Answered step by step

Verified Expert Solution

Question

1 Approved Answer

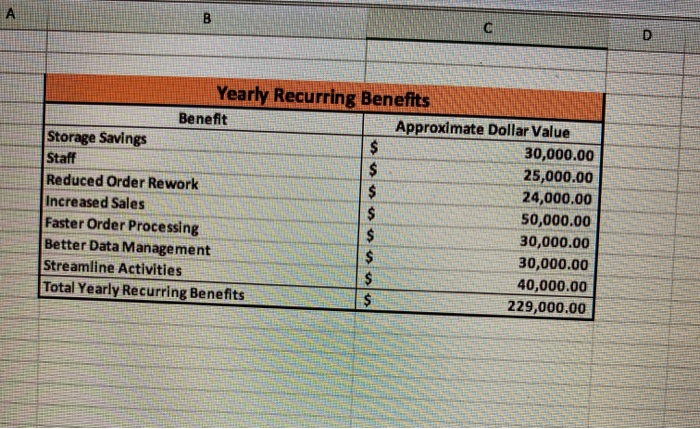

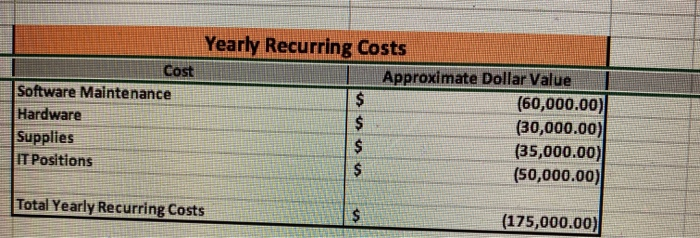

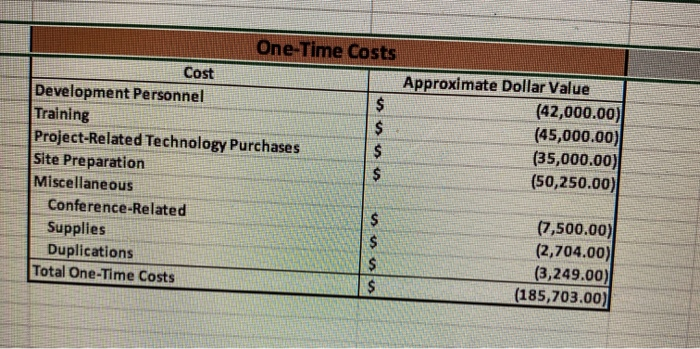

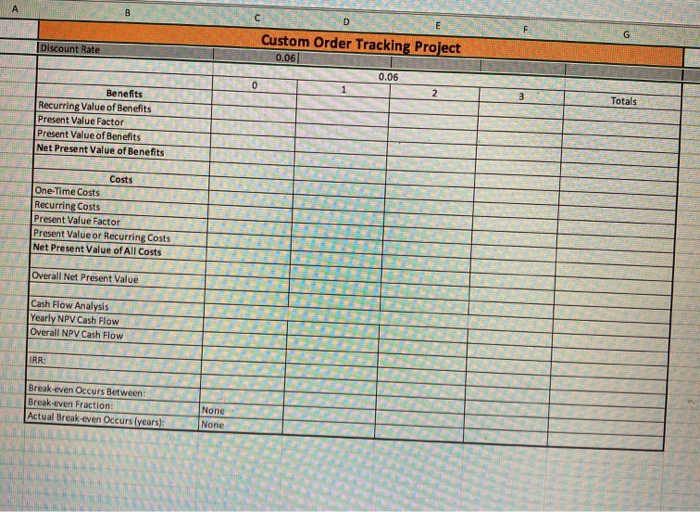

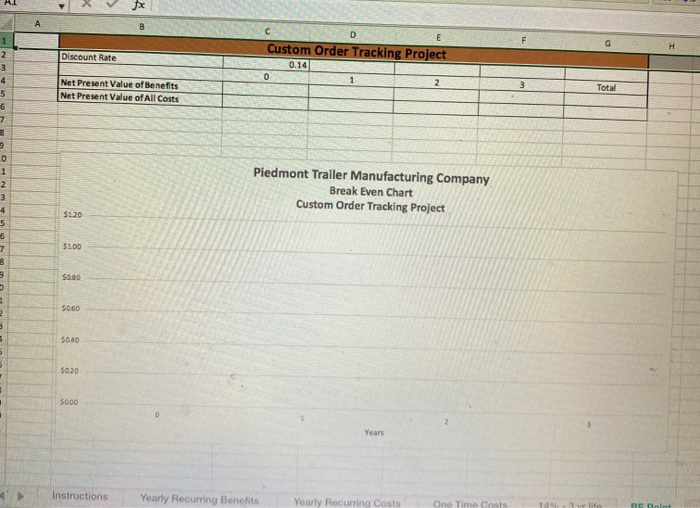

