Question

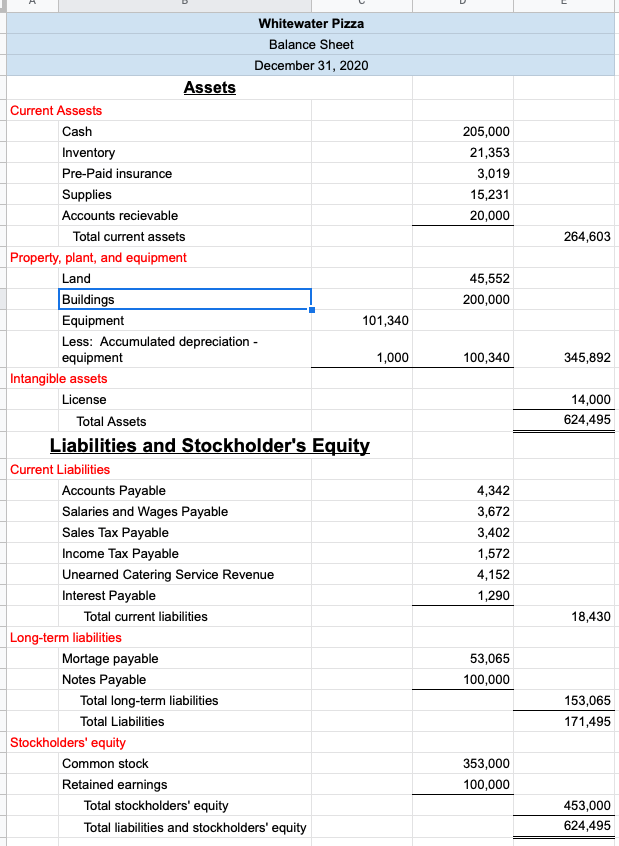

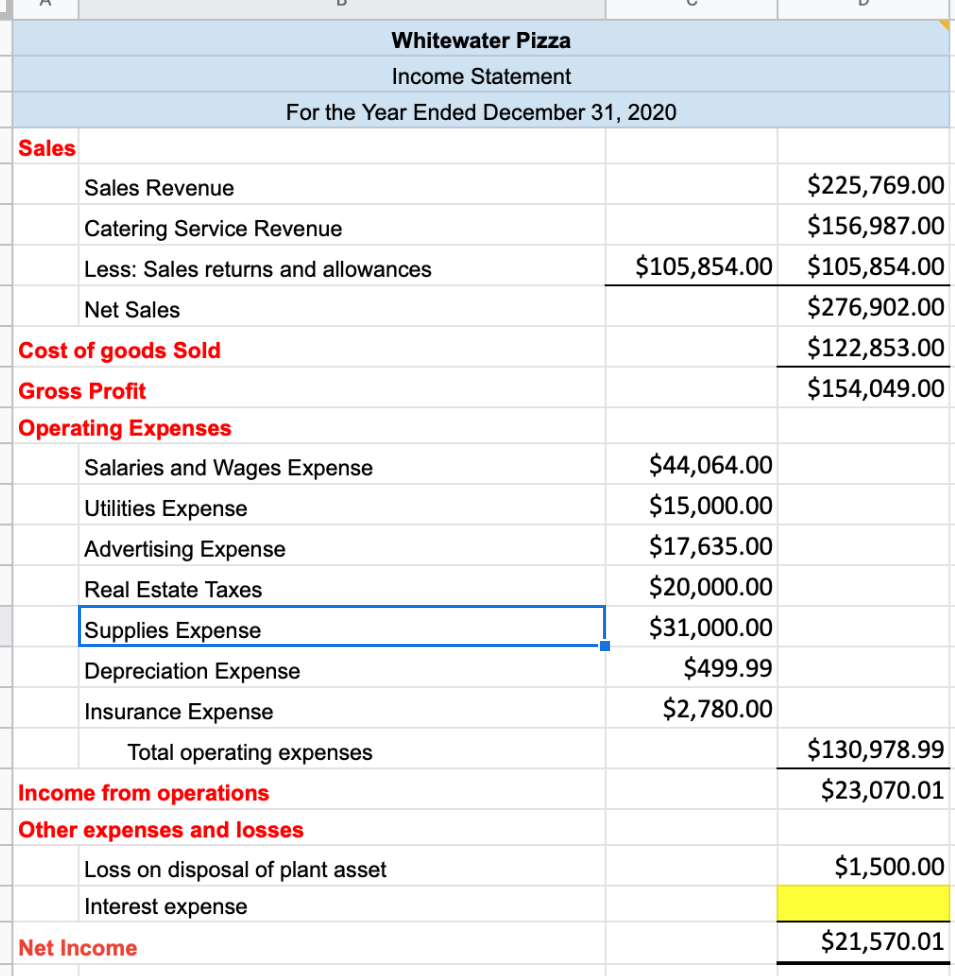

How do I create a statement of cash flows based on the income statement and balance sheets below? For this project this balance sheet and

How do I create a statement of cash flows based on the income statement and balance sheets below? For this project this balance sheet and income statement are the only statements given. more information includes :

-In addition to shares issued in prior years, the restaurant issued 50, 000 shares of common stock with a par value of $0.01 for a total of $200,000. There was no other stock related transaction in the year.

-The restaurant had $100,000 retained earnings and $37,000 cash balance at the beginning of 2020.

-The restaurant does not engage in any types of investment in securities of other business (e.g.,stocks,bonds,etc.).

-The restaurant owners took 10% of 2020 year net income as dividend.

-The restaurant borrowed $100,000 from a local bank to finance its operation in 2020. The fixed rate loan is due in 2025.Note thatitdoesnot loancashtoitsofficers,employeesoroutsideparties.

-The restaurant purchased a delivery van for its catering service for $27,000by paying $7,000 cash and signing a note for the remaining balance.It sold a piece of kitchen equipment for $500at the end of June. The equipment was purchased for $5,000 and had a book value of $2,000 at the beginning of 2020.The straight line depreciation is used for the equipment with a depreciation rate of $1,000 per year.

-I do not have any previous years statements, as they were not provided for this project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started