Answered step by step

Verified Expert Solution

Question

1 Approved Answer

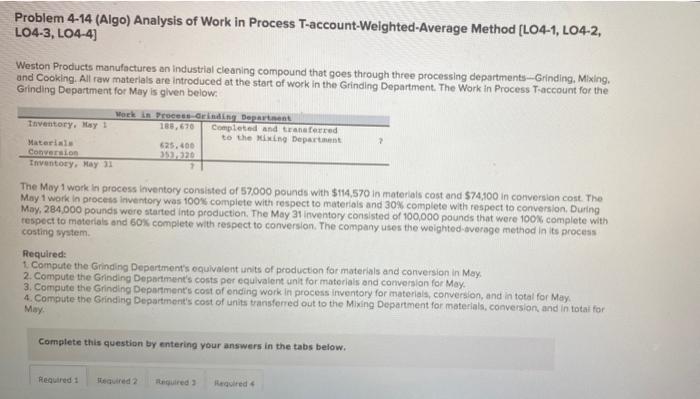

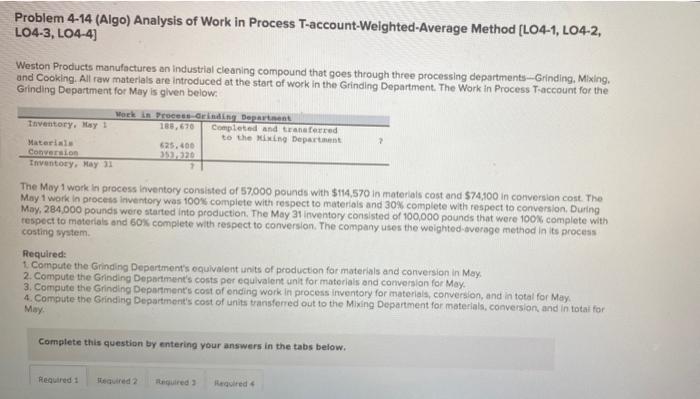

How do i get my answer on this question? I did the first one but than got a little confuse. Problem 4-14 (Algo) Analysis of

How do i get my answer on this question? I did the first one but than got a little confuse.

Problem 4-14 (Algo) Analysis of Work in Process T-account-Weighted Average Method (L04-1, L04-2, LO4-3, L04-4) Weston Products manufactures an industrial cleaning compound that goes through three processing departments - Grinding, Mixing. and Cooking. All raw materials are introduced at the start of work in the Grinding Department. The Work in Process T-account for the Grinding Department for May is given below: Work in procesoring Department Tnventory. Hy 188,670 Completed and transferred to the mixing Department Materiale 625.400 Conversion 353,320 Inventory, May 21 The May 1 work in process inventory consisted of 57000 pounds with $114.570 in materials cost and $74,900 in conversion cost. The May 1 work in process inventory was 100% complete with respect to materials and 30% complete with respect to conversion. During May, 284.000 pounds were started into production. The May 31 inventory consisted of 100,000 pounds that were 100% complete with respect to materials and 60% complete with respect to conversion. The company uses the weighted average method in its process costing system Required: 1 Compute the Grinding Department's equivalent units of production for materials and conversion in May 2. Compute the Grinding Department's costs per equivalent unit for materials and conversion for May 3. Compute the Grinding Department's cost of ending work in process Inventory for materials, conversion, and in total for May 4. Compute the Grinding Department's cost of units transferred out to the Mixing Department for materials, conversion and in totai for May Complete this question by entering your answers in the tabs below. Required: Required Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started