Answered step by step

Verified Expert Solution

Question

1 Approved Answer

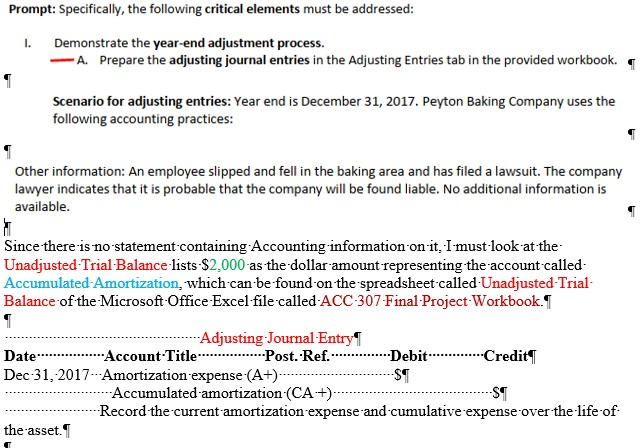

How do I interpret the sentence above in order to calculate and determine what the dollar amount will be for the Amortization expense, an asset

How do I interpret the sentence above in order to calculate and determine what the dollar amount will be for the Amortization expense, an asset account, and Accumulated amortization account, a contra asset account in my attempt to make an adjusting journal entry for this transaction? And could you show me the mathematics that you must perform to calculate the Amortization expense and the Accumulated amortization accounts, please?

