Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I find the ratios? Edit: Ive uploaded more clear pictures. Please please help! July 31, 2020 Adjusted Trial Balance Dr. Cr. July 31,

how do I find the ratios?

Edit: Ive uploaded more clear pictures. Please please help!

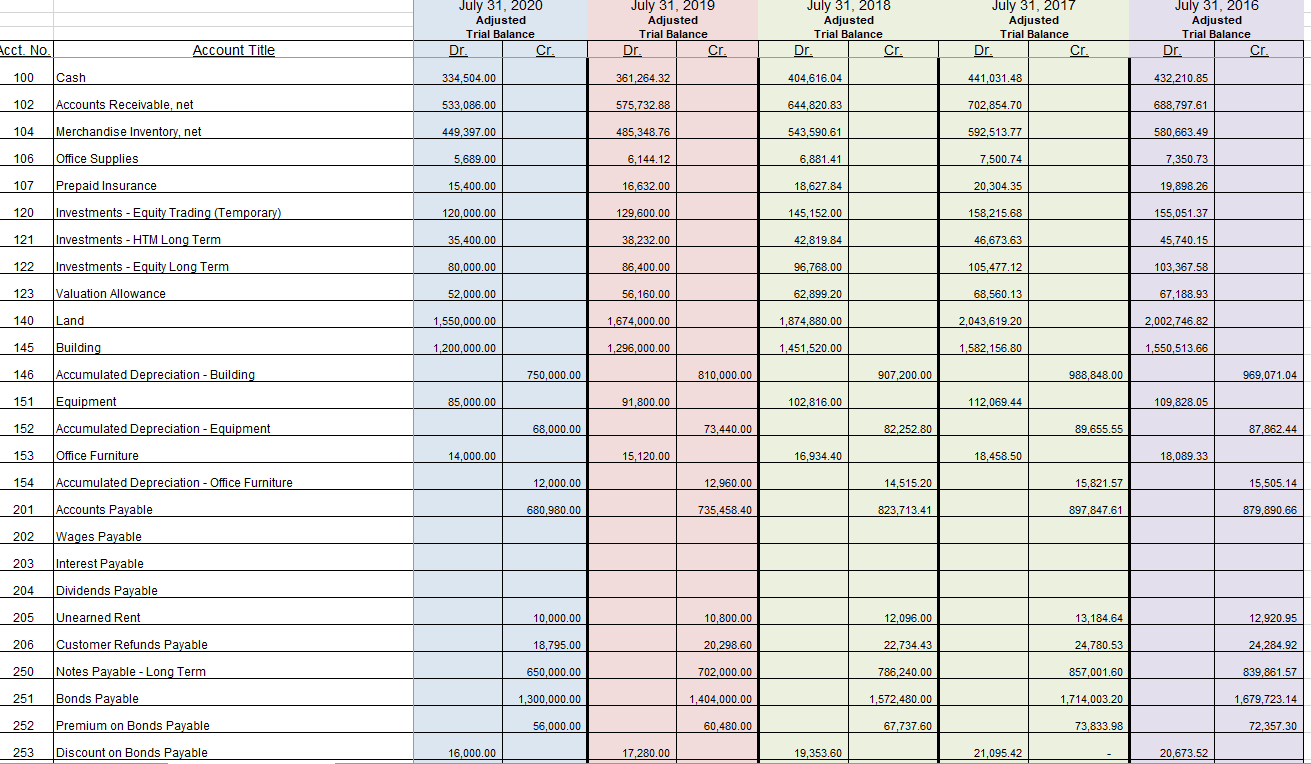

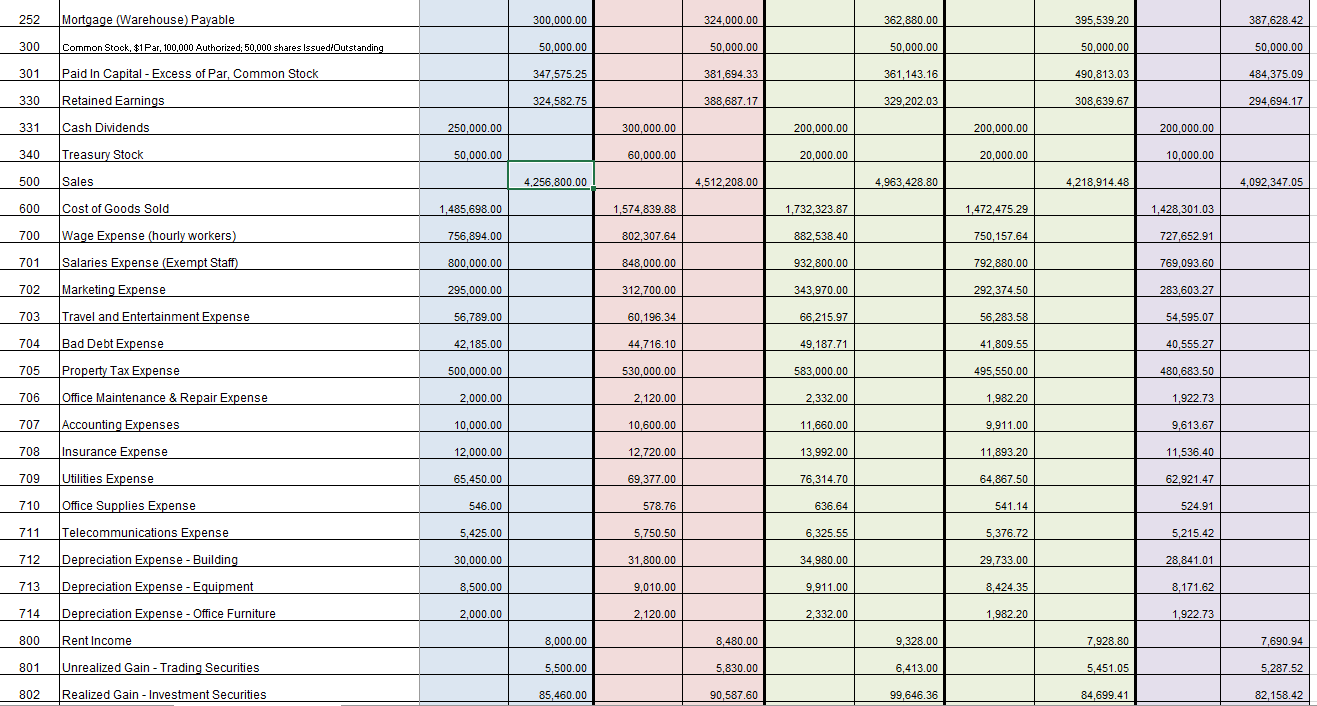

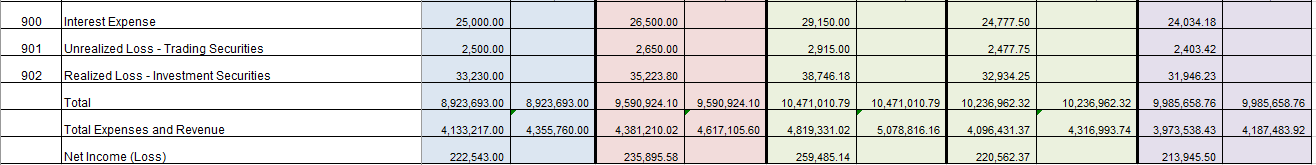

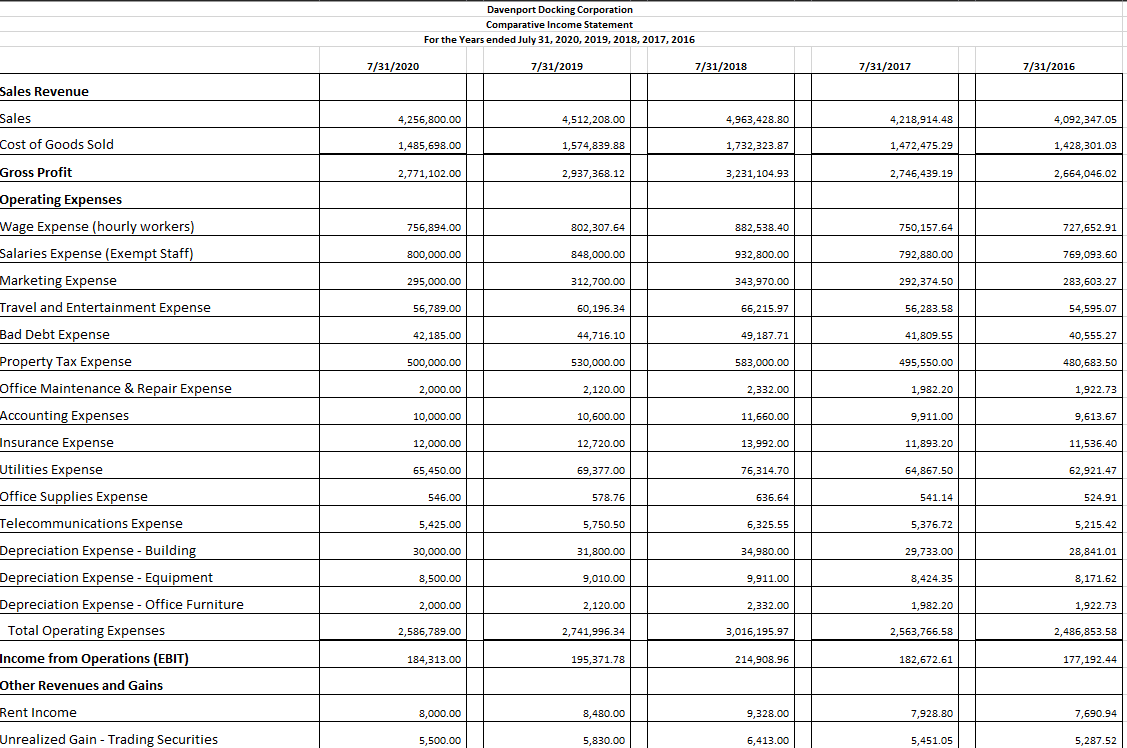

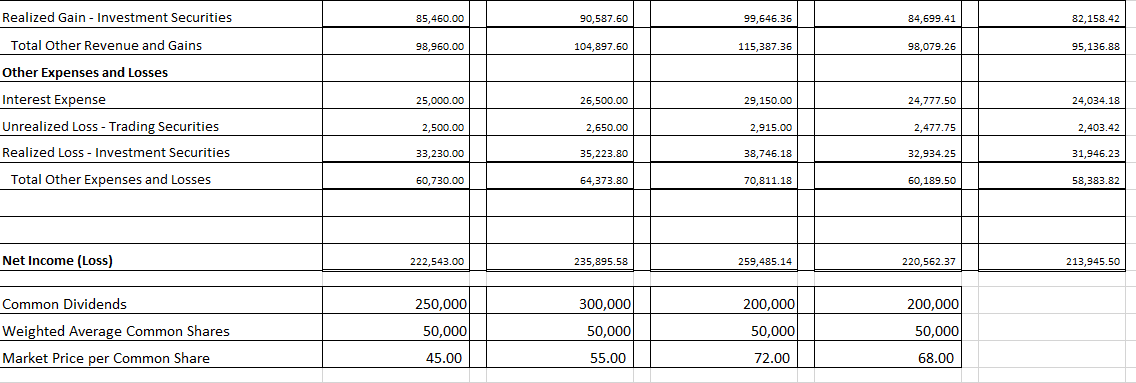

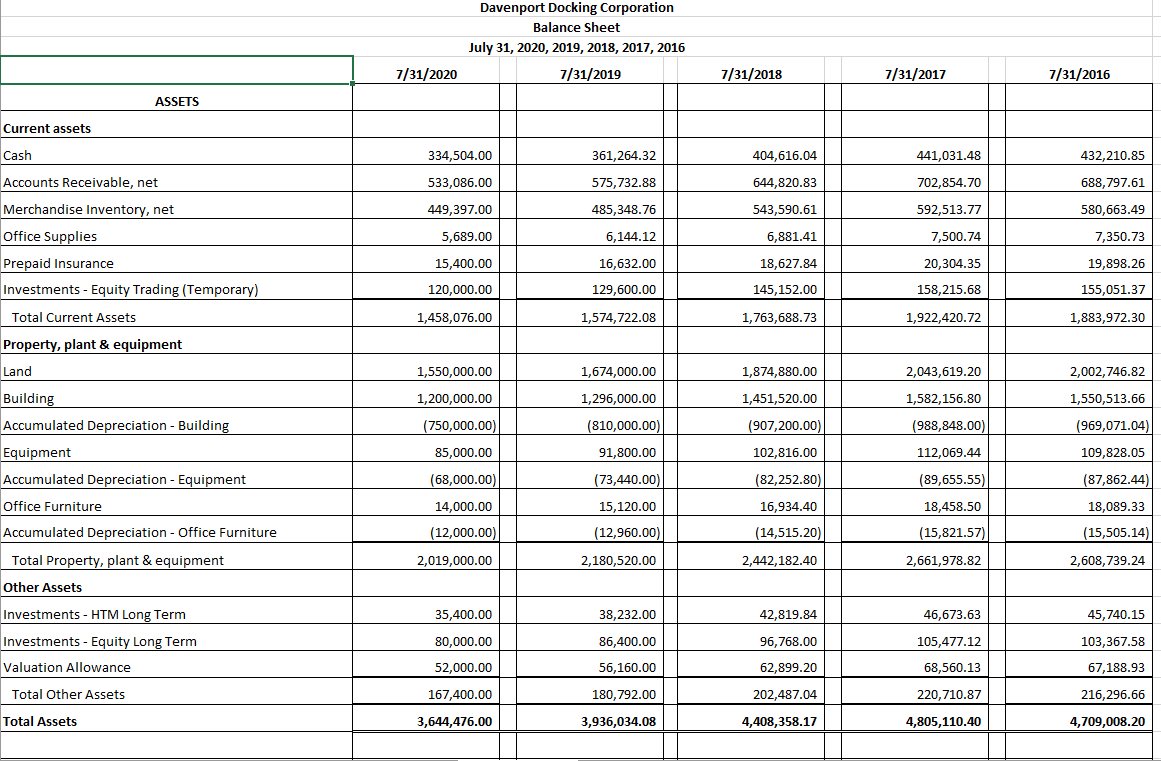

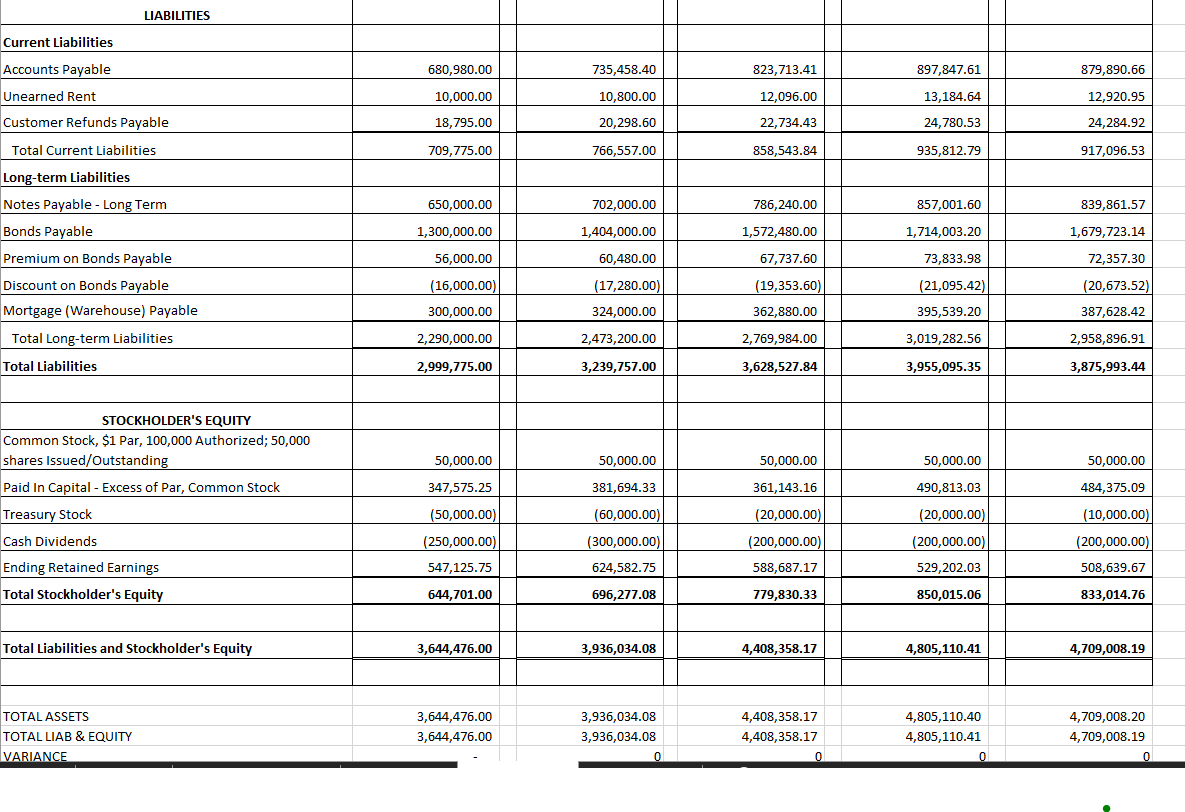

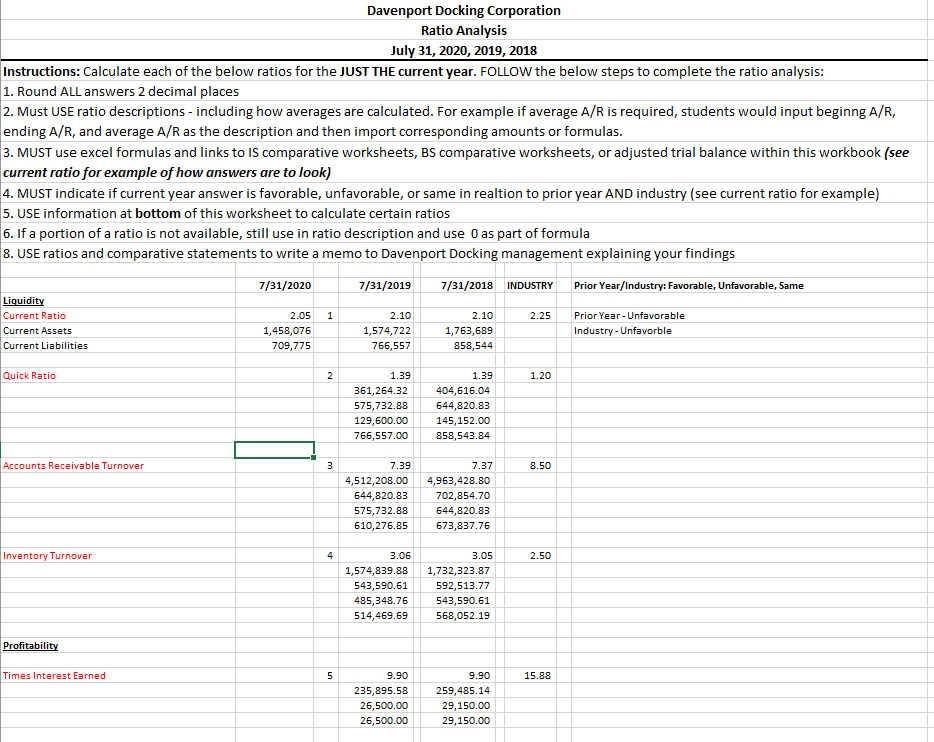

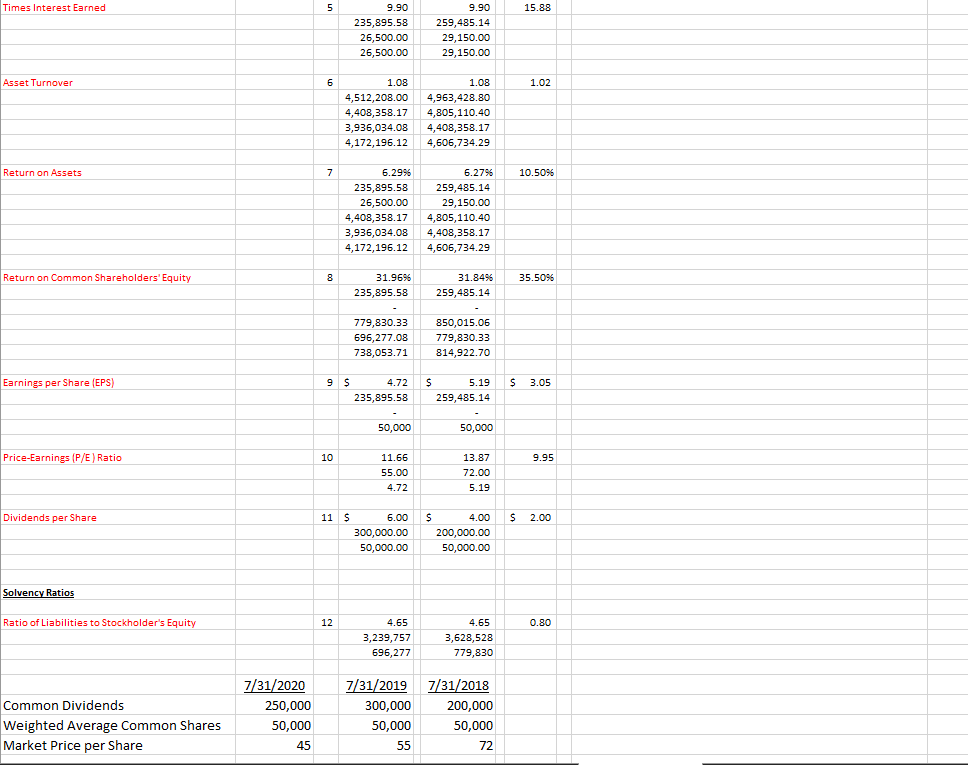

July 31, 2020 Adjusted Trial Balance Dr. Cr. July 31, 2019 Adjusted Trial Balance Dr. Cr. July 31, 2018 Adjusted Trial Balance Dr. Cr. July 31, 2017 Adjusted Trial Balance Dr. Cr. July 31, 2016 Adjusted Trial Balance Dr. Cr. Acct. No. Account Title 100 Cash 334,504.00 361,264.32 404,616.04 441,031.48 432,210.85 102 Accounts Receivable, net 533,086.00 575,732.88 644,820.83 702,854.70 688,797.61 104 Merchandise Inventory, net 449,397.00 485,348.76 543,590.61 592,513.77 580,663.49 106 Office Supplies 5,689.00 6,144.12 6,881.41 7,500.74 7,350.73 107 Prepaid Insurance 15,400.00 16,632.00 18,627.84 20,304.35 19,898.26 120 Investments - Equity Trading (Temporary) 120,000.00 129,600.00 145,152.00 158,215.68 155,051.37 121 Investments - HTM Long Term 35,400.00 38,232.00 42,819.84 46,673.63 45,740.15 122 Investments - Equity Long Term 80,000.00 86,400.00 96,768.00 105.477.12 103,367.58 123 Valuation Allowance 52,000.00 56,160.00 62.899.20 68,560.13 67,188.93 140 Land 1,550,000.00 1,674,000.00 1,874,880.00 2,043,619.20 2,002,746.82 145 Building 1,200,000.00 1,296,000.00 1,451,520.00 1,582,156.80 1,550,513.66 146 Accumulated Depreciation - Building 750,000.00 810,000.00 907,200.00 