Answered step by step

Verified Expert Solution

Question

1 Approved Answer

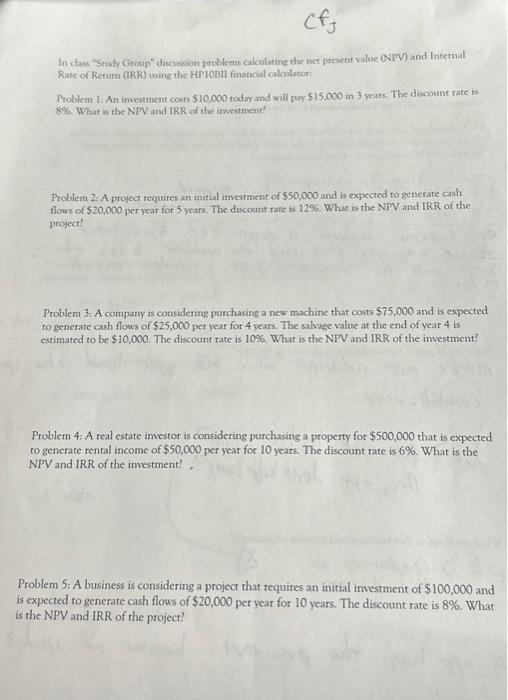

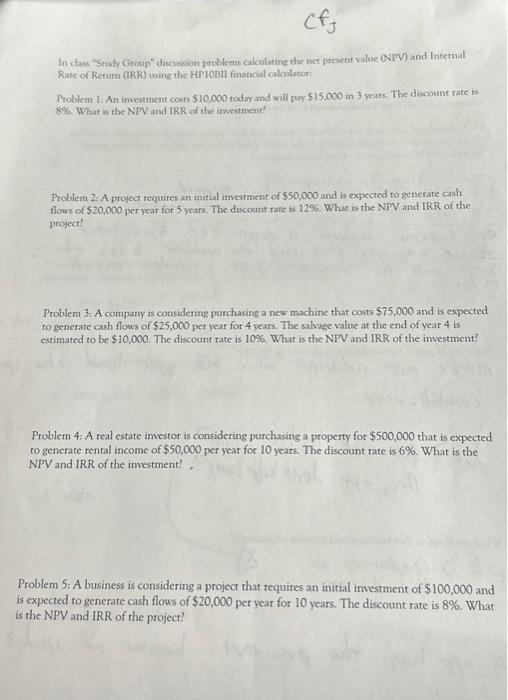

how do i calculate this using the hp10||+ calculator In clas Srudr Group discussion problems calculatine the net present value (NFV) and Internal Problem I:

