How do you make a flexible budget where applicable? Some expenses cannot be adjusted because there is no information of the costs are fixed. How do you calculate variance between actual and flexible budget?

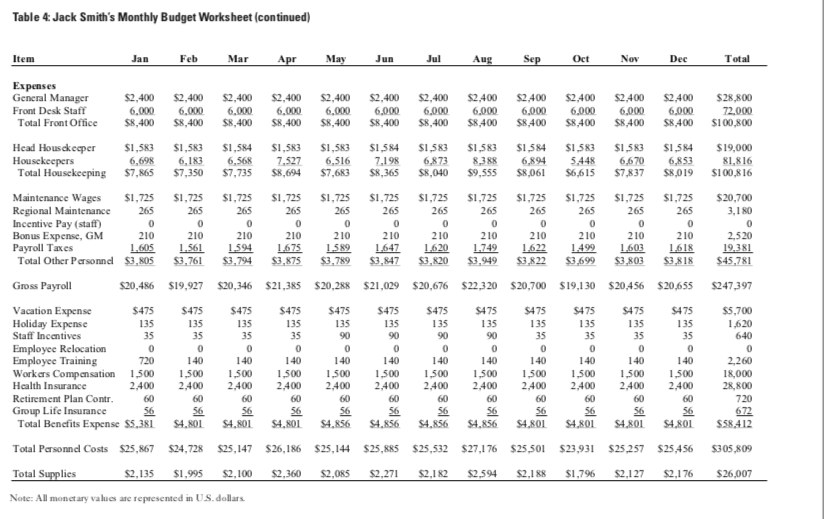

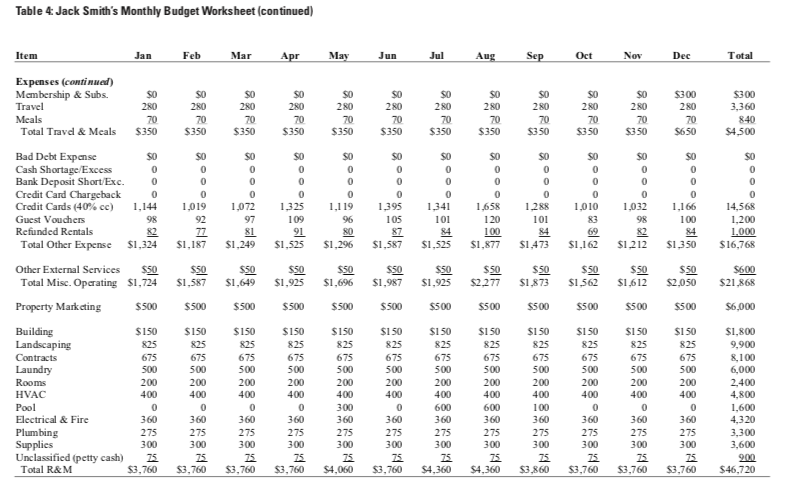

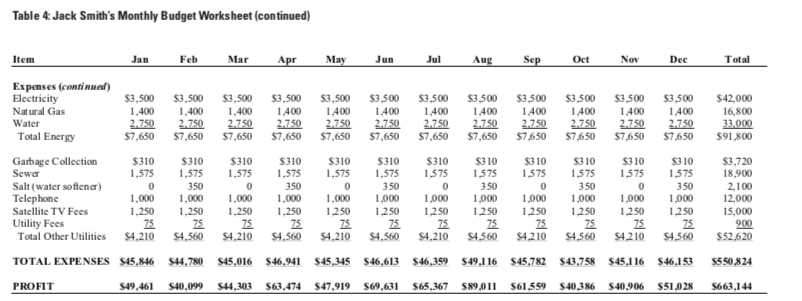

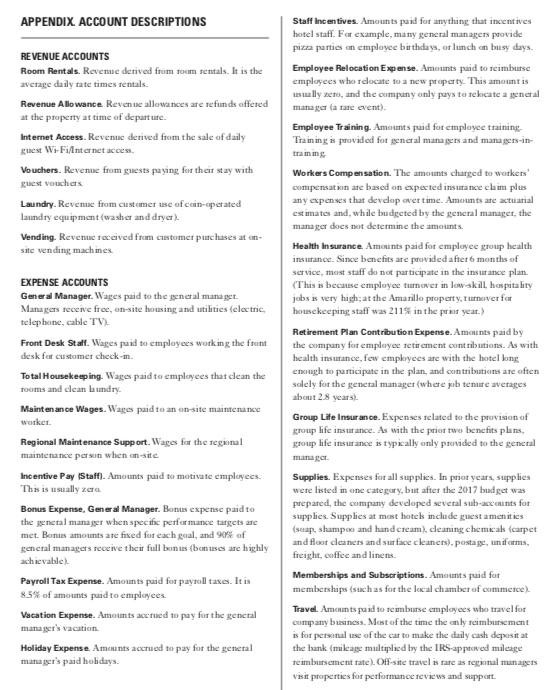

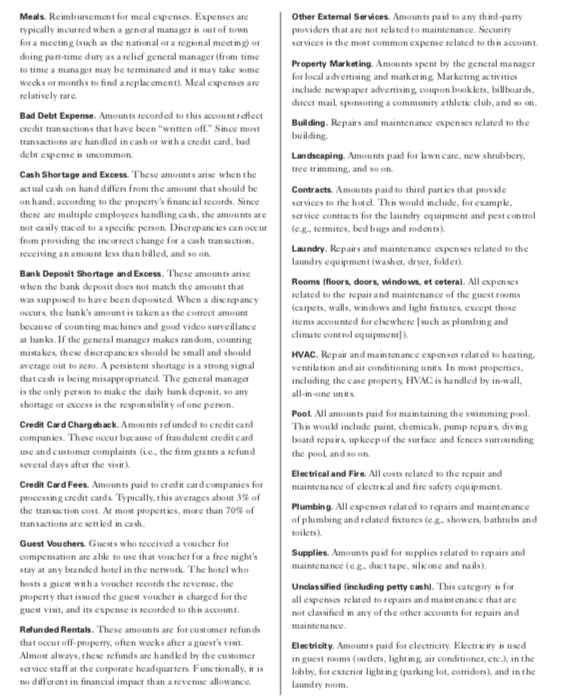

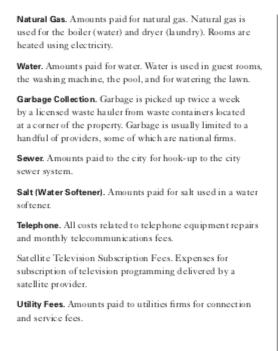

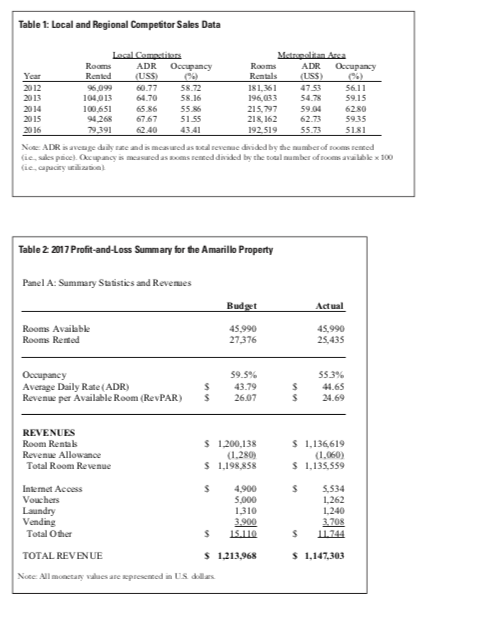