988,848.00 969,071.04 151 Equipment 85,000.00 91,800.00 102.816.00 112,069.44 109,828.05 152 Accumulated Depreciation - Equipment 68,000.00 73,440.00 82,252.80 89,655.55 87,862.44 153 Office Furniture 14,000.00 15,120.00 16,934.40 18,458.50 18,089.33 154 Accumulated Depreciation - Office Furniture 12,000.00 12,960.00 14,515.20 15,821.57 15,505.14 201 Accounts Payable 680,980.00 735,458.40 823,713.41 897,847.61 879,890.66 202 Wages Payable 203 Interest Payable 204 Dividends Payable 205 Unearned Rent 10,000.00 10,800.00 12,096.00 13,184.64 12,920.95 206 Customer Refunds Payable 18,795.00 20,298.60 22,734.43 24,780.53 24,284.92 250 Notes Payable - Long Term 650,000.00 702,000.00 786,240.00 857,001.60 839,861.57 251 Bonds Payable 1,300,000.00 1,404,000.00 1,572,480.00 1,714,003.20 1,679,723.14 252 Premium on Bonds Payable 56,000.00 60,480.00 67,737.60 73,833.98 72,357.30 253 Discount on Bonds Payable 16,000.00 17,280.00 19,353.60 21,095.42 20,673.52 252 Mortgage Warehouse) Payable 300,000.00 324,000.00 362.880.00 395,539.20 387,628,42 300 50,000.00 50,000.00 50,000.00 50,000.00 50,000.00 Common Stock, $1Par, 100,000 Authorized: 50,000 shares Issued/Outstanding Paid In Capital - Excess of Par, Common Stock 301 347,575.25 381,694.33 361,143.16 490,813.03 484,375.09 330 Retained Earnings 324,582.75 388,687.17 329,202.03 308,639.67 294,694.17 331 Cash Dividends 250,000.00 300,000.00 200,000.00 200,000.00 200,000.00 340 Treasury Stock 50,000.00 60,000.00 20,000.00 20,000.00 10,000.00 500 Sales 4,256,800.00 4,512,208.00 4,963,428.80 4,218,914.48 4,092,347.05 600 Cost of Goods Sold 1,485,698.00 1,574,839.88 1,732,323.87 1,472,475.29 1,428,301.03 700 Wage Expense (hourly workers) 756,894.00 802,307.64 882,538.40 750,157.64 727,652.91 701 Salaries Expense (Exempt Staff) 800,000.00 848,000.00 932,800.00 792,880.00 769,093.60 702 