Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I prepare the answers to the below questions: Please provide the formulas as well as the explanation so I can fully understand. Year

How do I prepare the answers to the below questions:

Please provide the formulas as well as the explanation so I can fully understand.

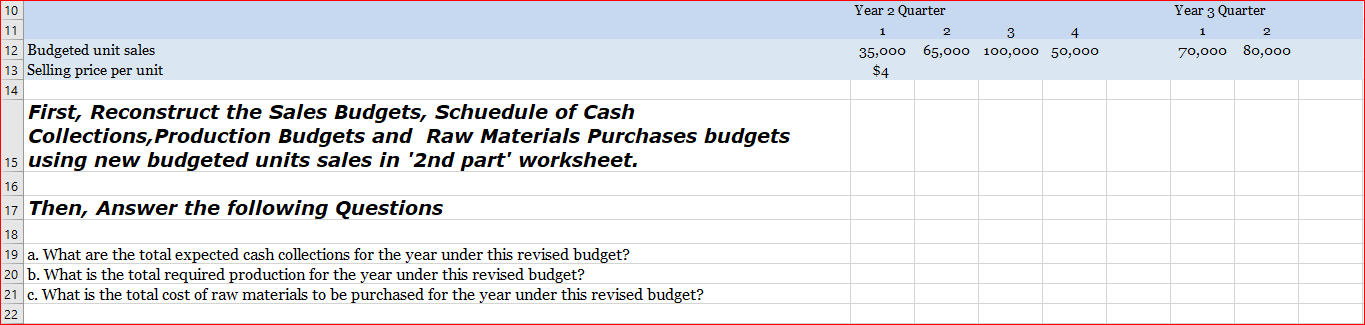

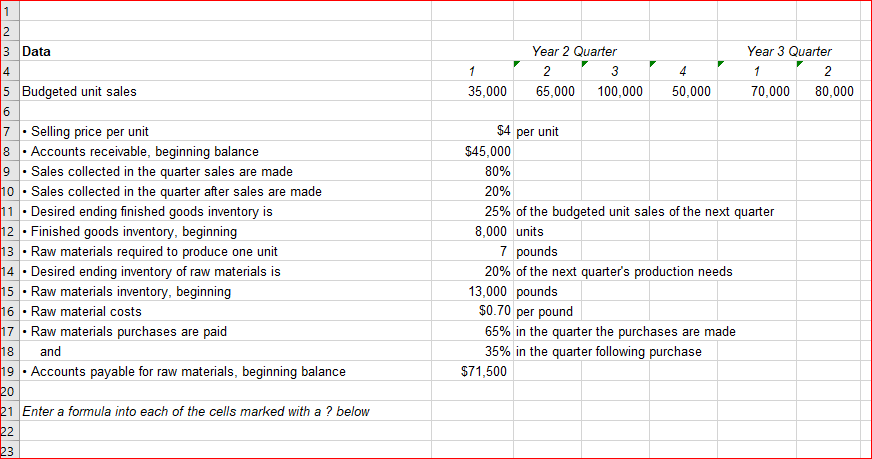

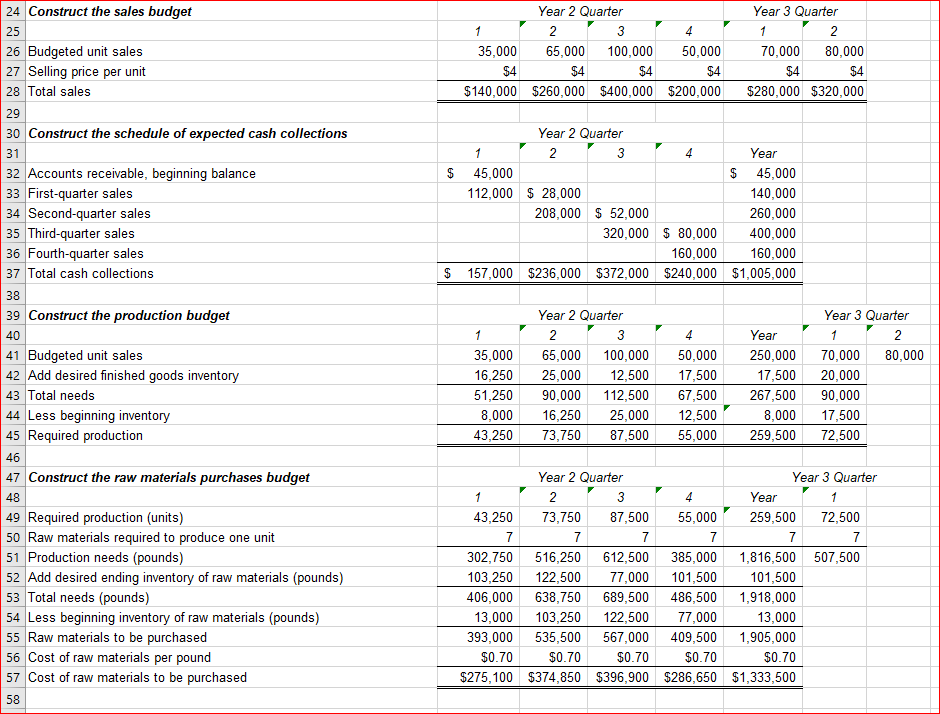

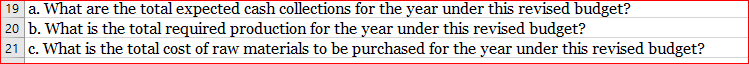

Year 2 Quarter Year 3 Quarter Budgeted unit sales Selling price per unit 135,000$4265,0003100,000450,000 1 2 14 First, Reconstruct the Sales Budgets, Schuedule of Cash Collections, Production Budgets and Raw Materials Purchases budgets using new budgeted units sales in '2nd part' worksheet. Then, Answer the following Questions a. What are the total expected cash collections for the year under this revised budget? b. What is the total required production for the year under this revised budget? c. What is the total cost of raw materials to be purchased for the year under this revised budget? \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|l|}{1} \\ \hline 2 & & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{ll} 3 & Data \\ 4 & \end{tabular}}} & \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline & & 1 & 2 & 3 & 4 & r & 2 \\ \hline 5 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 70,000 & 80,000 \\ \hline \multicolumn{8}{|l|}{6} \\ \hline 7 & - Selling price per unit & $4 & 4 per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $45,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & 80% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & 20% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & \multicolumn{5}{|c|}{25% of the budgeted unit sales of the next quarter } & \\ \hline 12 & 2. Finished goods inventory, beginning & 8,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & 7 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & 20% & \multicolumn{4}{|c|}{6 of