how do i calculate this using the hp10||+ calculator

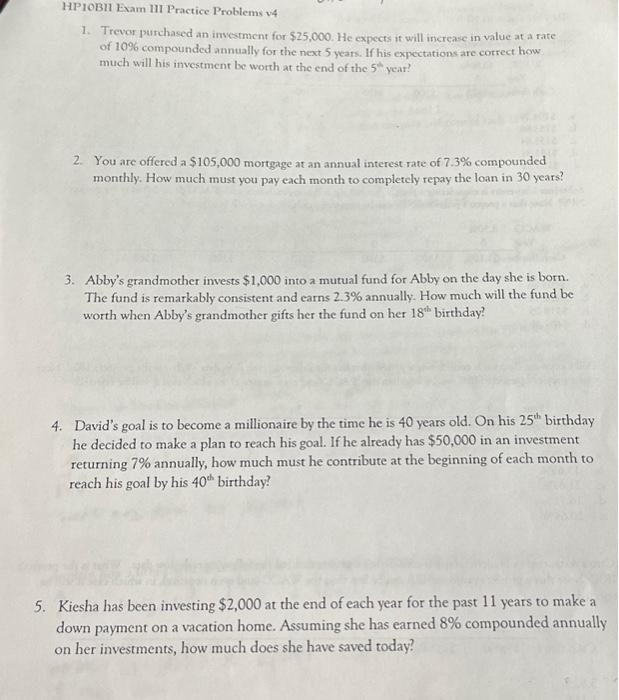

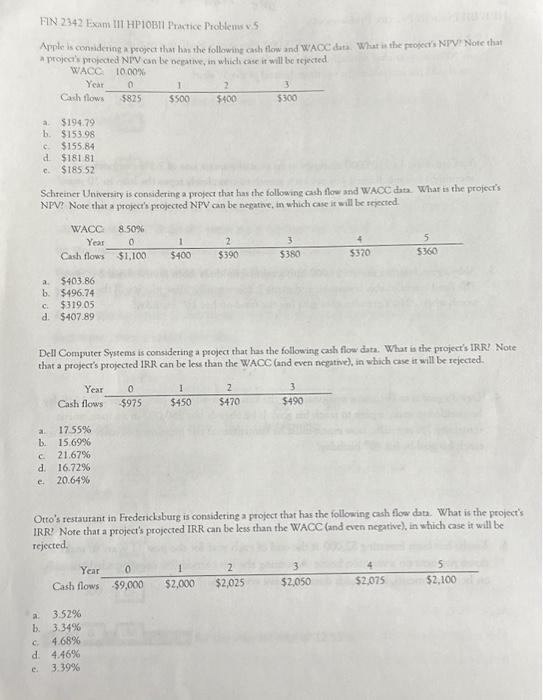

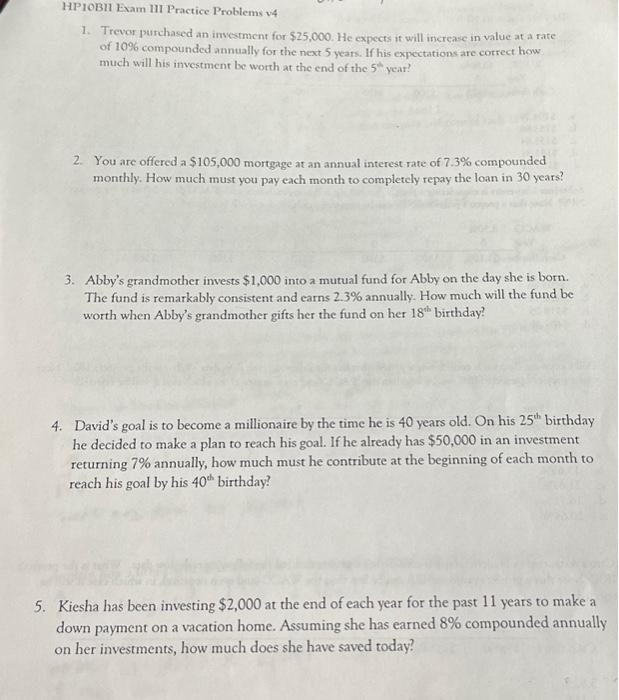

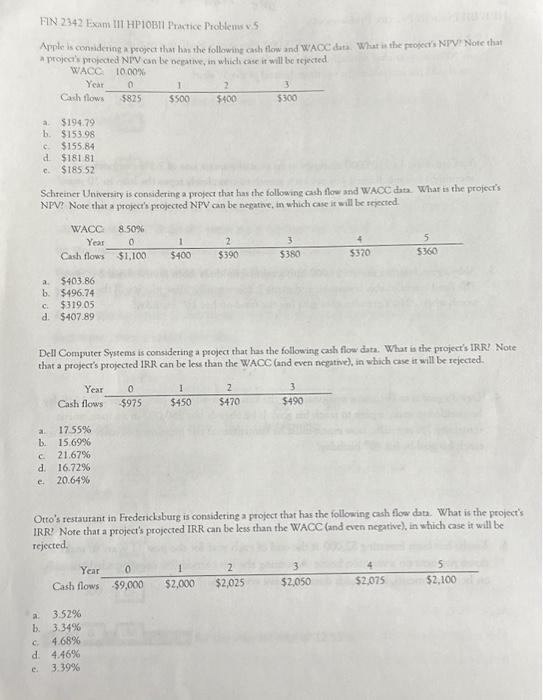

In clas "Srudr Group" discussion problems calculatine the net present value (NFV) and Internal Problem I: An inverment coots $10,000 today and will puy $15,000 in 3 years. The discount rate is 8\%. What is the NPV and IRR of the imvestment? Problem 2: A project requires an thitial imvestment of $50,000 and is expected to generate cash flows of $20,000 per year for 5 years. The discount rate is 12%. What is the NPV and IRR of the project? Problem 3: A company is considering purchasing a new machine that costs $75,000 and is expected to generate cash flows of $25,000 per year for 4 years. The sahage value at the end of year 4 is estimated to be $10,000. The discount rate is 10%. What is the NPV and IRR of the investment? Problem 4: A real estate investor is considering purchasing a property for $500,000 that is expected to generate rental income of $50,000 per year for 10 years. The discount rate is 6%. What is the NPV and IRR of the investment? Problem 5: A business is considering a project that requires an initial investment of $100,000 and is expected to generate cash flows of $20,000 per year for 10 years. The discount rate is 8%. What is the NPV and IRR of the project? HPIOBII Exam III Practice Problems v 4 1. Trevor purchased an investment for $25,000. He expects it will increave in value at a rate of 10% compounded annually for the next 5 years. If his expectations are correct how much will his investment be worth at the end of the 5tyear? 2. You are offered a $105,000 mortgage at an annual interest rate of 7.3% compounded monthly. How much must you pay each month to completcly repay the loan in 30 years? 3. Abby's grandmother invests $1,000 into a mutual fund for Abby on the day she is born. The fund is remarkably consistent and earns 2.3% annually. How much will the fund be worth when Abby's grandmother gifts her the fund on her 18th birthday? 4. David's goal is to become a millionaire by the time he is 40 years old. On his 25th birthday he decided to make a plan to reach his goal. If he already has $50,000 in an investment returning 7% annually, how much must he contribute at the beginning of each month to reach his goal by his 40th birthday? 5. Kiesha has been investing $2,000 at the end of each year for the past 11 years to make a down payment on a vacation home. Assuming she has earned 8% compounded annually on her investments, how much does she have saved today? FIN 2342 Exam III HP10BII Practice Problems v5 a. $194.79 b. $15398 c. $155.84 d. $181.81 c. $18552 Schteiner University is considering a project that has the following cash flow sad WAOC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be sejected. d. 940 . 8y Dell Computer Systems is considering a project that has the following cash flow data. Whar is the project's IRR' Note that a project's projected IRR can be less than the WAOC (and even negatine), in which cise it will be rejected. Otto's restaurant in Frederickburg is considering a project that has the following cash flow dan. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and cien negative), in which case it will be rejected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started