Answered step by step

Verified Expert Solution

Question

1 Approved Answer

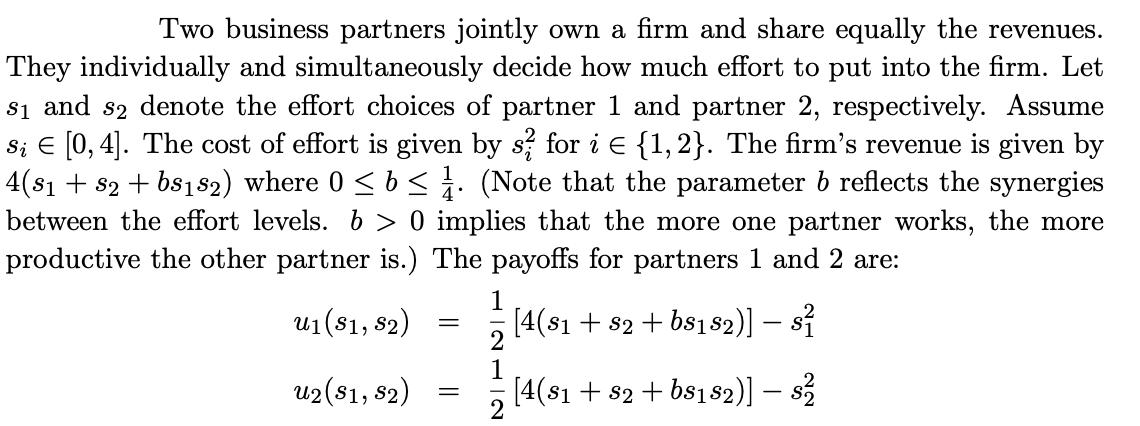

Two business partners jointly own a firm and share equally the revenues. They individually and simultaneously decide how much effort to put into the

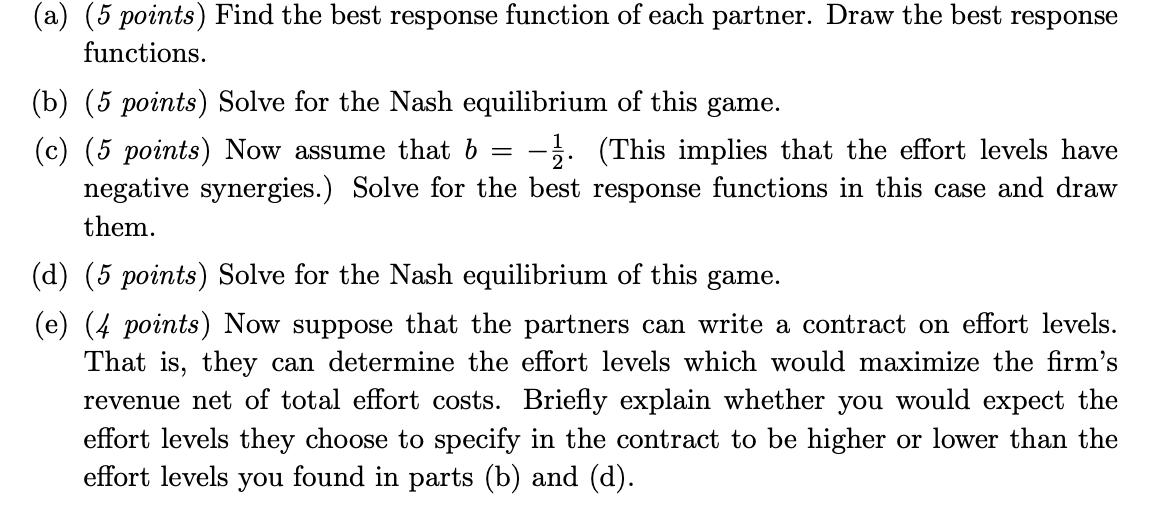

Two business partners jointly own a firm and share equally the revenues. They individually and simultaneously decide how much effort to put into the firm. Let $8 and s2 denote the effort choices of partner 1 and partner 2, respectively. Assume s [0, 4]. The cost of effort is given by s? for i E {1, 2}. The firm's revenue is given by 4(s1 + 82 + bs182) where 0 b 1. (Note that the parameter 6 reflects the synergies between the effort levels. b> 0 implies that the more one partner works, the more productive the other partner is.) The payoffs for partners 1 and 2 are: u(S1, S2) u2 (81, 82) = = 1 [4(s1 +82 + bs182)] [4(81 +82 +bs182)] $ (a) (5 points) Find the best response function of each partner. Draw the best response functions. (b) (5 points) Solve for the Nash equilibrium of this game. = (c) (5 points) Now assume that b -. (This implies that the effort levels have negative synergies.) Solve for the best response functions in this case and draw them. (d) (5 points) Solve for the Nash equilibrium of this game. (e) (4 points) Now suppose that the partners can write a contract on effort levels. That is, they can determine the effort levels which would maximize the firm's revenue net of total effort costs. Briefly explain whether you would expect the effort levels they choose to specify in the contract to be higher or lower than the effort levels you found in parts (b) and (d).

Step by Step Solution

★★★★★

3.38 Rating (185 Votes )

There are 3 Steps involved in it

Step: 1

a Find the best response function of each partner Draw the best response functions Ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started