Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I calculate using the Gordon Model? Exhibit IV: SCRPC's Balance Sheet Information ($000s) BOOK Accounts Payable Accruals and Other Current Liabilities Notes Payable

How do I calculate using the Gordon Model?

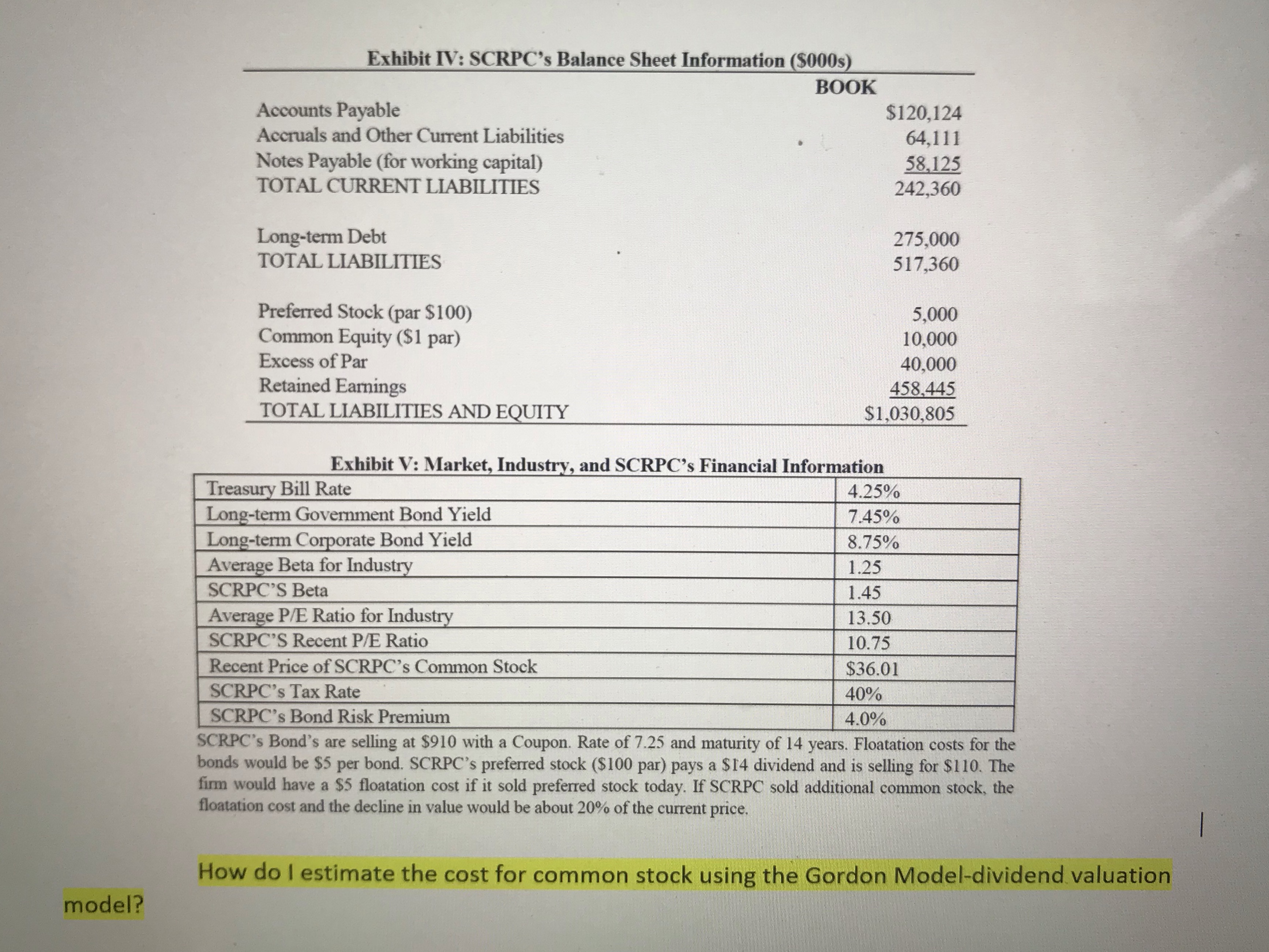

Exhibit IV: SCRPC's Balance Sheet Information ($000s) BOOK Accounts Payable Accruals and Other Current Liabilities Notes Payable (for working capital) $120,124 64,111 58,125 TOTAL CURRENT LIABILITIES Long-term Debt TOTAL LIABILITIES Preferred Stock (par $100) 242,360 275,000 517,360 5,000 Common Equity ($1 par) 10,000 Excess of Par 40,000 Retained Earnings 458,445 TOTAL LIABILITIES AND EQUITY $1,030,805 Exhibit V: Market, Industry, and SCRPC's Financial Information Treasury Bill Rate 4.25% Long-term Government Bond Yield 7.45% Long-term Corporate Bond Yield 8.75% Average Beta for Industry 1.25 SCRPC'S Beta 1.45 Average P/E Ratio for Industry 13.50 SCRPC'S Recent P/E Ratio 10.75 Recent Price of SCRPC's Common Stock $36.01 SCRPC's Tax Rate 40% SCRPC's Bond Risk Premium 4.0% model? SCRPC's Bond's are selling at $910 with a Coupon. Rate of 7.25 and maturity of 14 years. Floatation costs for the bonds would be $5 per bond. SCRPC's preferred stock ($100 par) pays a $14 dividend and is selling for $110. The firm would have a $5 floatation cost if it sold preferred stock today. If SCRPC sold additional common stock, the floatation cost and the decline in value would be about 20% of the current price. How do I estimate the cost for common stock using the Gordon Model-dividend valuation

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the cost of common stock using the Gordon Model dividend valuation model follow these st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started