How do I find out Requirement 1 and 2

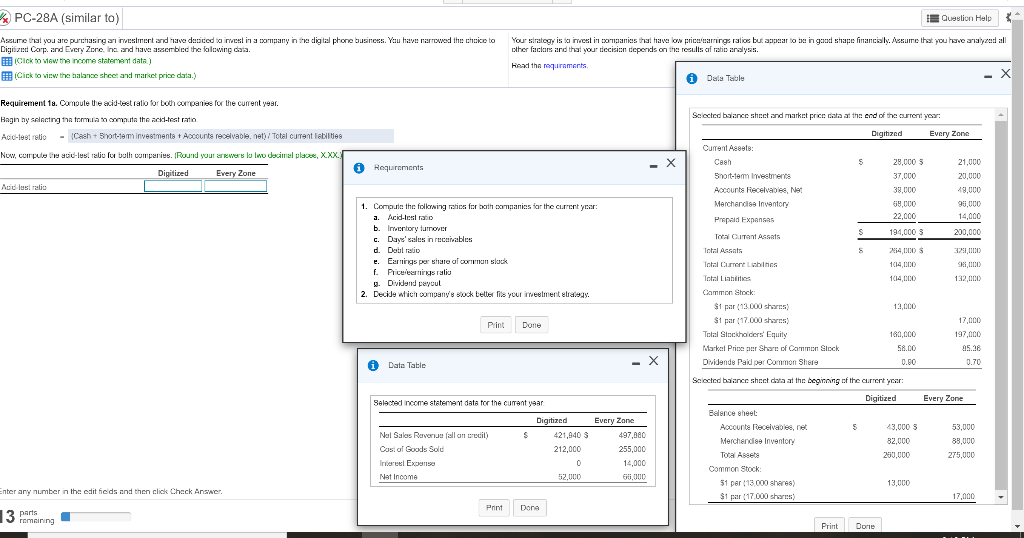

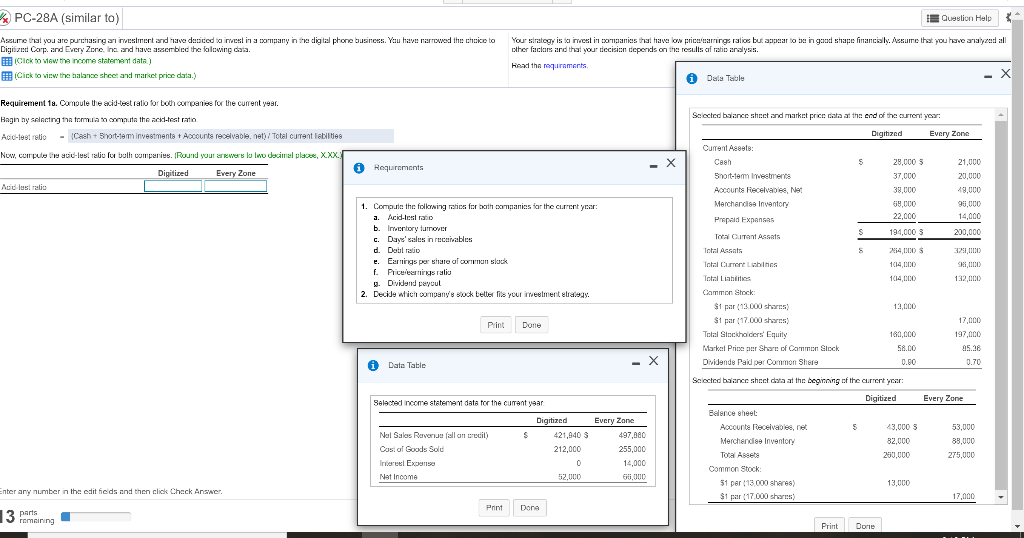

Question Help PC-28A (similar to) Aszume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Every Zone Inc and have assembled the following ca. Cick to view the income statement data) Click to view the balance sheet and market price data.) Your strategy is to invest in comanies that have low price uamings ralios butapear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis Headtharements A Data Table X Requirement 1a. Compute the acid-tect ratio for both companies for the current year. Hagin hy selecting the tomu nemate the acid-test ratio Acid-test ratio Cash + short-term investments + Accounts receivable.net/Total current abilities Now, computer Sci-les. zliu for bull companies. Round your are were lo lo decimal plae, xxx. Digitized Every Zone Acid lustra i Requirements 1. Compute the following for bath xmpanies for the current year: a. Acid-lerato b. Inventory turnover C. Dave'salus in receivables d. Dobil ratio e. Earnings per stare al comman slock 1. Priceleringsraliu Dvidend payout 2. Decide which company's stock belter lis your investment alleg. Selected balance sheet and market price Gala at the end of the current year: Digitized Every Zone Current Ascots Cash s 28,000 $ 21,000 Short-tem Inwestments 37,000 20,000 Accounts Receivable, Ne 38,000 18,000 Merchandise Inventory 69,000 95,000 Prepaid Expanses 22,000 14,000 S Toral Tant Assets 194,000 3 200,000 Total Assets S Total Current Labin 1014,000 S1811000 Total Liabilities 114,000 132,000 Cammon Stock $1 par (13.000 shares 13,000 $1 par (17.000 shares) 17,000 Total Stockholders' Equity 180,000 197,000 Narket Priser Share of Cammon Stock 58.00 95.38 Dividende Pald par Common Shere 0.00 0.70 Print Done i Data Table Every Zone Selected income statement data for the current year Digitized Nal Sales Ravori allan crecil $ 421,940 S Cos of Goods Solu 212,000 Interest Expense 0 Net Income 52.000 Every Zone 497,000 255,000 14,000 65,000 Sclected balance sheet data at the beginning of the current year: Digitized Belance sheet Account receivables, ne 43,000 $ Merchandise Inventory 82,000 Tocal Are 250,000 Common Stock 51 par 13000 shares) 13.000 $1 par 17.000 short 53,000 83,000 275,000 Enter any number in the editfieds and then click