Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I solve and what are the answers to Req. C1 and C2? Please provide explanation and how you arrive at the numbers. Thank

How do I solve and what are the answers to Req. C1 and C2? Please provide explanation and how you arrive at the numbers. Thank you!

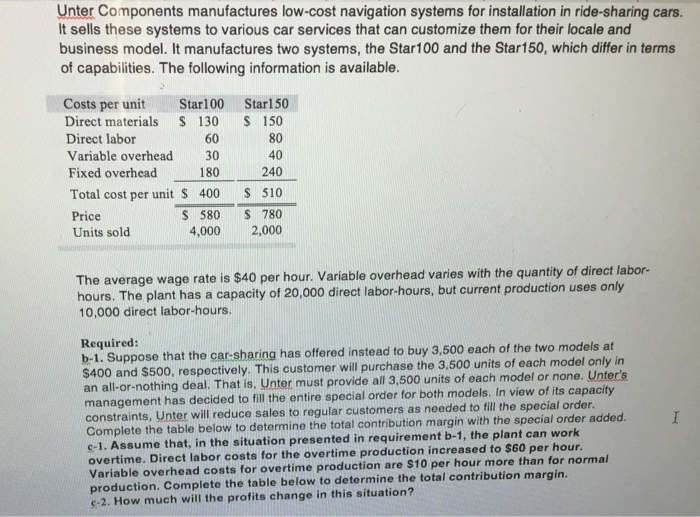

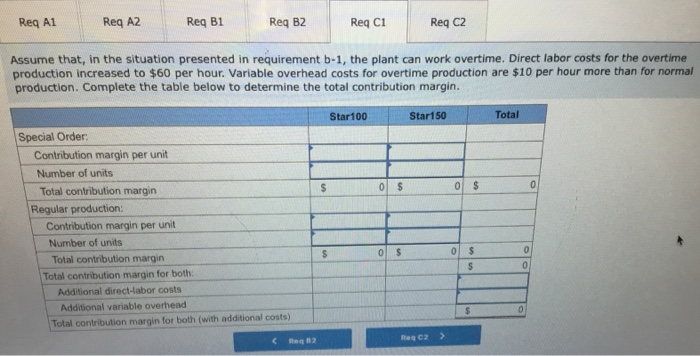

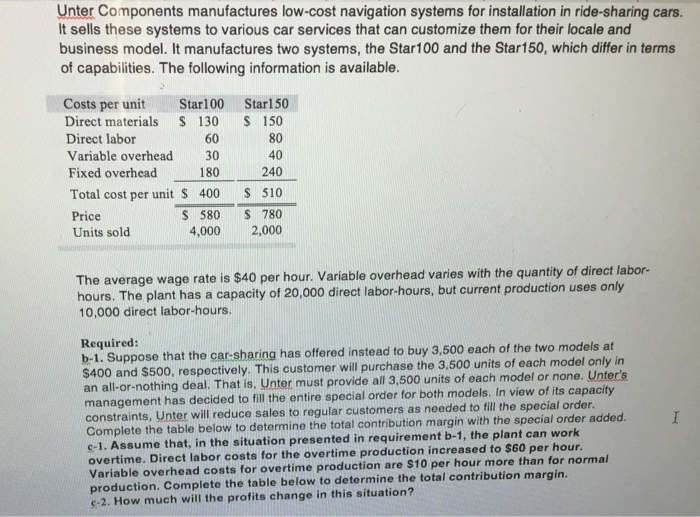

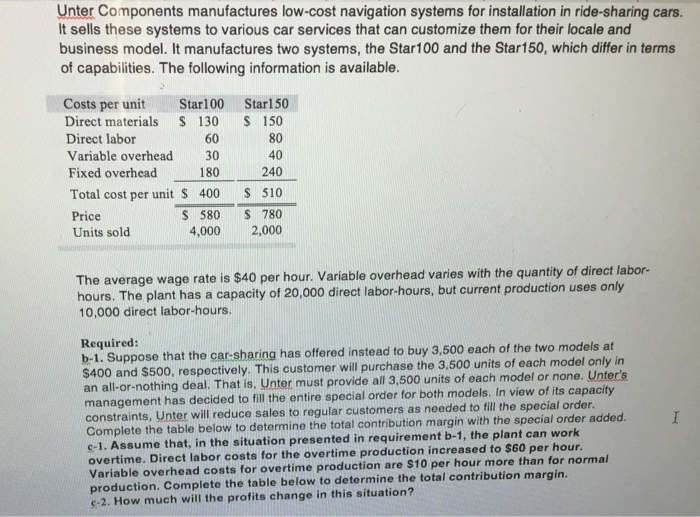

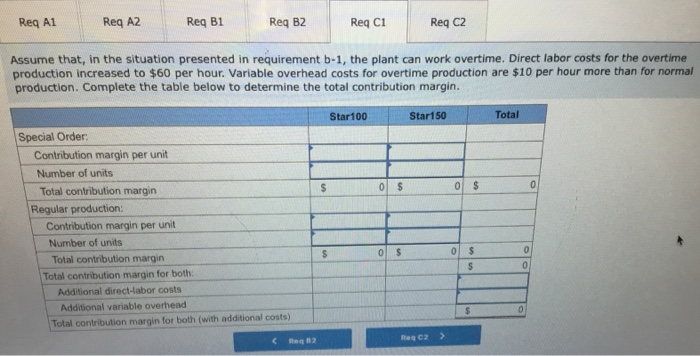

Unter Components manufactures low-cost navigation systems for installation in ride-sharing cars. It sells these systems to various car services that can customize them for their locale and business model. It manufactures two systems, the Star 100 and the Star150, which differ in terms of capabilities. The following information is available. Costs per unit Star100 Direct materials $ 130 Direct labor 60 Variable overhead 30 Fixed overhead 180 Total cost per unit $ 400 Price S 580 Units sold 4,000 Star150 $ 150 80 40 240 $ 510 S 780 2,000 The average wage rate is $40 per hour. Variable overhead varies with the quantity of direct labor hours. The plant has a capacity of 20,000 direct labor-hours, but current production uses only 10,000 direct labor-hours. Required: b-1. Suppose that the car-sharing has offered instead to buy 3,500 each of the two models at $400 and $500, respectively. This customer will purchase the 3,500 units of each model only in an all-or-nothing deal. That is, Unter must provide all 3,500 units of each model or none. Unter's management has decided to fill the entire special order for both models. In view of its capacity constraints, Unter will reduce sales to regular customers as needed to fill the special order. Complete the table below to determine the total contribution margin with the special order added. e-1. Assume that, in the situation presented in requirement b-1, the plant can work overtime. Direct labor costs for the overtime production increased to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production Complete the table below to determine the total contribution margin. -2. How much will the profits change in this situation? Req Al Req A2 Req B1 Req B2 Reg CI Req C2 Assume that, in the situation presented in requirement b-1, the plant can work overtime. Direct labor costs for the overtime production increased to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production. Complete the table below to determine the total contribution margin. Star 100 Star150 Total Special Order Contribution margin per unit Number of units Total contribution margin Regular production: Contribution margin per unit Number of units Total contribution margin Total contribution margin for both Additional direct labor costs Additional variable overhead TO Contribution margin for both with additional costs)

