Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do you calculate the equipment value by using BAII Plus Texes Instruments ? On January 1, 2020, Sage Company makes the two following acquisitions.

How do you calculate the equipment value by using BAII Plus Texes Instruments ?

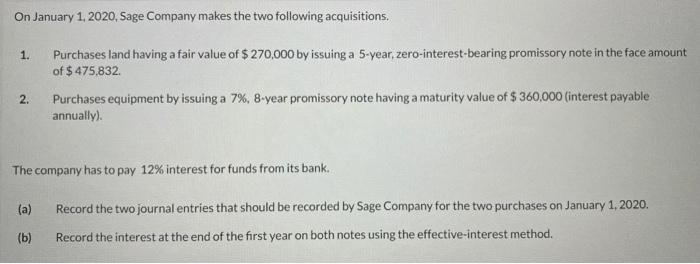

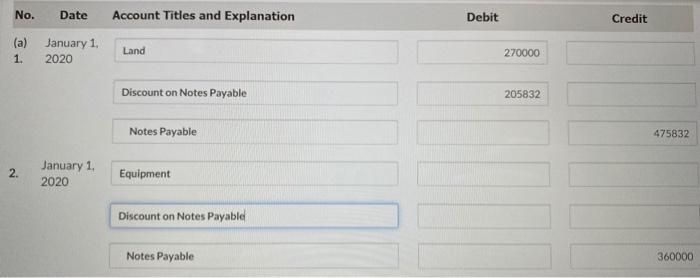

On January 1, 2020, Sage Company makes the two following acquisitions. 1. Purchases land having a fair value of $ 270,000 by issuing a 5-year, zero-interest-bearing promissory note in the face amount of $475,832 Purchases equipment by issuing a 7%, 8-year promissory note having a maturity value of $ 360,000 (interest payable annually). 2. The company has to pay 12% interest for funds from its bank. (a) Record the two journal entries that should be recorded by Sage Company for the two purchases on January 1, 2020. Record the interest at the end of the first year on both notes using the effective-interest method. (b) No. Date Account Titles and Explanation Debit Credit (a) 1. January 1, 2020 Land 270000 Discount on Notes Payable 205832 Notes Payable 475832 2. January 1. 2020 Equipment Discount on Notes Payable Notes Payable 360000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started