Answered step by step

Verified Expert Solution

Question

1 Approved Answer

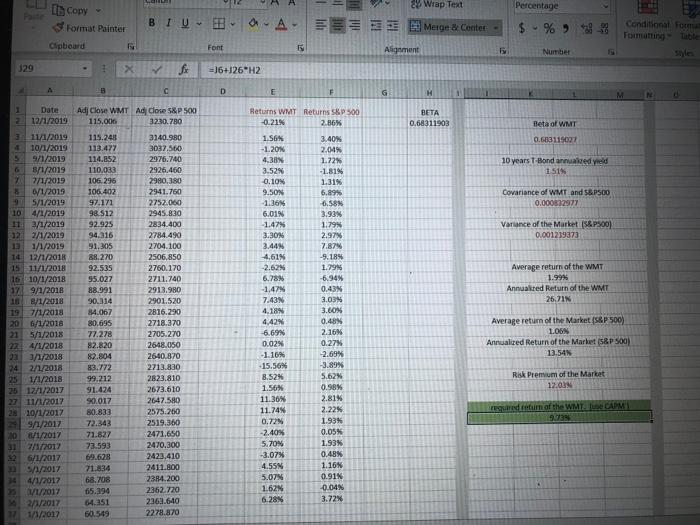

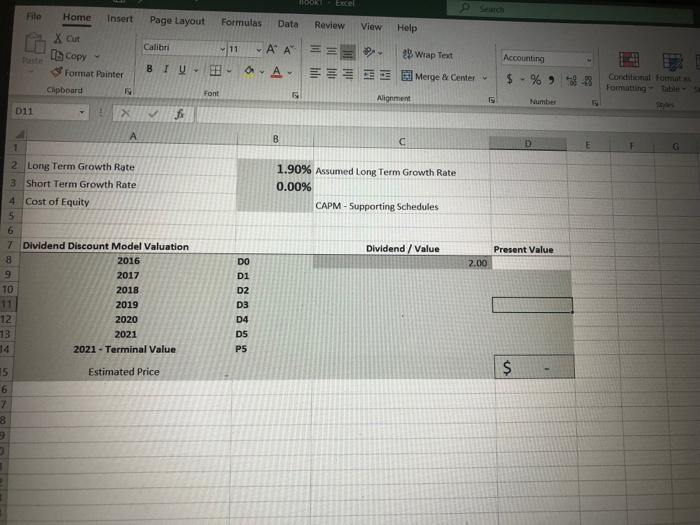

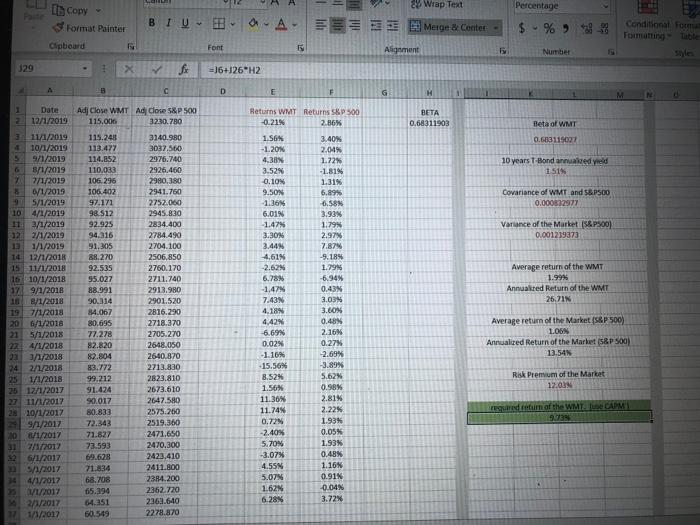

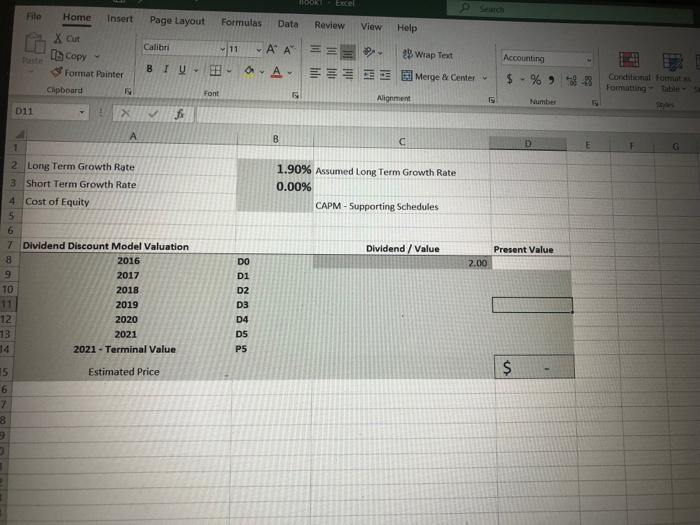

How do I calculte the DDM ( terminal value, dividend value and present value) from the following information? If needed add values but I am

