Answered step by step

Verified Expert Solution

Question

1 Approved Answer

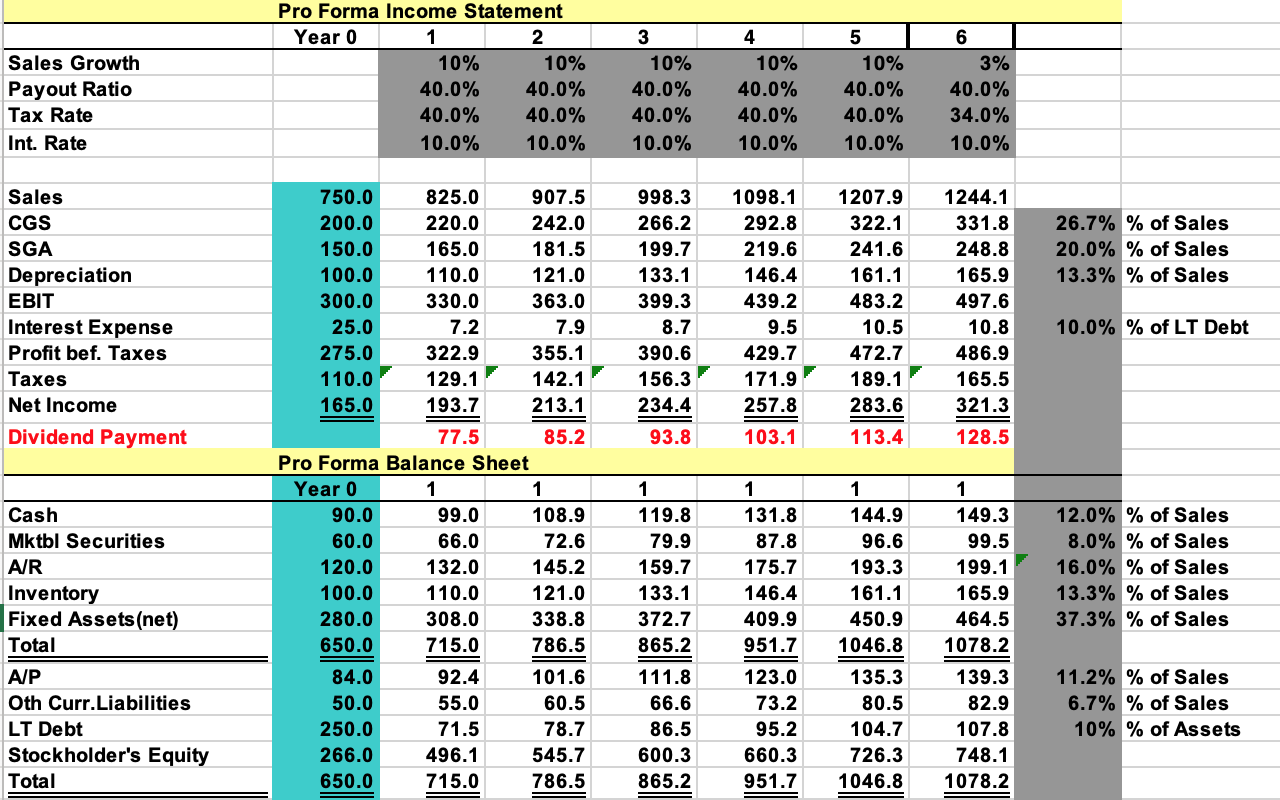

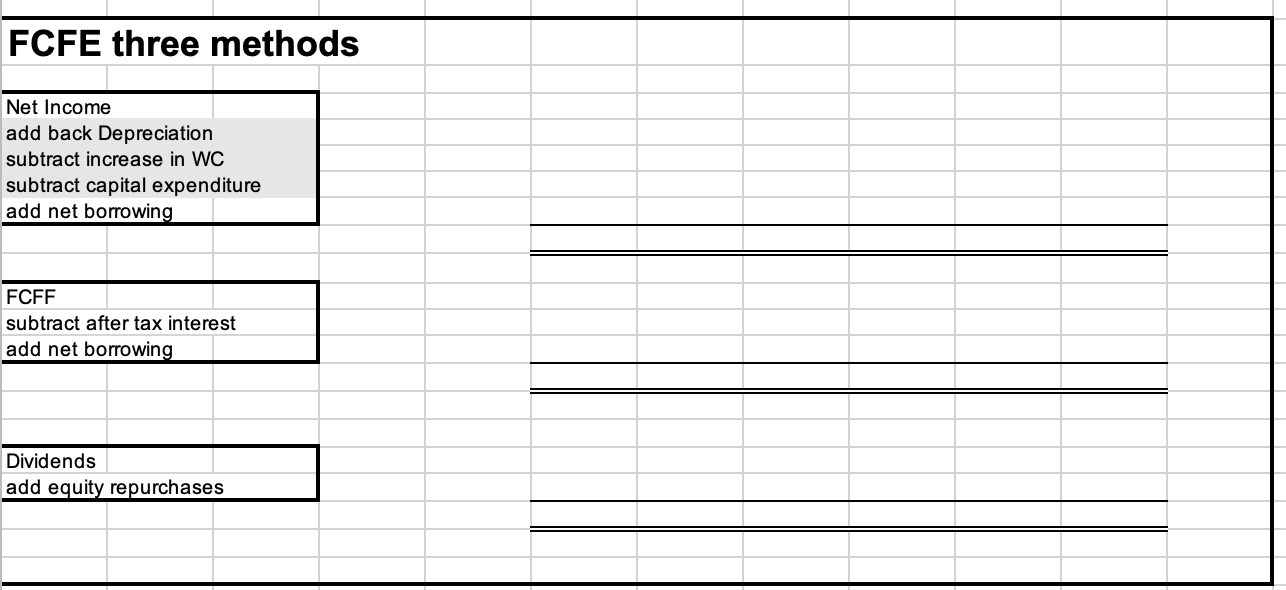

How did you find Net borrowing and equity repurchases? Can you show the step to find it........ Sales Growth Payout Ratio Tax Rate Int. Rate

How did you find Net borrowing and equity repurchases?

Can you show the step to find it........

