How do you journalize a job order cost system?

I made some errors and I can't find what's missing.

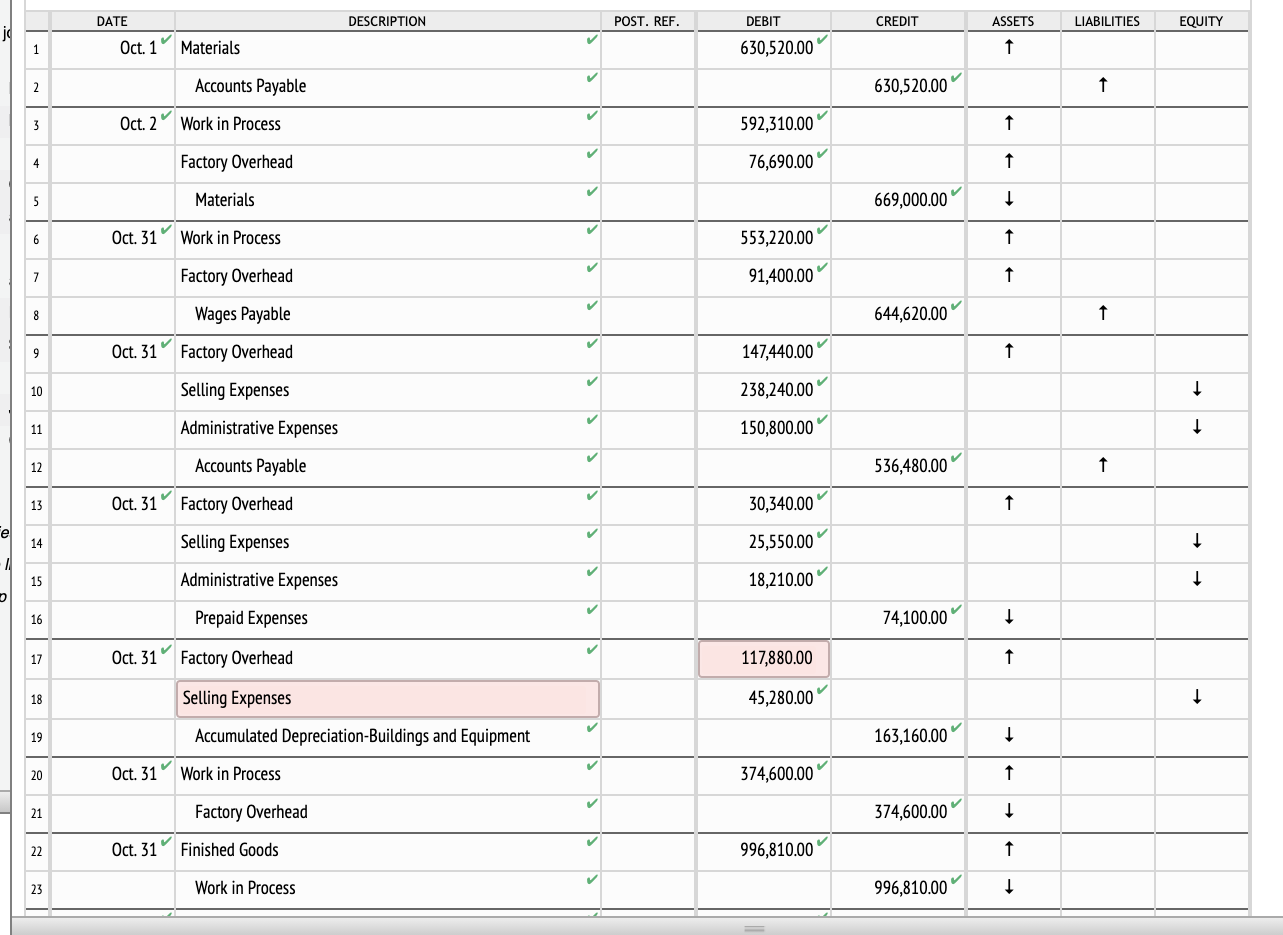

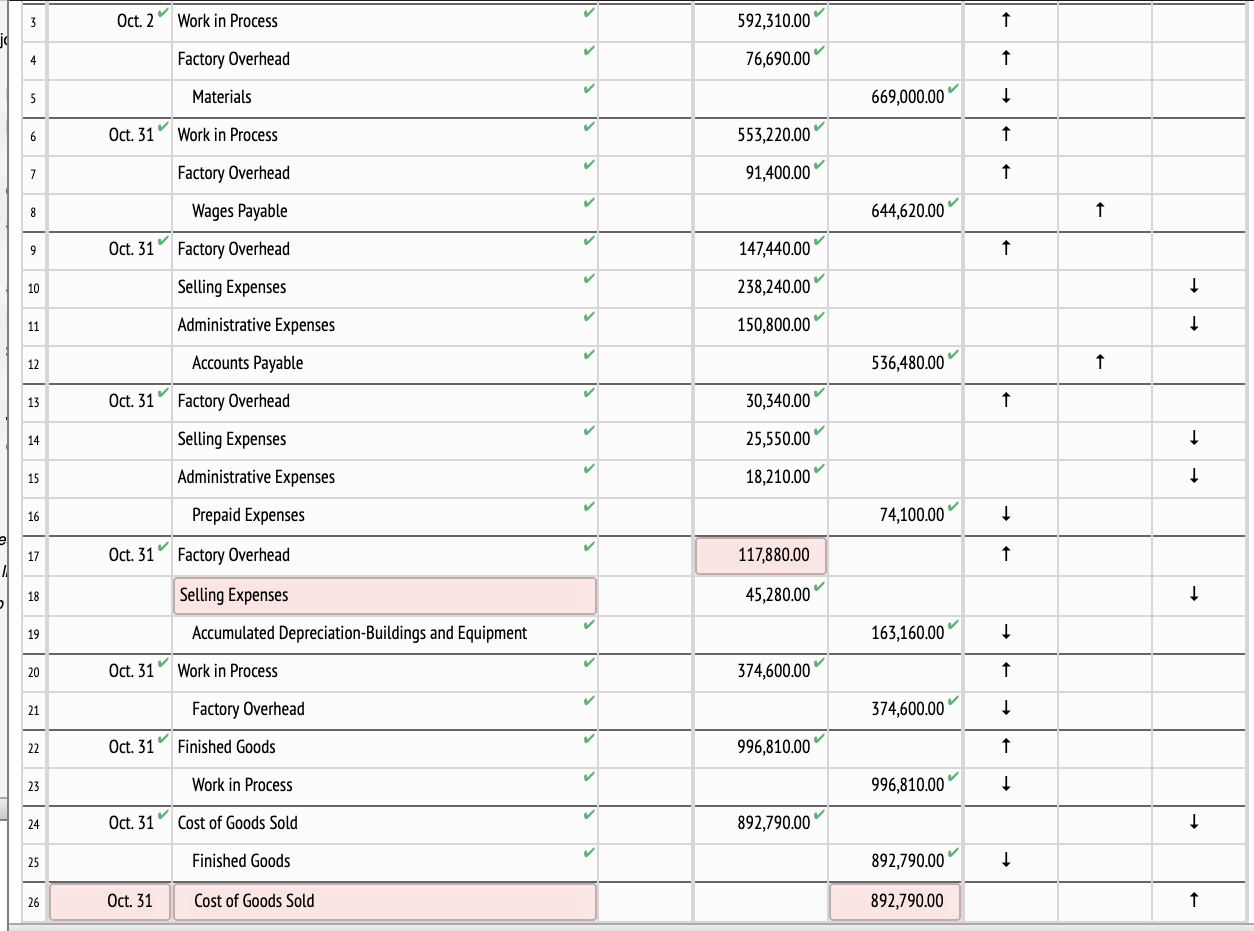

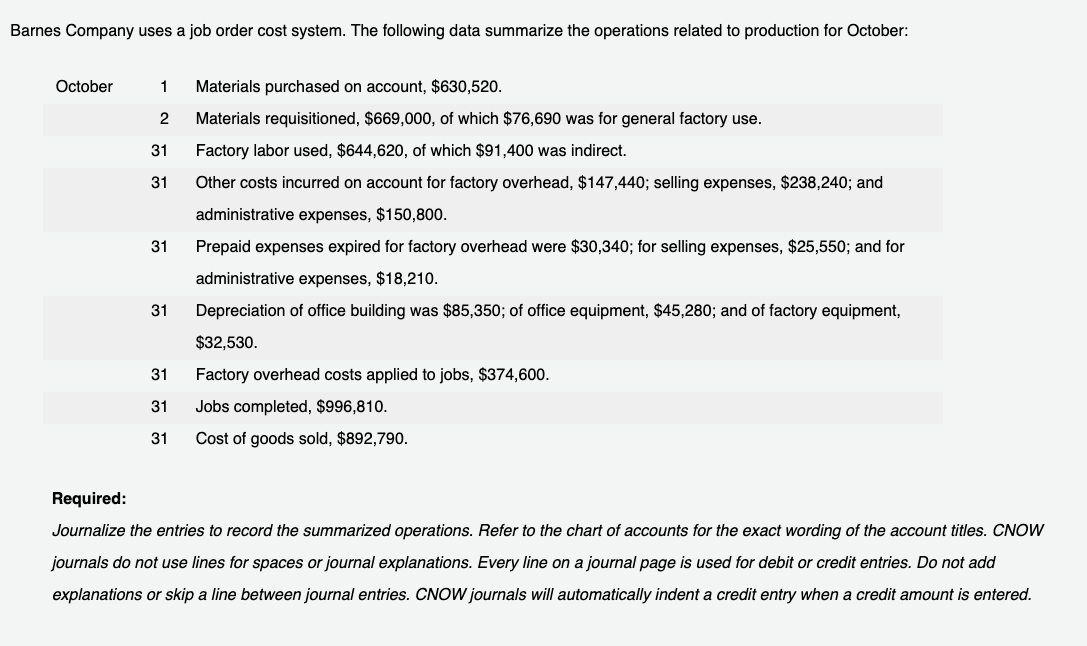

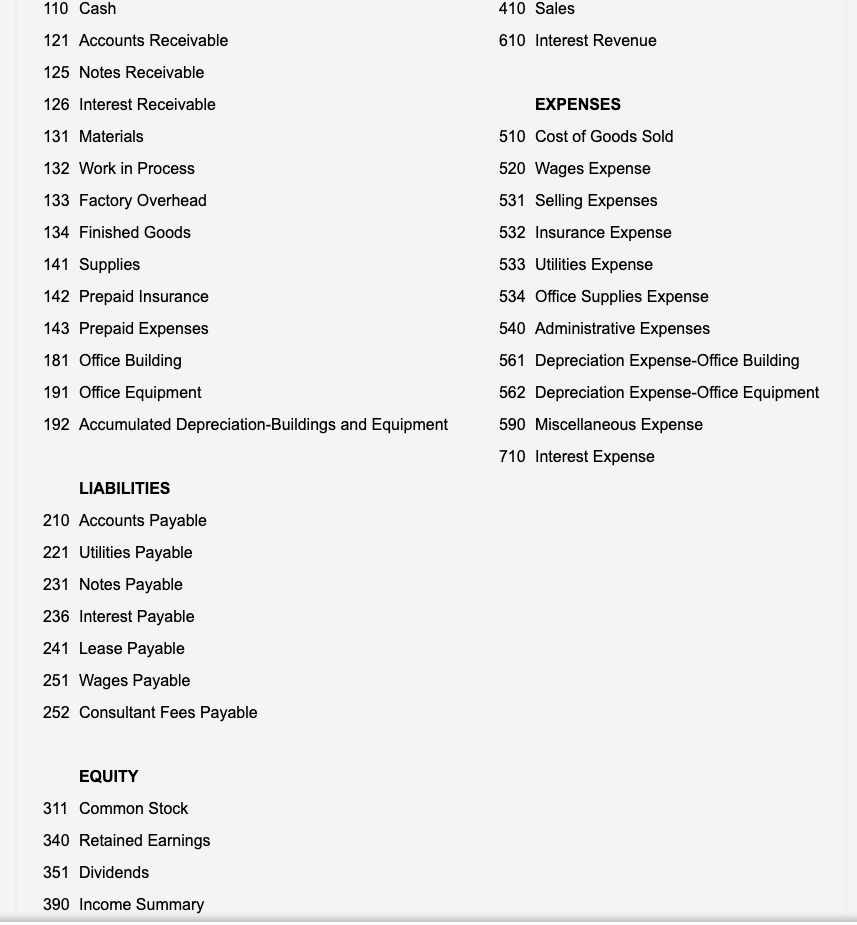

DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Oct. 1 Materials 630,520.00 T Accounts Payable 630,520.00 Oct. 2 Work in Process 592,310.00 Factory Overhead V 76,690.00 Materials 669,000.00 + Oct. 31 Work in Process 553,220.00 Factory Overhead 91,400.00 Wages Payable 644,620.00 Oct. 31 Factory Overhead 147,440.00 10 Selling Expenses 238,240.00 + 11 Administrative Expenses 150,800.00 + 12 Accounts Payable 536,480.00 13 Oct. 31 Factory Overhead 30,340.00 14 Selling Expenses 25,550.00 + 15 Administrative Expenses V 18,210.00 + 16 Prepaid Expenses 74,100.00 17 Oct. 31 Factory Overhead V 117,880.00 18 Selling Expenses 45,280.00 19 Accumulated Depreciation-Buildings and