company, in India exemplifies the process of understanding and adapting to market segments. Renault's initial unsatisfactory release of the Logan was overcome with Renault's subsequent launches of the Duster and Kwid. This comeback demonstrates how learning and adapting to local needs can lead to success in emerging markets, and to recovery of brand image lost from prior setbacks. Case Learning Outcomes By the end ofthis case study, students should be able to: 1. Identify the needs and aspirations of customers in an emerging market like India. 2. Explain how companies can learn about local needs, and what frameworks and processes can support this learning and adaptation process. 3. Understand how differing market needs are mapped into the product design process as companies work to adapt and succeed in market segments. Introduction \"The Duster succeeded because it is the right product at the right time in the right segment at the right price."Sumit Sawhney, CEO & Managing Director, Renault India (Modi, 2016) It is December 2012 in Bangalore, India. The small Renault showroom \"Palace Orchards\" is full of clients who enquire about the newly launched Duster, and want to take the sport utility vehicle (SUW for a test drive. Some try to haggle about the price. Tea and coffee are offered. The atmosphere feels more like a bazaar than a car showroom. But any attempts of negotiation are ruthlessly turned down. Sales associate: \"Sir, there is a three months waiting period for the Duster. We have no cars, how can I offer you a discount? Don't you see how busy we are?" Conversations with some customers in the showroom reveal their opinions about Renault's new SUV, which had been introduced to India in the summer of 2012. Customer 1: \"We just moved back to India for family reasons. We earned good money abroad, so the price of the car is not a big deal. Still, we don't want to spend unnecessarily. We plan to go on many road trips; the ghats (mountains) are just so amazingly beautiful. But our roads here are in a sorry statepotholes everywhere. We want a comfortable and safe car with at least two airbags, and an anti-lock braking breaking system. A full-sized spare wheel would be good; this run-flat technology is nonsense. The Renault Duster has everything we need, and it comes at a decent price.\" Customer 2: \"I own a coffee estate in Coorg some five hours away from here. We often come to Bangalore, and five hours is a long drive. We need a comfortable and fast car. I have just booked the entry-level Duster for my son as a wedding gift. Airbags? Come on? You have a small accident, and boom, the airbag comes out. How much is this going to cost me each time?" Renault Duster in India: Creating a Market Segment Page 3 of 21 , SAGE busmesscases SAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Customer 3: \"The Duster looks like a good car, but it has only five seats. How will I fit my wife, our three young kids, my parents, and our maid in there? These foreign companies just don't understand India!\" Only five years ago, in 2007, Renault had launched its first car in India. This, however, had turned out to be a major disaster; nobody really wanted to buy the car. In 2010, the joint venture with the Indian partner Mahindra 8: Mahindra (IVI&M) was dissolved. How did Renault manage to overcome failure, and launch a car that fit so well in the market in 2012? And how can it build a continuous success story going forward? Indian Automobile Industry and Market India is a very young country; 50% of India's population of nearly 1.3 billion people were below the age of 28 in 2016 (CIA, 2017). Members of the Indian middle class typically live in extended families under one roof. In an Indian metropolissuch as Delhi, Mumbai, Bangalore, or Hyderabadthis is often a condominium. When compared with a U.S. standard, the living space could be considered cramped. Most condominiums have parking spaces allotted to them and older houses normally have very small parking spaces. A typical salary in India after postgraduate studies is about one-third of a US. salary (in absolute monetary terms, purchasing power not taken into consideration). While many costs of daily subsistence are also a lot cheaper in India, prices for comparable cars are often more expensive. Petrol in India is twice as expensive as in the United States. In 2016 in Mumbai, petrol was at INR 73 (USD 1.12) per liter, diesel at INR 61 (USD 0.94) per liter (@ChkPetrolPrice, 2017; Global Petrol Prices, 2017). In the United States, gasoline prices were around USD 0.54 per liter as observed from the average price USD 2.05 per gallon in Columbia, South Carolina (both April 2017) at that time. In this market, the Indian middle-class consumers typically expect from their cars high fuel efficiency, low maintenance costs, room for many people and a comfortable back bench, powerful air conditioning (AC), as well as electronic features. Lower on the priority list are vehicle safety and engine power. These expectations were born from key factors in the lives of Indian consumers, including frugal spending preferences, extended family relationships and living arrangements, high fuel costs, the hot climate, the tendency to hire drivers, and younger consumers' desire to look more upmarket. Indian Automotive Industry: 19471990 The Indian automotive industry has grown considerably since 1897 when the first car traveled on Indian roads. Forty years later, domestic companies such as Hindustan Motors, Premier, Tata Motors, and M&M emerged to initiate the process of vehicle manufacturing in India (CarTrade, 2013). After independence from the UK in 1947, India pursued a social democratic economic policy that prioritized the protection of domestic industries, and imposed limitations on foreign investment through capital controls and trade restrictions. The 19605 and 19705 were dominated by Hindustan Motors on the back of the famous Ambassador model (see Figure 1). In the 1980s, it recorded sales of nearly 24,000 units a year. However, the Ambassador lost against other local and especially foreign cars, and its production was halted in 2014 (Abraham, 2017; CarTrade, 2013). Renault