Marketing Expense 295,000.00 312.700.00 343,970.00 292.374.50 283,603.27 703 Travel and Entertainment Expense 56,789.00 60,196.34 66,215.97 56,283.58 54,595.07 704 Bad Debt Expense 42,185.00 44,716.10 49,187.71 41,809.55 40,555.27 705 Property Tax Expense 500,000.00 530,000.00 583,000.00 495,550.00 480,683.50 706 Office Maintenance & Repair Expense 2,000.00 2,120.00 2,332.00 1,982.20 1,922.73 707 Accounting Expenses 10,000.00 10,600.00 11,660.00 9,911.00 9,613.67 708 Insurance Expense 12,000.00 12.720.00 13,992.00 11,893.20 11,536.40 709 Utilities Expense 65,450.00 69,377.00 76,314.70 64,867.50 62.921.47 710 Office Supplies Expense 546.00 578.76 636.64 541.14 524.91 711 Telecommunications Expense 5,425.00 5,750.50 6,325.55 5,376.72 5,215.42 712 Depreciation Expense - Building 30,000.00 31,800.00 34.980.00 29.733.00 28,841.01 713 Depreciation Expense - Equipment 8,500.00 9,010.00 9,911.00 8,424.35 8,171.62 714 Depreciation Expense - Office Furniture 2,000.00 2,120.00 2,332.00 1,982.20 1,922.73 800 Rent Income 8,000.00 8,480.00 9,328.00 7,928.80 7,690.94 801 Unrealized Gain - Trading Securities 5,500.00 5,830.00 6,413.00 5,451.05 5,287.52 802 Realized Gain - Investment Securities 85,460.00 90,587.60 99,646.36 84,699.41 82,158.42 900 Interest Expense 25,000.00 26,500.00 29,150.00 24,777.50 24,034.18 901 Unrealized Loss - Trading Securities 2,500.00 2,650.00 2,915.00 2,477.75 2.403.42 902 Realized Loss - Investment Securities 33,230.00 35,223.80 38,746.18 32,934.25 31,946.23 Total 8,923,693.00 8.923.693.00 9,590,924.10 9,590,924.10 10,471,010.79 10,471,010.79 10,236,962.32 10,236,962.32 9,985,658.76 9,985,658.76 Total Expenses and Revenue 4,133,217.00 4,355,760.00 4,381,210.02 4,617,105.60 4,819,331.02 5,078,816.16 4,096,431.37 4,316,993.74 3,973,538.43 4,187,483.92 Net Income (Loss) 222,543.00 235,895.58 259,485.14 