Unter Components manufactures low-cost navigation systems for installation in ride-sharing cars. It sells these systems to various car services that can customize them for their locale and business model. It manufactures two systems, the Star 100 and the Star150, which differ in terms of capabilities. The following information is available. Costs per unit Star100 Direct materials $ 130 Direct labor 60 Variable overhead 30 Fixed overhead 180 Total cost per unit $ 400 Price S 580 Units sold 4,000 Star150 $ 150 80 40 240 $ 510 S 780 2,000 The average wage rate is $40 per hour. Variable overhead varies with the quantity of direct labor hours. The plant has a capacity of 20,000 direct labor-hours, but current production uses only 10,000 direct labor-hours. Required: b-1. Suppose that the car-sharing has offered instead to buy 3,500 each of the two models at $400 and $500, respectively. This customer will purchase the 3,500 units of each model only in an all-or-nothing deal. That is, Unter must provide all 3,500 units of each model or none. Unter's management has decided to fill the entire special order for both models. In view of its capacity constraints, Unter will reduce sales to regular customers as needed to fill the special order. Complete the table below to determine the total contribution margin with the special order added. e-1. Assume that, in the situation presented in requirement b-1, the plant can work overtime. Direct labor costs for the overtime production increased to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production Complete the table below to determine the total contribution margin. -2. How much will the profits change in this situation? Req Al Req A2 Req B1 Req B2 Reg CI Req C2 Assume that, in the situation presented in requirement b-1, the plant can work overtime. Direct labor costs for the overtime production increased to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production. Complete the table below to determine the total contribution margin. Star 100 Star150 Total Special Order Contribution margin per unit Number of units Total contribution margin Regular production: Contribution margin per unit Number of units Total contribution margin Total contribution margin for both Additional direct labor costs Additional variable overhead TO Contribution margin for both with additional costs)

How do I solve and what are the answers to Req. C1 and C2? Please provide explanation and how you arrive at the numbers. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started