Duster in India: Creating a Market Segment Page 4 of 21 , SAGE busmesscases SAGE Business Cases g Messner and Ammad Ejaz Chaudhary 2019 Figure 1. The Ambassador OR-05C-4003 Source: Photo by Steve Browne and John Verkleir, October 28, 2010. Licensed under cc-by-2.0, https://commons. wikimedia.org/wiki/File:Real_sweet_Ambassador!.jpa (accessed May 13, 2017). The 1980s saw the launch of the compact car Maruti 800 (Figure 2) by Maruti Udyog in collaboration with Japan's Suzuki. It took the Indian market by storm, and became the second longest production car after the Ambassador (Prashanth, 2010). Page 5 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Figure 2. The Maruti 800 (1987 model) MARUTI UGX 6058 Source: Photo by Simrandeep Chamak, August 22, 2009. Licensed under cc-by-4.0, https://commons. wikimedia.org/wiki/File:First_Facelift_Model_of_Maruti_Suzuki_800_in_India.jpa (accessed May 13, 2017) Financial Crisis, Economic Liberalization, and Entry of Global Manufacturers When oil prices went up during the first Gulf War (August 1990 to February 1991), India did not have enough foreign exchange reserves left to buy oil. This in turn led to a flight in capital by an estimated twenty million nonresident Indians, many of whom had invested in high interest accounts in Indian banks. In 1991, India was de-facto bankrupt. But the crisis was also an opportunity for change, and India's Government spearheaded by then Foreign Minister Manmohan Singh began its journey towards trade and economic liberalization Messner, 2009; Centre for Civil Society, 2017). These reforms proved instrumental in the transformation of ndia from a closed economy into a major developing power. The 1990s, thereafter, saw a surge in the entry of foreign manufacturers, especially in the automotive industry (see Figure 3). Page 6 of 21 Renault Duster in India: Creating a Market Segment OSAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Figure 3. Domestic and Foreign Car Manufacturers in India Indian domestic car manufacturers Eicher Eicher Hindustan M. Hindustan M. Hindustan M. Hindustan M. Hindustan M. M&M M&M M&M M&M Hindustan M. Hindustan M. Hindustan M. M&M Maruti Suzuki Maruti Suzuki Maruti Suzuki Maruti Suzuki M&M M&M M&M Premier Premier Premier Premier Premier Premier Premier Premier Sipani Sipani Sipan Sipani Sipan Tata Motors Tata Motors Tata Motors Tata Motors Tata Motors Tata Motors Tata Motors Tata Motors 1900 1920 1940 1950 1960 1970 1980 1990 2000 2010 Fiat Fiat Fiat Standard Standard Fiat BMW BMW GM GM Ford Fiat Fiat Standard GM Ford Ford Hyundai GM GM Honda Hyundai Hyundai Mercedes-B Honda Honda Mitsubishi Mercedes-B. Mercedes-B Toyota Mitsubishi Mitsubishi Foreign car manufacturers Renault Renault Rolls-Royce Rolls-Royce Skoda Skoda Toyota SsangYong Abbreviations: GM = General Motors; Hindustan M. = Hindustan Volkswagen Toyota Motors; M&M = Mahindra & Mahindra; Mercedes-B. = Mercedes Benz Volkswagen Source: Created by authors based on their own market research and information from Becker and Nagporewalla (2010). Spurred by the country's rising economic prowess, Fiat, Ford, General Motors, Honda, Hyundai, Mercedes- Benz, Mitsubishi, Rover, and Toyota all entered the country in the 1990s (Becker & Nagporewalla, 2010). Volkswagen followed suit in the 2000s, and has since then introduced its brands Audi, Lamborghini, Porsche, Skoda, and Volkswagen (Volkswagen, 2017). The lucrativeness of the Indian automobile market, one of the largest in the world, also attracted Renault, the French automobile manufacturer. Between 2005 and 2010, Renault initially operated in India as Mahindra Renault through a joint venture with M&M, and, in 2007, launched a compact family car, the Logan (see Figure 4) (Renault India, 2017). Page 7 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Figure 4. The Renault Logan CITY TAXI KA 53 6389 MERU RELY ON US 1422 4472 1453 6389 Source: Photo by Veeresh Malik, Jun 29, 2008. Licensed under cc-by-2.0, https://commons.wikimedia.org/ wiki/File:Bangalore_Taxi.jpa (accessed May 27, 2017). Indian Automobile Sector 2012-2015 The fiscal year (FY) 2012/13 saw domestic sales of passenger vehicles in India reach 2,665,015 units corresponding to production of 3,231, 058 units; the production surplus was mainly exported. Table 1 presents production, sales, and export trends from FY 2010/11 to FY 2016/17. FY 2012/13 saw a sharp slowdown in domestic sales growth to 1.3% (SIAM, 2016), which, however, could be attributed to an exceptionally strong previous year. Table 1. Performance of the Indian Automobile Industry, 2010-2017 Passenger vehicles FY 2010/11 FY 2011/12 FY 2012/13 FY 2013/14FY 2014/15 FY 2015/16FY 2016/17 Production 2,982,772 3, 146,069 3,231,058 3,087,973 3,221,419 3,465,045 3,791,540 Page 8 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Domestic sales 2,501,542 2,629,839 2,665,015 2,503,509 2,601,236 2,789,208 3,046,727 Exports 444,326 508,783 559,414 596, 142 621,341 653,053 758,830 Source: Created by authors with information from SIAM (2016). In 2012, Maruti Suzuki remained the dominant market player with a market share of 42.4%, followed by Hyundai with 14.78% (Thakkar, 2015). By 2015, the Indian automobile industry had become a USD 74 billion ndustry representing 7.1% of the nation's gross domestic product (GDP). It was responsible for 45% of India's manufacturing GDP, and contributed 4.3% to exports (Jain & Mittal, 2015). In 2015, India overtook Brazil to become the fifth largest market for automobiles: 3.4 million passenger cars were produced annually. At 15.6% India expanded at a much faster growth rate than the global and emerging markets (3.2% and 4.5%, respectively, for the year 2016) (Shyam & Thakkar, 2016). Also in 2015, the Indian passenger vehicle market continued to be dominated by Maruti Suzuki with a market share of 48.3% (Table 2). The next closest competitors were Hyundai (17.66%), M&M (8.39%), and Toyota (5.40%) (Khan, 2016). Passenger vehicles accounted for 14% of the automobile industry, commercial vehicles for 3%, three wheelers for 3%, and two wheelers for 80%. Table 2. Indian Passenger Vehicle Market Share Automobile manufacturer Market share (May 2016) Maruti Suzuki 48.30% Hyundai 17.66% Mahindra & Mahindra 8.39% Toyota 5.40% Honda 4.25% Tata Motors 3.68% Renault 3.60% Ford 2.47% Volkswagen 1.53% Page 9 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Nissan (incl. Datsun) 1.50% General Motors 1. 