Answered step by step

Verified Expert Solution

Question

1 Approved Answer

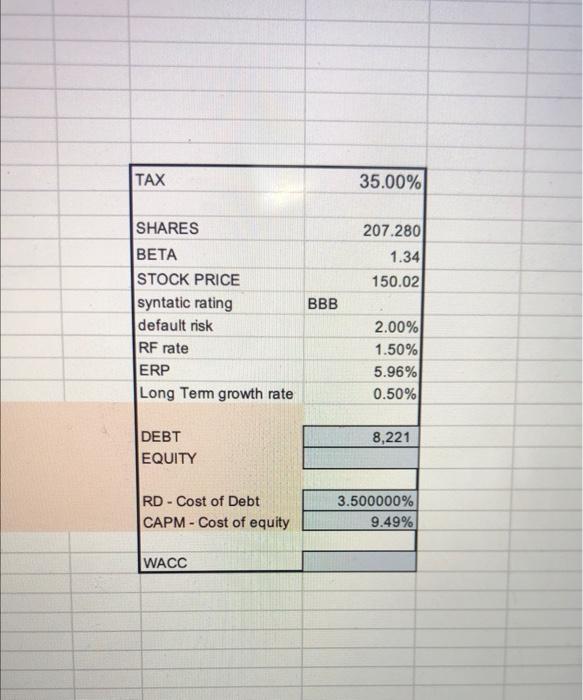

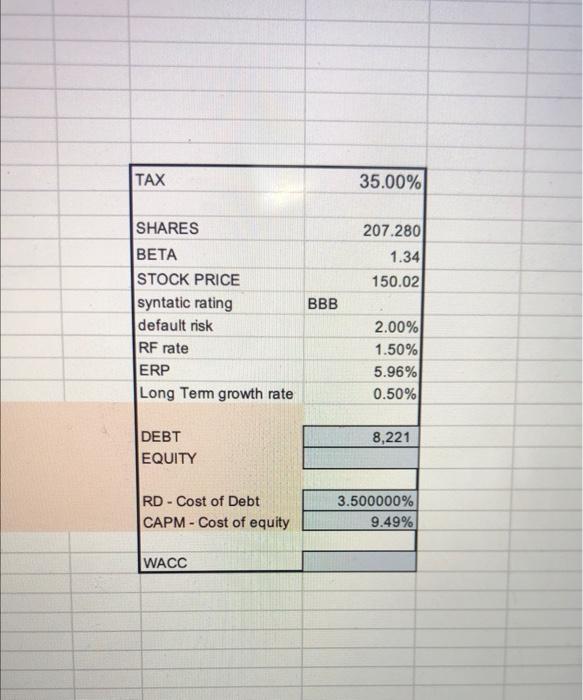

how do i find the equity value to continue with this discounted cash flow problem? TAX 35.00% 207.280 1.34 150.02 BBB SHARES BETA STOCK PRICE

how do i find the equity value to continue with this discounted cash flow problem?

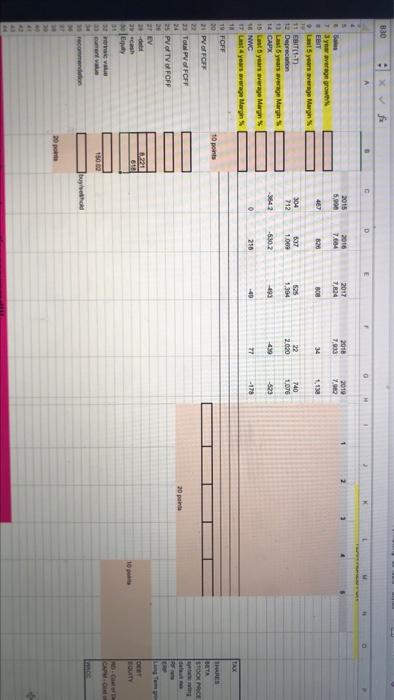

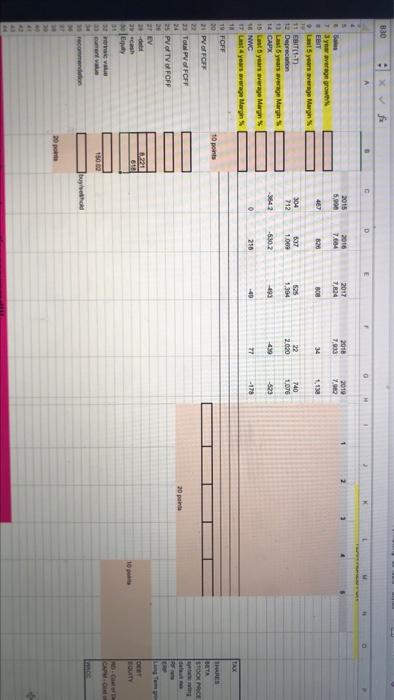

TAX 35.00% 207.280 1.34 150.02 BBB SHARES BETA STOCK PRICE syntatic rating default risk RF rate ERP Long Term growth rate 2.00% 1.50% 5.96% 0.50% 8,221 DEBT EQUITY RD - Cost of Debt CAPM - Cost of equity 3.500000% 9.49% WACC 330 ext D E 1 2015 500 2016 704 1 2017 7,824 1 2016 7,935 2019 19 2 47 820 808 34 1.18 304 712 DO DOO 6:37 1000 22 2020 1,394 740 1.078 -3842 yer average grow EBIT 5 years avrge Margin 11 EBITD 12 Depreciation Last years werage Mar 14 CAPX 15 Last years average Muryn 18 NWC 4 years ago Margin 11 TW FCFF 30 21 PV of FCFF -5302 93 439 123 O 250 -40 77 -178 TAX HJES 10 ports STDOK PROCE 20 po 33 Total PV of FCFF 24 25 PV of TV of FCFF 26 EV 20 de 2 cash ly 1 DOHO | BOTY 2 buren 15 cm wy 20 por

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started