Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I do a vertical analysis on the 10-k income statement? Net operating revenues Operating costs and expenses: Salaries and benefits Supplies COMMUNITY HEALTH

how do I do a vertical analysis on the 10-k income statement?

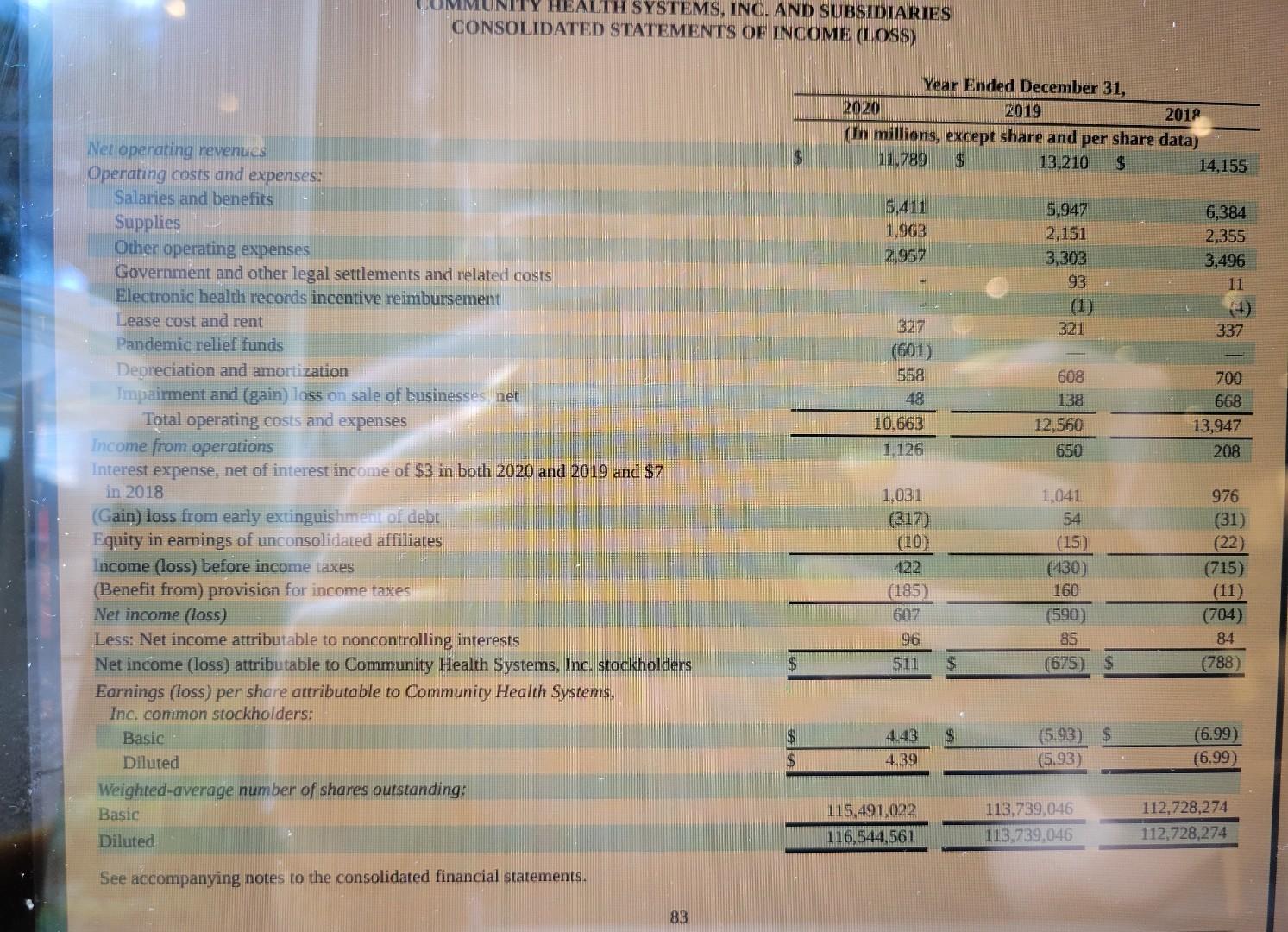

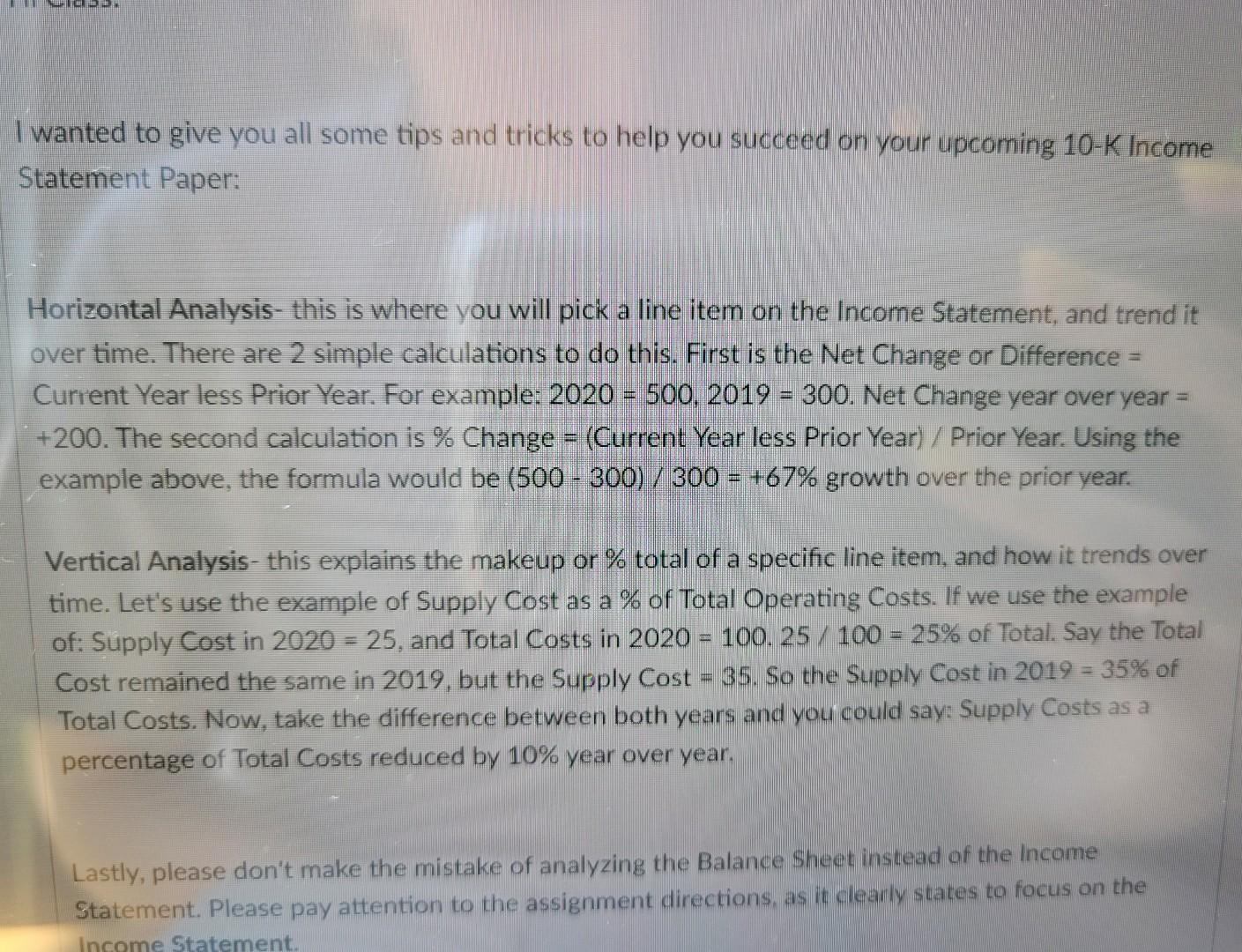

Net operating revenues Operating costs and expenses: Salaries and benefits Supplies COMMUNITY HEALTH SYSTEMS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (LOSS) Other operating expenses Government and other legal settlements and related costs Electronic health records incentive reimbursement Lease cost and rent Pandemic relief funds Depreciation and amortization Impairment and (gain) loss on sale of businesses, net Total operating costs and expenses Income from operations Interest expense, net of interest income of $3 in both 2020 and 2019 and $7 in 2018 (Gain) loss from early extinguishment of debt Equity in earnings of unconsolidated affiliates Income (loss) before income taxes (Benefit from) provision for income taxes Net income (loss) Less: Net income attributable to noncontrolling interests Net income (loss) attributable to Community Health Systems, Inc. stockholders Earnings (loss) per share attributable to Community Health Systems, Inc. conimon stockholders: Basic Diluted Weighted-average number of shares outstanding: Basic Diluted See accompanying notes to the consolidated financial statements. 