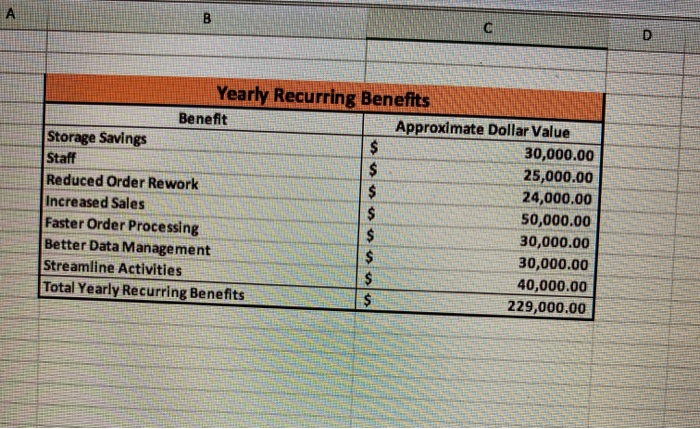

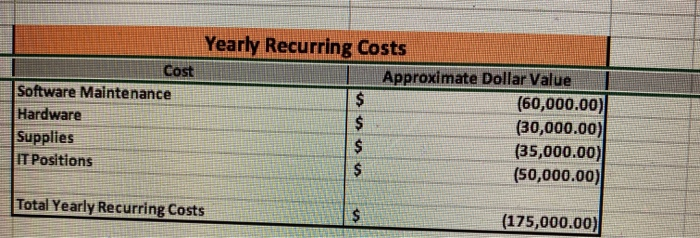

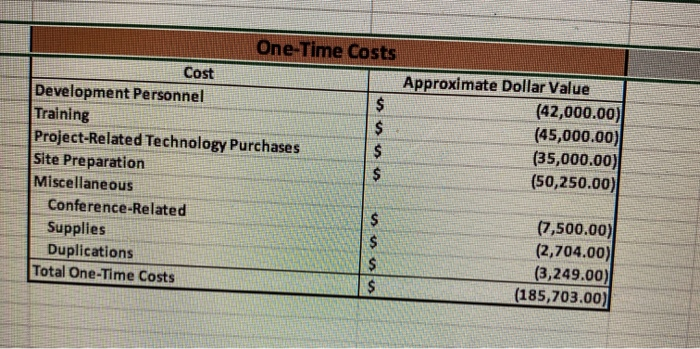

how do i do last 2 chart? including (0) B C D Yearly Recurring Benefits Benefit Approximate Dollar Value Storage Savings $ 30,000.00 Staff $

how do i do last 2 chart? including (0)

