Answered step by step

Verified Expert Solution

Question

1 Approved Answer

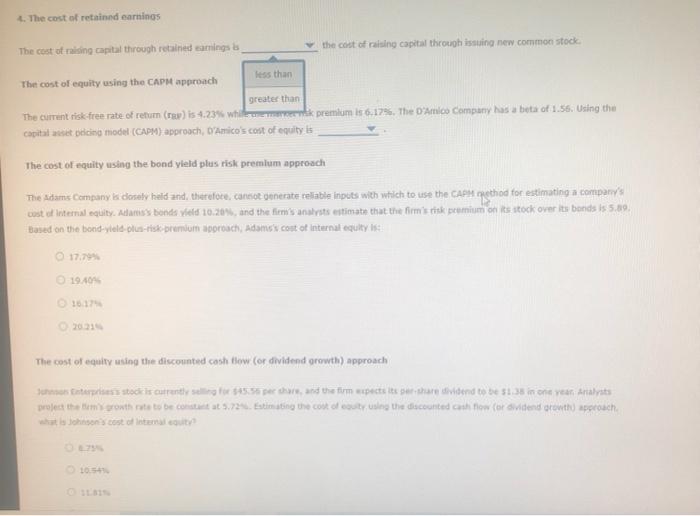

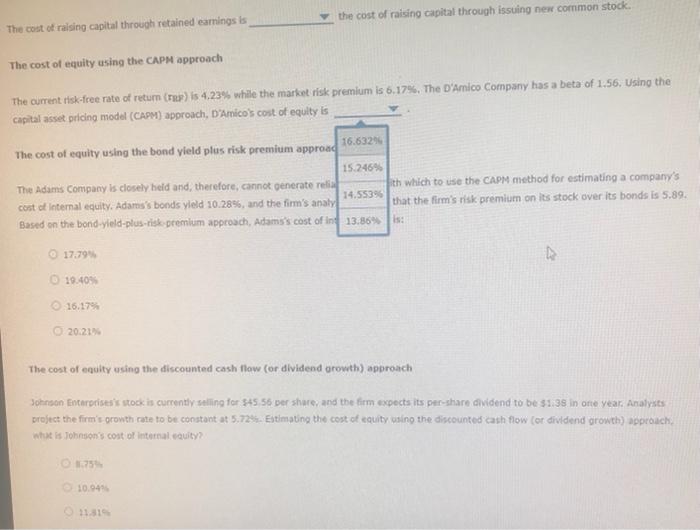

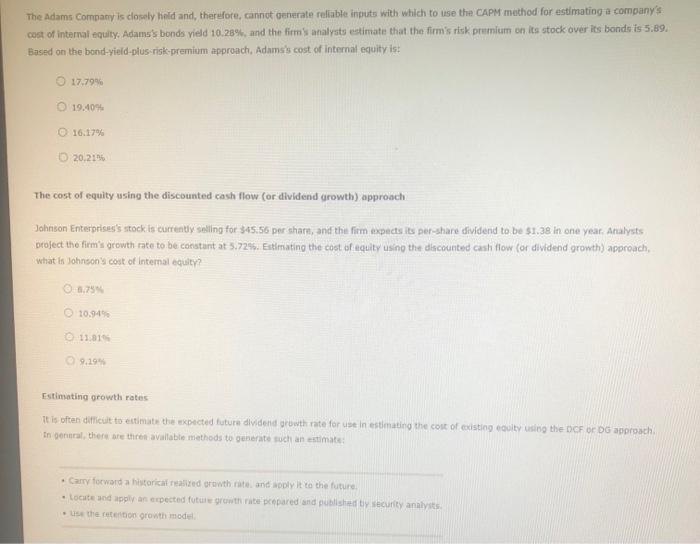

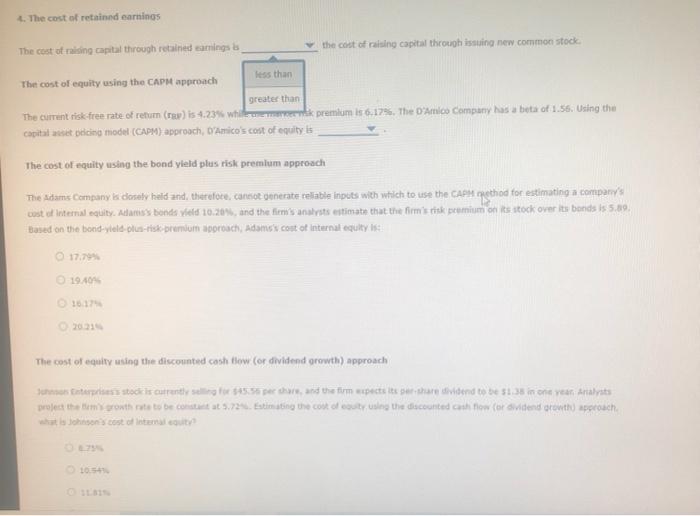

how dir you get your answer? The cost of raising capital through retalned eimings is the cost of relsing capital through issuing new common stock.

how dir you get your answer?