83 $ $ 2020 2019 2018 (In millions, except share and per share data) 11.789 $ $ 13,210 5,411 1,963 2,957 Year Ended December 31, 327 (601) 558 48 10.663 1,126 1,031 (317) (10) 422 (185) 607 96 511 4.43 4.39 115,491,022 116,544,561 5,947 2,151 3,303 93 321 - 608 138 12,560 650 1,041 54 (15) (430) 160 (590) 85 (675) $ (5.93) (5.93) 113,739,046 113,739,046 $ 14,155 6,384 2,355 3,496 11 337 700 668 13,947 208 976 (31) (22) (715) (11) (704) 84 (788) (6.99) (6.99) 112,728,274 112,728,274 I wanted to give you all some tips and tricks to help you succeed on your upcoming 10-K Income Statement Paper: Horizontal Analysis- this is where you will pick a line item on the Income Statement, and trend it over time. There are 2 simple calculations to do this. First is the Net Change or Difference = Current Year less Prior Year. For example: 2020 = 500, 2019 = 300. Net Change year over year = +200. The second calculation is % Change = (Current Year less Prior Year) / Prior Year. Using the example above, the formula would be (500-300) / 300 = +67% growth over the prior year. # Vertical Analysis- this explains the makeup or % total of a specific line item, and how it trends over time. Let's use the example of Supply Cost as a % of Total Operating Costs. If we use the example of: Supply Cost in 2020 = 25, and Total Costs in 2020 = 100. 25/ 100 = 25% of Total. Say the Total Cost remained the same in 2019, but the Supply Cost = 35. So the Supply Cost in 2019 = 35% of Total Costs. Now, take the difference between both years and you could say: Supply Costs as a percentage of Total Costs reduced by 10% year over year. Lastly, please don't make the mistake of analyzing the Balance Sheet instead of the Income Statement. Please pay attention to the assignment directions, as it clearly states to focus on the Income StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started