Question

How do I calculate the inventory turnover?. Audit Objective(s): Valuation Audit Procedure: Prepare a report of all finished goods with a turnover less. Following are

Following are audit procedures commonly performed in the inventory and warehousing cycle for a manufacturing company:

1. Account for a sequence of raw material requisitions and examine each requisition for an authorized approval.

2. Trace the recorded additions on the finished goods perpetual inventory master file to the records for completed production.

3. Compare the client’s count of physical inventory at an interim date with the perpetual inventory master file.

4. Use audit software to compute inventory turnover by major product line and compare it to turnover in the prior year.

5. Read the client’s physical inventory instructions and observe whether they are being followed by those responsible for counting the inventory.

6. Account for a sequence of inventory tags and trace each tag to the physical inventory to make sure it actually exists.

7. Trace the auditor’s test counts recorded in the audit files to the final inventory compilation and compare the tag number, description, and quantity.

8. Compare the unit price on the final inventory summary with vendor’s invoices.

a. Identify whether each of the procedures is primarily a test of control or a substantive test.

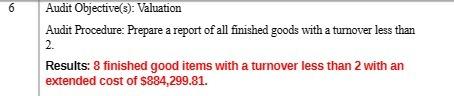

6 Audit Objective(s): Valuation Audit Procedure: Prepare a report of all finished goods with a turnover less than 2. Results: 8 finished good items with a turnover less than 2 with an extended cost of $884,299.81. 6 Audit Objective(s): Valuation Audit Procedure: Prepare a report of all finished goods with a turnover less than 2. Results: 8 finished good items with a turnover less than 2 with an extended cost of $884,299.81. 6 Audit Objective(s): Valuation Audit Procedure: Prepare a report of all finished goods with a turnover less than 2. Results: 8 finished good items with a turnover less than 2 with an extended cost of $884,299.81. 6 Audit Objective(s): Valuation Audit Procedure: Prepare a report of all finished goods with a turnover less than 2. Results: 8 finished good items with a turnover less than 2 with an extended cost of $884,299.81.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Account for a sequence of raw material requisitions and examine each requisition for an authorized approval Test of control Trace the recorded additions on the finished goods perpetual inventory maste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started