Answered step by step

Verified Expert Solution

Question

1 Approved Answer

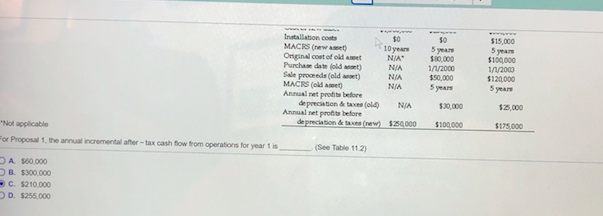

How do I find the annual incremental after tax cash flow? 40% tax rate $15,000 5 years $100000 1/2003 $120,000 5 year S0 50 10year$80,000

How do I find the annual incremental after tax cash flow?

40% tax rate

$15,000 5 years $100000 1/2003 $120,000 5 year S0 50 10year$80,000 Inatallation coets MACRS (new asset Original coet of old aset Purchase date fold asont) Sale proceeds (old aeset) MACRS (old amet Anual net protits before N/A N/A N/A $50,000 5 years $25,000 de preciation&taxes (ol4 NIA de preciasion &taxns (new) $250000$100000 -(see Table 112) 530,000 Annual net protits before $175,000 Not applicable or Proposal 1, the annual incremental afher -tax cash fow from operations for year 1 is A $80,000 B. $300,000 C. $210,000 D. $255,000 $15,000 5 years $100000 1/2003 $120,000 5 year S0 50 10year$80,000 Inatallation coets MACRS (new asset Original coet of old aset Purchase date fold asont) Sale proceeds (old aeset) MACRS (old amet Anual net protits before N/A N/A N/A $50,000 5 years $25,000 de preciation&taxes (ol4 NIA de preciasion &taxns (new) $250000$100000 -(see Table 112) 530,000 Annual net protits before $175,000 Not applicable or Proposal 1, the annual incremental afher -tax cash fow from operations for year 1 is A $80,000 B. $300,000 C. $210,000 D. $255,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started