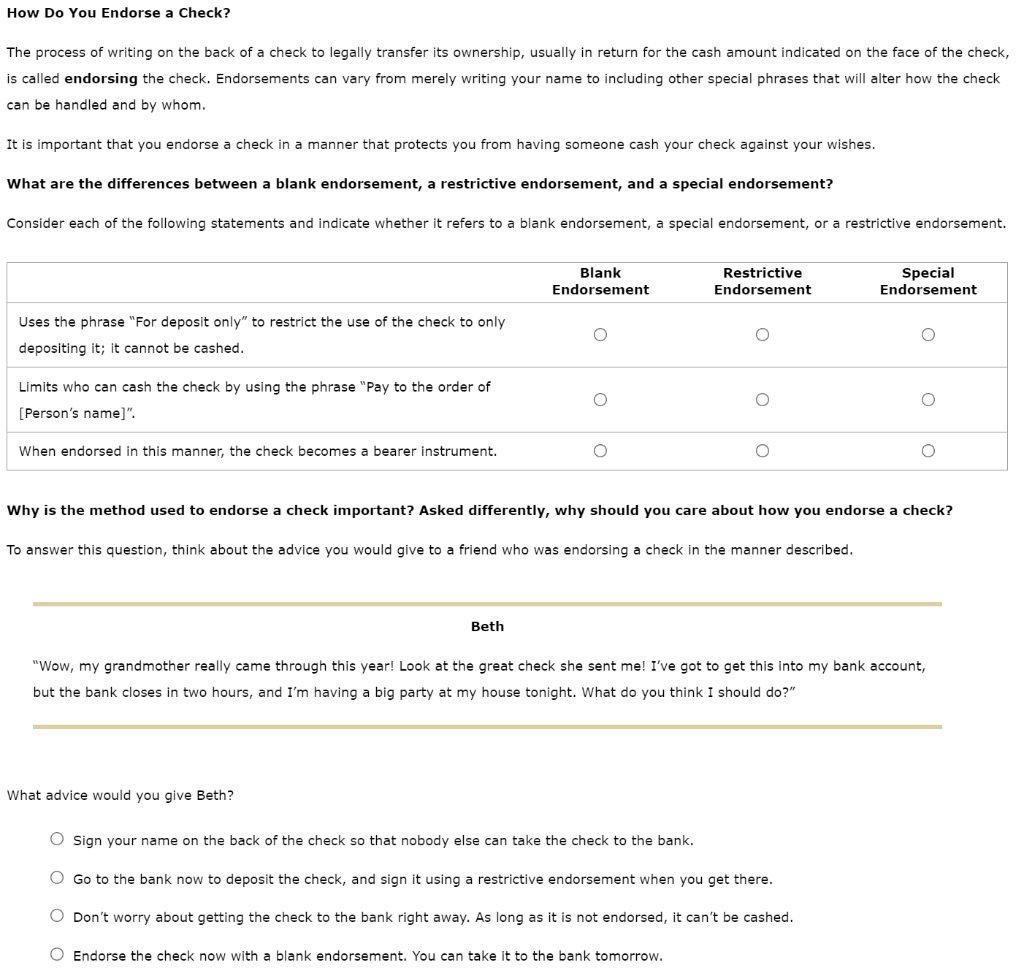

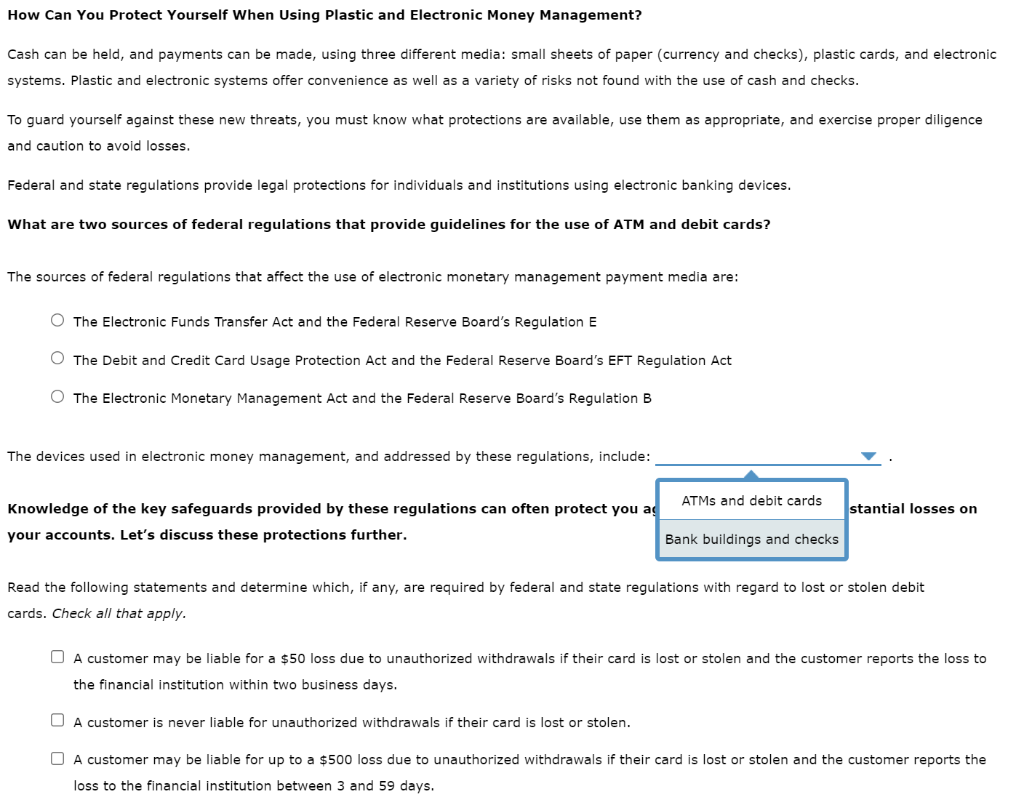

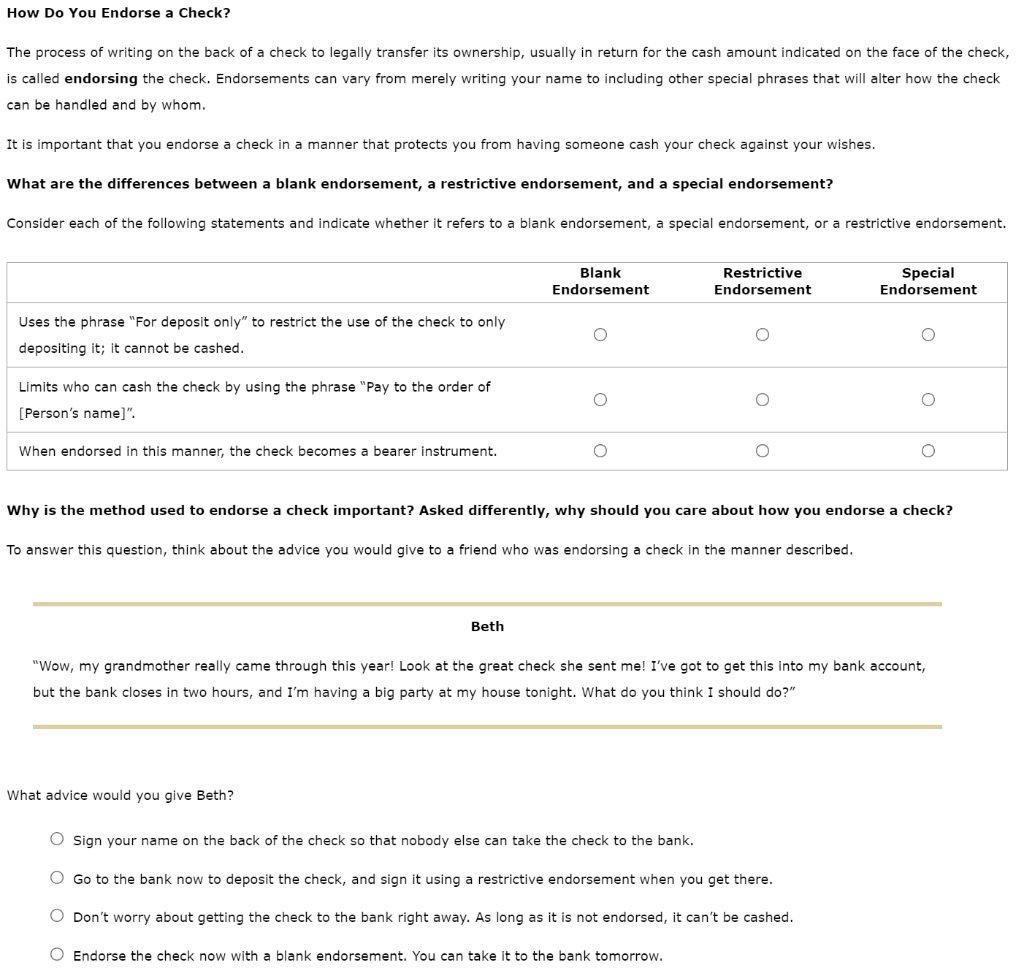

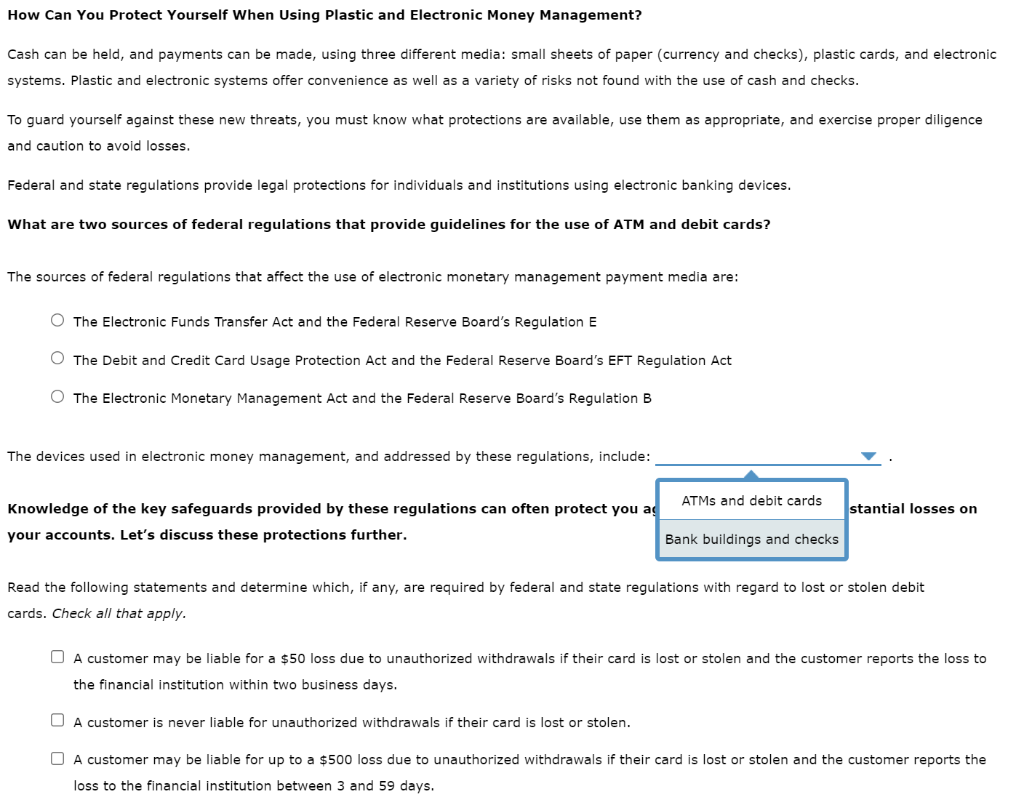

How Do You Endorse a Check? The process of writing on the back of a check to legally transfer its ownership, usually in return for the cash amount indicated on the face of the check, is called endorsing the check. Endorsements can vary from merely writing your name to including other special phrases that will alter how the check can be handled and by whom. It is important that you endorse a check in a manner that protects you from having someone cash your check against your wishes. What are the differences between a blank endorsement, a restrictive endorsement, and a special endorsement? Consider each of the following statements and indicate whether it refers to a blank endorsement, a special endorsement, or a restrictive endorsement. Blank Endorsement Restrictive Endorsement Special Endorsement Uses the phrase "For deposit only" to restrict the use of the check to only depositing it; it cannot be cashed. Limits who can cash the check by using the phrase "Pay to the order of [Person's name)". 0 O When endorsed in this manner, the check becomes a bearer instrument. O O Why is the method used to endorse a check important? Asked differently, why should you care about how you endorse a check? To answer this question, think about the advice you would give to a friend who was endorsing a check in the manner described. Beth "Wow, my grandmother really came through this year! Look at the great check she sent me! I've got to get this into my bank account, but the bank closes in two hours, and I'm having a big party at my house tonight. What do you think I should do?" What advice would you give Beth? O Sign your name on the back of the check so that nobody else can take the check to the bank. Go to the bank now to deposit the check, and sign it using a restrictive endorsement when you get there. Don't worry about getting the check to the bank right away. As long as it is not endorsed, it can't be