12% Skoda 0.38% Fiat 0.21% Others 1.51% Source: Created by authors with information from Khan (2016). Small cars remained one of the Indian middle class consumers' most favored passenger vehicles, accounting for nearly 45% of the overall market share (EuroMonitor, 2017). Foreign small car manufacturers, such as Toyota and Hyundai, increased their presence over the years owing to the perception of locally made cars being somewhat sub-standard and of cheap quality (King, 2015). SUVs represented 14% of new sales, and were an important new segment in the country. Luxury car sales remained a repressed segment with overall volumes below 1%. However, the prominence of German luxury cars such as Audi, BMW, and Mercedes along with the growing number of affluent Indian consumers resulted in the expansion of segment sales by nearly 28% in 2015. Leading foreign manufacturers all invested new capital in 2015 (EuroMonitor, 2017). Renault-A Multinational French Car Manufacturer Renault is a French car manufacturer present in 125 countries with group sales of nearly 2.8 million vehicles per annum (Renault UK, 2017). Groupe Renault operates in car manufacturing through its holdings in Nissan Motors (43.4%), Renault SAS (100%), Dacia (99.4%), and Daimler AG (1.55%) (Renault, 2015). In Europe, Renault is a major player with a market share of more than 10%. Despite the corporation's global outreach, France remained the leading market with more than 607,173 units sold in 2015 (Figure 5). Page 10 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Figure 5. Renault Group Sales by Country Russia 151,633 France 145,612 Brazil 117,303 O India 85,974 Germany 70,159 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 Unit sales, 2014 Source: Created by authors with information from PTI (2014). Story of the Duster Three of Renault's five best-selling passenger cars, the Duster, Sandero, and Logan, are all manufactured by its Romanian daughter company Dacia. One of Dacia's global success stories is the mid-segment SUV Duster (see Figure 6), which, originally planned for Europe and a number of North African countries, has since penetrated many other emerging markets, including India. Developed by Dacia, the Duster was first launched in 2010, and has since then produced over one million units both under the Renault and Dacia prands (Renault Group, 2017). The Duster has, over the years, bagged several awards including Top Gear's 'Bargain of the Year" in 2012, which has given credence to its overall image as a family-friendly and affordable SUV. With global sales of 331,238 units in 2015 and being manufactured in three worldwide locations, namely Chennai (India), Pitesti (Romania), and Envigado (Columbia), the Duster became the second most popular Renault car brand (Renault Group, 2017). Page 11 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Figure 6. The Renault Duster (India Top-End Version) KAOS MM 3853 Source: Photo by Wolfgang Messner, February 3, 2013. The international SUV segment was dominated by premium priced models, such as the Land Rover, BMW X5, and Toyota 4Runner with prices ranging between USD 30,000 all the way up to USD 100,000. The Duster, however, positioned itself in Europe on a unique price-value proposition between USD 11,000 to USD 22,000, depending on customers' preferences for additional features versus a real price bargain (Top Gear, 2017). Dacia designed, built, and offered the Duster as an everyday SUV with only basic functionalities, yet superior quality and road performance. We think we'll have two kinds of clients in Europe. First of all, people who need a 4x4 but can't afford the vehicles which are currently on the market from 20 to 40 thousand euros. These clients are condemned to buy second-hand cars. For the same price, we offer them a new car with a 3-year guarantee [... ] The other type of client are Sedan-owners who have always dreamed of owning a 4x4, but have never been able to afford one. They can buy a Duster for the price of a Peugeot 207 or an Opel Corsa. (Vincent Carr, Global Marketing Director, Dacia; as quoted in MediaRenault, n.d.) The Duster can seat up to five adults with ample leg-space and luggage compartment. Special attention is devoted to the aesthetic composition of the Duster with front fog lights, 16" wheels, and roof bars (Auto Trader, 2014). An excerpt from the AutoTrader website describes the Duster's interior design, Inside, comfort and convenience are at their best with standard manual air conditioning, front and rear power windows, remote central locking, electrically adjustable side mirrors, height adjustable steering wheel and driver seat, CD/MP3/Radio [... ], four speakers [... ], jack and USB ports, Bluetooth@ connectivity, onboard computer, and rear parking sensors. (Auto Trader, 2014) Page 12 of 21 Renault Duster in India: Creating a Market Segment OSAGE businesscasesSAGE Business Cas Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Within its first six years, more than a million Dusters were sold, with Russia being the biggest market, followed by France, Brazil, India, and Germany (PTI, 2014). Despite focusing on affordability, the Duster was able to maintain an image of quality owing to strict adherence to Renault's quality standards. While Western European consumers considered the Dacia brand as a "cheap" car, consumers in Russia, Brazil, and India received the Duster with plenty of enthusiasm. In the emerging economies, the car's low entry price was not equated with cheapness. Renault Enters India in 2005 Renault was officially registered in Mumbai in October 2005 (Renault India, 2017). As a relatively late entrant to the Indian market, Renault formed a 51:49 joint venture with M&M, the latter being the majority partner. The joint venture's main purpose was a single product alliance for the launch of the Renault Logan in India under the banner of Mahindra Renault (Figure 4). The Logan was designed