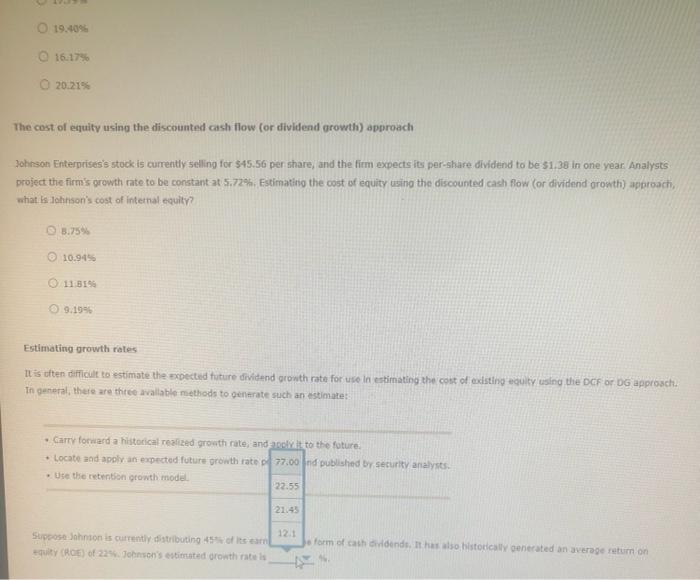

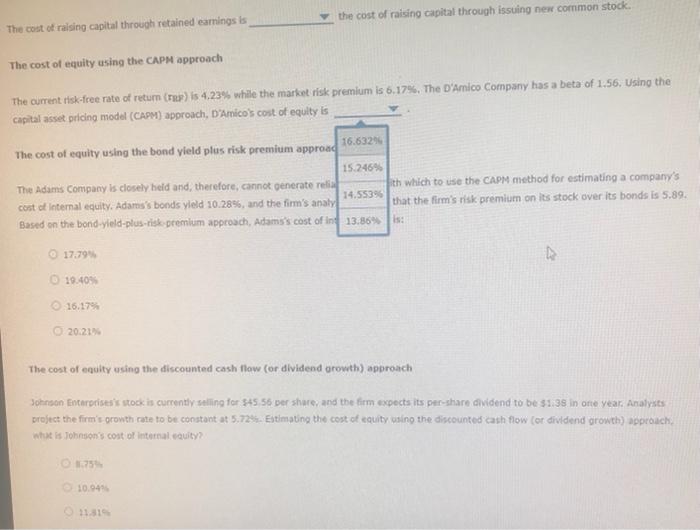

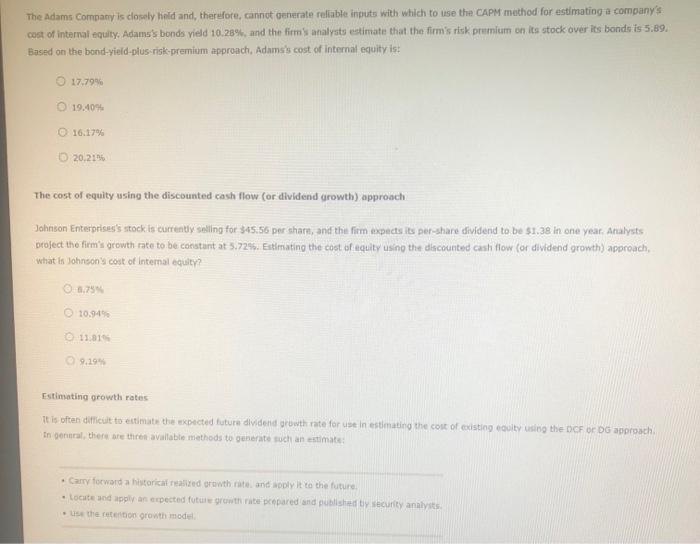

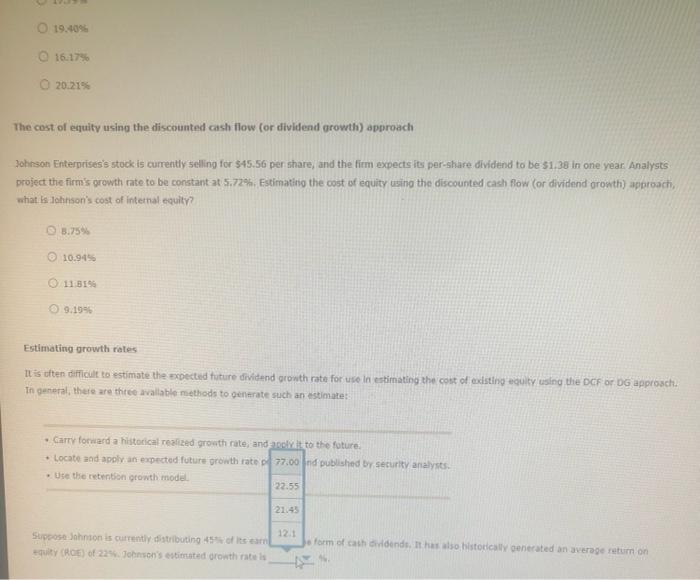

The cost of raising capital through retalned eimings is the cost of relsing capital through issuing new common stock. The cost of equity using the CAPM approach capital acsiet beicind model (CAMM) approoch, D'Amico's cost of equity is The cost of equity using the bond yleld plas risk premium approach Based on the bons-yleld plus-risk-premium aporoach, Adames' cont of internal equity lis: 17,7494 19.404 16114 20714 The cost of equity using the discounted cosh tlow (or dividend arowith) approach 10=34 The cost of raising capital through retained eamings is the cost of raising capital through issuing new common stock. The cost of equity using the CAPM approach The current risk-free rate of retum (rap) is 4.23% while the market risk premium is 6.17%. The D'Amico Company has a beta of 1.56. Using the capital asset priding model (CAPM) approach, D'Amico's cost of equity is 17.79% 19.4005 16.17% 20.21% The cost of equity using the discounted cash flow (or dividend orowth) approach Jotrson Entarorisesis rock is currently selling for $45,56 per share, and the firm expects its per-ahare dividend to be $1:35 in ofe year. Analysts broject the firm's orowth rate to be constant at 5.72\%. Estimating the cost of equity using the discounted cash flow (or dividend growth) approach, whye is Tohnsen's cost of internal vauity? 10.9494 11310 The adams Company is closely hidd and, therefore, cannot generate reliable inplits with which to use the CAPM mathod for estimating a company's cost of internal tquity. Adams's bonds vield 10.28%, and the firmi's analyats eatimate that the firm's risk premitum on its stock over its bonde is 5.89. Based on the bond-yield-plus risk-premium approzch, Adams's cost of internal equity is: 17.79% 19.4094 16.17% 20.2155 The cost of equity using the discounted