cashed. Endorse the check now with a blank endorsement. You can take it to the bank tomorrow. How Can You Protect Yourself When Using Plastic and Electronic Money Management? Cash can be held, and payments can be made, using three different media: small sheets of paper (currency and checks), plastic cards, and electronic systems. Plastic and electronic systems offer convenience as well as a variety of risks not found with the use of cash and checks. To guard yourself against these new threats, you must know what protections are available, use them as appropriate, and exercise proper diligence and caution to avoid losses. Federal and state regulations provide legal protections for individuals and institutions using electronic banking devices. What are two sources of federal regulations that provide guidelines for the use of ATM and debit cards? The sources of federal regulations that affect the use of electronic monetary management payment media are: The Electronic Funds Transfer Act and the Federal Reserve Board's Regulation E The Debit and Credit Card Usage Protection Act and the Federal Reserve Board's EFT Regulation Act The Electronic Monetary Management Act and the Federal Reserve Board's Regulation B The devices used in electronic money management, and addressed by these regulations, include: ATMs and debit cards stantial losses on Knowledge of the key safeguards provided by these regulations can often protect you a your accounts. Let's discuss these protections further. Bank buildings and checks Read the following statements and determine which, if any, are required by federal and state regulations with regard to lost or stolen debit cards. Check all that apply. O A customer may be liable for a $50 loss due to unauthorized withdrawals if their card is lost or stolen and the customer reports the loss to the financial institution within two business days. A customer is never liable for unauthorized withdrawals if their card is lost or stolen. O A customer may be liable for up to a $500 loss due to unauthorized withdrawals if their card is lost or stolen and the customer reports the loss to the financial institution between 3 and 59 days. How Do You Endorse a Check? The process of writing on the back of a check to legally transfer its ownership, usually in return for the cash amount indicated on the face of the check, is called endorsing the check. Endorsements can vary from merely writing your name to including other special phrases that will alter how the check can be handled and by whom. It is important that you endorse a check in a manner that protects you from having someone cash your check against your wishes. What are the differences between a blank endorsement, a restrictive endorsement, and a special endorsement? Consider each of the following statements and indicate whether it refers to a blank endorsement, a special endorsement, or a restrictive endorsement. Blank Endorsement Restrictive Endorsement Special Endorsement Uses the phrase "For deposit only" to restrict the use of the check to only depositing it; it cannot be cashed. Limits who can cash the check by using the phrase "Pay to the order of [Person's name)". 0 O When endorsed in this manner, the check becomes a bearer instrument. O O Why is the method used to endorse a check important? Asked differently, why should you care about how you endorse a check? To answer this question, think about the advice you would give to a friend who was endorsing a check in the manner described. Beth "Wow, my grandmother really came through this year! Look at the great check she sent me! I've got to get this into my bank account, but the bank closes in two hours, and I'm having a big party at my house tonight. What do you think I should do?" What advice would you give Beth? O Sign your name on the back of the check so that nobody else can take the check to the bank. Go to the bank now to deposit the check, and sign it using a restrictive endorsement when you get there. Don't worry about getting the check to the bank right away. As long as it is not endorsed, it can't be cashed. Endorse the check now with a blank endorsement. You can take it to the bank