by Dacia in 2004 as a mid-sized sedan for new markets with high growth potential, to be marketed to families who owned just one vehicle, and to businesses such as taxi companies, which needed a sturdy and reliable car. For India, the Logan was customized and stripped off many of its costlier design features. In May 2007, nearly two years after Renault's initial incorporation in India, the Logan was launched through the Mahindra Renault joint venture (Renault India, 2017), and produced at M&M's facilities. M&M also assumed control of financing and distribution while Renault was responsible for quality control, engineering, and purchasing (The Hindu, 2005). The Logan was, however, unable to generate the expected enthusiasm with Indian customers. Indian customers felt that the Logan had antiquated looks, and they perceived the pricing as too high (Madhavan, 2013). Reviews in Indian car magazines pointed out the following, The car looks like a box with a few bold styling touches. [...] Designed as a basic car, with little attention paid to design, it's little surprise that the insides lack any flair. The single-piece, square-shaped dashboard is functional at best. [...] Renault has taken its low-cost mantra too far. (AutoCarIndia, 2009 The price superiority claimed by Mahindra Renault was unfounded because Maruti, Tata, Hyundai, and Ford were already offering their vehicles below the Logan's price range of INR 450,000 (USD 9,400) to INR 650,000 (USD 13,600; prices as per 2009). Mahindra Renault was unable to lower their production costs due to a high reliance on imported parts. Even the engines were directly imported from France. The market leaders Maruti Suzuki and Tata, on the other hand, had a much higher percentage of localization enabling them to price more aggressively (Baggonkar, 2009). The failure of the Logan venture was so huge that it led to Renault's divorce from M&M in 2010. Renault's brand name in India took a massive hit. M&M, however, continued to manufacture the Logan under a special licensing agreement (Renault India, 2017). Renault subsequently tied up with Bajaj Auto Lid. to build an ultra- cheap car in an attempt to counter Tata's Nano. But when Bajaj showcased the production-ready model to Renault, the product turned out to be a quadricycle rather than a car. And so, in 2011, this alliance had to be abandoned as well (Raj, 2015). After these false starts, Renault needed to turnaround quickly to ensure its stakes in the booming automobile sector of the world's second-most-populous country. Death and Rebirth: Reimagining the Renault Brand in India In order to prove its international reputation to the Indian market, Renault participated in the New Delhi Auto Expo 2010 for the first time, showcasing a large array of cars from its global range. Following a favorable reception, Renault announced the launch of country-wide Renault dealerships and an investment of INR 45 billion (USD 1 billion) to establish a manufacturing plant together with its global partner Nissan in the South- Indian city of Chennai (Renault India, 2017). Renault started introducing a series of premium offerings from Europe to the Indian market. The Renault Fluence and Koleos, a sedan and SUV, respectively, were launched in 2011 with a bloated price tag. Subsequently, the Renault Pulse, a premium priced compact car, was launched in a glamorous event on the eve of the Indian Grand Prix (Madhavan, 2013). While these cars were unable to generate volume sales Page 13 of 21 Renault Duster in India: Creating a Market Segment SSAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 owing to their high price in a market dominated by value-formoney seeking customers, Renault's brand image improved with respect to superior quality and technical excellence, eventually paving the way for the India launch of the Duster during the Auto Expo of 2012. Going Mass-Market: Introducing the Duster to India \"We believe there are three pillars in ensuring the success of a car the right product, at the right cost, launched at the right time [...]. We created a new segment [...] and the response was overwhelming.\"Sumit Sawhney, CEO & Managing Director, Renault India (Shrivastava, 2015) Following Renault's lackluster performance in India, the launch of the Duster was watched with anxiety. The Duster would clearly be the company's make or break into India. The Duster instantly generated an unprecedented media and customer frenzy. It was named Indian Car of the Year in 2013 (by AutoCarin, Bloomberg, NDTV, and Economic Times), and Compact SUV of the Year (by NDTV, Car India, and CNBC). In total, the Duster won 29 awards in India (Daily FT, 2015). This extraordinary reception even led to customers being turned awaydespite three shifts of round the clock manufacturing in Renault's India plants (Gautam, 2012). Early customer reviews ranged from praise for the value-formoney offering to a disappointment over the dealers' perceived inefficiencies handling customer demand. \"At 8.02 Iakhs [INR 802,000], I would any day choose the Duster dCi over a '7-seater' Scorpio or Safari.\" \"For people who have always wanted an SUV and don't have a big budget, this is certainly a good option.\" \"I was promised delivery within a month, we have been making multiple calls, till last week the update was the vehicle is awaiting RTO approval, and now they say vehicles are approved and on their way to delivery, but they are not committing to a date.