Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do i solve this ,using form 1040 and other forms.? Alice J, and Bruce M. Jones are married taxpayers who file a joim return.

how do i solve this ,using form 1040 and other forms.?

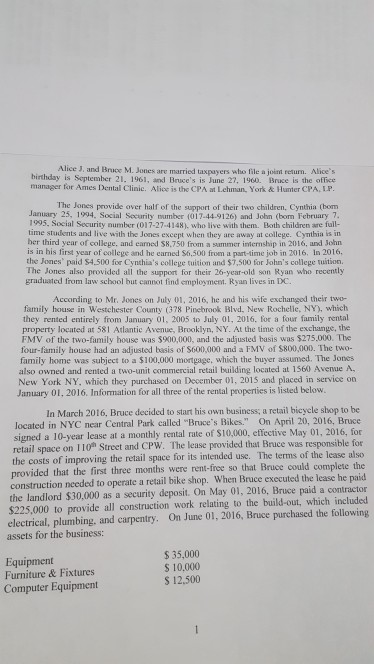

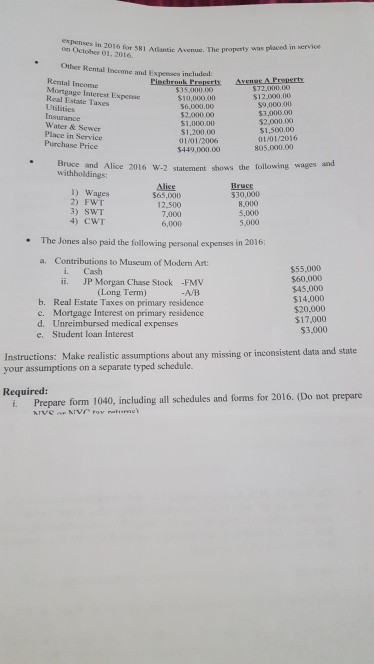

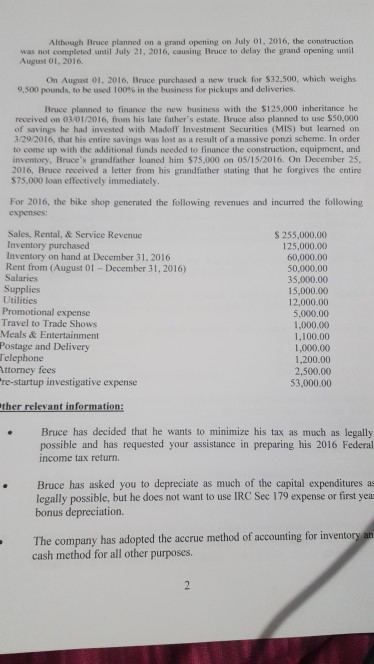

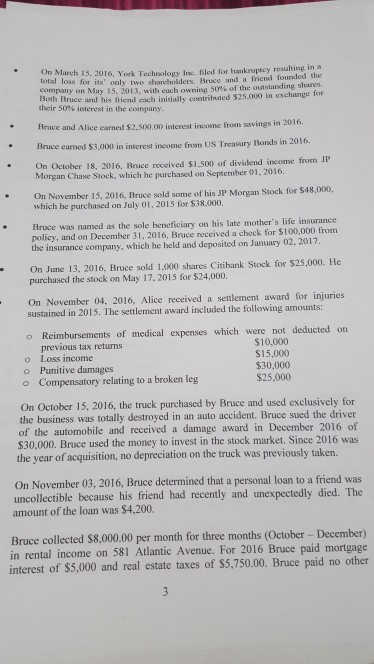

Alice J, and Bruce M. Jones are married taxpayers who file a joim return. Alice's birthday is September 21. 1961, and Bruce's is June 27. 1960. Bruce is the office manager for Ames Dental Clinic. Alice is the CPA at Lehman, York & Hunter CPA. LP The Jones provide over half of the support of their two children, Cynthia (bom January 25, 1994, Social Security number (017-449126) and John (bom February 7 1995. Social Security number (017-27-4148). who live with them. Both children are full- time students and live with the Jones except when they are away at college. Cynthia is in ber third year of college, and caned 58,750 from a summer internship in 2016, and Sohn is in his first year of college and he earned $6,500 from a part-time job in 2016. In 2016 the Jones paid $4.500 for Cynthia's college tuition and $7,500 for John's college tuition. The Jones also provided all the support for their 26-year-old son Ryan who recently graduated from law school but cannot find employment. Ryan lives in DC. According to Mr. Jones on July 01, 2016, he and his wife exchanged their two- family house in Westchester County (378 Pinebrook Blvd. New Rochelle, NY), which they rented entirely from January 01, 2005 to July 01, 2016, for a four family rental property located at 581 Atlantic Avenue, Brooklyn, NY. At the time of the exchange, the FMV of the two-family house was $900,000, and the adjusted basis was $275.000. The four-family house had an adjusted basis of $600,000 and a FMV of $800,000. The two- family home was subject to a $100,000 mortgage, which the buyer assumed. The Jones also owned and rented a two-unit commercial retail building located at 1560 Avenue A. New York NY, which they purchased on December 01, 2015 and placed in service on January 01, 2016. Information for all three of the rental properties is listed below. In March 2016, Bruce decided to start his own business, a retail bicycle shop to be located in NYC near Central Park called "Bruce's Bikes." On April 20, 2016, Bruce signed a 10-year lease at a monthly rental rate of S10,000, effective May 01, 2016, for retail space on 110h Street and CPW. The lease provided that Bruce was responsible for the costs of improving the retail space for its intended use. The terms of the lease also provided that the first three months were rent-free so that Bruce could construction needed to operate a retail bike shop. When Bruce executed the lease he paid the landlord $30,000 as a security deposit. On May 01, 2016, Bruce paid a contractor $225,000 to provide all construction work relating to the build-out, which included electrical, plumbing, and carpentry. On June 01, 2016, Bruce purchased the following assets for the business: Equipment Furniture &Fixtures Computer Equipment $35,000 S 10,000 S 12,500 Alice J, and Bruce M. Jones are married taxpayers who file a joim return. Alice's birthday is September 21. 