Answered step by step

Verified Expert Solution

Question

1 Approved Answer

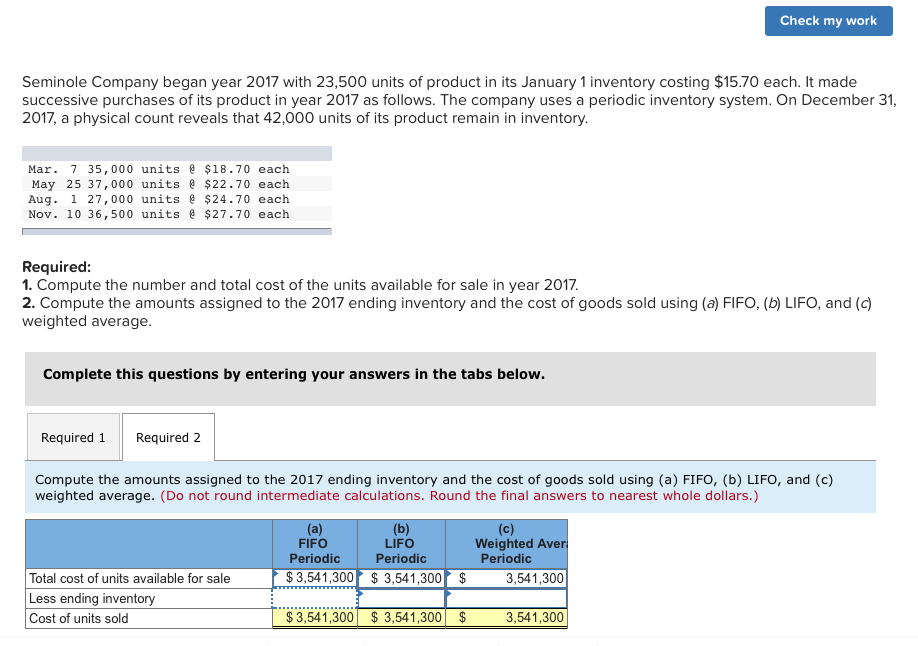

How do I get the Less ending inventory for each FIFO, LIFO and Weighted Avg.? Check my work Seminole Company began year 2017 with 23,500

How do I get the "Less ending inventory" for each FIFO, LIFO and Weighted Avg.?

Check my work Seminole Company began year 2017 with 23,500 units of product in its January 1 inventory costing $15.70 each. It made successive purchases of its product in year 2017 as follows. The company uses a periodic inventory system. On December 31 2017, a physical count reveals that 42,000 units of its product remain in inventory. Mar. 7 35,000 units $18.70 each May 25 37,000 units $22.70 each Aug. 1 27,000 units $24.70 each Nov. 10 36,500 units $27.70 each Required 1. Compute the number and total cost of the units available for sale in year 2017. 2. Compute the amounts assigned to the 2017 ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average Complete this questions by entering your answers in the tabs below. Required Required 2 Compute the amounts assigned to the 2017 ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average. (Do not round intermediate calculations. Round the final answers to nearest whole dollars.) FIFO Periodic $3,541,3003,541,300 LIFO Periodic Weighted Aver Periodic Total cost of units available for sale Less ending inventory Cost of units sold $3,541,300 3,541,300 3,541 300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started