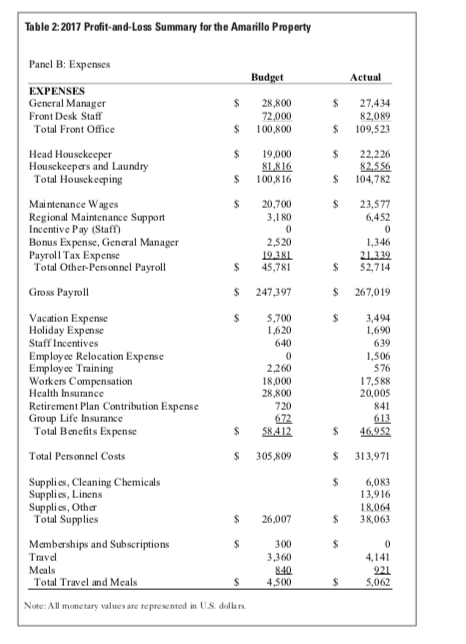

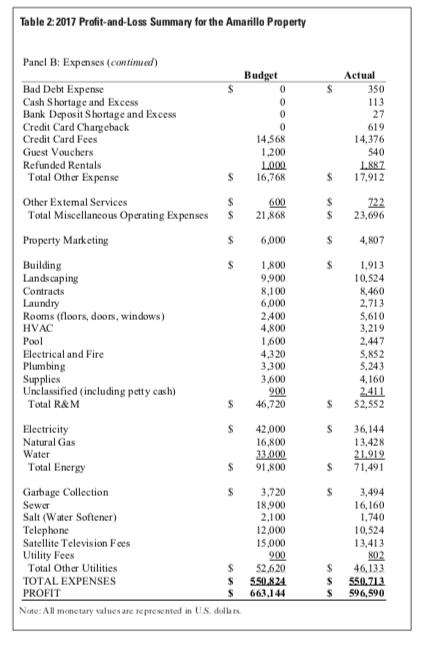

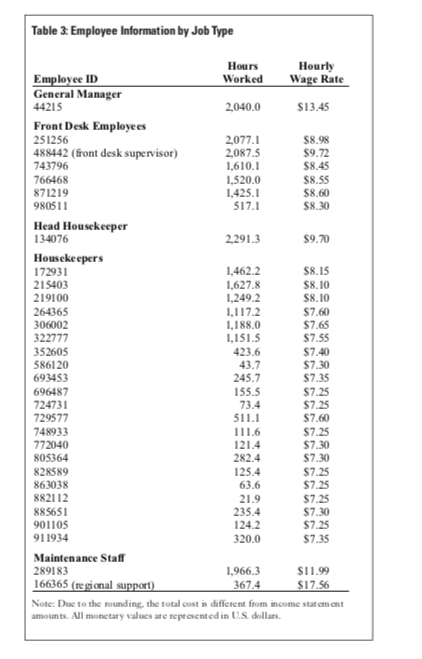

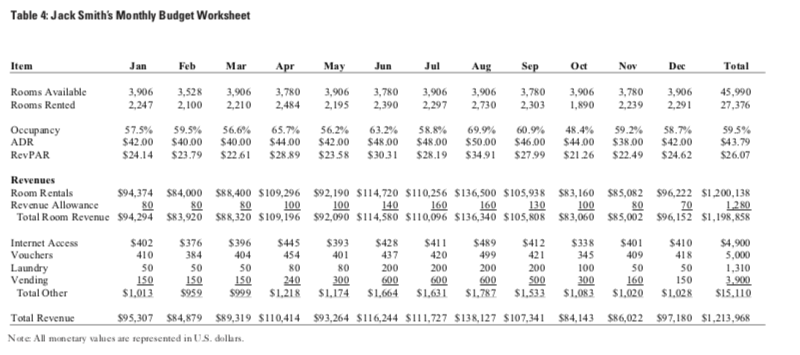

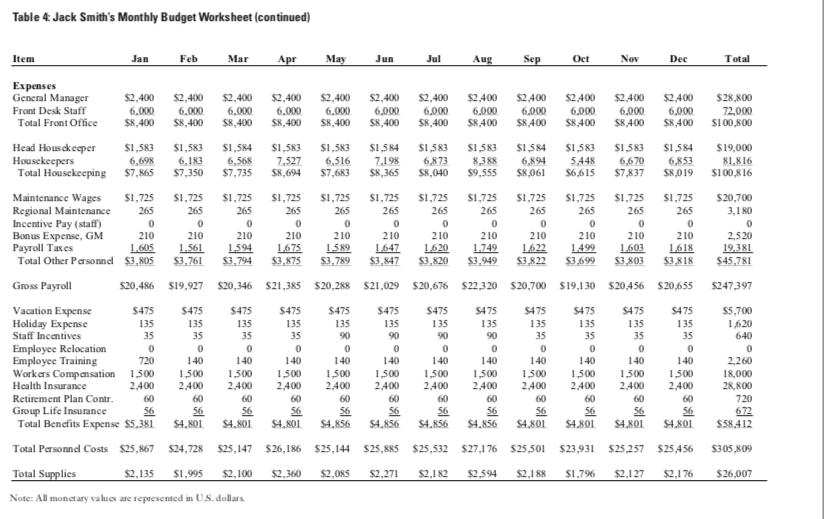

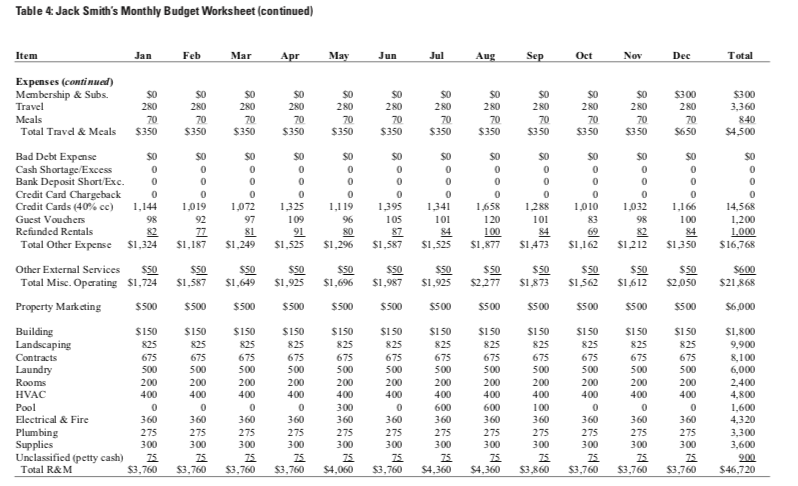

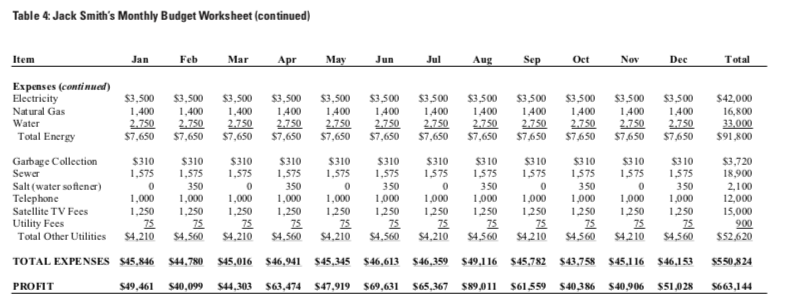

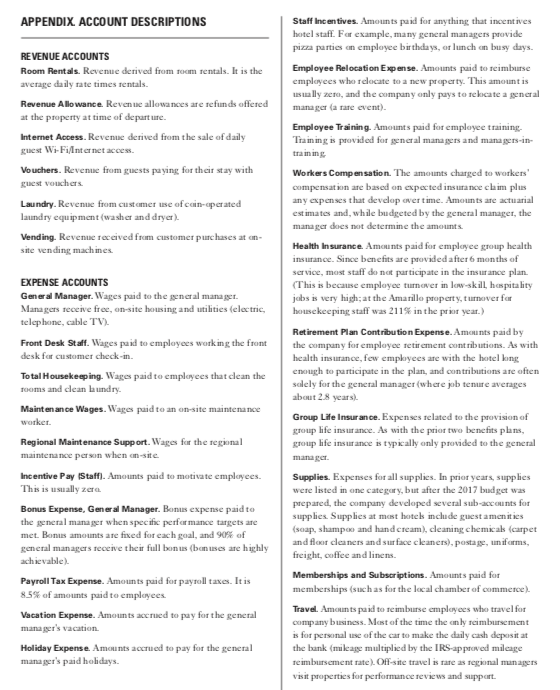

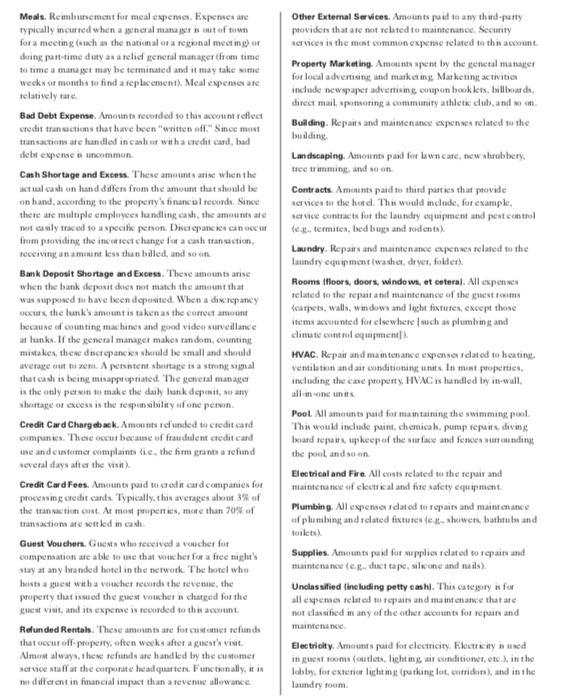

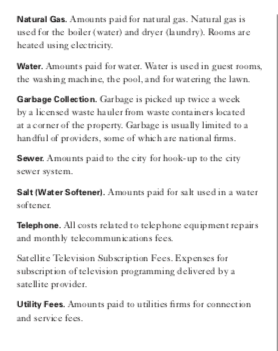

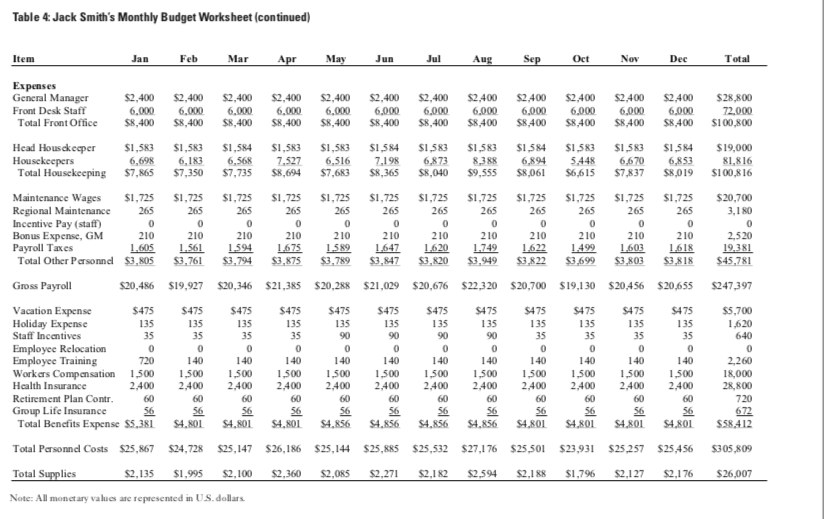

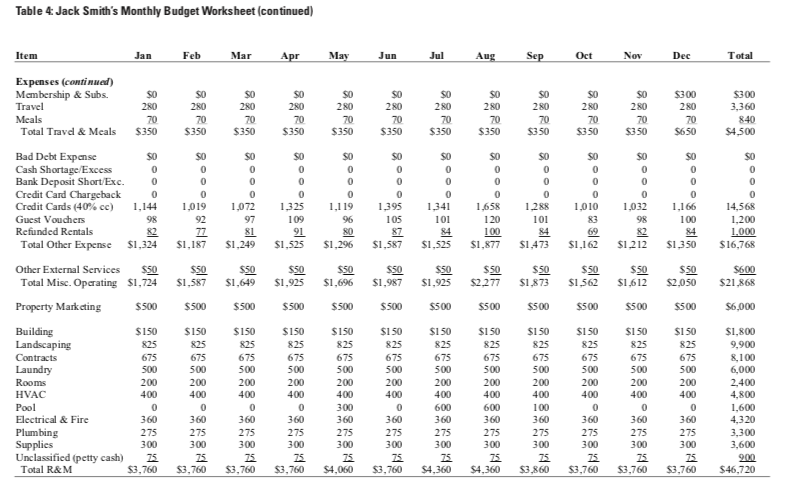