1961, and Bruce's is June 27. 1960. Bruce is the office manager for Ames Dental Clinic. Alice is the CPA at Lehman, York & Hunter CPA. LP The Jones provide over half of the support of their two children, Cynthia (bom January 25, 1994, Social Security number (017-449126) and John (bom February 7 1995. Social Security number (017-27-4148). who live with them. Both children are full- time students and live with the Jones except when they are away at college. Cynthia is in ber third year of college, and caned 58,750 from a summer internship in 2016, and Sohn is in his first year of college and he earned $6,500 from a part-time job in 2016. In 2016 the Jones paid $4.500 for Cynthia's college tuition and $7,500 for John's college tuition. The Jones also provided all the support for their 26-year-old son Ryan who recently graduated from law school but cannot find employment. Ryan lives in DC. According to Mr. Jones on July 01, 2016, he and his wife exchanged their two- family house in Westchester County (378 Pinebrook Blvd. New Rochelle, NY), which they rented entirely from January 01, 2005 to July 01, 2016, for a four family rental property located at 581 Atlantic Avenue, Brooklyn, NY. At the time of the exchange, the FMV of the two-family house was $900,000, and the adjusted basis was $275.000. The four-family house had an adjusted basis of $600,000 and a FMV of $800,000. The two- family home was subject to a $100,000 mortgage, which the buyer assumed. The Jones also owned and rented a two-unit commercial retail building located at 1560 Avenue A. New York NY, which they purchased on December 01, 2015 and placed in service on January 01, 2016. Information for all three of the rental properties is listed below. In March 2016, Bruce decided to start his own business, a retail bicycle shop to be located in NYC near Central Park called "Bruce's Bikes." On April 20, 2016, Bruce signed a 10-year lease at a monthly rental rate of S10,000, effective May 01, 2016, for retail space on 110h Street and CPW. The lease provided that Bruce was responsible for the costs of improving the retail space for its intended use. The terms of the lease also provided that the first three months were rent-free so that Bruce could construction needed to operate a retail bike shop. When Bruce executed the lease he paid the landlord $30,000 as a security deposit. On May 01, 2016, Bruce paid a contractor $225,000 to provide all construction work relating to the build-out, which included electrical, plumbing, and carpentry. On June 01, 2016, Bruce purchased the following assets for the business: Equipment Furniture &Fixtures Computer Equipment $35,000 S 10,000 S 12,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started