How do I calculte the DDM ( terminal value, dividend value and present value) from the following information? If needed add values but I am lost. It's about walmart if things needs to be looked up.

2 Wrap Text Percentage Its Copy 3 Format Painter BIU EB a-A- Merge & Contet $ % Conditional Form Formatting table Style Clipboard Font Alignment Number 329 f =16+126 H2 A B D E G H 1 1 2 Date 12/1/2019 BETA 0.68311903 Beta of WMT 0.683115027 10 years T-Bond annualedy ed 1515 Covariance of WMT and S&PSCO 0.000832977 Variance of the Market (5&P500) 0.001219373 Average return of the WMT 1.99% Annuaired Return of the WMT 25,71N 11/1/2019 4 10/1/2019 9/1/2019 6 8/1/2019 7 7/1/2019 . 6/1/2019 5/1/2019 10 4/1/2019 2/1/2019 122/1/2019 13 1/1/2019 14 12/1/2018 15 11/1/2018 110/1/2018 179/1/2018 10 8/1/2018 19 7/1/2018 20 6/1/2018 21 5/1/2018 27 4/1/2018 23 3/1/2018 24 2/1/2018 25 1/1/2018 25 12/1/2017 27 11/1/2017 28 10/1/2017 9/12/2017 30 3/1/2017 31 7/1/2017 126/1/2017 5/1/2017 34 4/1/2017 11/2017 2/1/2017 1/1/2017 Adj Close WMT Ad close 5&P 500 115.006 3230.780 115.248 3140.380 113.477 3037.500 114.852 2976.740 110.033 2926.460 106.296 2980,380 106.402 2941.760 97.171 2752.000 98.512 2945.830 92.925 2834.400 94,316 2784.490 91.305 2704.100 88.270 2506.850 92.535 2760.170 95.027 2711.740 88.991 2913.980 90.314 2901.520 84.067 2816.290 80.695 2718.370 77.278 2705.270 82.820 2648.050 82.804 2640.870 83.772 2713.830 99.212 2823.810 91.424 2673.610 90.017 2647.580 80.833 2575.260 72.343 2519.360 71.827 2471.650 22.593 2470.300 69.628 2422.410 71.834 2411.800 68.708 2384.200 65.394 2352.720 64.351 226.1.640 60.549 2278.870 Returns WMT Returns S&P 500 -0.21% 2.86% 1.SON 3.40% -1.20% 2.04% 4.38% 1.72% 3.52N -1,81% -0.10% 1.31% 9.50N 6.899 -1.36N 6.58N 6.01% 3.93N 1.47% 1.79N 3.30N 2.97% 3.44% 7.87 4,61% -9.18% -2.62 1.796 6.78% -6.94% -1.47 0.43N 7,43N 3.03N 4.189 3.60% 4.42% 0.48N -6.69% 2.16 0.02% 0.27 1.16% -2.699 -15.56N -3.89% 8.52% 5.62% 1.56% 0.58% 11.36% 2.81% 11.74% 2.22% 0.72% 1.935 -2.40% 0.05% 5.709 1.93% -3.07% 0.48% 4.55N 1.16% 5.07N 0.913 1.62% 0.04 6.28 3.72% Average return of the Market S&P 500) 1.OGN Annualced Return of the Market (S&P 500) 13.54% Risk Premium of the Market 12.034 gunum of the WMILLE CAPM 9.735 DOR Excel 8 Sena File Home Insert X Cut lb Copy Page Layout Formulas Data Review View Help Calibri 11 AA== 2 Wrap Text B TV OA. Merge & Center Font Alignment Accounting Format Painter Clipboard $ - % -8 Conditional Format Formatting G Number 011 > B C 1 G 1.90% Assumed Long Term Growth Rate 0.00% CAPM - Supporting Schedules Dividend/Value Present Value 2 Long Term Growth Rate 3 Short Term Growth Rate 4 Cost of Equity 5 6 7 Dividend Discount Model Valuation 8 2016 9 2017 TO 2018 11 2019 12 2020 13 2021 2021 - Terminal Value 2.00 DO D1 D2 D3 D4 DS PS Estimated Price $ 15 6 7 8 3 2 Wrap Text Percentage Its Copy 3 Format Painter BIU EB a-A- Merge & Contet $ % Conditional Form Formatting table Style Clipboard Font Alignment Number 329 f =16+126 H2 A B D E G H 1 1 2 Date 12/1/2019 BETA 0.68311903 Beta of WMT 0.683115027 10 years T-Bond annualedy ed 1515 Covariance of WMT and S&PSCO 0.000832977 Variance of the Market (5&P500) 0.001219373 Average return of the WMT 1.99% Annuaired Return of the WMT 25,71N 11/1/2019 4 10/1/2019 9/1/2019 6 8/1/2019 7 7/1/2019 . 6/1/2019 5/1/2019 10 4/1/2019 2/1/2019 122/1/2019 13 1/1/2019 14 12/1/2018 15 11/1/2018 110/1/2018 179/1/2018 10 8/1/2018 19 7/1/2018 20 6/1/2018 21 5/1/2018 27 4/1/2018 23 3/1/2018 24 2/1/2018 25 1/1/2018 25 12/1/2017 27 11/1/2017 28 10/1/2017 9/12/2017 30 3/1/2017 31 7/1/2017 126/1/2017 5/1/2017 34 4/1/2017 11/2017 2/1/2017 1/1/2017 Adj Close WMT Ad close 5&P 500 115.006 3230.780 115.248 3140.380 113.477 3037.500 114.852 2976.740 110.033 2926.460 106.296 2980,380 106.402 2941.760 97.171 2752.000 98.512 2945.830 92.925 2834.400 94,316 2784.490 91.305 2704.100 88.270 2506.850 92.535 2760.170 95.027 2711.740 88.991 2913.980 90.314 2901.520 84.067 2816.290 80.695 2718.370 77.278 2705.270 82.820 2648.050 82.804 2640.870 83.772 2713.830 99.212 2823.810 91.424 2673.610 90.017 2647.580 80.833 2575.260 72.343 2519.360 71.827 2471.650 22.593 2470.300 69.628 2422.410 71.834 2411.800 68.708 2384.200 65.394 2352.720 64.351 226.1.640 60.549 2278.870 Returns WMT Returns S&P 500 -0.21% 2.86% 1.SON 3.40% -1.20% 2.04% 4.38% 1.72% 3.52N -1,81% -0.10% 1.31% 9.50N 6.899 -1.36N 6.58N 6.01% 3.93N 1.47% 1.79N 3.30N 2.97% 3.44% 7.87 4,61% -9.18% -2.62 1.796 6.78% -6.94% -1.47 0.43N 7,43N 3.03N 4.189 3.60% 4.42% 0.48N -6.69% 2.16 0.02% 0.27 1.16% -2.699 -15.56N -3.89% 8.52% 5.62% 1.56% 0.58% 11.36% 2.81% 11.74% 2.22% 0.72% 1.935 -2.40% 0.05% 5.709 1.93% -3.07% 0.48% 4.55N 1.16% 5.07N 0.913 1.62% 0.04 6.28 3.72% Average return of the Market S&P 500) 1.OGN Annualced Return of the Market (S&P 500) 13.54% Risk Premium of the Market 12.034 gunum of the WMILLE CAPM 9.735 DOR Excel 8 Sena File Home Insert X Cut lb Copy Page Layout Formulas Data Review View Help Calibri 11 AA== 2 Wrap Text B TV OA. Merge & Center Font Alignment Accounting Format Painter Clipboard $ - % -8 Conditional Format Formatting G Number 011 > B C 1 G 1.90% Assumed Long Term Growth Rate 0.00% CAPM - Supporting Schedules Dividend/Value Present Value 2 Long Term Growth Rate 3 Short Term Growth Rate 4 Cost of Equity 5 6 7 Dividend Discount Model Valuation 8 2016 9 2017 TO 2018 11 2019 12 2020 13 2021 2021 - Terminal Value 2.00 DO D1 D2 D3 D4 DS PS Estimated Price $ 15 6 7 8 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started