How do I solve a problem like this? All number calculations included.

How do I solve a problem like this? All number calculations included.

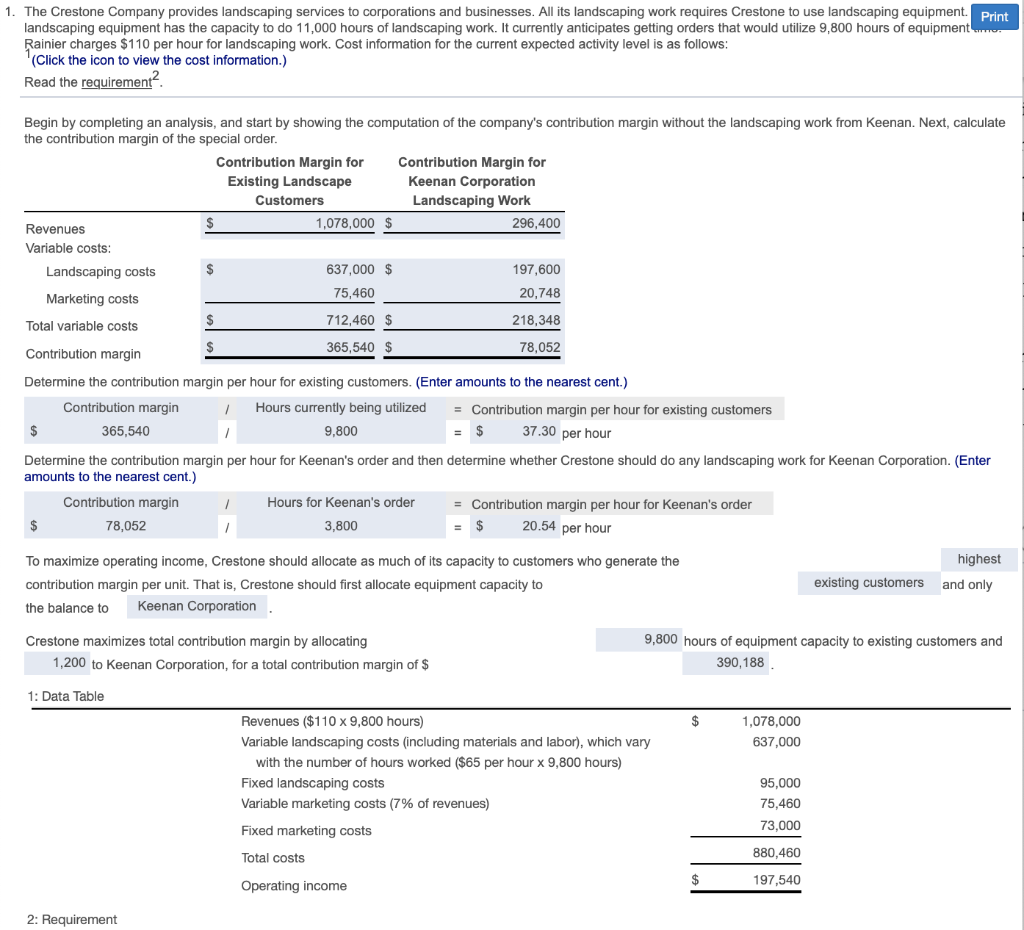

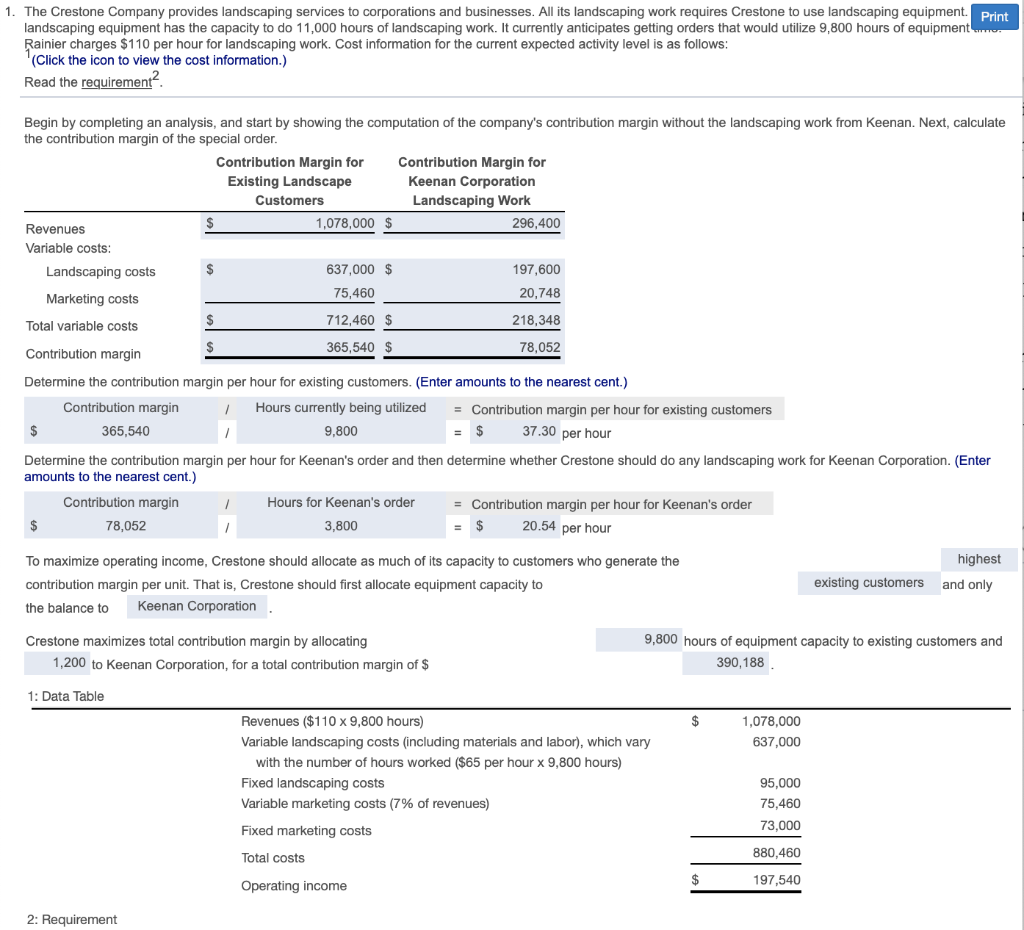

1. The Crestone Company provides landscaping services to corporations and businesses. All its landscaping work requires Crestone to use landscaping equipment. Print landscaping equipment has the capacity to do 11,000 hours of landscaping work. It currently anticipates getting orders that would utilize 9,800 hours of equipment Rainier charges $110 per hour for landscaping work. Cost information for the current expected activity level is as follows: (Click the icon to view the cost information.) Read the requirement? Begin by completing an analysis, and start by showing the computation of the company's contribution margin without the landscaping work from Keenan. Next, calculate the contribution margin of the special order. Contribution Margin for Contribution Margin for Existing Landscape Keenan Corporation Customers Landscaping Work S 1,078,000 $ 296,400 Revenues Variable costs: Landscaping costs $ 637,000 $ 197,600 75,460 20,748 Marketing costs $ Total variable costs 712,460 $ 218,348 Contribution margin $ 365,540 $ 78,052 Determine the contribution margin per hour for existing customers. (Enter amounts to the nearest cent.) Contribution margin Hours currently being utilized = Contribution margin per hour for existing customers 365,540 $ 9,800 $ 37.30 per hour Determine the contribution margin per hour for Keenan's order and then determine whether Crestone should do any landscaping work for Keenan Corporation. (Enter amounts to the nearest cent.) Hours for Keenan's order Contribution margin 78,052 = Contribution margin per hour for Keenan's order = $ $ 1 3,800 20.54 per hour highest To maximize operating income, Crestone should allocate as much of its capacity to customers who generate the existing customers and only contribution margin per unit. That is, Crestone should first allocate equipment capacity to the balance to Keenan Corporation Crestone maximizes total contribution margin by allocating 9,800 hours of equipment capacity to existing customers and 1,200 to Keenan Corporation, for a total contribution margin of $ 390,188 1: Data Table $ 1,078.000 637,000 Revenues ($110 x 9,800 hours) Variable landscaping costs (including materials and labor), which vary with the number of hours worked ($65 per hour x 9,800 hours) Fixed landscaping costs Variable marketing costs (7% of revenues) Fixed marketing costs 95,000 75,460 73,000 Total costs 880,460 197,540 Operating income $ 2: Requirement

How do I solve a problem like this? All number calculations included.

How do I solve a problem like this? All number calculations included.