Answered step by step

Verified Expert Solution

Question

1 Approved Answer

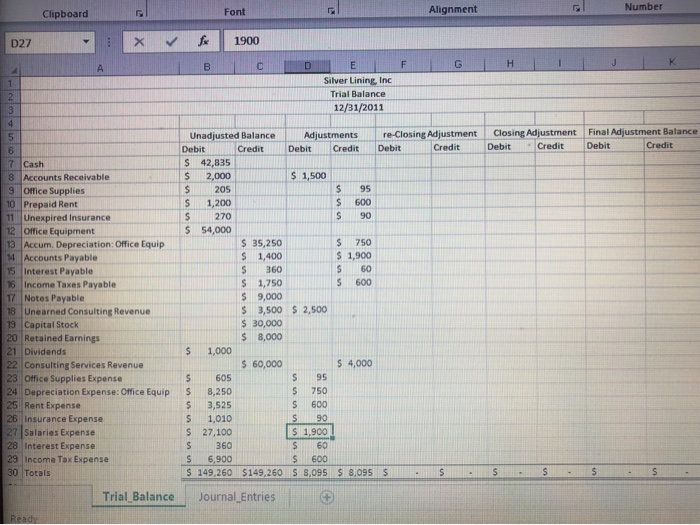

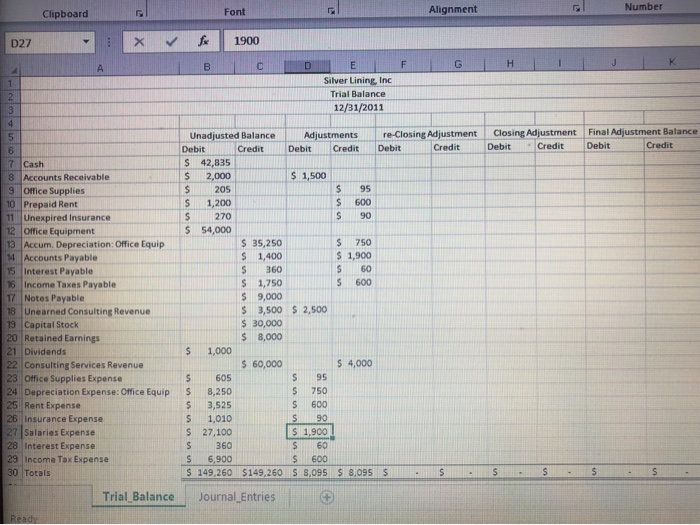

how do you closing adjustments? Number Alignment Font Clipboard fr 1900 X D27 G H F F Silver Lining, Inc Trial Balance 2 12/31/2011 Final

how do you closing adjustments?