Check Answer 17.000 Print Dora 13 parts remaining Print Done Question Help PC-28A (similar to) Aszume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Every Zone Inc and have assembled the following ca. Cick to view the income statement data) Click to view the balance sheet and market price data.) Your strategy is to invest in comanies that have low price uamings ralios butapear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis Headtharements A Data Table X Requirement 1a. Compute the acid-tect ratio for both companies for the current year. Hagin hy selecting the tomu nemate the acid-test ratio Acid-test ratio Cash + short-term investments + Accounts receivable.net/Total current abilities Now, computer Sci-les. zliu for bull companies. Round your are were lo lo decimal plae, xxx. Digitized Every Zone Acid lustra i Requirements 1. Compute the following for bath xmpanies for the current year: a. Acid-lerato b. Inventory turnover C. Dave'salus in receivables d. Dobil ratio e. Earnings per stare al comman slock 1. Priceleringsraliu Dvidend payout 2. Decide which company's stock belter lis your investment alleg. Selected balance sheet and market price Gala at the end of the current year: Digitized Every Zone Current Ascots Cash s 28,000 $ 21,000 Short-tem Inwestments 37,000 20,000 Accounts Receivable, Ne 38,000 18,000 Merchandise Inventory 69,000 95,000 Prepaid Expanses 22,000 14,000 S Toral Tant Assets 194,000 3 200,000 Total Assets S Total Current Labin 1014,000 S1811000 Total Liabilities 114,000 132,000 Cammon Stock $1 par (13.000 shares 13,000 $1 par (17.000 shares) 17,000 Total Stockholders' Equity 180,000 197,000 Narket Priser Share of Cammon Stock 58.00 95.38 Dividende Pald par Common Shere 0.00 0.70 Print Done i Data Table Every Zone Selected income statement data for the current year Digitized Nal Sales Ravori allan crecil $ 421,940 S Cos of Goods Solu 212,000 Interest Expense 0 Net Income 52.000 Every Zone 497,000 255,000 14,000 65,000 Sclected balance sheet data at the beginning of the current year: Digitized Belance sheet Account receivables, ne 43,000 $ Merchandise Inventory 82,000 Tocal Are 250,000 Common Stock 51 par 13000 shares) 13.000 $1 par 17.000 short 53,000 83,000 275,000 Enter any number in the editfieds and then click Check Answer 17.000 Print Dora 13 parts remaining Print Done