Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How did they get highlighted answer. What calculation they did? THIS IS A TAX Based Course Question? Jennifer Ratushny is a middle-level manager at a

How did they get highlighted answer. What calculation they did? THIS IS A TAX Based Course Question?

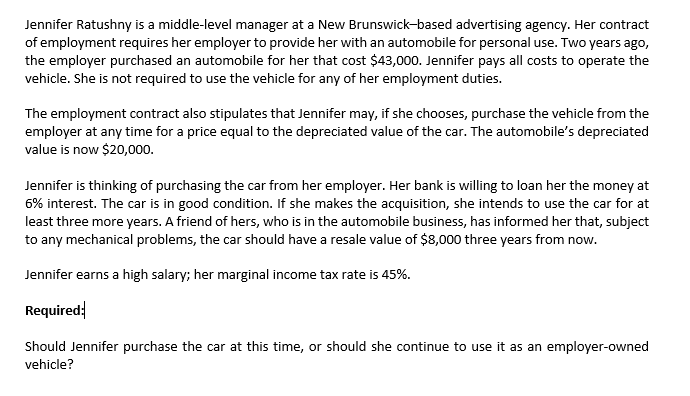

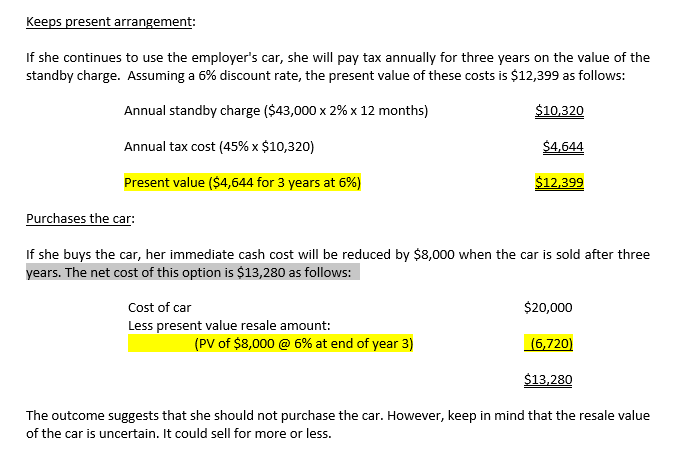

Jennifer Ratushny is a middle-level manager at a New Brunswick-based advertising agency. Her contract of employment requires her employer to provide her with an automobile for personal use. Two years ago, the employer purchased an automobile for her that cost $43,000. Jennifer pays all costs to operate the vehicle. She is not required to use the vehicle for any of her employment duties. The employment contract also stipulates that Jennifer may, if she chooses, purchase the vehicle from the employer at any time for a price equal to the depreciated value of the car. The automobile's depreciated value is now $20,000. Jennifer is thinking of purchasing the car from her employer. Her bank is willing to loan her the money at 6% interest. The car is in good condition. If she makes the acquisition, she intends to use the car for at least three more years. A friend of hers, who is in the automobile business, has informed her that, subject to any mechanical problems, the car should have a resale value of $8,000 three years from now. Jennifer earns a high salary; her marginal income tax rate is 45%. Required: Should Jennifer purchase the car at this time, or should she continue to use it as an employer-owned vehicle? Keeps present arrangement: If she continues to use the employer's car, she will pay tax annually for three years on the value of the standby charge. Assuming a 6% discount rate, the present value of these costs is $12,399 as follows: Annual standby charge ($43,000 x 2% x 12 months) $10,320 Annual tax cost (45% x $10,320) $4,644 Present value ($4,644 for 3 years at 6%) $12,399 Purchases the car: If she buys the car, her immediate cash cost will be reduced by $8,000 when the car is sold after three years. The net cost of this option is $13,280 as follows: $20,000 Cost of car Less present value resale amount: (PV of $8,000 @ 6% at end of year 3) (6,720) $13,280 The outcome suggests that she should not purchase the car. However, keep in mind that the resale value of the car is uncertain. It could sell for more or less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started