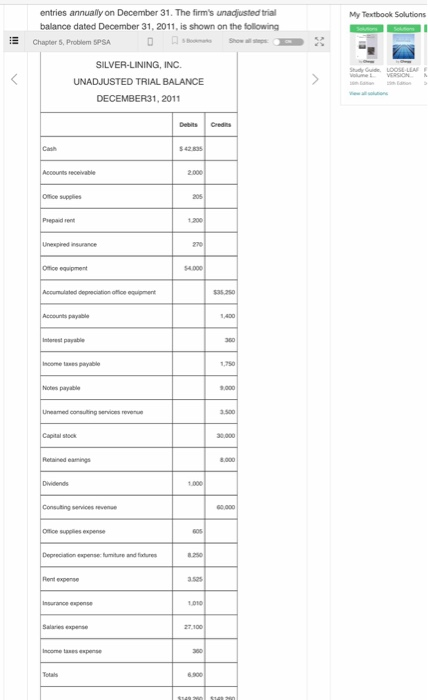

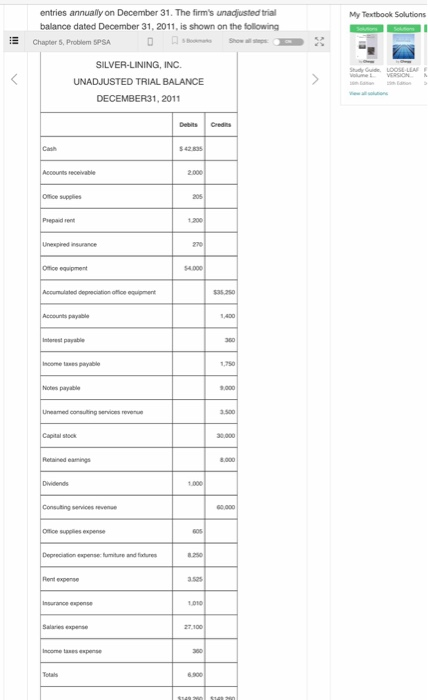

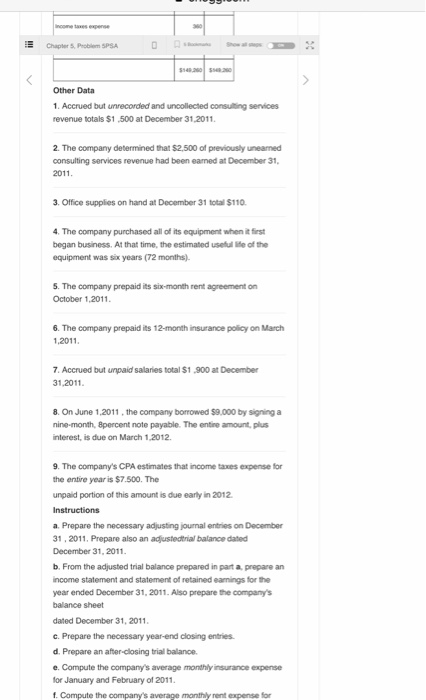

Number Alignment Font Clipboard fr 1900 X D27 G H F F Silver Lining, Inc Trial Balance 2 12/31/2011 Final Adjustment Balance Closing Adjustment Unadjusted Balance Debit $ 42,835 2,000 re-Closing Adjustment Debit Adjustments Credit Credit Debit Credit Debit Debit Credit Credit 7 Cash 8 Accounts Receivable $ 1,500 9 Office Supplies 10 Prepaid Rent 11 Unexpired Insurance 12 Office Equipment 13 Accum. Depreciation: Office Equip 14 Accounts Payable 15 Interest Payable 16 Income Taxes Payable 17 Notes Payable 18 Unearned Consulting Revenue 19 Capital Stock 20 Retained Earnings 21 Dividends S 95 205 S 1,200 S 600 90 270 $ 54,000 S 35,250 750 $ 1,900 1,400 60 360 S 600 1,750 $ 9,000 $ 3,500 $ 2,500 $ 30,000 $ 8,000 1,000 $ 4,000 22 Consulting Services Revenue 23 Office Supplies Expense 24 Depreciation Expense: Office Equip 25 Rent Expense 26 Insurance Expense 27 Salaries Expense 28 Interest Expense 29 Income Tax Expense $ 60,000 95 605 8,250 3,525 750 $ 600 1,010 S 27,100 90 S 1,900 60 $ 360 600 6,900 30 Totals S 149,260 $149,260 S 8,095 $8,095 $ S S Trial Balance Journal Entries Ready entries annually on December 31. The firm's unadjusted trial My Textbook Solutions balance dated December 31, 2011, is shown on the following so Show all s Chapter 5, Problem SPSA SILVER-LINING, INC Shuy Ge LOoSE-LEA VlumeL VERSION UNADJUSTED TRIAL BALANCE n DECEMBER31, 2011 Debits Credits Cash 42835 Accounts receivable 2000 office supplies 205 Prepaid rent 1200 Unexpired insurance 270 Office equipment $4.000 Accumulated depeciation office equipment sas 250 Accounts payable 1400 Interest payable 360 Income taxes payable 1750 Notes payable 9000 Uneamed consulting services revenue 3500 Capital stock 30000 Retained eamings 8.000 Dividends 1.000 G0,000 Consuting services revenue office supplies expense 605 Depreciation expense: fumiture and fatures 82504 Rent expense 3s2s Insurance expense 1,010 Salanes expense 27.100 Income tases expense 300 6900 Totals S149 260 $148 260 Income taxes expense- Chapter 5, Problem SPSA Show all s $148 260 Other Data 1. Accrued but unrecorded and uncollected consulting services revenue totals $1,500 at December 31,2011 2. The company determined that $2,500 of previously unearned consulting services revenue had been eamed at December 31, 2011 3. Office supplies on hand at December 31 total $110 of its equipment when it first 4. The company purchased began business. At that time, the estimated useful ife of the equipment was six years (72 months). 5. The company prepaid its six-month rent agreement on October 1,2011 6. The company prepaid its 12-month insurance policy on March 1,2011 7. Accrued but unpaid salaries total $1,900 at December 31,2011 8. On June 1,2011, the company borrowed $9.000 by signing a nine-month, 8percent note payable. The entire amount, plus interest, is due on March 1,2012. 9. The company's CPA estimates that income taxes expense for the entire year is $7.500. The unpaid portion of this amount is due early in 2012 Instructions a. Prepare the necessary adjusting journal entries on December 31, 2011. Prepare also an adjustedtrial balance dated December 31, 2011. b. From the adjusted trial balance prepared in part a, prepare an income statement and statement of retained earnings for the year ended December 31, 2011. Also prepare the company's balance sheet dated December 31, 2011 c. Prepare the necessary year-end closing entries d. Prepare an after-closing trial balance. e. Compute the company's average monthly insurance expense for January and February of 2011 f. Compute the company's average monthly rent expense for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started