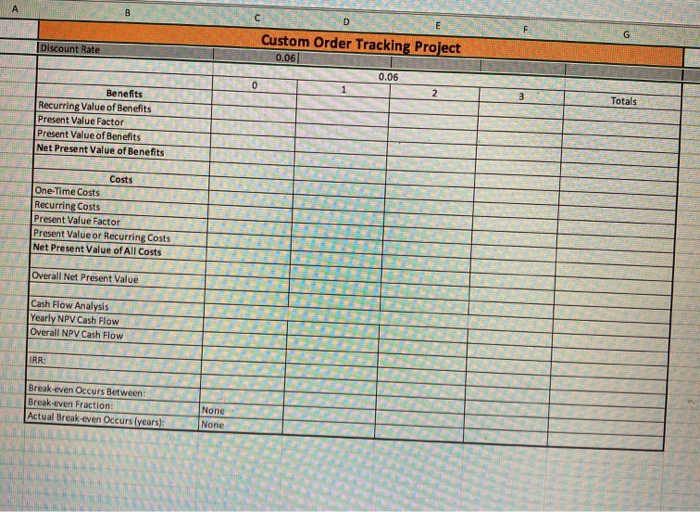

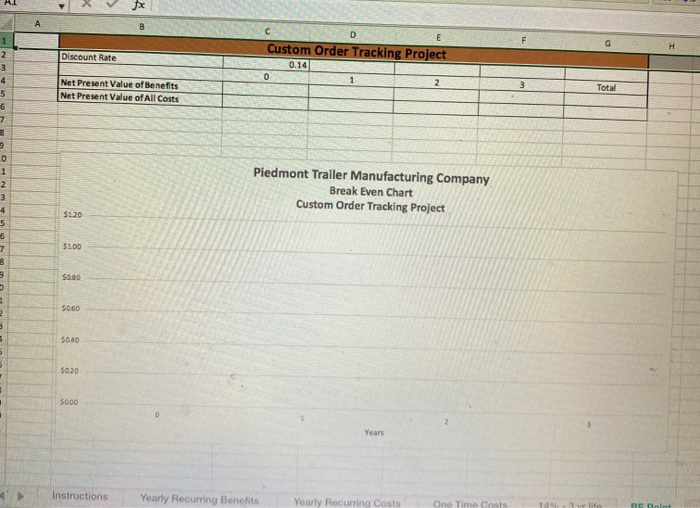

B C D Yearly Recurring Benefits Benefit Approximate Dollar Value Storage Savings $ 30,000.00 Staff $ 25,000.00 Reduced Order Rework $ 24,000.00 Increased Sales $ 50,000.00 Faster Order Processing $ 30,000.00 Better Data Management $ 30,000.00 Streamline Activities $ 40,000.00 Total Yearly Recurring Benefits $ 229,000.00 Cost Software Maintenance Hardware Supplies IT Positions Yearly Recurring Costs Approximate Dollar Value $ (60,000.00) $ (30,000.00) $ (35,000.00) $ (50,000.00) Total Yearly Recurring Costs $ (175,000.00) One-Time Costs Cost Approximate Dollar Value Development Personnel $ (42,000.00) Training $ (45,000.00) Project-Related Technology Purchases $ (35,000.00) Site Preparation $ (50,250.00) Miscellaneous Conference-Related $ (7,500.00) Supplies (2,704.00) Duplications $ (3,249.00) Total One-Time Costs $ (185,703.00) D E G Discount Rate Custom Order Tracking Project 0.06 0.06 0 1 2 Totals Benefits Recurring Value of Benefits Present Value Factor Present Value of Benefits Net Present Value of Benefits Costs One-Time Costs Recurring Costs Present Value Factor Present Value or Recurring Costs Net Present Value of All Costs Overall Net Present Value Cash Flow Analysis Yearly NPV Cash Flow Overall NPV Cash Flow IRR: Break even Occurs Between: Break-even Fraction: Actual Break even Occurs (years): None None fx B D E 2 3 Discount Rate Custom Order Tracking Project 0.14 4 1 2 Net Present Value of Benefits Net Present Value of All Costs Total 5 5 7 8 3 0 1 N Piedmont Trailer Manufacturing Company Break Even Chart Custom Order Tracking Project 3 $1.20 4 5 5 7 $1.00 8 3 $0.80 $0.60 2 3 50.40 5 5020 5000 Years Instructions Yearly Recurring Benefits Yearly Recurring Costs One Time Costs RED B C D Yearly Recurring Benefits Benefit Approximate Dollar Value Storage Savings $ 30,000.00 Staff $ 25,000.00 Reduced Order Rework $ 24,000.00 Increased Sales $ 50,000.00 Faster Order Processing $ 30,000.00 Better Data Management $ 30,000.00 Streamline Activities $ 40,000.00 Total Yearly Recurring Benefits $ 229,000.00 Cost Software Maintenance Hardware Supplies IT Positions Yearly Recurring Costs Approximate Dollar Value $ (60,000.00) $ (30,000.00) $ (35,000.00) $ (50,000.00) Total Yearly Recurring Costs $ (175,000.00) One-Time Costs Cost Approximate Dollar Value Development Personnel $ (42,000.00) Training $ (45,000.00) Project-Related Technology Purchases $ (35,000.00) Site Preparation $ (50,250.00) Miscellaneous Conference-Related $ (7,500.00) Supplies (2,704.00) Duplications $ (3,249.00) Total One-Time Costs $ (185,703.00) D E G Discount Rate Custom Order Tracking Project 0.06 0.06 0 1 2 Totals Benefits Recurring Value of Benefits Present Value Factor Present Value of Benefits Net Present Value of Benefits Costs One-Time Costs Recurring Costs Present Value Factor Present Value or Recurring Costs Net Present Value of All Costs Overall Net Present Value Cash Flow Analysis Yearly NPV Cash Flow Overall NPV Cash Flow IRR: Break even Occurs Between: Break-even Fraction: Actual Break even Occurs (years): None None fx B D E 2 3 Discount Rate Custom Order Tracking Project 0.14 4 1 2 Net Present Value of Benefits Net Present Value of All Costs Total 5 5 7 8 3 0 1 N Piedmont Trailer Manufacturing Company Break Even Chart Custom Order Tracking Project 3 $1.20 4 5 5 7 $1.00 8 3 $0.80 $0.60 2 3 50.40 5 5020 5000 Years Instructions Yearly Recurring Benefits Yearly Recurring Costs One Time Costs RED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started