Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do i solve this, what is the answer and what did i do wrong 3 ct d out of 1 You purchased shares of

how do i solve this, what is the answer and what did i do wrong

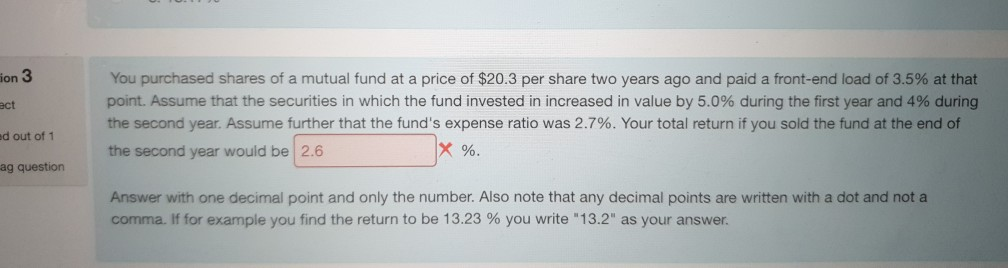

3 ct d out of 1 You purchased shares of a mutual fund at a price of $20.3 per share two years ago and paid a front-end load of 3.5% at that point. Assume that the securities in which the fund invested in increased in value by 5.0% during the first year and 4% during the second year. Assume further that the fund's expense ratio was 2.7%. Your total return if you sold the fund at the end of the second year would be 2.6 ion ag question Answer with one decimal point and only the number. Also note that any decimal points are written with a dot and not a comma. If for example you find the return to be 13.23 % you write "132" as yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started