Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do I solve these questions? Question 44 Not complete Marked out of 8,00 P Flag question The Analysis of Bond Investments The Discovery Company

How do I solve these questions?

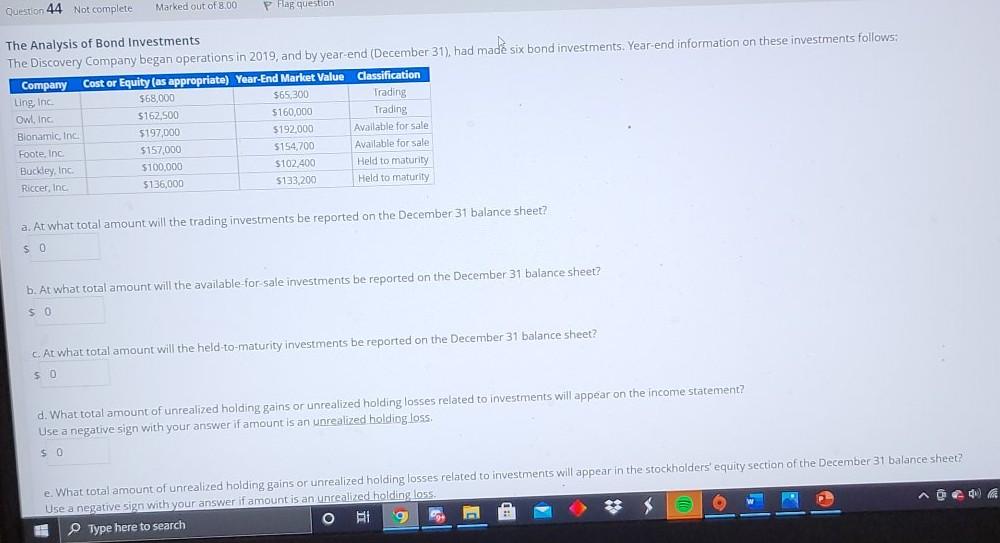

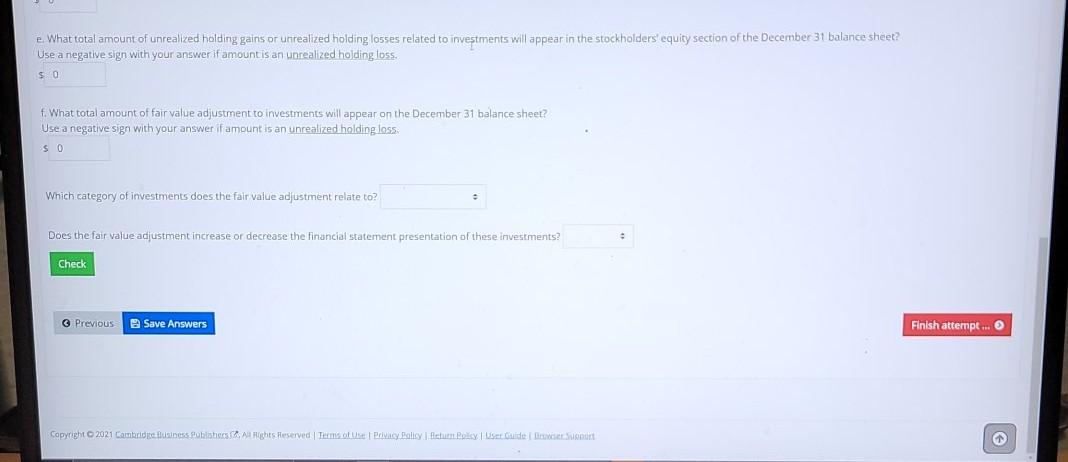

Question 44 Not complete Marked out of 8,00 P Flag question The Analysis of Bond Investments The Discovery Company began operations in 2019, and by year-end (December 31), had made six bond investments. Year-end information on these investments follows: . Company Cost or Equity (as appropriate) Year-End Market Value Classification Ling, Inc $68,000 $65.300 Trading Owl, Inc $162,500 5160,000 Trading Bionamic inc $197 DOO 5192.000 Available for sale Foote, Inc $157,000 5154,700 Available for sale Buckley, Inc $100,000 $102,400 Held to maturity Riccer, Inc 5136,000 $133,200 Held to maturity a. At what total amount will the trading investments be reported on the December 31 balance sheet? $0 b. At what total amount will the available for sale investments be reported on the December 31 balance sheet? $0 c. At what total amount will the held-to-maturity investments be reported on the December 31 balance sheet? 50 d. What total amount of unrealized holding gains or unrealized holding losses related to investments will appear on the income statement? Use a negative sign with your answer if amount is an unrealized holding loss, $0 e. What total amount of unrealized holding gains or unrealized holding losses related to investments will appear in the stockholders equity section of the December 31 balance sheet? Use a negative sign with your answer ifamount is an unrealized holding loss Type here to search P ^c e What total amount of unrealized holding gains or unrealized holding losses related to investments will appear in the stockholders' equity section of the December 31 balance sheet? Use a negative sign with your answer if amount is an unrealized holding loss. f. What total amount of fair value adjustment to investments will appear on the December 31 balance sheet? Use a negative sign with your answer if amount is an unrealized holding loss S 0 Which category of investments does the fair value adjustment relate to? Does the fair value adjustment increase or decrease the financial statement presentation of these investments? . Check Previous Save Answers Finish attempt... Copyright 2021 Cambridite usiness Publishers Rights Reserved | Terms Privacy Policy Return Policy User Guide totStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started