Answered step by step

Verified Expert Solution

Question

1 Approved Answer

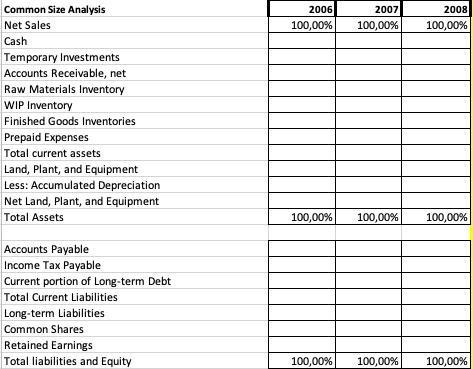

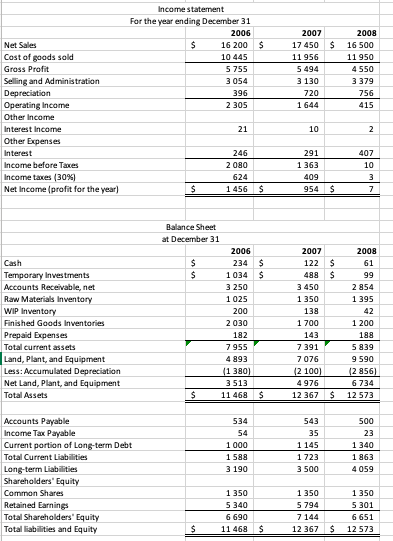

How do I complete a common-size analysis of the income statement and balance sheet based on the second picture? The first picture is the ones

How do I complete a common-size analysis of the income statement and balance sheet based on the second picture? The first picture is the ones that has to be calculated in the common size analysis

2006 100,00% 2007 100,00% 2008 100,00% Common Size Analysis Net Sales Cash Temporary Investments Accounts Receivable, net Raw Materials Inventory WIP Inventory Finished Goods Inventories Prepaid Expenses Total current assets Land, Plant, and Equipment Less: Accumulated Depreciation Net Land, Plant, and Equipment Total Assets 100,00% 100,00% 100,00% Accounts Payable Income Tax Payable Current portion of Long-term Debt Total Current Liabilities Long-term Liabilities Common Shares Retained Earnings Total liabilities and Equity 100,00% 100,00% 100,00% $ Income statement For the year ending December 31 2006 $ 16 200 10 445 5 755 3 054 396 2 305 2007 17 450 11 956 5494 3 130 720 1 644 2008 $ 16 500 11 950 4550 3 379 756 415 Net Sales Cost of goods sold Gross Profit Selling and Administration Depreciation Operating Income Other Income Interest Income Other Expenses Interest Income before Taxes Income taxes (30%) Net Income (profit for the year) 21 10 2 246 2080 624 1 456 291 1 363 409 954 407 10 3 7 $ $ $ $ $ 2008 61 99 Cash Temporary Investments Accounts Receivable, net Raw Materials Inventory WIP Inventory Finished Goods Inventories Prepaid Expenses Total current assets Land, Plant, and Equipment Less: Accumulated Depreciation Net Land, Plant, and Equipment Total Assets Balance Sheet at December 31 2006 $ 234 $ 1034 3 250 1 025 200 2030 182 7955 4893 (1 380) 3513 $ 11 468 2007 122 $ 488 $ 3 450 1 350 138 1 700 143 7 391 7076 (2100) 4976 12 367 $ 2854 1 395 42 1 200 188 5839 9 590 (2 856) 6734 12 573 $ 534 54 1 000 1588 3190 543 35 1 145 1723 3 500 500 23 1 340 1863 4059 Accounts Payable Income Tax Payable Current portion of Long-term Debt Total Current Liabilities Long-term Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total liabilities and Equity 1 350 5 340 6690 11 468 1 350 5 794 7 144 12 367 1 350 5 301 6651 12 573 $ $ $ 2006 100,00% 2007 100,00% 2008 100,00% Common Size Analysis Net Sales Cash Temporary Investments Accounts Receivable, net Raw Materials Inventory WIP Inventory Finished Goods Inventories Prepaid Expenses Total current assets Land, Plant, and Equipment Less: Accumulated Depreciation Net Land, Plant, and Equipment Total Assets 100,00% 100,00% 100,00% Accounts Payable Income Tax Payable Current portion of Long-term Debt Total Current Liabilities Long-term Liabilities Common Shares Retained Earnings Total liabilities and Equity 100,00% 100,00% 100,00% $ Income statement For the year ending December 31 2006 $ 16 200 10 445 5 755 3 054 396 2 305 2007 17 450 11 956 5494 3 130 720 1 644 2008 $ 16 500 11 950 4550 3 379 756 415 Net Sales Cost of goods sold Gross Profit Selling and Administration Depreciation Operating Income Other Income Interest Income Other Expenses Interest Income before Taxes Income taxes (30%) Net Income (profit for the year) 21 10 2 246 2080 624 1 456 291 1 363 409 954 407 10 3 7 $ $ $ $ $ 2008 61 99 Cash Temporary Investments Accounts Receivable, net Raw Materials Inventory WIP Inventory Finished Goods Inventories Prepaid Expenses Total current assets Land, Plant, and Equipment Less: Accumulated Depreciation Net Land, Plant, and Equipment Total Assets Balance Sheet at December 31 2006 $ 234 $ 1034 3 250 1 025 200 2030 182 7955 4893 (1 380) 3513 $ 11 468 2007 122 $ 488 $ 3 450 1 350 138 1 700 143 7 391 7076 (2100) 4976 12 367 $ 2854 1 395 42 1 200 188 5839 9 590 (2 856) 6734 12 573 $ 534 54 1 000 1588 3190 543 35 1 145 1723 3 500 500 23 1 340 1863 4059 Accounts Payable Income Tax Payable Current portion of Long-term Debt Total Current Liabilities Long-term Liabilities Shareholders' Equity Common Shares Retained Earnings Total Shareholders' Equity Total liabilities and Equity 1 350 5 340 6690 11 468 1 350 5 794 7 144 12 367 1 350 5 301 6651 12 573 $ $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started