Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I do this? I attempted it, but I don't think it's right. Master It! Solution $ $ $ Research and development Test marketing

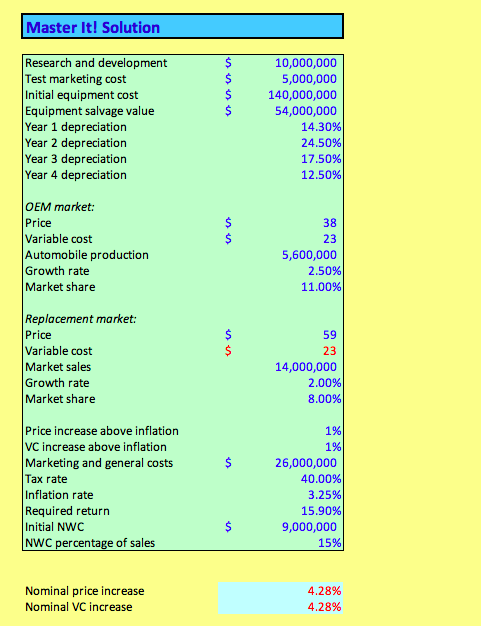

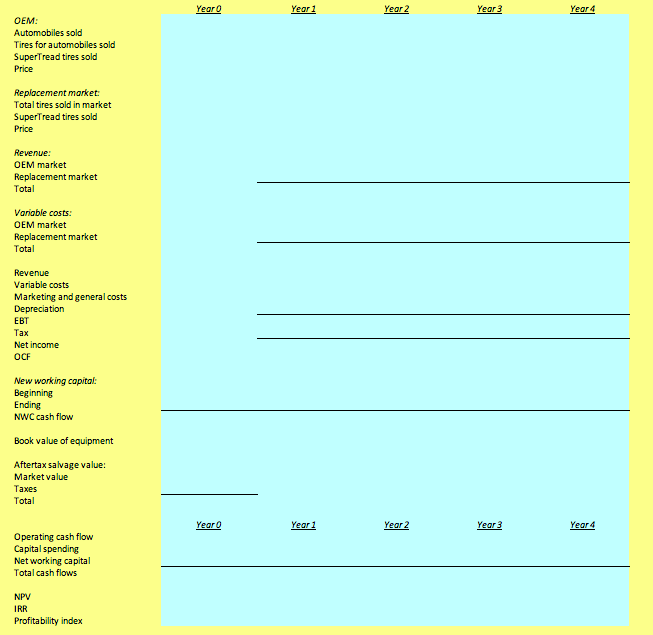

How do I do this? I attempted it, but I don't think it's right.

Master It! Solution $ $ $ Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 10,000,000 5,000,000 140,000,000 54,000,000 14.30% 24.50% 17.50% 12.50% $ $ OEM market: Price Variable cost Automobile production Growth rate Market share 38 23 5,600,000 2.50% 11.00% $ $ Replacement market: Price Variable cost Market sales Growth rate Market share 59 23 14,000,000 2.00% 8.00% $ Price increase above inflation VC increase above inflation Marketing and general costs Tax rate Inflation rate Required return Initial NWC NWC percentage of sales 1% 1% 26,000,000 40.00% 3.25% 15.90% 9,000,000 15% Nominal price increase Nominal VC increase 4.28% 4.28% Year o Year 1 Year 2 Year 3 Yeard OEM: Automobiles sold Tires for automobiles sold SuperTread tires sold Price Replacement market Total tires sold in market SuperTread tires sold Price Revenue: OEM market Replacement market Total Variable costs: OEM market Replacement market Total Revenue Variable costs Marketing and general costs Depreciation Tax Net income OCF New working capital Beginning Ending NWC cash flow Book value of equipment Aftertax salvage value: Market value Taxes Total Year o Year 1 Year2 Year 2 Year3 Year 3 Year Operating cash flow Capital spending Net working capital Total cash flows NPV IRR Profitability index Master It! Solution $ $ $ Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 10,000,000 5,000,000 140,000,000 54,000,000 14.30% 24.50% 17.50% 12.50% $ $ OEM market: Price Variable cost Automobile production Growth rate Market share 38 23 5,600,000 2.50% 11.00% $ $ Replacement market: Price Variable cost Market sales Growth rate Market share 59 23 14,000,000 2.00% 8.00% $ Price increase above inflation VC increase above inflation Marketing and general costs Tax rate Inflation rate Required return Initial NWC NWC percentage of sales 1% 1% 26,000,000 40.00% 3.25% 15.90% 9,000,000 15% Nominal price increase Nominal VC increase 4.28% 4.28% Year o Year 1 Year 2 Year 3 Yeard OEM: Automobiles sold Tires for automobiles sold SuperTread tires sold Price Replacement market Total tires sold in market SuperTread tires sold Price Revenue: OEM market Replacement market Total Variable costs: OEM market Replacement market Total Revenue Variable costs Marketing and general costs Depreciation Tax Net income OCF New working capital Beginning Ending NWC cash flow Book value of equipment Aftertax salvage value: Market value Taxes Total Year o Year 1 Year2 Year 2 Year3 Year 3 Year Operating cash flow Capital spending Net working capital Total cash flows NPV IRR Profitability indexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started