Answered step by step

Verified Expert Solution

Question

1 Approved Answer

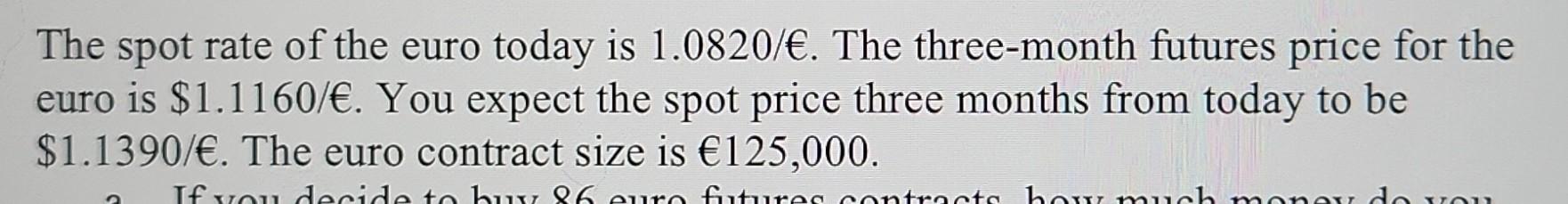

how do I do these? The spot rate of the euro today is 1.0820/. The three-month futures price for the euro is $1.1160/. You expect

how do I do these?