cash flow (or dividend arowth) approach Johnson Enterprises's stock is currenty seling for 345.56 per share, and the firm expects its per-share dividend to.be $1.38 in one year. Analysts orolect the firm's growth rate to be constant at 5.725. Eltimating the cost of equaty using the difacounted cash flow (or dividend gromth) approach, What is Johnson'y cost of intemal equity? 6.74x+1. 10.945 11.815 9,194 Estimating growth rates It is often dificuit to eutimate the expected hature dlyidend gruwth rate for use in estimating the colr of existiog eoulty using the Dof or DG approach. in gennral, there are thren avallable methods to generate such an estimate: - Camy forwgrd a historicai reasized oranth rate. and apoly it to the future. - Locate and apply an ecpected future gronth rate propared and poblishud ty lecurity anatyits. - lise the rerention growth modet. 16.1770 20.214 The cost of equity using the discounted cash flow (or dividend growth) approach Johrson Enterprises's stock is currently 5 elling for $45.56 per share, and the firm expects its per-share dividend to be 31.38 in one year Analysts project the firmis orowth rate to be constant at 5.72\%. Estimating the cost of equity using the discounted cash flow (or dividend orowth) approach, what is lohnson's cost of intetnal equity? b.754 10.9455 118195 9,19=6 Estimating orowth rates II is titen difficult to estimate the moected tuture dividend growth rate for use in estimating the cost of exlsting eculty using the DCf of bG approsch. In general, thete are thitee avallable nethods to genterate such an estimate: - Gamr forward a historical realized growth rate; and a selycit to the foture. - Locate aad apoliv an expected future orowth rate p.77.00 nd published br security analyis. - tse the retentish growth model. 5tipeose Jahmon is cuttentiy distributing 4 the of lis earn 12i *quily (Ho.E) of 22t. Johnson's estimated orowth rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started