220,562.37 213,945.50 Davenport Docking Corporation Comparative Income Statement For the Years ended July 31, 2020, 2019, 2018, 2017, 2016 7/31/2020 7/31/2019 7/31/2018 7/31/2017 7/31/2016 Sales Revenue Sales 4,256,800.00 4,512,208.00 4,963,428.80 4,218,914.48 4,092,347.05 Cost of Goods Sold 1,485,698.00 1,574,839.88 1,732,323.87 1,472,475.29 1,428,301.03 Gross Profit 2,771,102.00 2,937,368.12 3,231,104.93 2,746,439.19 2,664,046.02 756,894.00 802,307.64 882,538.40 750,157.64 727,652.91 800,000.00 848,000.00 932,800.00 792,880.00 769,093.60 295,000.00 312,700.00 343,970.00 292,374.50 283,603.27 56,789.00 60,196.34 66,215.97 56,283.58 54,595.07 Operating Expenses Wage Expense (hourly workers) Salaries Expense (Exempt Staff) Marketing Expense Travel and Entertainment Expense Bad Debt Expense Property Tax Expense Office Maintenance & Repair Expense Accounting Expenses Insurance Expense 42,185.00 44,716.10 49,187.71 41,809.55 40,555.27 500,000.00 530,000.00 583,000.00 495,550.00 480,683.50 2,000.00 2,120.00 2,332.00 1,982.20 1,922.73 10,000.00 10,600.00 11,660.00 9,911.00 9,613.67 12,000.00 12,720.00 13,992.00 11,893.20 11,536.40 Utilities Expense 65,450.00 69,377.00 76,314.70 64.867.50 62,921.47 546.00 578.76 636.64 541.14 524.91 5,425.00 5,750.50 6,325.55 5,376.72 5,215.42 30,000.00 31,800.00 34,980.00 29,733.00 28,841.01 8,500.00 9,010.00 9,911.00 8,424.35 8,171.62 Office Supplies Expense Telecommunications Expense Depreciation Expense - Building Depreciation Expense - Equipment Depreciation Expense - Office Furniture Total Operating Expenses Income from Operations (EBIT) Other Revenues and Gains 2,000.00 2,120.00 2,332.00 1,982.20 1,922.73 2,586,789.00 2,741,996.34 3,016, 195.97 2,563,766.58 2,486,853.58 184,313.00 195,371.78 214,908.96 182,672.61 177,192.44 Rent Income 8,000.00 8,480.00 9,328.00 7,928.80 7,690.94 