Equipment V 163,160.00 + 20 Oct. 31 Work in Process 374,600.00 21 Factory Overhead 374,600.00 22 Oct. 31 Finished Goods 996,810.00 23 Work in Process 996,810.00 +3 Oct. 2 Work in Process 592,310.00 4 Factory Overhead 76,690.00 5 Materials 669,000.00 + 6 Oct. 31 Work in Process 553,220.00 Factory Overhead 91,400.00 8 Wages Payable 644,620.00 9 Oct. 31 Factory Overhead 147,440.00 t 10 Selling Expenses 238,240.00 + 11 Administrative Expenses 150,800.00 + 12 Accounts Payable 536,480.00 t 13 Oct. 31 Factory Overhead 30,340.00 t 14 Selling Expenses 25,550.00 + 15 Administrative Expenses 18,210.00 + 16 Prepaid Expenses 74,100.00 + 17 Oct. 31 Factory Overhead 117,880.00 18 Selling Expenses 45,280.00 + 19 Accumulated Depreciation-Buildings and Equipment 163,160.00 + 20 Oct. 31 Work in Process $74,600.00 21 Factory Overhead 374,600.00 + 22 Oct. 31 Finished Goods 996,810.00 23 Work in Process 996,810.00 + 24 Oct. 31 Cost of Goods Sold 892,790.00 + 25 Finished Goods 892,790.00 26 Oct. 31 Cost of Goods Sold 892,790.00Barnes Company uses a job order cost system. The following data summarize the operations related to production for October: October 1 Materials purchased on account, $630,520. 2 Materials requisitioned, $669,000, of which $76,690 was for general factory use. 31 Factory labor used, $644,620, of which $91,400 was indirect. 31 Other costs incurred on account for factory overhead, $147,440; selling expenses, $238,240; and administrative expenses, $150,800. 31 Prepaid expenses expired for factory overhead were $30,340; for selling expenses, $25,550; and for administrative expenses, $18,210. 31 Depreciation of office building was $85,350; of office equipment, $45,280; and of factory equipment, $32,530. 31 Factory overhead costs applied to jobs, $374,600. 31 Jobs completed, $996,810. 31 Cost of goods sold, $892,790. Required: Journalize the entries to record the summarized operations. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for spaces or journal explanations. Every line on a journal page is used for debit or credit entries. Do not add explanations or skip a line between journal entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.110 Cash 410 Sales 121 Accounts Receivable 610 Interest Revenue 125 Notes Receivable 126 Interest Receivable EXPENSES 131 Materials 510 Cost of Goods Sold 132 Work in Process 520 Wages Expense 133 Factory Overhead 531 Selling Expenses 134 Finished Goods 532 Insurance Expense 141 Supplies 533 Utilities Expense 142 Prepaid Insurance 534 Office Supplies Expense 143 Prepaid Expenses 540 Administrative Expenses 181 Office Building 561 Depreciation Expense-Office Building 191 Office Equipment 562 Depreciation Expense-Office Equipment 192 Accumulated Depreciation-Buildings and Equipment 590 Miscellaneous Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary