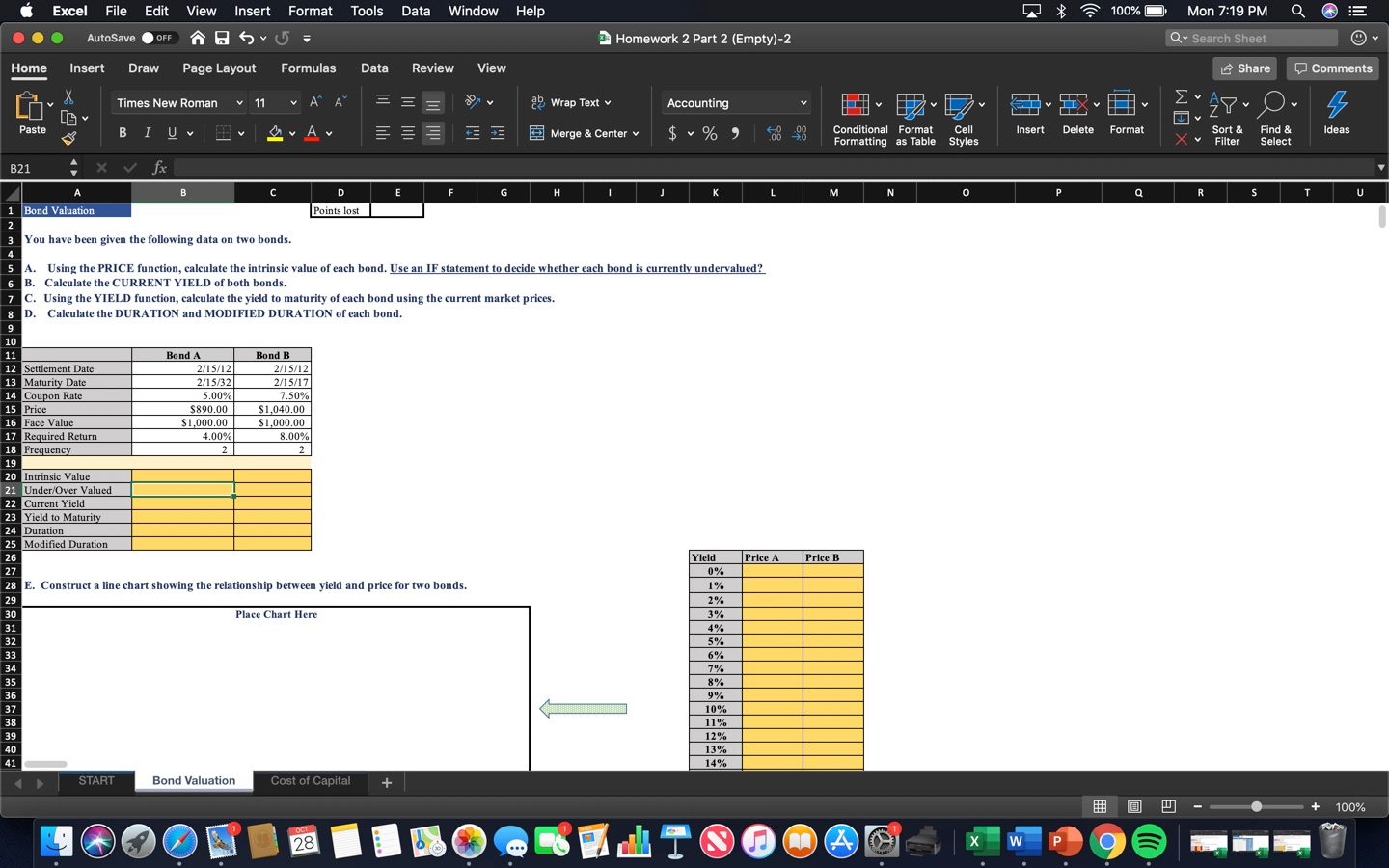

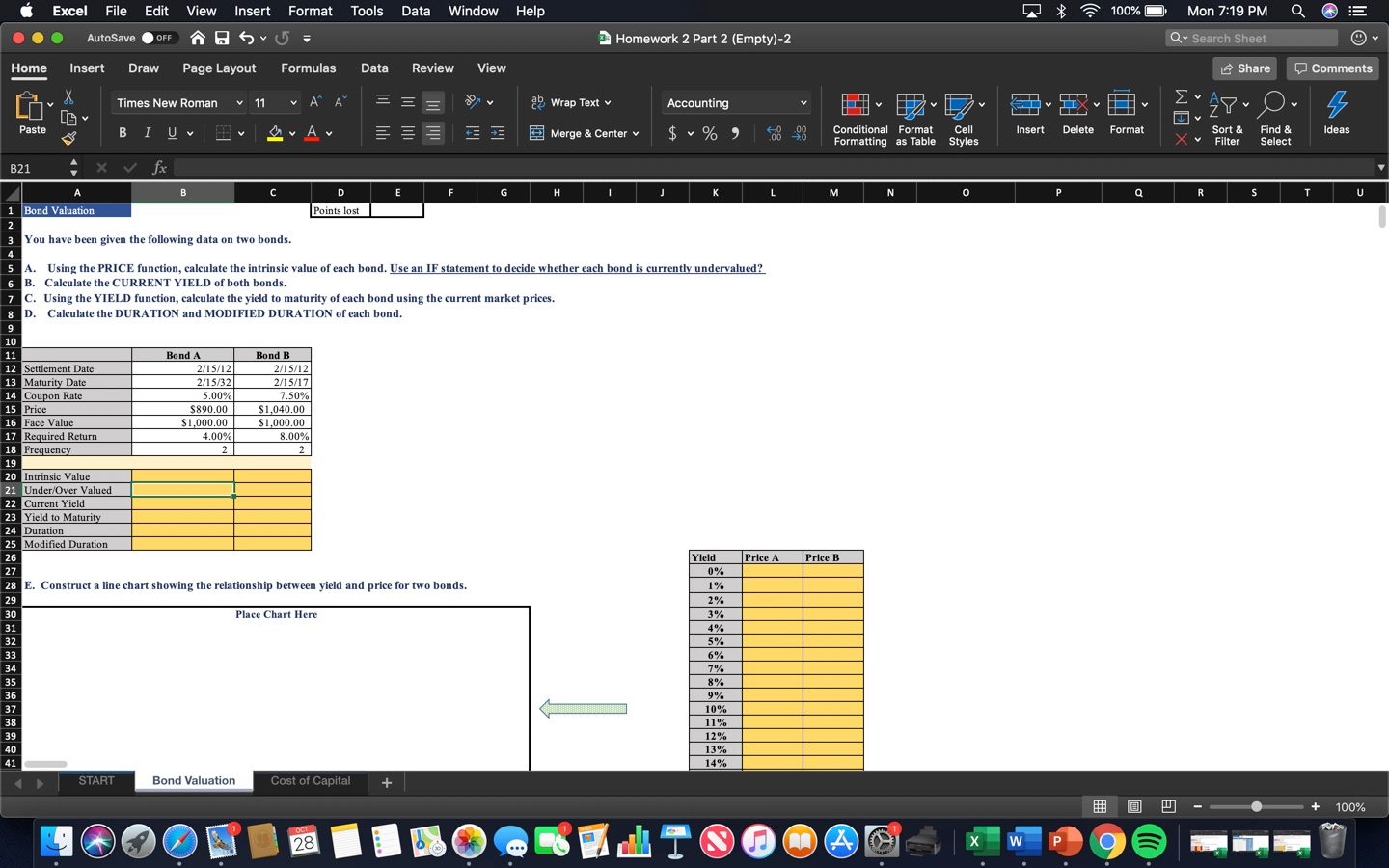

How do I get A and B using excel functions?

Tools Data Window Help * 100% D E Excel File Edit 000 AutoSave OFF Home Insert Draw View Insert Format A Svo Homework 2 Part 2 (Empty)-2 Mon 7:19 PM Q Qw Search Sheet Share Page Layout Formulas Data Review View Comments 11 = = = Ov a Accounting DIY v TITA Times New Roman BI U - 02-D AA Av S Wrap Text Merge & Center A -E . 48v O Paste $ - % , og Insert Delete Format Ideas 0070 Conditional Format Formatting as Table Cell Styles Sort & XV Filter Find & Select B21 XV fx 1 Bond Valuation Points lost 3 You have been given the following data on two bonds. 5 A. Using the PRICE function, calculate the intrinsic value of each bond. Use an IF statement to decide whether each bond is currently undervalued? 6 B. Calculate the CURRENT YIELD of both bonds. 7 c. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices. 8 D. Calculate the DURATION and MODIFIED DURATION of each bond. 9 10 Bond A 2/15/12 2/15/32 5.00% $890.00 $1,000.00 4.00% Bond B 2/15/12 2 /15/17 7.50% $1,040.00 $1,000.00 8.00% 11 12 Settlement Date 13 Maturity Date 14 Coupon Rate 15 Price 16 Face Value 17 Required Return 18 Frequency 19 20 Intrinsic Value 21 Under/Over Valued 22 Current Yield 23 Yield to Maturity 24 Duration 25 Modified Duration 2 26 Price A Price ! 27 28 E. Construct a line chart showing the relationship between yield and price for two bonds. Yield 0% 1% 2% 3% Place Chart Here 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% START Bond Valuation Cost of Capital + @ u- + 100% Tools Data Window Help * 100% D E Excel File Edit 000 AutoSave OFF Home Insert Draw View Insert Format A Svo Homework 2 Part 2 (Empty)-2 Mon 7:19 PM Q Qw Search Sheet Share Page Layout Formulas Data Review View Comments 11 = = = Ov a Accounting DIY v TITA Times New Roman BI U - 02-D AA Av S Wrap Text Merge & Center A -E . 48v O Paste $ - % , og Insert Delete Format Ideas 0070 Conditional Format Formatting as Table Cell Styles Sort & XV Filter Find & Select B21 XV fx 1 Bond Valuation Points lost 3 You have been given the following data on two bonds. 5 A. Using the PRICE function, calculate the intrinsic value of each bond. Use an IF statement to decide whether each bond is currently undervalued? 6 B. Calculate the CURRENT YIELD of both bonds. 7 c. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices. 8 D. Calculate the DURATION and MODIFIED DURATION of each bond. 9 10 Bond A 2/15/12 2/15/32 5.00% $890.00 $1,000.00 4.00% Bond B 2/15/12 2 /15/17 7.50% $1,040.00 $1,000.00 8.00% 11 12 Settlement Date 13 Maturity Date 14 Coupon Rate 15 Price 16 Face Value 17 Required Return 18 Frequency 19 20 Intrinsic Value 21 Under/Over Valued 22 Current Yield 23 Yield to Maturity 24 Duration 25 Modified Duration 2 26 Price A Price ! 27 28 E. Construct a line chart showing the relationship between yield and price for two bonds. Yield 0% 1% 2% 3% Place Chart Here 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% START Bond Valuation Cost of Capital + @ u- + 100%