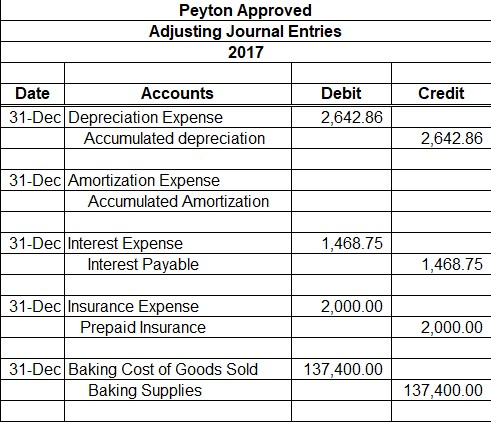

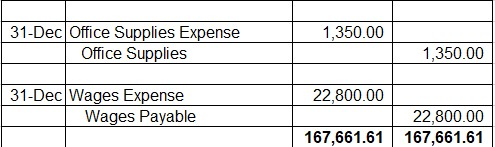

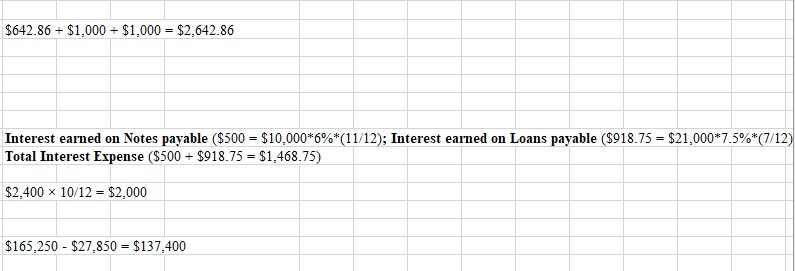

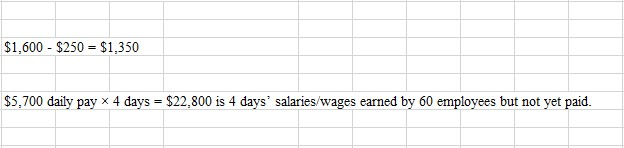

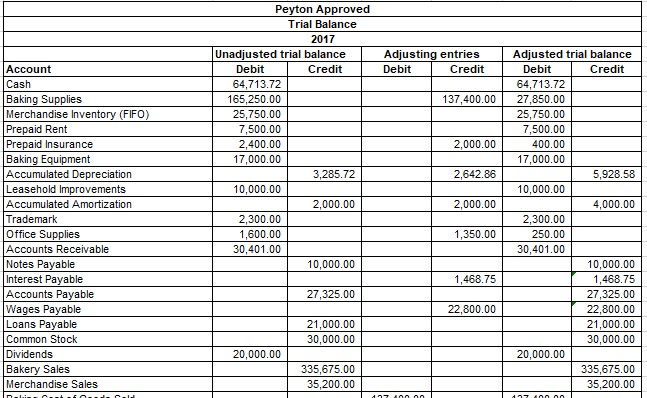

Peyton Approved Adjusting Journal Entries 2017 Credit Date Accounts 31-Dec Depreciation Expense Accumulated depreciation Debit 2,642.86 2,642.86 31-Dec Amortization Expense Accumulated Amortization 1,468.75 31-Dec Interest Expense Interest Payable 1,468.75 2,000.00 31-Dec Insurance Expense Prepaid Insurance 2,000.00 137,400.00 31-Dec Baking Cost of Goods Sold Baking Supplies 137,400.00 31-Dec Office Supplies Expense Office Supplies 1,350.00 1,350.00 31-Dec Wages Expense Wages Payable 22,800.00 22,800.00 167,661.61 167,661.61 $642.86 + $1,000+ $1,000 = $2,642.86 Interest earned on Notes payable ($500 = $10,000*6%*(11/12); Interest earned on Loans payable ($918.75 = $21,000*7.5%*(7/12) Total Interest Expense ($500 + $918.75 = $1,468.75) $2,400 x 10/12 = $2,000 $165,250 - $27,850 = $137,400 $1,600 - $250 = $1,350 $5,700 daily pay x 4 days = $22,800 is 4 days' salaries/wages earned by 60 employees but not yet paid. Adjusting entries Debit Credit 137,400.00 Peyton Approved Trial Balance 2017 Unadjusted trial balance Debit Credit 64,713.72 165,250.00 25,750.00 7,500.00 2,400.00 17,000.00 3,285.72 10,000.00 2,000.00 2,300.00 1,600.00 30,401.00 10,000.00 2,000.00 2,642.86 Account Cash Baking Supplies Merchandise Inventory (FIFO) Prepaid Rent Prepaid Insurance Baking Equipment Accumulated Depreciation Leasehold Improvements Accumulated Amortization Trademark Office Supplies Accounts Receivable Notes Payable Interest Payable Accounts Payable Wages Payable Loans Payable Common Stock Dividends Bakery Sales Merchandise Sales 2,000.00 Adjusted trial balance Debit Credit 64,713.72 27,850.00 25,750.00 7,500.00 400.00 17,000.00 5,928.58 10,000.00 4,000.00 2,300.00 250.00 30,401.00 10,000.00 1,468.75 27,325.00 22,800.00 21,000.00 30,000.00 20,000.00 335,675.00 35,200.00 1,350.00 1,468.75 27,325.00 22,800.00 21,000.00 30,000.00 20,000.00 335,675.00 35,200.00 ru 17 10 177 Innnn Prompt: Specifically, the following critical elements must be addressed: 1. Demonstrate the year-end adjustment process. -A. Prepare the adjusting journal entries in the Adjusting Entries tab in the provided workbook. 1 Scenario for adjusting entries: Year end is December 31, 2017. Peyton Baking Company uses the following accounting practices: 1 Other information: An employee slipped and fell in the baking area and has filed a lawsuit. The company lawyer indicates that it is probable that the company will be found liable. No additional information is available. = 1 Since there is no-statement containing Accounting information-on-it. I must-look at the Unadjusted-Trial-Balance lists $2,000 as the dollar amount representing the account called Accumulated-Amortization, which can be found on the spreadsheet called-Unadjusted-Trial- Balance of the Microsoft Office Excel file called ACC-307-Final-Project-Workbook. I - Adjusting Journal Entry Date" - Account Title Post. Ref. --Debit --Credit Dec 31, 2017 Amortization expense (A+). $ --Accumulated-amortization (CA+). ST -Record the current amortization expense and cumulative expense over the life of the assetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started