\" (BHP Reviewer, 2012) With this success, Renault changed the landscape of the Indian automobile industry, which was historically dominated by compact and low price sedans. Despite its limited Indian dealership network, the Duster sold more than 140,000 units within its first four years, and represented the most popular utility vehicle in the segment (Yashvardhan, 2016). Understanding the Indian customer was essential to delivering a car that would capture the complex mindset and wants of Indians. Prior to launching the Duster in India, Renault set out to understand the emerging Indian market. Renault identified a focus group of 200 people. Next, 30 families from this focus group across five Indian cities were chosen for an ethnographic study. Members of Renault's product development team lived with these customers and their families to observe them, and most importantly understand their lives and needs. They also discussed with them what they liked and did not like about the vehicles they currently owned. This approach helped Renault identify target market segments for the Duster in India: young and aspiring middle class in the metropolis who want a big carto impress family, friends, and colleagues at work. People who like to drive, and get out of the city over the week-end for trips; 0 upper middle class and lower upper class in Tier-2 and Tier-3 cities; people who live in nuclear families (rather than extended families), and do not mind the Duster's five- seat limitation; and o upper class in the small town and villages, who need an off-road capable car. This includes coffee and tea plantation owners, factory owners, doctors, etc. Renault also learned that these Indian consumers expected certain things from an SUV. First and foremost, they wanted to stand out from the crowd of small car owners, signaling that they had arrived at higher levels. A slightly higher purchase price was often accepted, but running costs (fuel efficiency and maintenance costs) Renault Duster in India: Creating a Market Segment Page 14 of 21 , SAGE busmesscases SAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 needed to be similar to a smaller car. Despite this expectation, Indian consumers did not want an oversized SUV because it would make maneuvering the car through bumper-to-bumper traffic jams and finding a parking space a nightmare. Renault's market research eventually yielded a set of 41 necessary modifications to the Duster's European version. Through Renault's ethnographic studies, the company learned that the ability of an SUV to offer sedan-like fuel efficiency was a critical factor in Indian consumers' purchase decisions; in addition, the car's rugged exteriors were able to draw attention. Other changes, such as rear seat comfort, reading lights, and a mobile charger were also incorporated into the Indian version. Moreover, the rough roadside conditions demanded special variations to the suspension. We understood that a critical purchasing factor of a car in India is the exterior design. People loved an SUV with rugged looks that stood out in the crowd, but at the same time wanted it to operationally perform like a sedaneasy to drive and good fuel efficiency. (Armelle Guerin, Director, Product Planning, Renault India; as quoted in Madhavan, 2013) Also, Renault's research indicated that the macro-environment was ripe for an \"affordable\" SUV supplied by a foreign manufacturer. The general favorable attitude in India towards foreign made products certainly contributed to the Duster's success. But the accompanying marketing also helped hype up the brand promise of hip, cool, and urban. The Duster was launched with an initial slogan of \"Big. Beautiful. Efficient.\" in 2012, which emphasized the Duster's characteristics and their importance to the Indian consumer: powerful engine which provides a high mileage; . driving comfort both in stop-and-go traffic in the city, on highways, and off-road; - perfect design for driving on bad roads with potholes and speed bumps; bullish exterior and comfortable interior design; and . accessible price. By 2016, Renault started using the slogan \"What's stopping you?\" and highlighted its comfort and capacity for adventure. Over that time, Renault's multi-channel marketing approach included radio, television, print, and social media with celebrity endorsements being used across all these channels. In India, celebrities, like Bollywood actors, use their social status or fame to help promote a product and offer it legitimacy. Renault aligned with Ranbir Kapoor, one of India's highest paid and most attractive actors, as a brand endorser focusing on the Duster and Kwid. In addition, the Gang of Dusters (G.o.D.) built a network of owners who would travel and explore different parts of the country in their Dusters. It was modeled similar to the Harley Owners Group (H.O.G.), and inspired by the successful Bollywood movie Gangs of Wasseypur, which was popular for its bold language and action-packed sequences. By 2015, G.o.D. already undertook 14 trips across India with membership crossing 40,000 Duster owners. Moreover, G.0.D. members were provided complimentary services such as car wash, AC performance check, and special offers such as insurance renewal, or wheel alignment. With 50,000 app downloads and significant social media buzz, G.o.D. managed to achieve an above-expectation following and popularity among Duster owners and enthusiasts (Yashvardhan, 2016). The unique price positioning of the Duster, however, was perhaps the biggest contributor to its early success. The foreign design and quality appeal effectively drew customers towards the Duster, and away from both the perceived low comfort and low quality stigma of local competitors and the premium but fuel inefficient disadvantage of foreign SUVs. With a starting price tag of INR 799,000 (USD 14,400), the Duster revolutionized the SUV market segment. Prior to the Duster, most SUVs in India were priced from INR 1.5 million (USD 27,000) onwards with the majority of foreign models in the range of INR 2.5 million (USD 45,000) (Madhavan, 2013). The Indian domestic SUVs offered at a comparable price, on the other hand, were considered cheap and sub-standard. Renault Duster in India: Creating a Market Segment Page 15 of 21 , SAGE busmesscases SAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Addressing Challenges: Only One Car and a Growing Competition Ford's EcoSport was the first major challenger to the Duster in the affordable SUV segment in India. The model was launched by Ford India in June 2013, and led to an almost instant decrease in Duster's sales by 30% within a month (Srikant, 2015). "We expect EcoSport to be a game changer for Ford in India, and also set a benchmark in the Indian auto industry," said Joginder Singh, President & Managing Director, Ford India Bhargava, 2013). In 2015, Hyundai also ventured into the compact SUV segment with the launch of the Hyundai Creta at a starting price of INR 859,000 (USD 13,400), i.e., at approximately the same price as the Duster. Similarly, Maruti stepped its feet in the compact SUV segment with the Maruti S Cross at an entry price of INR 834,000 (USD 13,000) (ET, 2015). Kenichi Ayukawa, CEO, Maruti said, "We are targeting the premium segment for the first time as [our] 45% market share in the passenger vehicles market leaves us vying for the other 55% of market currently not with us" (Chauhan, 2015). In addition, various manufacturers offered vehicles in the premium SUV segment for consumers who expected premium service, both in the showroom or garage and on the road with roadside support. Premium SUVs by Toyota, Mitsubishi, and Honda all marketed better than the Renault Koleos, which only sold a meager 61 units across India in 2015. And so the Koleos was pulled from the Indian market in 2017. Renault's overdependence on the Duster as its lone revenue driver in India presented Renault's leadership eam with a real challenge regarding sustained market share and future growth opportunities. The combined share of the other Renault models (Fluence, Pulse, Scala, and Koleos) accounted for only 10% of total sales; the Duster was solely responsible for the other 90% (Raj, 2013). All direct competitors offered cars at comparable prices (Table 3). Given the ever increasing competition, it was becoming more and more difficult for Renault to sustain its India growth story on the back of a singular prime offering. Table 3. Compact SUV Segment Price Range Automobile manufacturer Price range (INR) Price range (USD) Renault Duster 835,000 to 1,362,000 12,760 to 20,820 Ford EcoSport 675,000 to 1,024,000 10,320 to 15,650 Hyundai Creta 750,000 to 1,300,000 11,460 to 19,870 Maruti Suzuki S Cross 800,000 to 1, 100,000 12,230 to 16,810 USD prices based on conversion rate of USD 1 = INR 65.269, as of October 31, 2015. Source: Created by authors with information from NDTV Auto Team (2015). Repeating the Success Story in a Different Segment While Renault's success in India was totally dependent on the Duster, there was a huge market segment of first-time car buyers directly underneath the Duster, which was till then primarily served by the Maruti 800. And so Renault toyed with the idea of replicating the Duster's success in the segment of small cars by launching the Renault Kwid (see Figure 7), an 800 cc five-seater mini SUV with a sleek design, in September 2015. In Page 16 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 contrast to the Duster, which was developed by Dacia in Romania, and then adapted to the requirements of Indian customers and road conditions, the Kwid was inspired by the needs of Indian first-time car buyers, and entirely developed in India. According to Carlos Ghosn, Chairman & CEO, Renault, "Renault Kwid will be the game-changer for us in India [... ]. [It] will help us achieve our goal of 5% market share" (Madhavan, 2015). Figure 7. The Renault Kwid KL 11BB8817 Source: Photo by Aswin Krishna Poyil, November 11, 2016. Licensed under cc-by-4.0, https://commons. wikimedia. org/wiki/File:Renault Kwid_RXT(O).jpq (accessed May 31, 2017). The Kwid had a starting price of only INR 300,000 (USD 4,700). With a navigation system and excellent fuel-efficiency, Renault offered its Indian customers the best value for money in the segment. With 97% manufacturing at local level in India and reliance on local Indian suppliers, Renault was able to reduce costs and barriers to purchase. Such cost-efficiencies achieved through localization helped deliver exciting features at minimal additional cost. In comparison, luxury car manufacturers like BMW and Mercedes had 50 and 60% localization across their models in India respectively (TranslateMedia, 2016). 35% of the Kwid's first customers were from Tier-2 and Tier-3 cities (i.e., not from the metropolitan areas of Bangalore, Mumbai Delhi, etc.), 40% were below the age of 28, and 15% were female customers (Khan, 2015). The Kwid was designed for the Indian market, but with future plans to roll it out to other countries on the subcontinent and to other South-East Asian markets (Madhavan, 2015). The car's design also set it apart from established models such as the Maruti 800. Its high ground clearance and SUV-like body provided the Kwid with more upmarket aesthetics luring the exterior-conscious Indian consumers: "We could not have done it in France or Japan. We did it in India while leveraging our global expertise. India is not an easy market. We are learning our way. Kwid's success will show that we have learnt a lot," said Carlos Ghosn, Chairman & CEO, Renault (Madhavan, 2015). Page 17 of 21 Renault Duster in India: Creating a Market Segment OSAGE businesscasesSAGE iness C Wolfgang Messner and Ammad Ejaz Chaudhary 2019 Renault managed to differentiate the Kwid from the Maruti 800 by offering optional airbags and GPS navigation systems, both ures that were uncommon in the small car segment in India (Ravishankar, 2015). Within the first month of Kwid's launch in September 2015, 50,000 bookings were made. By March 2016, 100,000 units were sold, and another 65,000 by August 2016. In early 2017, the volume sales of the Kwid were still growing at a healthy 15.7% (Modi, 2017). Overall, Renault maintained a 3.6% market share as of May 2016 (Khan, 2016), closing the gap on Ghosn's vision of 5% for India. But Renault did not forget the Duster either. To regain competitive advantage over the Hyundai Creta, which had already overtaken the Duster in terms of volume sales due to Hyundai's established position in the market and its new offerings that appealed to Indian consumers (Saxena, 2017), new and attractive features had to be introduced. In early 2017, Renault unveiled the new Renault Grand Duster to be launched in India by 2018. The Grand Duster was not only a significant facelift, but also offered seven seats catering to the transportation needs of extended families. Conclusion Renault, a French multinational automobile company, entered the Indian market in 2005 through a joint venture with M&M, the Indian multinational manufacturing