the next quarter's production needs } & \\ \hline 15 & - Raw materials inventory, beginning & 13,000 & pounds & & & & \\ \hline 16 & 5. Raw material costs & $0.70 & per pound & & & & \\ \hline 17 & 7. Raw materials purchases are paid & 65% & \multicolumn{4}{|c|}{6 in the quarter the purchases are made } & \\ \hline 18 & and & 35% & \multicolumn{3}{|c|}{ in the quarter following purchase } & & \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $71,500 & & & & & \\ \hline \multirow{2}{*}{\begin{tabular}{l} 20 \\ 21 \end{tabular}} & & & & & & & \\ \hline & Enter a formula into each of the cells marked with a ? below & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{22}} & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} 24 \\ 25 \end{tabular}} & \multirow[t]{2}{*}{ Construct the sales budget } & & \multicolumn{2}{|c|}{ Year 3 Quarter } & \\ \hline & & 1 & \begin{tabular}{cl} Y ear 2Q0 \\ 2 \end{tabular} & 3 & 4 & \multicolumn{2}{|c|}{1>2} & \\ \hline 26 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 70,000 & 80,000 & \\ \hline 27 & Selling price per unit & $4 & $4 & $4 & $4 & $4 & $4 & \\ \hline 28 & Total sales & $140,000 & $260,000 & $400,000 & $200,000 & $280,000 & $320,000 & \\ \hline \multicolumn{9}{|l|}{29} \\ \hline 30 & Construct the schedule of expected cash collections & \multicolumn{4}{|c|}{ Year 2 Quarter } & & & \\ \hline 31 & & 1 & 2 & 3 & 4 & Year & & \\ \hline 32 & Accounts receivable, beginning balance & 45,000 & & & & $45,000 & & \\ \hline 33 & First-quarter sales & 112,000 & $28,000 & & & 140,000 & & \\ \hline 34 & Second-quarter sales & & 208,000 & $52,000 & & 260,000 & & \\ \hline 35 & Third-quarter sales & & & 320,000 & $80,000 & 400,000 & & \\ \hline 36 & Fourth-quarter sales & & & & 160,000 & 160,000 & & \\ \hline 37 & Total cash collections & $157,000 & $236,000 & $372,000 & $240,000 & $1,005,000 & & \\ \hline \multicolumn{9}{|l|}{38} \\ \hline 39 & Construct the production budget & \multicolumn{4}{|c|}{ Year 2 Quarter } & & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline 40 & & 1 & 2 & 3 & 4 & Year & 1 & 2 \\ \hline 41 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 250,000 & 70,000 & 80,000 \\ \hline 42 & Add desired finished goods inventory & 16,250 & 25,000 & 12,500 & 17,500 & 17,500 & 20,000 & \\ \hline 43 & Total needs & 51,250 & 90,000 & 112,500 & 67,500 & 267,500 & 90,000 & \\ \hline 44 & Less beginning inventory & 8,000 & 16,250 & 25,000 & 12,500 & 8,000 & 17,500 & \\ \hline 45 & Required production & 43,250 & 73,750 & 87,500 & 55,000 & 259,500 & 72,500 & \\ \hline \multicolumn{9}{|l|}{46} \\ \hline 47 & Construct the raw materials purchases budget & \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{3}{|c|}{ Year 3 Quarter } \\ \hline 48 & & 1 & 2 & 3 & 4 & Year & 1 & \\ \hline 49 & Required production (units) & 43,250 & 73,750 & 87,500 & 55,000 & 259,500 & 72,500 & \\ \hline 50 & Raw materials required to produce one unit & 7 & 7 & 7 & 7 & 7 & 7 & \\ \hline 51 & Production needs (pounds) & 302,750 & 516,250 & 612,500 & 385,000 & 1,816,500 & 507,500 & \\ \hline 52 & Add desired ending inventory of raw materials (pounds) & 103,250 & 122,500 & 77,000 & 101,500 & 101,500 & & \\ \hline 53 & Total needs (pounds) & 406,000 & 638,750 & 689,500 & 486,500 & 1,918,000 & & \\ \hline 54 & Less beginning inventory of raw materials (pounds) & 13,000 & 103,250 & 122,500 & 77,000 & 13,000 & & \\ \hline 55 & Raw materials to be purchased & 393,000 & 535,500 & 567,000 & 409,500 & 1,905,000 & & \\ \hline 56 & Cost of raw materials per pound & $0.70 & $0.70 & $0.70 & $0.70 & $0.70 & & \\ \hline 57 & Cost of raw materials to be purchased & $275,100 & $374,850 & $396,900 & $286,650 & $1,333,500 & & \\ \hline 10 & & & & & & & & \\ \hline \end{tabular} a. What are the total expected cash collections for the year under this revised budget? b. What is the total required production for the year under this revised budget? c. What is the total cost of raw materials to be purchased for the year under this revised budget

