Answered step by step

Verified Expert Solution

Question

1 Approved Answer

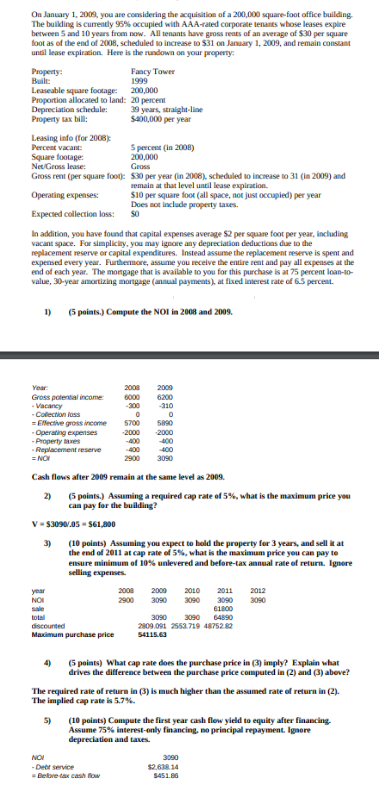

how do you find the debt service payment amount in part 5? On January 1, 2009 , you are considering the acquisition of a 200,000

how do you find the debt service payment amount in part 5?

On January 1, 2009 , you are considering the acquisition of a 200,000 square-foot office building The building is currently 96% occupied with AAA-rated corporate tenants whose leases expire between $ and 10 years from now. All tenants have gross reats of an average of $30 per square foot as of the end of 2008 , scheduled to increase is $31 on January 1, 2009, and remain constant unal lease expiracion. Here is the rundowa on your property: In addition, you have found that capital expenses average $2 per square foot per year, including vacant space. For simpliciry, you may ignore any depreciation deductions due to the replacement reserve or capital expendirures. Instead assume the replacement reserve is spent and expensed every year. Furthermore, assume you receive the entire teat and pay all expenses at the end of each year. The monpage that is wailable to you for this purchase is at 75 percent loan-10value, 30-year ancotizing mortgage (annual payments), at flxed imerest rate of 6.5 percent. 1) (5 points.) Compute the NOI in 2008 and 2009. Cash flews after 2009 remain at the came leved as 2009. 2) (5 points.) Assuming a required cap rate of 5%, what is the maximum price you caa pay for the building? V=$3090/.05=$61.200 3) (10 points) Assuming you expect to hold the property for 3 years, and sell it at the end of 2011 at cap rate of 5%, what is the maximum price you can pay to ensure minimum of 10% unlevered and before-tax anneal rate of return. Ignore selling expenses. 4) (5 points) What cap rate does the purchase price in (3) imply? Explain what drives the difference between the purchase price conputed in (2) and (3) abeve? The required rate of reture in (3) is much higher than the assamed rate of return in (2). The implied cap rate is 5.7%. 5) (10 points) Compute the first year cash flew yield to equity after financing. Assume 75% interest-only financing, no priacipal reparyment. Igaore depreciation and taves

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started