company. After the first joint product, the Logan, failed to appeal to the Indian customer base, Renault had to reposition its brand. Based on extensive market research in India, Renault customized the Duster, a value-for-money SUV originally developed by Renault's Romanian daughter company Dacia, for the specific needs of the Indian market. While the launch of the Duster in 2012 was a huge success, the competition did not sleep either, and Renault's success on the India market was soon challenged again. Renault, however, successfully expanded into the market segment directly below the Duster with the indigenously developed small SUV Kwid. How can Renault continue leveraging its India experience and sustaining its success in this emerging market? Would it be a good idea to relaunch the Koleos as a luxury SUV in India? Discussion Questions 1. What is the Duster's target market segment in India? What does this segment want from a car? 2. How did Renault's brand image change over time in India? Evaluate Renault's use of marketing to develop and support its brand. 3. How did Renault customize the Duster for the Indian market? Why did Renault choose to manufacture the car in India, and not simply import it? 4. How did Renault respond to competitive pressure after the launch of the Duster in the Indian market? 5. What suggestions do you have for Renault and the Duster in the coming years to help them sustain their success in emerging markets? Further Reading The references below are helpful in understanding the mindset of the Indian consumer and the context in which Renault does business in India. Cappelli, P. , Singh, H. , Singh, J. , & Useem, M. (2010). Leadership lessons from India. Harvard Business Review, 88(3), 90-97. Messner, W. , Shainesh, G. , & Zalesky, N. (2017). Succeeding in India. Business Expert Press. Retrieved rom http://www.businessexpertpress.com/expert-insights-article?id=127 Silverstein, M. J. , Singhi, A. , Liao, C. , & Michael, D. (2012). The $10 trillion prize. Captivating the newly affluent in China and India. Boston, MA: Harvard Business Review Press. Page 18 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 References @ChkPetrolPrice. (2017, March 31). Petrol and diesel prices in India. Retrieved from http://www.checkpetrolprice.com/Current/Petrol-price-in-India.php and http://www.checkpetrolprice.com/ Current/Diesel-price-In-India.php Abraham, B. (2017, February 11). Hindustan Motors sells the iconic Ambassador car brand to French company Peugeot for just 280 crores. India Times. Retrieved from http://www.indiatimes.comews/india/ hindustan-motors-sells-the-iconic-ambassador-car-brand-to-french-company-peugeot-for- just-80-crores-271302.html AutoCarlndia. (2009, September 14). Mahindra Renault Logan 1.5 DLS review. Retrieved from http://m.autocarindia.com/Reviews/Review.aspx?CIID=269159&page=1 Auto Trader. (2014). New Renault Duster. Retrieved from http://www.autotrader.co.za/car-news/renault/ duster/b80bd239-6452-4697-9765-eaa638ef72da-new-renault-duster Baggonkar, S. (2009, November 10). What went wrong with Logan. Business Standard. Retrieved from http://www.business-standard.com/article/companies/what-went-wrong-with-logan-109111000042_1.html Becker, D. , & Nagporewalla, Y. (2010, December 31). The Indian automotive industry. Evolving dynamics. Retrieved from https://www.kpma.de/docs/Auto_survey.pdf Bhargava, Y. (2013, June 26). Ford drives in compact EcoSport. The Hindu. Retrieved from http://www.thehindu.com/business/Industry/ford-drives-in-compact-ecosport/article4853522.ece BHP Reviewer. (2012, July). Renault Duster: Official launch report. Retrieved from http:/www.team-bhp.com/ forum/indian-car-scene/122963-renault-duster-official-launch-report-4.html CarTrade. (2013, December 9). A brief history of the Indian automobile industry. Retrieved from https://www.cartrade.com/car-bike-news/a-brief-history-of-the-indian-automobile-industry-122518.html Centre for Civil Society. (2017, March 19). 1991: Economic reforms. Retrieved from http://indiabefore91.in/ 1991-economic-reforms Chauhan, C. P. (2015, August 06). Maruti Suzuki S-Cross launched at a starting price of Rs 8.34 lakh. The Economic Times. Retrieved from http://economictimes.indiatimes.comews/industry/autoews/passenger- vehicle/cars/maruti-suzuki-s-cross-launched-at-a-starting-price-of-rs-8-34-lakh/articleshow/48357269.cms CIA. (2017, May 1). The world factbook: India. Retrieved from https://www.cia.gov/library/publications/the- world-factbook/geos/in.html Daily FT. (2015, January 26). Renault Duster bags most awards in India. Retrieved from http://www.ft.lk/ article/384804/Renault-Duster-bags-most-awards-in-India ET. (2015, July 22). Hyundai Creta SUV launched at a starting price of Rs 8.59 lakh. The Economic Times. Retrieved from http://economictimes.indiatimes.comews/industry/autoews/passenger-vehicle/uv/hyundai- creta-suv-launched-at-a-starting-price-of-rs-8-59-lakh/articleshow/48156369.cms EuroMonitor. (2017, January 31). Motor vehicles, trailers and semitrailers in India: ISIC 34. Retrieved from http://www.euromonitor.com/motor-vehicles-trailers-and-semi-trailers-in-india-Isic-34/report Gautam. (2012, September 9). To buy a Renault Duster you have wait for long, 15k bookings crossed. Retrieved from http://www.goaonwheels.com/to-buy-a-renault-duster-you-have-wait-for-long-15k-bookings- crossed/ Global Petrol Prices. (2017, March 27). Gasoline prices, liter. Retrieved from http://www.globalpetrolprices.com/gasoline_prices/ Jain, A. , & Mittal, K. (2015, October 20). Indian automotive industry: The road ahead. Retrieved from http://www.forbesindia.com/blog/business-strategy/indian-automotive-industry-the-road-ahead/ Khan, J. (2015, October 12). Renault to target Tier-4 markets with kwid car off to a flying start. Retrieved from https://www.motorbeam.com/2015/10/cars/renault-kwid/renault-to-target-tier-4-markets-with-kwid-car-off-to- a-flying-start/ Khan, N. A. (2016, June 2). Complete Indian passenger vehicle sales analysis for May 2016. India Times. Retrieved from http://auto.economictimes.indiatimes.comews/industry/complete-indian-passenger-vehicle- sales-analysis-for-may-2016/52543651 King, N. (2015, April 