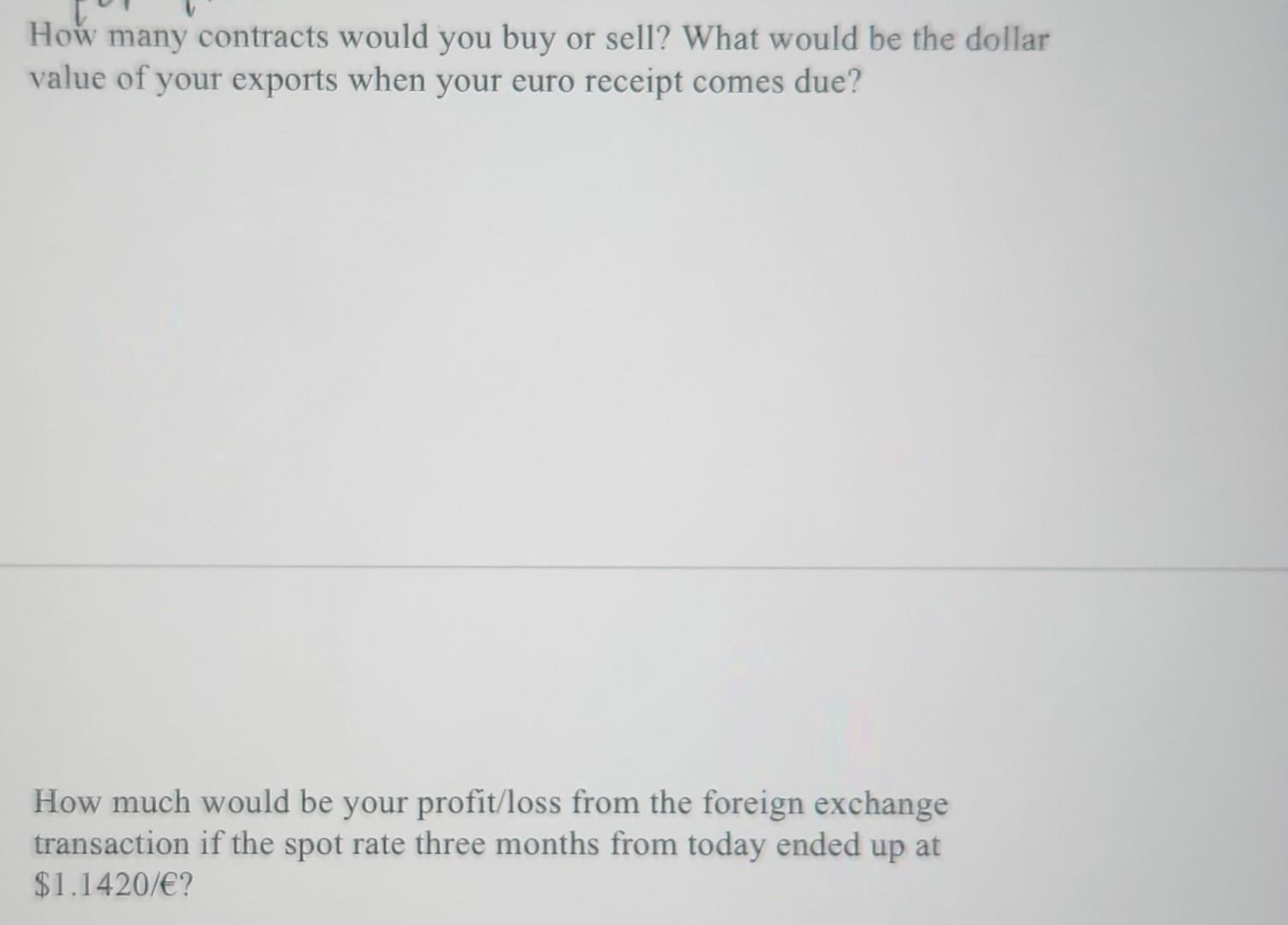

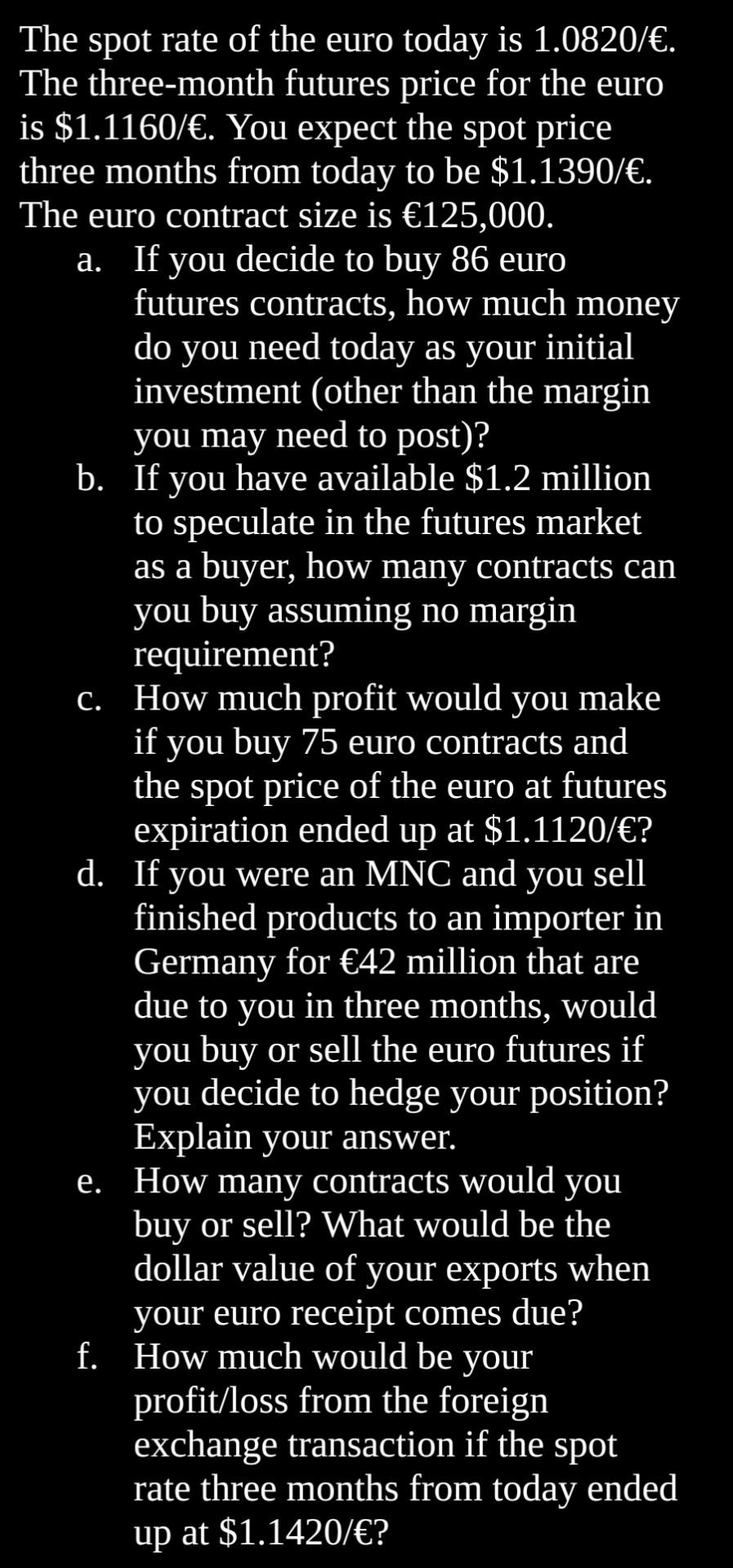

The spot rate of the euro today is 1.0820/. The three-month futures price for the euro is $1.1160/. You expect the spot price three months from today to be $1.1390/. The euro contract size is 125,000. How many contracts would you buy or sell? What would be the dollar value of your exports when your euro receipt comes due? How much would be your profit/loss from the foreign exchange transaction if the spot rate three months from today ended up at $1.1420/? The spot rate of the euro today is 1.0820/. The three-month futures price for the euro is $1.1160/. You expect the spot price three months from today to be $1.1390/. The euro contract size is 125,000. a. If you decide to buy 86 euro futures contracts, how much money do you need today as your initial investment (other than the margin you may need to post)? b. If you have available $1.2 million to speculate in the futures market as a buyer, how many contracts can you buy assuming no margin requirement? c. How much profit would you make if you buy 75 euro contracts and the spot price of the euro at futures expiration ended up at $1.1120/ ? d. If you were an MNC and you sell finished products to an importer in Germany for 42 million that are due to you in three months, would you buy or sell the euro futures if you decide to hedge your position? Explain your answer. e. How many contracts would you buy or sell? What would be the dollar value of your exports when your euro receipt comes due? f. How much would be your profit/loss from the foreign exchange transaction if the spot rate three months from today ended up at $1.1420/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started