Sales Growth Payout Ratio Tax Rate Int. Rate Pro Forma Income Statement Year 0 1 2 10% 10% 40.0% 40.0% 40.0% 40.0% 10.0% 10.0% 3 10% 40.0% 40.0% 10.0% 4 10% 40.0% 40.0% 10.0% 5 10% 40.0% 40.0% 10.0% 6 3% 40.0% 34.0% 10.0% 26.7% % of Sales 20.0% % of Sales 13.3% % of Sales Sales CGS SGA Depreciation EBIT Interest Expense Profit bef. Taxes Taxes Net Income Dividend Payment 998.3 266.2 199.7 133.1 399.3 8.7 390.6 156.3 234.4 1098.1 292.8 219.6 146.4 439.2 9.5 429.7 171.9 257.8 103.1 1207.9 322.1 241.6 161.1 483.2 10.5 472.7 189.1 283.6 113.4 1244.1 331.8 248.8 165.9 497.6 10.8 486.9 165.5 321.3 128.5 10.0% % of LT Debt 93.8 750.0 825.0 907.5 200.0 220.0 242.0 150.0 165.0 181.5 100.0 110.0 121.0 300.0 330.0 363.0 25.0 7.2 7.9 275.0 322.9 355.1 110.0 129.1 142.1 165.0 193.7 213.1 77.5 85.2 Pro Forma Balance heet Year 0 1 1 90.0 99.0 108.9 60.0 66.0 72.6 120.0 132.0 145.2 100.0 110.0 121.0 280.0 308.0 338.8 650.0 715.0 786.5 84.0 92.4 101.6 50.0 55.0 60.5 250.0 71.5 78.7 266.0 496.1 545.7 650.0 715.0 786.5 1 1 12.0% % of Sales 8.0% % of Sales 16.0% % of Sales 13.3% % of Sales 37.3% % of Sales Cash Mktbl Securities AIR Inventory Fixed Assets (net) Total A/P Oth Curr.Liabilities LT Debt Stockholder's Equity Total 119.8 79.9 159.7 133.1 372.7 865.2 111.8 66.6 86.5 600.3 865.2 131.8 87.8 175.7 146.4 409.9 951.7 123.0 73.2 95.2 660.3 951.7 1 144.9 96.6 193.3 161.1 450.9 1046.8 135.3 80.5 104.7 726.3 1046.8 1 149.3 99.5 199.1 165.9 464.5 1078.2 139.3 82.9 107.8 748.1 1078.2 11.2% % of Sales 6.7% % of Sales 10% % of Assets FCFE three methods Net Income add back Depreciation subtract increase in WC subtract capital expenditure add net borrowing FCFF subtract after tax interest add net borrowing Dividends add equity repurchases Sales Growth Payout Ratio Tax Rate Int. Rate Pro Forma Income Statement Year 0 1 2 10% 10% 40.0% 40.0% 40.0% 40.0% 10.0% 10.0% 3 10% 40.0% 40.0% 10.0% 4 10% 40.0% 40.0% 10.0% 5 10% 40.0% 40.0% 10.0% 6 3% 40.0% 34.0% 10.0% 26.7% % of Sales 20.0% % of Sales 13.3% % of Sales Sales CGS SGA Depreciation EBIT Interest Expense Profit bef. Taxes Taxes Net Income Dividend Payment 998.3 266.2 199.7 133.1 399.3 8.7 390.6 156.3 234.4 1098.1 292.8 219.6 146.4 439.2 9.5 429.7 171.9 257.8 103.1 1207.9 322.1 241.6 161.1 483.2 10.5 472.7 189.1 283.6 113.4 1244.1 331.8 248.8 165.9 497.6 10.8 486.9 165.5 321.3 128.5 10.0% % of LT Debt 93.8 750.0 825.0 907.5 200.0 220.0 242.0 150.0 165.0 181.5 100.0 110.0 121.0 300.0 330.0 363.0 25.0 7.2 7.9 275.0 322.9 355.1 110.0 129.1 142.1 165.0 193.7 213.1 77.5 85.2 Pro Forma Balance heet Year 0 1 1 90.0 99.0 108.9 60.0 66.0 72.6 120.0 132.0 145.2 100.0 110.0 121.0 280.0 308.0 338.8 650.0 715.0 786.5 84.0 92.4 101.6 50.0 55.0 60.5 250.0 71.5 78.7 266.0 496.1 545.7 650.0 715.0 786.5 1 1 12.0% % of Sales 8.0% % of Sales 16.0% % of Sales 13.3% % of Sales 37.3% % of Sales Cash Mktbl Securities AIR Inventory Fixed Assets (net) Total A/P Oth Curr.Liabilities LT Debt Stockholder's Equity Total 119.8 79.9 159.7 133.1 372.7 865.2 111.8 66.6 86.5 600.3 865.2 131.8 87.8 175.7 146.4 409.9 951.7 123.0 73.2 95.2 660.3 951.7 1 144.9 96.6 193.3 161.1 450.9 1046.8 135.3 80.5 104.7 726.3 1046.8 1 149.3 99.5 199.1 165.9 464.5 1078.2 139.3 82.9 107.8 748.1 1078.2 11.2% % of Sales 6.7% % of Sales 10% % of Assets FCFE three methods Net Income add back Depreciation subtract increase in WC subtract capital expenditure add net borrowing FCFF subtract after tax interest add net borrowing Dividends add equity repurchasesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started