Year 2 Quarter Year 3 Quarter Budgeted unit sales Selling price per unit 135,000$4265,0003100,000450,000 1 2 14 First, Reconstruct the Sales Budgets, Schuedule of Cash Collections, Production Budgets and Raw Materials Purchases budgets using new budgeted units sales in '2nd part' worksheet. Then, Answer the following Questions a. What are the total expected cash collections for the year under this revised budget? b. What is the total required production for the year under this revised budget? c. What is the total cost of raw materials to be purchased for the year under this revised budget? \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{8}{|l|}{1} \\ \hline 2 & & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{ll} 3 & Data \\ 4 & \end{tabular}}} & \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline & & 1 & 2 & 3 & 4 & r & 2 \\ \hline 5 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 70,000 & 80,000 \\ \hline \multicolumn{8}{|l|}{6} \\ \hline 7 & - Selling price per unit & $4 & 4 per unit & & & & \\ \hline 8 & - Accounts receivable, beginning balance & $45,000 & & & & & \\ \hline 9 & - Sales collected in the quarter sales are made & 80% & & & & & \\ \hline 10 & - Sales collected in the quarter after sales are made & 20% & & & & & \\ \hline 11 & - Desired ending finished goods inventory is & \multicolumn{5}{|c|}{25% of the budgeted unit sales of the next quarter } & \\ \hline 12 & 2. Finished goods inventory, beginning & 8,000 & units & & & & \\ \hline 13 & - Raw materials required to produce one unit & 7 & pounds & & & & \\ \hline 14 & - Desired ending inventory of raw materials is & 20% & \multicolumn{4}{|c|}{6 of the next quarter's production needs } & \\ \hline 15 & - Raw materials inventory, beginning & 13,000 & pounds & & & & \\ \hline 16 & 5. Raw material costs & $0.70 & per pound & & & & \\ \hline 17 & 7. Raw materials purchases are paid & 65% & \multicolumn{4}{|c|}{6 in the quarter the purchases are made } & \\ \hline 18 & and & 35% & \multicolumn{3}{|c|}{ in the quarter following purchase } & & \\ \hline 19 & - Accounts payable for raw materials, beginning balance & $71,500 & & & & & \\ \hline \multirow{2}{*}{\begin{tabular}{l} 20 \\ 21 \end{tabular}} & & & & & & & \\ \hline & Enter a formula into each of the cells marked with a ? below & & & & & & \\ \hline \multirow{2}{*}{\multicolumn{2}{|c|}{22}} & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} 24 \\ 25 \end{tabular}} & \multirow[t]{2}{*}{ Construct the sales budget } & & \multicolumn{2}{|c|}{ Year 3 Quarter } & \\ \hline & & 1 & \begin{tabular}{cl} Y ear 2Q0 \\ 2 \end{tabular} & 3 & 4 & \multicolumn{2}{|c|}{1>2} & \\ \hline 26 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 70,000 & 80,000 & \\ \hline 27 & Selling price per unit & $4 & $4 & $4 & $4 & $4 & $4 & \\ \hline 28 & Total sales & $140,000 & $260,000 & $400,000 & $200,000 & $280,000 & $320,000 & \\ \hline \multicolumn{9}{|l|}{29} \\ \hline 30 & Construct the schedule of expected cash collections & \multicolumn{4}{|c|}{ Year 2 Quarter } & & & \\ \hline 31 & & 1 & 2 & 3 & 4 & Year & & \\ \hline 32 & Accounts receivable, beginning balance & 45,000 & & & & $45,000 & & \\ \hline 33 & First-quarter sales & 112,000 & $28,000 & & & 140,000 & & \\ \hline 34 & Second-quarter sales & & 208,000 & $52,000 & & 260,000 & & \\ \hline 35 & Third-quarter sales & & & 320,000 & $80,000 & 400,000 & & \\ \hline 36 & Fourth-quarter sales & & & & 160,000 & 160,000 & & \\ \hline 37 & Total cash collections & $157,000 & $236,000 & $372,000 & $240,000 & $1,005,000 & & \\ \hline \multicolumn{9}{|l|}{38} \\ \hline 39 & Construct the production budget & \multicolumn{4}{|c|}{ Year 2 Quarter } & & \multicolumn{2}{|c|}{ Year 3 Quarter } \\ \hline 40 & & 1 & 2 & 3 & 4 & Year & 1 & 2 \\ \hline 41 & Budgeted unit sales & 35,000 & 65,000 & 100,000 & 50,000 & 250,000 & 70,000 & 80,000 \\ \hline 42 & Add desired finished goods inventory & 16,250 & 25,000 & 12,500 & 17,500 & 17,500 & 20,000 & \\ \hline 43 & Total needs & 51,250 & 90,000 & 112,500 & 67,500 & 267,500 & 90,000 & \\ \hline 44 & Less beginning inventory & 8,000 & 16,250 & 25,000 & 12,500 & 8,000 & 17,500 & \\ \hline 45 & Required production & 43,250 & 73,750 & 87,500 & 55,000 & 259,500 & 72,500 & \\ \hline \multicolumn{9}{|l|}{46} \\ \hline 47 & Construct the raw materials purchases budget & \multicolumn{4}{|c|}{ Year 2 Quarter } & \multicolumn{3}{|c|}{ Year 3 Quarter } \\ \hline 48 & & 1 & 2 & 3 & 4 & Year & 1 & \\ \hline 49 & Required production (units) & 43,250 & 73,750 & 87,500 & 55,000 & 259,500 & 72,500 & \\ \hline 50 & Raw materials required to produce one unit & 7 & 7 & 7 & 7 & 7 & 7 & \\ \hline 51 & Production needs (pounds) & 302,750 & 516,250 & 612,500 & 385,000 & 1,816,500 & 507,500 & \\ \hline 52 & Add desired ending inventory of raw materials (pounds) & 103,250 & 122,500 & 77,000 & 101,500 & 101,500 & & \\ \hline 53 & Total needs (pounds) & 406,000 & 638,750 & 689,500 & 486,500 & 1,918,000 & & \\ \hline 54 & Less beginning inventory of raw materials (pounds) & 13,000 & 103,250 & 122,500 & 77,000 & 13,000 & & \\ \hline 55 & Raw materials to be purchased & 393,000 & 535,500 & 567,000 & 409,500 & 1,905,000 & & \\ \hline 56 & Cost of raw materials per pound & $0.70 & $0.70 & $0.70 & $0.70 & $0.70 & & \\ \hline 57 & Cost of raw materials to be purchased & $275,100 & $374,850 & $396,900 & $286,650 & $1,333,500 & & \\ \hline 10 & & & & & & & & \\ \hline \end{tabular} a. What are the total expected cash collections for the year under this revised budget? b. What is the total required production for the year under this revised budget? c. What is the total cost of raw materials to be purchased for the year under this revised budget Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started