28). India's car market returns to growth: Potential to be the largest market by 2030. Retrieved from http://www.portal.euromonitor.com.pallas2.tcl.sc.edu/portal/analysis/tab Madhavan, N. (2013, October 27). Dusting off the competition. Business Today, 157-161. Madhavan, N. (2015, May 20). Renault launches Kwid to 'conquer' Indian market. Retrieved from http://www.forbesindia.com/article/special/renault-launches-kwid-to-conquer-indian-market/40317/1 Messner, W. (2009). Working with India. The softer aspects of a successful collaboration with the Indian IT & Page 19 of 21 Renault Duster in India: Creating a Market Segment SSAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 BPO industry. Heidelberg, Germany: Springer. Modi, A. (2016, August 9). How Renault put itself back in the game. Business Standard. Retrieved from http://www.business-standard.com/article/specials/how-renault-put-itself-back-in-the- game-116080901678_1.html Modi, A. (2017, February 27). Clash of the titans: Renault's Kwid skids on volume. Business Standard. Retrieved from http://www.business-standard.com/article/companies/clash-of-the-titans-renault-s-kwid-skids- on-volume-117022600688 1.htm NDTV Auto Team. (2015, October 1). Hyundai Creta vs Maruti Suzuki S-Cross vs Renault Duster vs Ford EcoSport: Specifications comparison. Retrieved from http://auto.ndtv.comews/hyundai-creta-vs-maruti- suzuki-s-cross-vs-renault-duster-vs-ford-ecosport-specifications-comparison-776780 Prashanth, J. (2010, February 13). The Maruti 800 story. Retrieved from http://www.indiancarsbikes.in/cars/ maruti-800-tribute-3703/ PTI. (2014, April 13). India fourth largest global market for Renault's Duster. Times of India. Retrieved from http://www.timesofindia.indiatimes.com/business/india-business/India-fourth-largest-global-market-for- Renaults-Duster/articleshow/33690370.cms Raj, A. (2013, June 4). Renault Duster overtakes rivals aschallenge looms from Ford EcoSport. Retrieved from http://www.livemint.com/Industry/TulRbd7QUMyDYVcxyAO74L/Renault-India-hits-sweet-spot-with- DusterEcoSport-maypose.html Raj, A. (2015, June 13). Carlos Ghosn seeks Indian 'jugaad' for Renault. Retrieved from http://www.livemint.com/Opinion/dtqZ9HrDWeQqbBVSVtwVUL/Carlos-Ghosn-seeks-Indian-jugaad-for- Renault.html Ravishankar, S. (2015, May 20). Renault targets aspirational buyers in India with new premium compact car Kwid. Reuters India. Retrieved from http:/in.reuters.com/article/renault-car-kwid-hatchback-india- idINKBNOO50XX20150520 Renault. (2015, December 31). Groupe Renault: 2015 annual report. Retrieved from https://rapport- annuel.group.renault.com/#/en/les-chiffres-cle Renault Group. (2017). Dacia vehicles. Retrieved from https://group.renault.com/en/company-vehicles/ discover/dacia/ Renault India. (2017, March 19). Milestones in India. Retrieved from https://www.renault.co.in/discover- renault/renault-in-india.html Renault UK. (2017, March 19). Our journey through the years and across the globe: Renault history. Retrieved from https://www.renault.co.uk/discover-renault/renault-globally.html Saxena, D. (2017, March 24). 2017 Renault Grand Duster likely to make its global debut in September! Retrieved from http://www.carblogindia.com/2017-renault-grand-duster-7-seater/ Shrivastava, A. (2015, August 24). "Right product, right cost and right timing ensure the success of a car:" Sumit Sawhney, country CEO & MD, Renault India Operations. Retrieved from http://www.afaqs.comews/ story/45365 Right-product-right-cost-and-right-timing-ensure-the-success-of-a-car-Sumit-Sawhney-country- CEO--MD-Renault-India-Operations Shyam, A. R. , & Thakkar, K. (2016, February 3). India chapter set to overtake global auto industry growth story. Times of India. Retrieved from http:/timesofindia.indiatimes.com/business/india-business/India- chapter-set-to-overtake-global-auto-industry-growth-story/articleshow/50830265.cms SIAM. (2016, December 31). Indian automobile industry statistics. Retrieved from http://www.siamindia.com/ statistics.aspx?mpgid=8&pgidtrail= 13 Srikant, J. (2015, July 15). The big fight: Hyundai Creta vs Ford Ecosport vs Renault Duster. India Times. Retrieved from http://auto.economictimes.indiatimes.comews/passenger-vehicle/uv/the-big-fight-hyundai- creta-vs-ford-ecosport-vs-renault-duster/48046023 Thakkar, K. (2015, August 11). Maruti wins the majority, corners highest market share in over a decade. Retrieved from http://auto.economictimes.indiatimes.comews/passenger-vehicle/cars/maruti-wins-the- majority-corners-highest-market-share-In-over-a-decade/48438555 The Hindu. (2005, February 23). Mahindra ties up with Renault. Joint venture to make Logan cars in India. The Hindu Business Line. Retrieved from http://www.thehindubusinessline.com/todays-paper/mahindra-ties- up-with-renault-joint-venture-to-make-logan-cars-in-india/article2169628.ece Top Gear . (2017, March 19). The Top Gear car reviews: Dacia Duster. Retrieved from https://www.topgear.com/car-reviews/dacia/duster TranslateMedia. (2016, September 15). How automotive manufacturers localize for emerging market consumers. Retrieved from https://www.translatemedia.com/us/blog-usa/automotive-manufacturers-localize- Page 20 of 21 Renault Duster in India: Creating a Market Segment SSAGE businesscasesSAGE Business Cases Wolfgang Messner and Ammad Ejaz Chaudhary 2019 emerging-market-consumers/ Volkswagen. (2017, March 19). Indian spirit meets German excellence. Retrieved from http://www.volkswagen.co.in/en/volkswagen_world/volkswagen_india.html Yashvardhan. (2016, June 15). How Renault India made an SUV cool: A case study on the Gang of Dusters. Retrieved from http://www.digitalvidya.com/blog/how-renault-india-made-an-suv-cool-a-case-study- on-the-gang-of-dusters/ https://dx.doi.org/10.4135/978 1526467836 Page 21 of 21 Renault Duster in India: Creating a Market Segment SAGE businesscases

Step by Step Solution

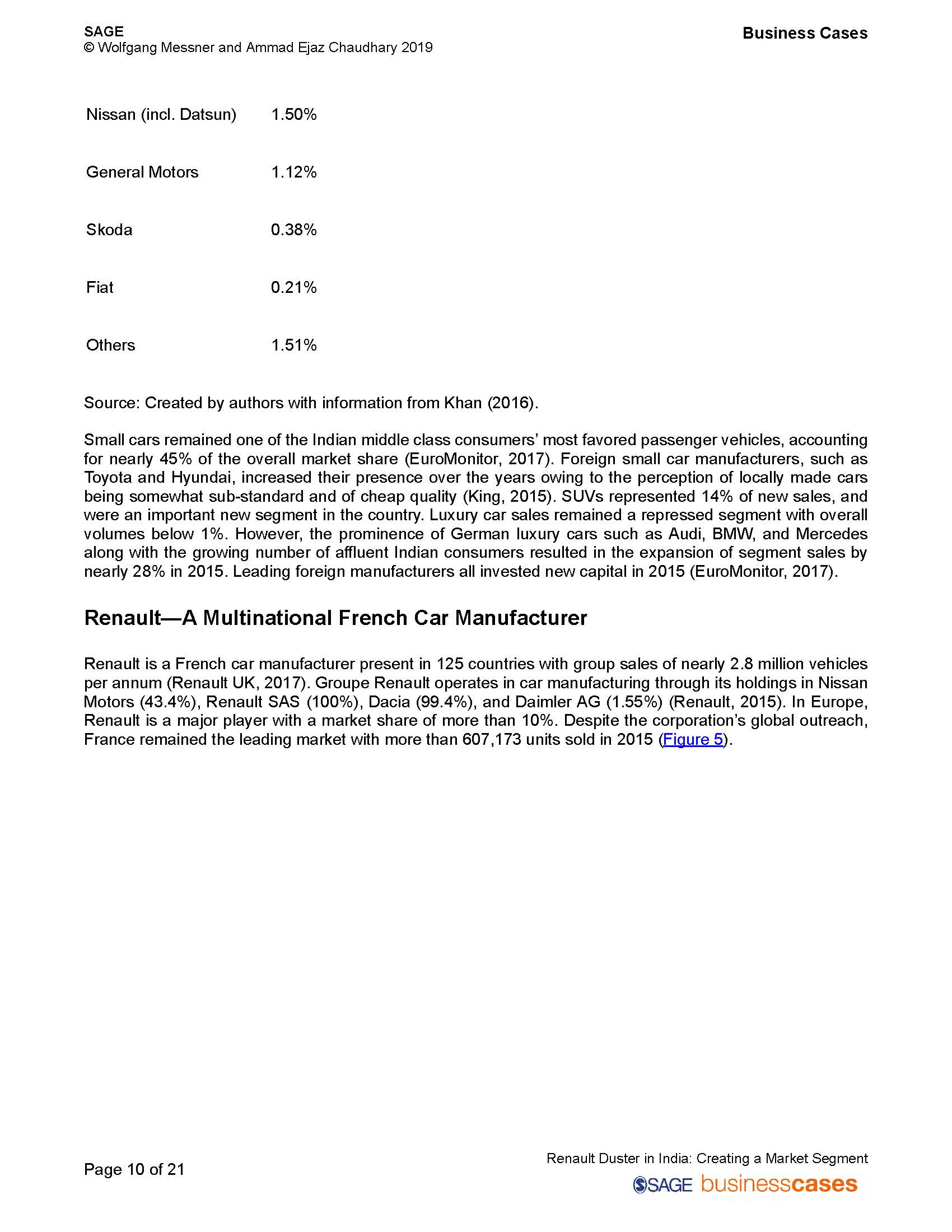

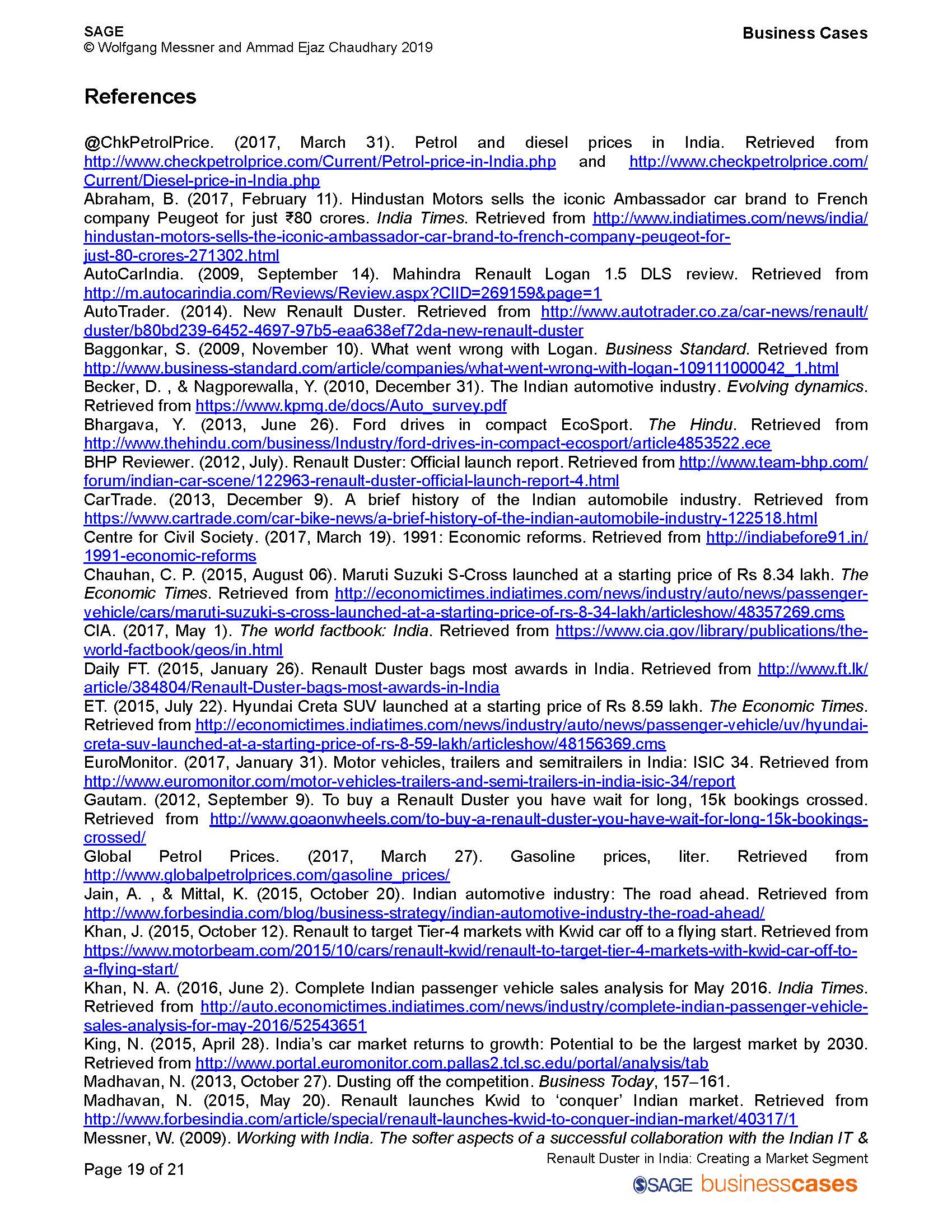

There are 3 Steps involved in it

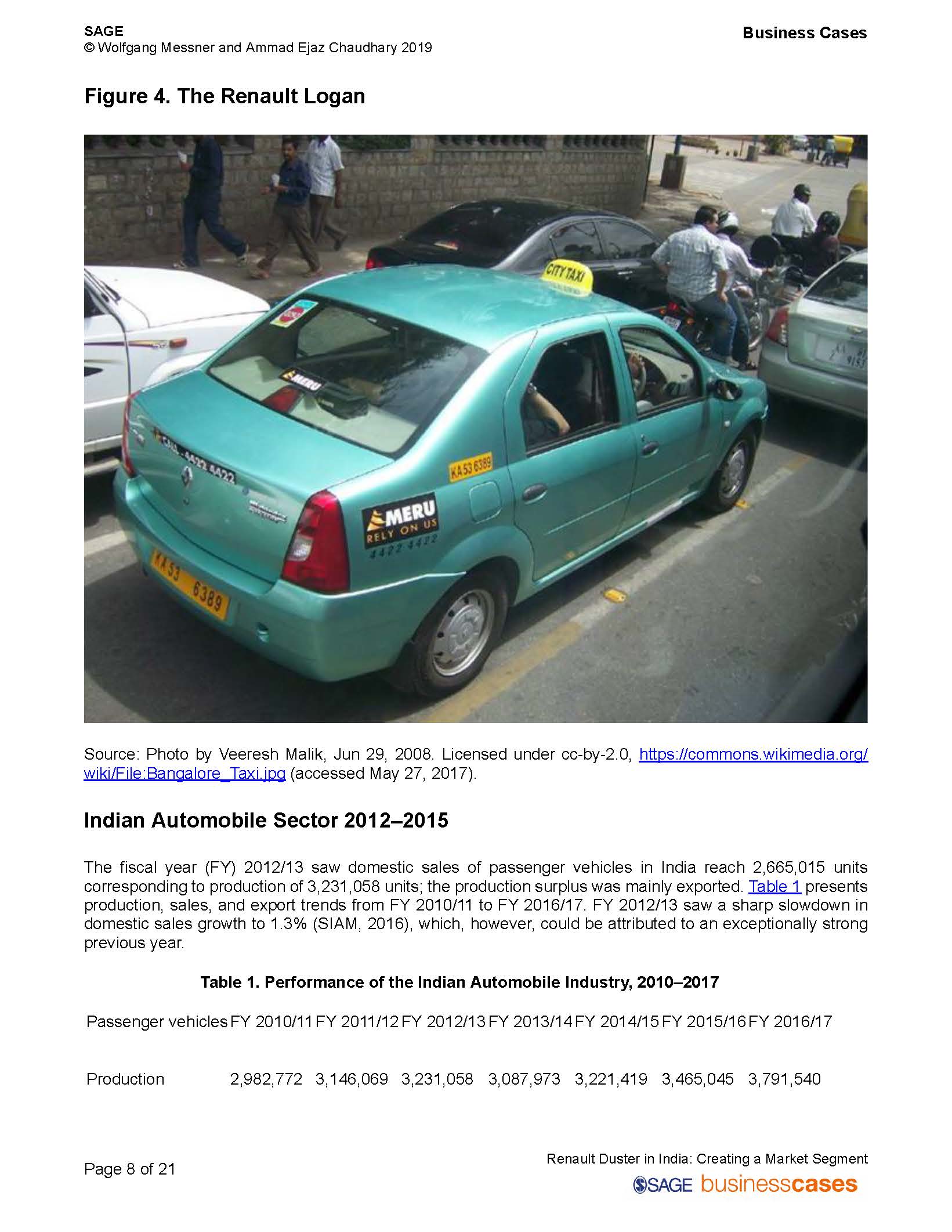

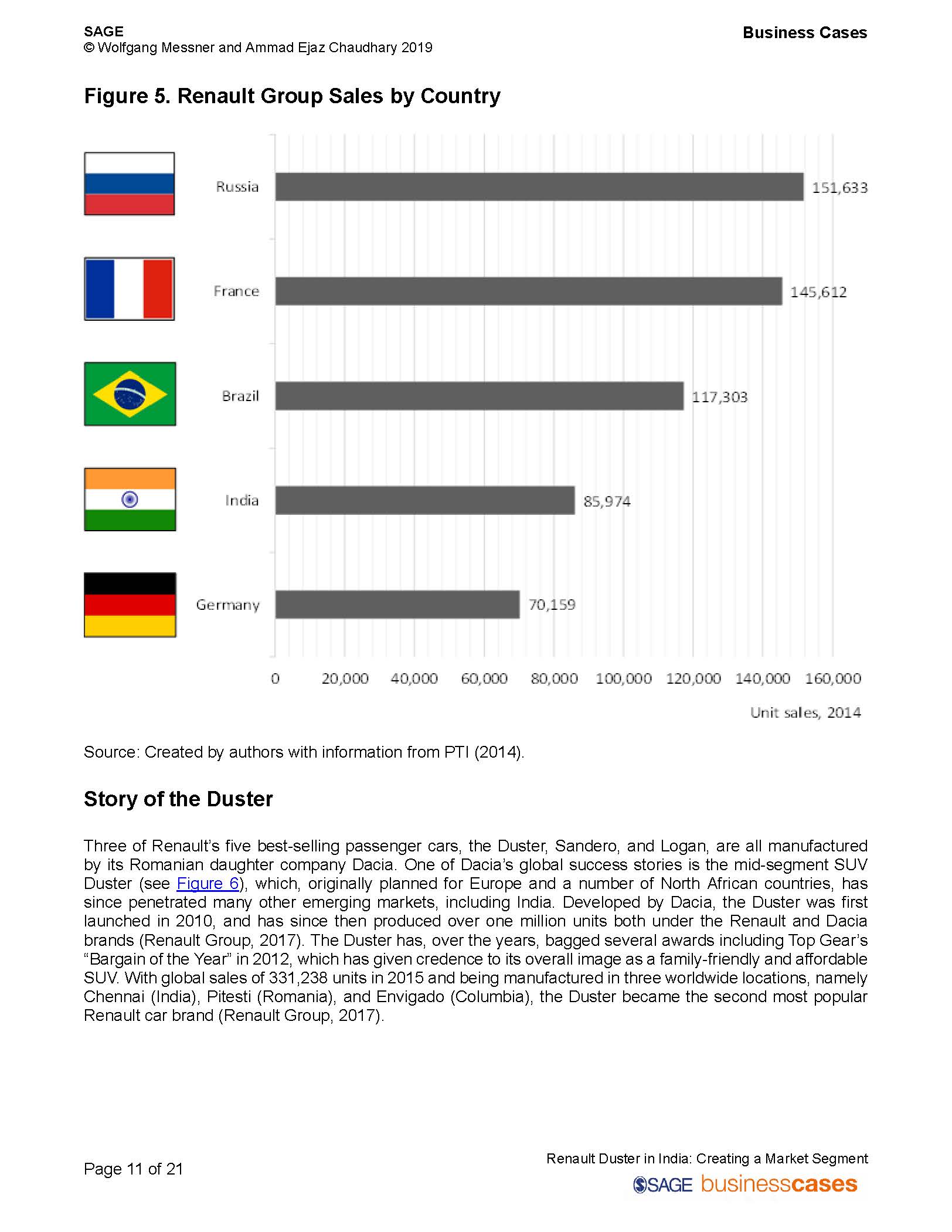

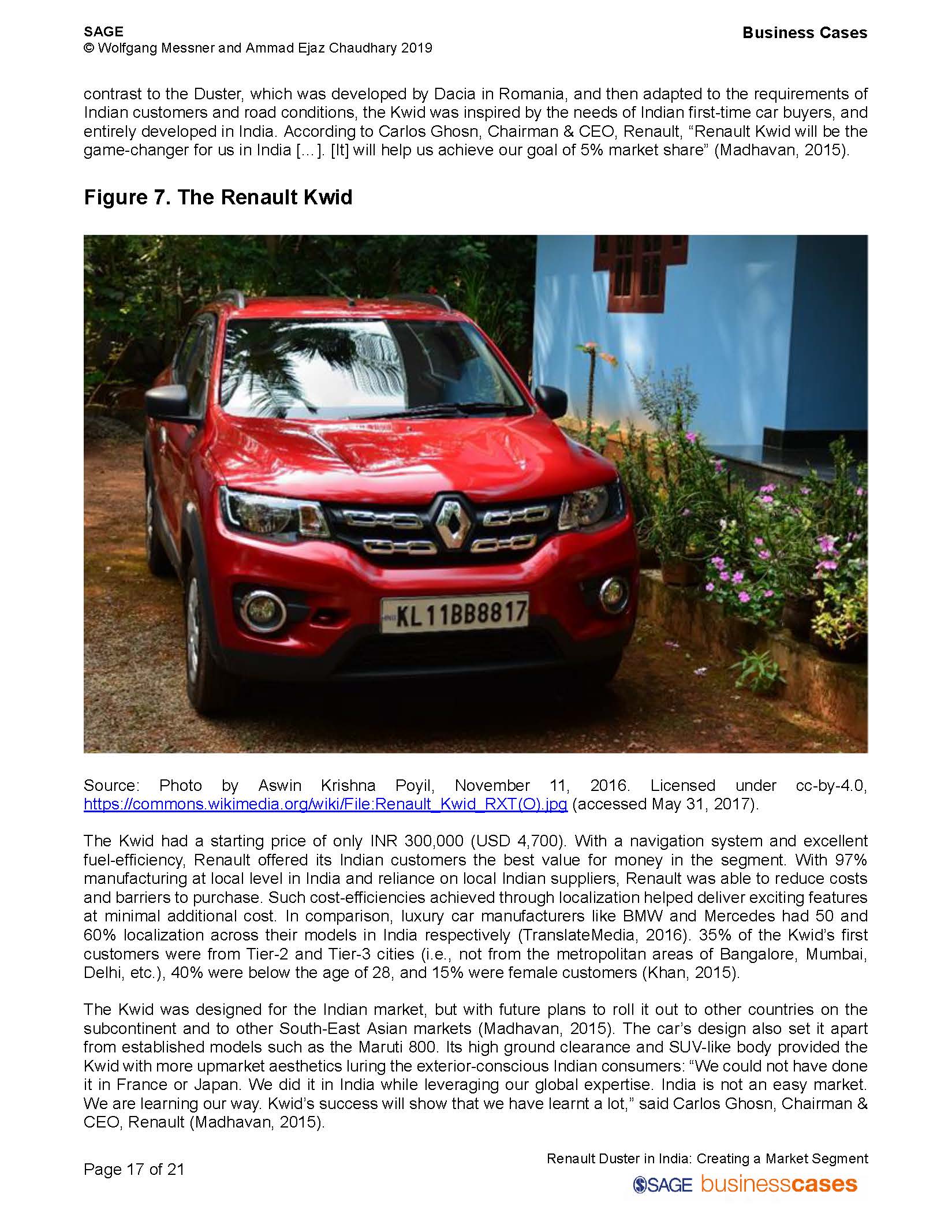

Get step-by-step solutions from verified subject matter experts