Question

How do I do this problem, question 5-66 in the Introduction to Financial Accounting Book? I have attached a photo of the problem. If you

How do I do this problem, question 5-66 in the Introduction to Financial Accounting Book? I have attached a photo of the problem. If you can't see the photo I have attached a type up at the bottom and maybe you can check the book itself

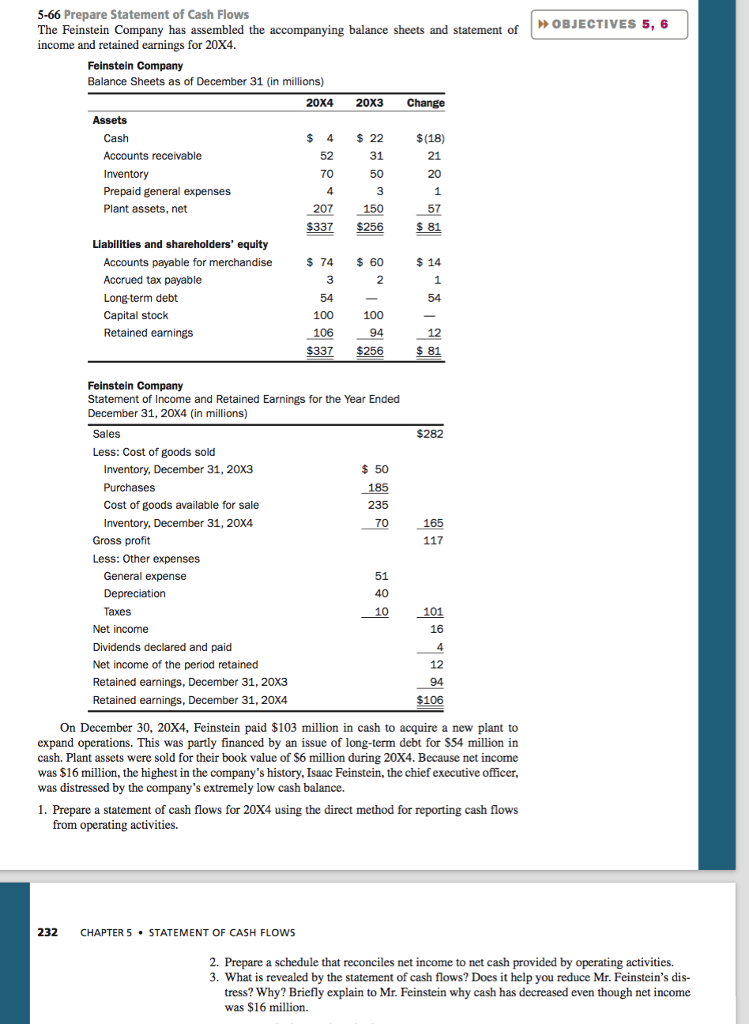

5-66 Prepare Statement of Cash Flows

The Feinstein Company has assembled the accompanying balance sheets and statement of income and retained earnings for 20X4 .

Feinstein Company Balance Sheets as of December 31 (in millions) 20X4 20X3 Change Cash Accounts receivable $ 422 31 S(18) 21 70 Prepaid general expenses Plant assets, net 57 $337 $256 81 Liabilities and shareholders' equity s 74 $ 60 Accounts payable for merchandise Accrued tax payable Long term debt Capital stock Retained earnings $ 14 2 100 94 S337 $256 54 100 106 12 $ 81 Feinstein Company Statement of Income and Retained Earnings for the Year Ended December 31, 20x4 (in millions) Sales $282 Less: Cost of goods sold 50 Inventory, December 31, 20X3 Purchases Cost of goods available for sale Inventory, December 31, 20X4 70165 Gross profit Less: Other expenses General expense 51 Taxes Net income Dividends declared and paid Net income of the period retained Retained earnings, December 31, 20X3 Retained earnings, December 31, 20X4 10 101 16 94 S106 On December 30, 20X4, Feinstein paid $103 million in cash to acquire a new plant to expand operations. This was partly financed by an issue of long-term debt for S54 million in cash. Plant assets were sold for their book value of S6 million during 20X4. Because net income was $16 million, the highest in the company's history, Isaac Feinstein, the chief executive officer, was distressed by the company's extremely low cash balance. 1. Prepare a statement of cash flows for 20X4 using the direct method for reporting cash flows from operating activities. 232 CHAPTER 5 STATEMENT OF CASH FLOWS 2. Prepare a schedule that reconciles net income to net cash provided by operating activities. 3. What is revealed by the statement of cash flows? Does it help you reduce Mr. Feinstein's dis- tress? Why? Briefly explain to Mr. Feinstein why cash has decreased even though net income was $16 million.

5-66 Prepare Statement of Cash Flows The Feinstein Company has assembled the accompanying balance sheets and statement of income and retained OBJECTIVES 5, 6 earnings for 20X4 Feinstein Company Balance Sheets as of December 31 (in millions) 20X4 20X3 Change Cash Accounts receivable $ 422 31 S(18) 21 70 Prepaid general expenses Plant assets, net 57 $337 $256 81 Liabilities and shareholders' equity s 74 $ 60 Accounts payable for merchandise Accrued tax payable Long term debt Capital stock Retained earnings $ 14 2 100 94 S337 $256 54 100 106 12 $ 81 Feinstein Company Statement of Income and Retained Earnings for the Year Ended December 31, 20x4 (in millions) Sales $282 Less: Cost of goods sold 50 Inventory, December 31, 20X3 Purchases Cost of goods available for sale Inventory, December 31, 20X4 70165 Gross profit Less: Other expenses General expense 51 Taxes Net income Dividends declared and paid Net income of the period retained Retained earnings, December 31, 20X3 Retained earnings, December 31, 20X4 10 101 16 94 S106 On December 30, 20X4, Feinstein paid $103 million in cash to acquire a new plant to expand operations. This was partly financed by an issue of long-term debt for S54 million in cash. Plant assets were sold for their book value of S6 million during 20X4. Because net income was $16 million, the highest in the company's history, Isaac Feinstein, the chief executive officer, was distressed by the company's extremely low cash balance. 1. Prepare a statement of cash flows for 20X4 using the direct method for reporting cash flows from operating activities. 232 CHAPTER 5 STATEMENT OF CASH FLOWS 2. Prepare a schedule that reconciles net income to net cash provided by operating activities. 3. What is revealed by the statement of cash flows? Does it help you reduce Mr. Feinstein's dis- tress? Why? Briefly explain to Mr. Feinstein why cash has decreased even though net income was $16 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started