Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do I solve those 2 questions? can you show your work? thanks 4 Mountain Manufacturing Company produces custom stamped metal parts for a variety

how do I solve those 2 questions? can you show your work? thanks

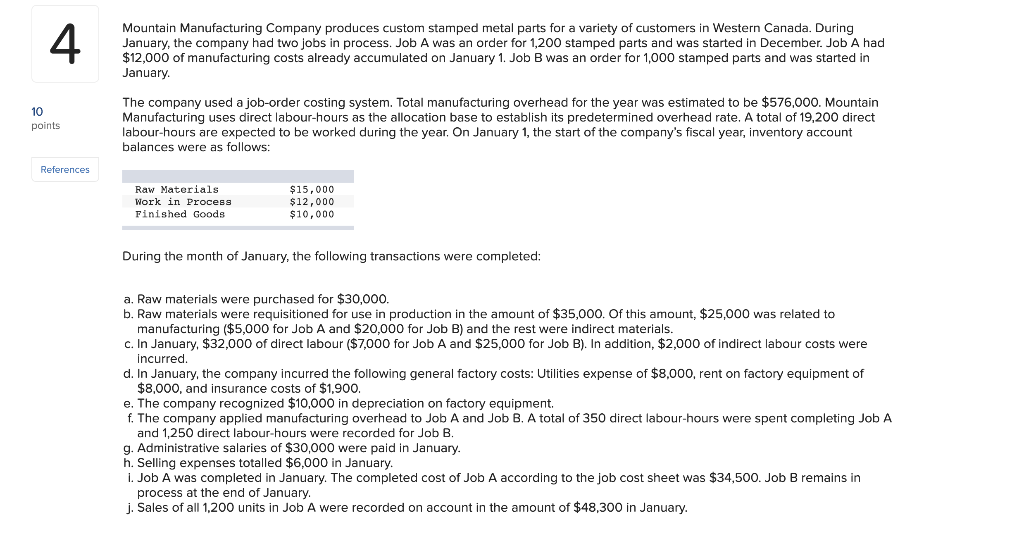

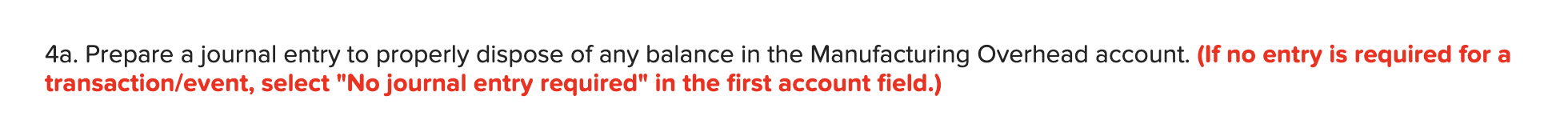

4 Mountain Manufacturing Company produces custom stamped metal parts for a variety of customers in Western Canada. During January, the company had two jobs in process. Job A was an order for 1,200 stamped parts and was started in December. Job Ahad $12,000 of manufacturing costs already accumulated on January 1. Job B was an order for 1,000 stamped parts and was started in January 10 points The company used a job-order costing system. Total manufacturing overhead for the year was estimated to be $576,000. Mountain Manufacturing uses direct labour-hours as the allocation base to establish its predetermined overhead rate. A total of 19,200 direct labour-hours are expected to be worked during the year. On January 1, the start of the company's fiscal year, inventory account balances were as follows: References Raw Materials Work in Process Finished Goods $15,000 $12,000 $10,000 During the month of January, the following transactions were completed: a. Raw materials were purchased for $30,000. b. Raw materials were requisitioned for use in production in the amount of $35,000. Of this amount, $25,000 was related to manufacturing ($5,000 for Job A and $20,000 for Job B) and the rest were indirect materials. c. In January, $32,000 of direct labour ($7,000 for Job A and $25,000 for Job B). In addition, $2,000 of indirect labour costs were incurred. d. In January, the company incurred the following general factory costs: Utilities expense of $8,000, rent on factory equipment of $8,000, and insurance costs of $1,900. e. The company recognized $10,000 in depreciation on factory equipment. f. The company applied manufacturing overhead to Job A and Job B. A total of 350 direct labour-hours were spent completing Job A and 1,250 direct labour-hours were recorded for Job B. g. Administrative salaries of $30,000 were paid in January h. Selling expenses totalled $6,000 in January. 1. Job A was completed in January. The completed cost of Job A according to the job cost sheet was $34,500. Job B remains in process at the end of January j. Sales of all 1,200 units in Job A were recorded on account in the amount of $48,300 in January. 4a. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 4b. Determine the adjusted Cost of Goods Sold. The adjusted Cost of Goods Sold $ 17,100 4 Mountain Manufacturing Company produces custom stamped metal parts for a variety of customers in Western Canada. During January, the company had two jobs in process. Job A was an order for 1,200 stamped parts and was started in December. Job Ahad $12,000 of manufacturing costs already accumulated on January 1. Job B was an order for 1,000 stamped parts and was started in January 10 points The company used a job-order costing system. Total manufacturing overhead for the year was estimated to be $576,000. Mountain Manufacturing uses direct labour-hours as the allocation base to establish its predetermined overhead rate. A total of 19,200 direct labour-hours are expected to be worked during the year. On January 1, the start of the company's fiscal year, inventory account balances were as follows: References Raw Materials Work in Process Finished Goods $15,000 $12,000 $10,000 During the month of January, the following transactions were completed: a. Raw materials were purchased for $30,000. b. Raw materials were requisitioned for use in production in the amount of $35,000. Of this amount, $25,000 was related to manufacturing ($5,000 for Job A and $20,000 for Job B) and the rest were indirect materials. c. In January, $32,000 of direct labour ($7,000 for Job A and $25,000 for Job B). In addition, $2,000 of indirect labour costs were incurred. d. In January, the company incurred the following general factory costs: Utilities expense of $8,000, rent on factory equipment of $8,000, and insurance costs of $1,900. e. The company recognized $10,000 in depreciation on factory equipment. f. The company applied manufacturing overhead to Job A and Job B. A total of 350 direct labour-hours were spent completing Job A and 1,250 direct labour-hours were recorded for Job B. g. Administrative salaries of $30,000 were paid in January h. Selling expenses totalled $6,000 in January. 1. Job A was completed in January. The completed cost of Job A according to the job cost sheet was $34,500. Job B remains in process at the end of January j. Sales of all 1,200 units in Job A were recorded on account in the amount of $48,300 in January. 4a. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 4b. Determine the adjusted Cost of Goods Sold. The adjusted Cost of Goods Sold $ 17,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started