how do I solve question 8 using the data above?

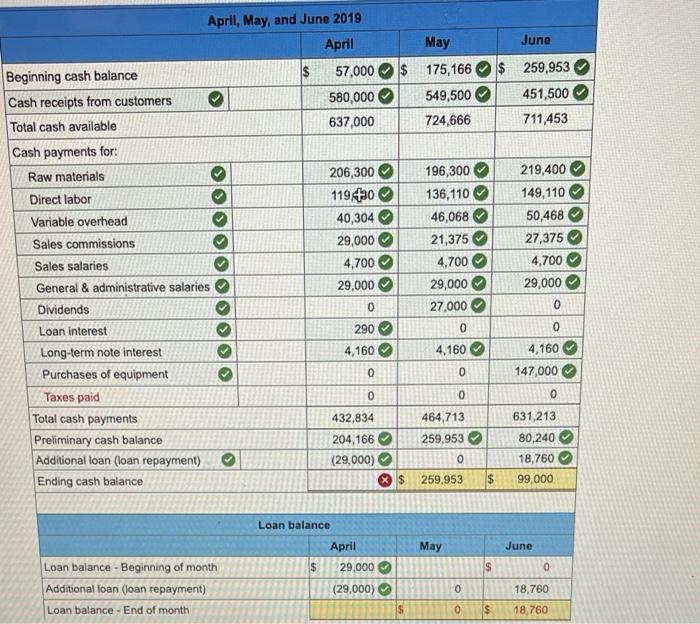

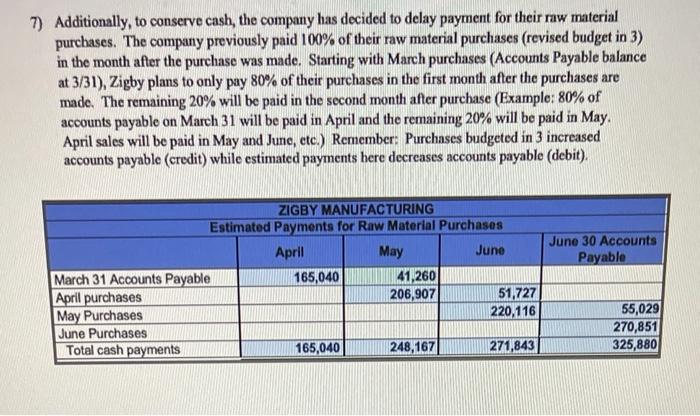

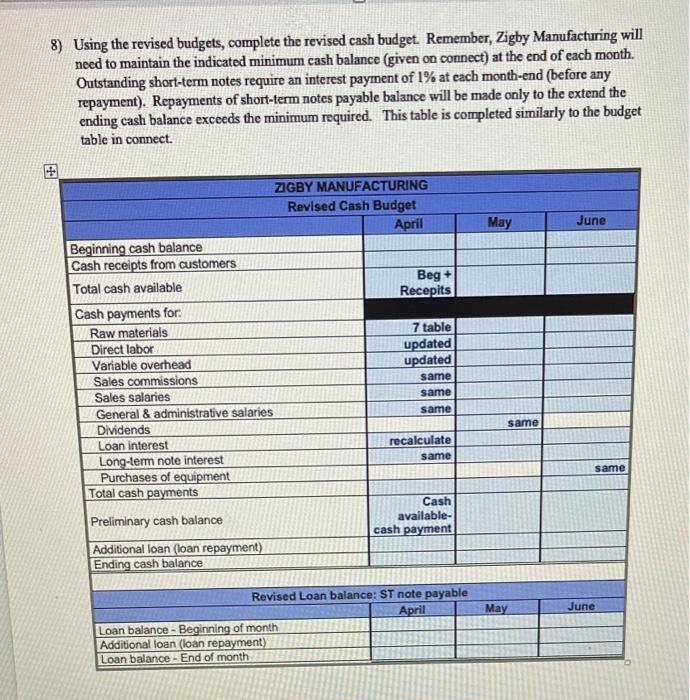

April, May, and June 2019 April May June $ 57,000 580,000 637,000 $ 175,166 549,500 724,666 $ 259,953 451,500 711,453 Beginning cash balance Cash receipts from customers Total cash available Cash payments for: Raw materials Direct labor Variable overhead Sales commissions Sales salaries General & administrative salaries Dividends Loan interest Long-term note interest Purchases of equipment Taxes paid Total cash payments Preliminary cash balance Additional loan (loan repayment) Ending cash balance 206,300 119.40 40,304 29,000 4,700 29,000 0 196,300 136,110 46,068 21,375 4,700 29,000 27,000 0 4,160 219,400 149,110 50,468 27,375 4,700 29,000 0 290 4,160 0 0 0 0 432,834 204,166 (29,000) 464 713 259,953 0 4,160 147,000 0 631,213 80,240 18,760 99,000 $ 259,953 $ Loan balance May June April 29,000 $ s 0 Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of month (29,000) 18,760 olo $ $ 18.760 7) Additionally, to conserve cash, the company has decided to delay payment for their raw material purchases. The company previously paid 100% of their raw material purchases (revised budget in 3) in the month after the purchase was made. Starting with March purchases (Accounts Payable balance at 3/31), Zigby plans to only pay 80% of their purchases in the first month after the purchases are made. The remaining 20% will be paid in the second month after purchase (Example: 80% of accounts payable on March 31 will be paid in April and the remaining 20% will be paid in May. April sales will be paid in May and Junc, etc.) Remember: Purchases budgeted in 3 increased accounts payable (credit) while estimated payments here decreases accounts payable (debit) June 30 Accounts Payable ZIGBY MANUFACTURING Estimated Payments for Raw Material Purchases April May June March 31 Accounts Payable 165,040 41,260 April purchases 206,907 51,727 May Purchases 220,116 June Purchases Total cash payments 165,040 248,1671 271,843 55,029 270,851 325,880 8) Using the revised budgets, complete the revised cash budget. Remember, Zigby Manufacturing will need to maintain the indicated minimum cash balance (given on connect) at the end of each month. Outstanding short-term notes require an interest payment of 1% at each month-end (before any repayment). Repayments of short-term notes payable balance will be made only to the extend the ending cash balance exceeds the minimum required. This table is completed similarly to the budget table in connect May June ZIGBY MANUFACTURING Revised Cash Budget April Beginning cash balance Cash receipts from customers Beg + Total cash available Recepits Cash payments for: Raw materials 7 table Direct labor updated Variable overhead updated Sales commissions same Sales salaries same General & administrative salaries same Dividends Loan interest recalculate Long-term note interest same Purchases of equipment Total cash payments Cash Preliminary cash balance available- cash payment Additional loan (loan repayment) Ending cash balance same same May June Revised Loan balance: ST note payable April Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of month