Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I do this? The three-month dollar interest rate in New Vork is 6.40% per anmum. Alternatively, the threemonth curo interest tate in I

how do I do this?

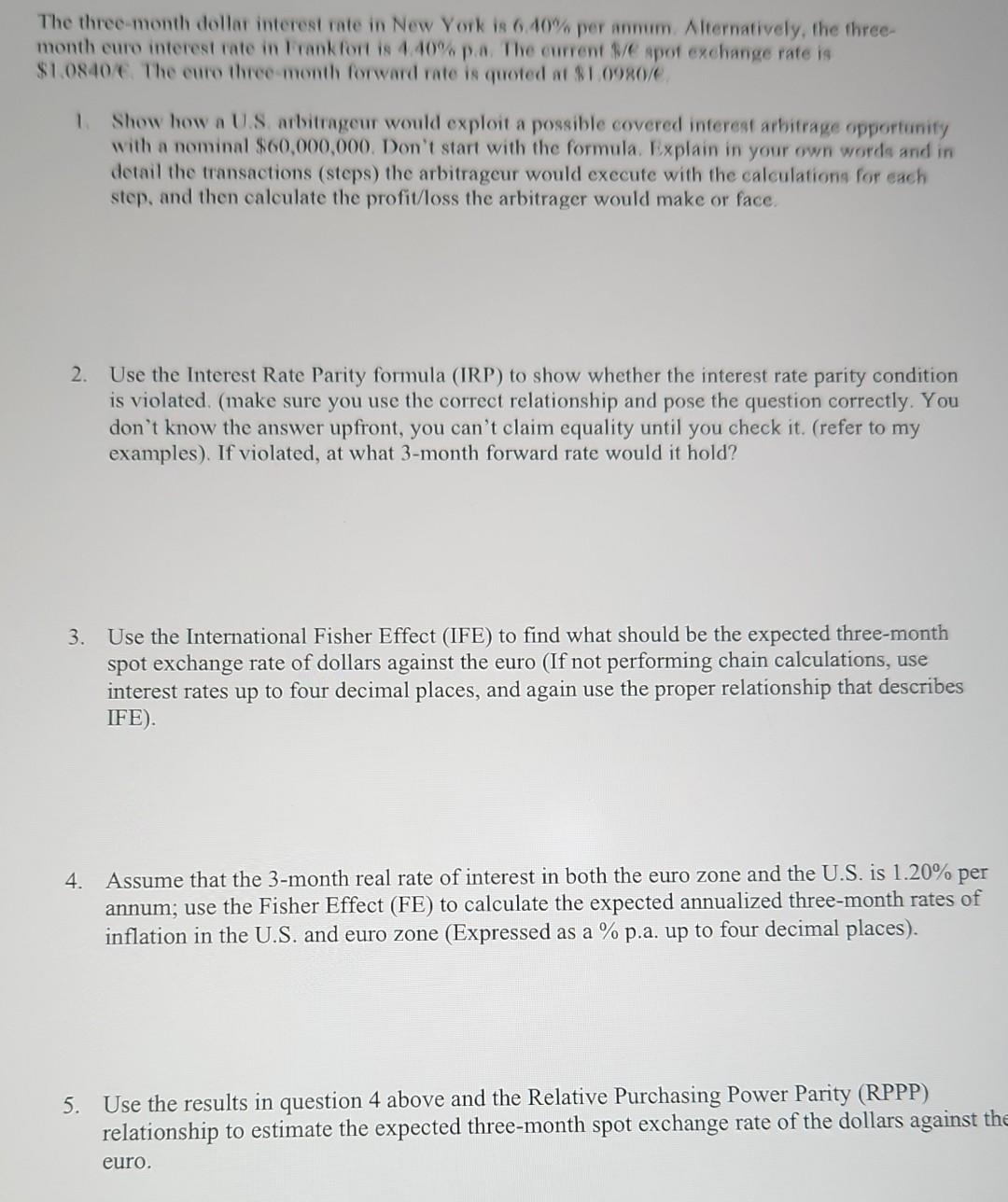

The three-month dollar interest rate in New Vork is 6.40% per anmum. Alternatively, the threemonth curo interest tate in I rankfort is 4.40% p.a. The current \$/e apot exchange rate is 81.0840 (. The curo three-month forward rate is quoted at $1.0980/ e. 1. Show how a U.S arbitrageur would exploit a possible covered interest arbitrage opportunify with a nominal $60,000,000. Don't start with the formula. Explain in your own words and in detail the transactions (steps) the arbitrageur would execute with the calculations for each step, and then calculate the profit/loss the arbitrager would make or face. 2. Use the Interest Rate Parity formula (IRP) to show whether the interest rate parity condition is violated. (make sure you use the correct relationship and pose the question correctly. You don't know the answer upfront, you can't claim equality until you check it. (refer to my examples). If violated, at what 3 -month forward rate would it hold? 3. Use the International Fisher Effect (IFE) to find what should be the expected three-month spot exchange rate of dollars against the euro (If not performing chain calculations, use interest rates up to four decimal places, and again use the proper relationship that describes IFE). 4. Assume that the 3-month real rate of interest in both the euro zone and the U.S. is 1.20% per annum; use the Fisher Effect (FE) to calculate the expected annualized three-month rates of inflation in the U.S. and euro zone (Expressed as a \% p.a. up to four decimal places). 5. Use the results in question 4 above and the Relative Purchasing Power Parity (RPPP) relationship to estimate the expected three-month spot exchange rate of the dollars against the euro. The three-month dollar interest rate in New Vork is 6.40% per anmum. Alternatively, the threemonth curo interest tate in I rankfort is 4.40% p.a. The current \$/e apot exchange rate is 81.0840 (. The curo three-month forward rate is quoted at $1.0980/ e. 1. Show how a U.S arbitrageur would exploit a possible covered interest arbitrage opportunify with a nominal $60,000,000. Don't start with the formula. Explain in your own words and in detail the transactions (steps) the arbitrageur would execute with the calculations for each step, and then calculate the profit/loss the arbitrager would make or face. 2. Use the Interest Rate Parity formula (IRP) to show whether the interest rate parity condition is violated. (make sure you use the correct relationship and pose the question correctly. You don't know the answer upfront, you can't claim equality until you check it. (refer to my examples). If violated, at what 3 -month forward rate would it hold? 3. Use the International Fisher Effect (IFE) to find what should be the expected three-month spot exchange rate of dollars against the euro (If not performing chain calculations, use interest rates up to four decimal places, and again use the proper relationship that describes IFE). 4. Assume that the 3-month real rate of interest in both the euro zone and the U.S. is 1.20% per annum; use the Fisher Effect (FE) to calculate the expected annualized three-month rates of inflation in the U.S. and euro zone (Expressed as a \% p.a. up to four decimal places). 5. Use the results in question 4 above and the Relative Purchasing Power Parity (RPPP) relationship to estimate the expected three-month spot exchange rate of the dollars against the euro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started