Unrealized Gain - Trading Securities 5,500.00 5,830.00 6,413.00 5,451.05 5,287.52 Realized Gain - Investment Securities 85,460.00 90,587.60 99,646.36 84,699.41 82,158.42 Total Other Revenue and Gains 98,960.00 104,897.60 115,387.36 98,079.26 95,136.88 25,000.00 26,500.00 29,150.00 24,777.50 24,034.18 Other Expenses and Losses Interest Expense Unrealized Loss - Trading Securities Realized Loss - Investment Securities 2,500.00 2,650.00 2.915.00 2,477.75 2,403.42 33,230.00 35,223.80 38,746.18 32,934.25 31,946.23 Total Other Expenses and Losses 60,730.00 64,373.80 70,811.18 60,189.50 58,383.82 Net Income (Loss) 222,543.00 235,895.58 259,485.14 220,562.37 213,945.50 250,000 200,000 Common Dividends Weighted Average Common Shares Market Price per Common Share 300,000 50,000 200,000 50,000 50,000 50,000 45.00 55.00 72.00 68.00 Davenport Docking Corporation Balance Sheet July 31, 2020, 2019, 2018, 2017, 2016 7/31/2019 7/31/2020 7/31/2018 7/31/2017 7/31/2016 ASSETS Current assets Cash 334,504.00 361,264.32 404,616.04 441,031.48 432,210.85 533,086.00 575,732.88 644,820.83 702,854.70 688,797.61 449,397.00 485.348.76 543,590.61 592,513.77 580,663.49 5,689.00 6,144.12 6,881.41 7,500.74 7,350.73 15,400.00 16,632.00 18,627.84 20,304.35 19,898.26 Accounts Receivable, net Merchandise Inventory, net Office Supplies Prepaid Insurance Investments - Equity Trading (Temporary) Total Current Assets Property, plant & equipment Land 120,000.00 129,600.00 145,152.00 158,215.68 155,051.37 1,458,076.00 1,574,722.08 1,763,688.73 1,922,420.72 1,883,972.30 1,550,000.00 1,674,000.00 1,874,880.00 2,043,619.20 2,002,746.82 1,200,000.00 1,296,000.00 1,451,520.00 1,582,156.80 1,550,513.66 (750,000.00) (810,000.00) (907,200.00) (988,848.00) (969,071.04) Building Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment 85,000.00 91,800.00 102,816.00 112,069.44 