tomorrow. How Can You Protect Yourself When Using Plastic and Electronic Money Management? Cash can be held, and payments can be made, using three different media: small sheets of paper (currency and checks), plastic cards, and electronic systems. Plastic and electronic systems offer convenience as well as a variety of risks not found with the use of cash and checks. To guard yourself against these new threats, you must know what protections are available, use them as appropriate, and exercise proper diligence and caution to avoid losses. Federal and state regulations provide legal protections for individuals and institutions using electronic banking devices. What are two sources of federal regulations that provide guidelines for the use of ATM and debit cards? The sources of federal regulations that affect the use of electronic monetary management payment media are: The Electronic Funds Transfer Act and the Federal Reserve Board's Regulation E The Debit and Credit Card Usage Protection Act and the Federal Reserve Board's EFT Regulation Act The Electronic Monetary Management Act and the Federal Reserve Board's Regulation B The devices used in electronic money management, and addressed by these regulations, include: ATMs and debit cards stantial losses on Knowledge of the key safeguards provided by these regulations can often protect you a your accounts. Let's discuss these protections further. Bank buildings and checks Read the following statements and determine which, if any, are required by federal and state regulations with regard to lost or stolen debit cards. Check all that apply. O A customer may be liable for a $50 loss due to unauthorized withdrawals if their card is lost or stolen and the customer reports the loss to the financial institution within two business days. A customer is never liable for unauthorized withdrawals if their card is lost or stolen. O A customer may be liable for up to a $500 loss due to unauthorized withdrawals if their card is lost or stolen and the customer reports the loss to the financial institution between 3 and 59 days