Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how do you find the current value (t=0) for bottle divish how do you find the current value (t=0) for sport division bottling division (BOT

how do you find the current value (t=0) for bottle divish

how do you find the current value (t=0) for sport division

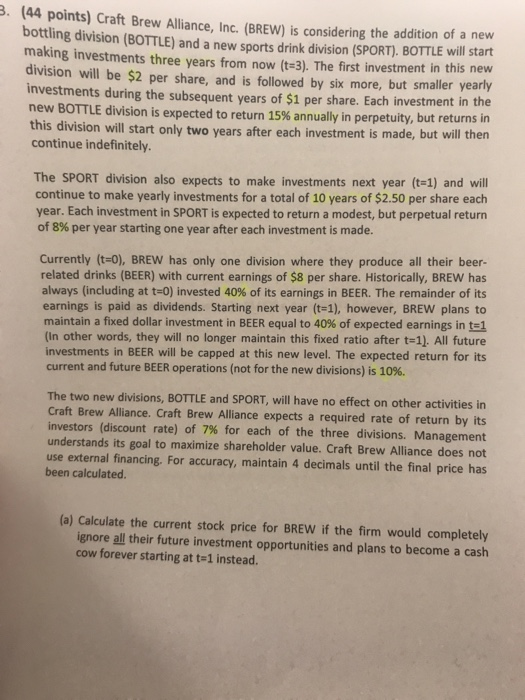

bottling division (BOT Alliance, Inc. (BREW) is considering the addition of a new making investments (BOTTLE) and a new sports drink division (SPORT). BOTTLE will start making investments three years from now (t=3). The first investment in this new division will be \$2 per share, and is followed by six more, but smaller yearly investments during the subsequent years of \$1 per share. Each investment in the new BOTTLE division is expected to return 15% annually in perpetuity, but returns in this division will start only two years after each investment is made, but will then continue indefinitely. The SPORT division also expects to make investments next year (t=1) and will continue to make yearly investments for a total of 10 years of $2.50 per share each year. Each investment in SPORT is expected to return a modest, but perpetual return of 8% per year starting one year after each investment is made. Currently (t=0), BREW has only one division where they produce all their beerrelated drinks (BEER) with current earnings of $8 per share. Historically, BREW has always (including at t=0 ) invested 40% of its earnings in BEER. The remainder of its earnings is paid as dividends. Starting next year (t=1), however, BREW plans to maintain a fixed dollar investment in BEER equal to 40% of expected earnings in t=1 (In other words, they will no longer maintain this fixed ratio after t=1 ). All future investments in BEER will be capped at this new level. The expected return for its current and future BEER operations (not for the new divisions) is 10%. The two new divisions, BOTTLE and SPORT, will have no effect on other activities in Craft Brew Alliance. Craft Brew Alliance expects a required rate of return by its investors (discount rate) of 7% for each of the three divisions. Management understands its goal to maximize shareholder value. Craft Brew Alliance does not use external financing. For accuracy, maintain 4 decimals until the final price has been calculated. (a) Calculate the current stock price for BREW if the firm would completely ignore all their future investment opportunities and plans to become a cash cow forever starting at t=1 insteadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started