109,828.05 (68,000.00) (73,440.00) (82,252.80) (89,655.55) (87,862.44) 14,000.00 15,120.00 16,934.40 18,458.50 18,089.33 Office Furniture Accumulated Depreciation - Office Furniture Total Property, plant & equipment (12,000.00) (12,960.00) (14,515.20) (15,821.57) (15,505.14) 2,019,000.00 2,180,520.00 2,442,182.40 2,661,978.82 2,608,739.24 Other Assets Investments - HTM Long Term 35,400.00 38,232.00 42,819.84 46,673.63 45,740.15 80,000.00 86,400.00 96,768.00 105,477.12 103,367.58 Investments - Equity Long Term Valuation Allowance 52,000.00 56,160.00 62,899.20 68,560.13 67,188.93 Total Other Assets 167,400.00 180,792.00 202,487.04 220,710.87 216,296.66 Total Assets 3,644,476.00 3,936,034.08 4,408,358.17 4,805, 110.40 4,709,008.20 LIABILITIES Current Liabilities 680,980.00 735,458.40 823,713.41 897,847.61 879,890.66 Accounts Payable Unearned Rent Customer Refunds Payable 10,000.00 10,800.00 12,096.00 13,184.64 12,920.95 18,795.00 20,298.60 22,734.43 24,780.53 24,284.92 Total Current Liabilities 709,775.00 766,557.00 858,543.84 935,812.79 917,096.53 650,000.00 702,000.00 786,240.00 857,001.60 839,861.57 1,300,000.00 1.404.000.00 1,572,480.00 1,714,003.20 1,679,723.14 56,000.00 60,480.00 67,737.60 73,833.98 72,357.30 Long-term Liabilities Notes Payable - Long Term Bonds Payable Premium on Bonds Payable Discount on Bonds Payable Mortgage (Warehouse) Payable Total Long-term Liabilities Total Liabilities (16,000.00) (17,280.00) (19,353.60) (21,095.42 (20,673.52) 300,000.00 324,000.00 362,880.00 395,539.20 387,628.42 2,290,000.00 2,473,200.00 2,769,984.00 3,019,282.56 2,958,896.91 2,999,775.00 3,239,757.00 3,628,527.84 3,955,095.35 3,875,993.44 50,000.00 50,000.00 50,000.00 50,000.00 50,000.00 347,575.25 381,694.33 361,143.16 490,813.03 484,375.09 STOCKHOLDER'S EQUITY Common Stock, $1 Par, 100,000 Authorized; 50,000 