Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how did they get the value for year 1 , 2 and 3 which add up to 161969 k 29 Taration of individuals The vehicle

how did they get the value for year 1 , 2 and 3 which add up to 161969 k

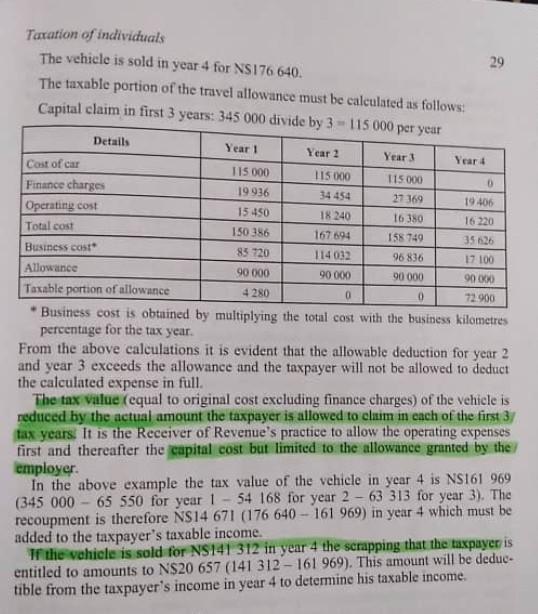

29 Taration of individuals The vehicle is sold in year 4 for NS176 640. The taxable portion of the travel allowance must be calculated as follows: Capital claim in first 3 years: 345 000 divide by 3 - 115 000 per year D Details Year 1 Year 2 Year 3 Year 4 Cost of car 115 000 115 000 115 000 Finance charges 19936 34 454 27 369 19406 Operating cost 15450 18 240 16 380 16220 Total cost 150 386 167 694 158 749 35 626 Business cost 85 720 114032 96 836 17 100 Allowance 90 000 90 000 90 000 90 000 Taxable portion of allowance 4 280 0 0 72.900 * Business cost is obtained by multiplying the total cost with the business kilometres percentage for the tax year. From the above calculations it is evident that the allowable deduction for year 2 and year 3 exceeds the allowance and the taxpayer will not be allowed to deduct the calculated expense in full. The tax value (equal to original cost excluding finance charges) of the vehicle is reduced by the actual amount the taxpayer is allowed to claim in each of the first 3 tax years. It is the Receiver of Revenue's practice to allow the operating expenses first and thereafter the capital cost but limited to the allowance granted by the employer. In the above example the tax value of the vehicle in year 4 is NS161 969 (345 000 65 550 for year 1 -54 168 for year 2 - 63 313 for year 3). The recoupment is therefore NS14 671 (176 640 - 161 969) in year 4 which must be added to the taxpayer's taxable income. Tf the vehicle is sold for NS141 312 in year 4 the scrapping that the taxpayer is entitled to amounts to N$20 657 (141 312 - 161 969). This amount will be deduc- tible from the taxpayer's income in year 4 to determine his taxable incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started