shares Issued/Outstanding Paid In Capital - Excess of Par, Common Stock Treasury Stock Cash Dividends Ending Retained Earnings Total Stockholder's Equity (50,000.00) (60,000.00) (20,000.00) (20,000.00) (10,000.00) (250,000.00) (300,000.00) (200,000.00) (200,000.00) (200,000.00) 547,125.75 624,582.75 588,687.17 529,202.03 508,639.67 644,701.00 696,277.08 779,830.33 850,015.06 833,014.76 Total Liabilities and Stockholder's Equity 3,644,476.00 3,936,034.08 4,408,358.17 4,805,110.41 4,709,008.19 TOTAL ASSETS TOTAL LIAB & EQUITY VARIANCE 3,644,476.00 3,644,476.00 3,936,034.08 3,936,034.08 4,408,358.17 4,408,358.17 4,805, 110.40 4,805, 110.41 4,709,008.20 4,709,008.19 0 Davenport Docking Corporation Ratio Analysis July 31, 2020, 2019, 2018 Instructions: Calculate each of the below ratios for the JUST THE current year. FOLLOW the below steps to complete the ratio analysis: 1. Round ALL answers 2 decimal places 2. Must USE ratio descriptions - including how averages are calculated. For example if average A/R is required, students would input beginng A/R, ending A/R, and average A/R as the description and then import corresponding amounts or formulas. 3. MUST use excel formulas and links to IS comparative worksheets, BS comparative worksheets, or adjusted trial balance within this workbook (see current ratio for example of how answers are to look) 4. MUST indicate if current year answer is favorable, unfavorable, or same in realtion to prior year AND industry (see current ratio for example) 5. USE information at bottom of this worksheet to calculate certain ratios 6. If a portion of a ratio is not available, still use in ratio description and use 0 as part of formula 8. USE ratios and comparative statements to write a memo to Davenport Docking management explaining your findings 7/31/2020 7/31/2019 7/31/2018 INDUSTRY Prior Year/Industry: Favorable, Unfavorable, Same 1 2.25 Liquidity Current Ratio Current Assets Current Liabilities 2.05 1,458,076 709,775 2.10 1,574,722 766,557 2.10 1,763,689 858,544 Prior Year - Unfavorable Industry - Unfavorble Quick Ratio 2 1.20 1.39 361,264.32 575,732.88 129,600.00 766,557.00 1.39 404,616.04 644,820.83 145,152.00 858,543.84 Accounts Receivable Turnover 3 8.50 7.39 4,512,208.00 644,820.83 575,732.88 610,276.85 7.37 4,963,428.80 702,854.70 644,820.83 673,837.76 Inventory Turnover 4 2.50 3.06 1,574,839.88 543,590.61 485,348.76 514,469.69 3.05 1,732,323.87 592,513.77 543,590.61 568,052.19 Profitability Times Interest Earned 5 15.88 9.90 235,895.58 26,500.00 26,500.00 9.90 259,485.14 29,150.00 29,150.00 Times Interest Earned 5 15.88 9.90 235,895.58 26,500.00 26,500.00 9.90 259,485.14 29,150.00 29,150.00 Asset Turnover 6 1.02 1.08 4,512,208.00 4,408,358.17 3,936,034.08 4,172,196.12 1.08 4,963,428.80 4,805, 110.40 4,408,358.17 4,606,734.29 Return on Assets 7 10.5096 6.2995 235,895.58 26,500.00 4,408,358.17 3,936,034.08 4,172,196.12 6.2796 259,485.14 29,150.00 4,805, 110.40 4,408,358.17 4,606,734.29 Return on Common Shareholders' Equity 8 35.5096 31.9696 235,895.58 31.8496 259,485.14 779,830.33 696,277.08 738,053.71 850,015.0E 779,830.33 814,922.70 Earnings per Share (EPS) $ 3.05 9 $ 4.72 235,895.58 $ 5.19 259,485.14 50,000 50,000 Price-Earnings (P/E) Ratio 10 9.95 11.66 55.00 4.72 13.87 72.00 5.19 Dividends per Share 11 S $ 2.00 6.00 300,000.00 50,000.00 $ 4.00 200,000.00 50,000.00 Solvency Ratios Ratio of Liabilities to Stockholder's Equity 12 0.80 4.65 3,239,757 696,277 4.65 3,628,528 779,830 Common Dividends Weighted Average Common Shares Market Price per Share 7/31/2020 250,000 50,000 45 7/31/2019 300,000 50,000 55 7/31/2018 200,000 50,000 72Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started