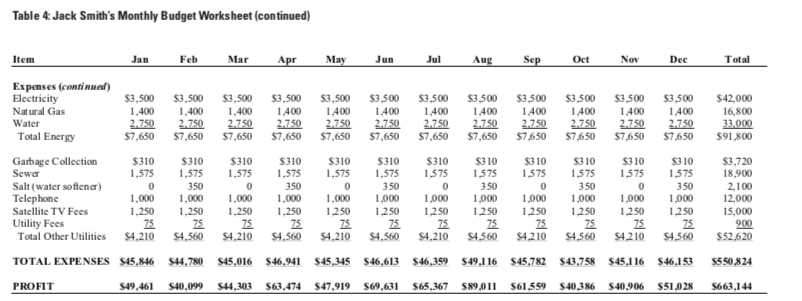

Lone Star Lodging Thomas Calderon James W. Heford* Mina Phun Mihad J. Turner Unkeruity of Lethbridge MiCay College of Bruises The University of Ouradand Dhithe School of Business Tears State Unitenin UP Brunei School INTRODUCTION as the total number of rooms rented (output) divided by the number of rooms available during the period (capacity). In Sining at his desk reviewing the results of the last year, Jack preparing his budget, Smith expected the 2017 market size Smith reflected on his second year as General Manager of to be 10% higher than the 2016 market size. For 2017. the the Lone Star Motel. Next week is the Regional Operations benchmarking firm reported that local competitors rented Review in nearby Lubbock, Texas, where managers from 77.291 room at an ADR of $59.80. surrounding areas will gather with Victoria Jennings, Regional Smith turned to the report detailing budgeted and actual Vice President of Operations. Smith will need to summarize the revenue and expense data (see Table 2). Accounting provided hotel's performance and, recalling variance analysis, thought this Smith with the hours worked by hold staff. The maintenance tool would be a rigorous way to conduct his analysis. worker and general manager are normally full-time workers (that is, 40 hours per week, 50 weeks a year). All other workers COMPANY BACKGROUND are comideed full time, though many of them work less than 4 hours per week (see Table 3). In preparing the budget. The Lone Star Motel is a 126-room economy-lodging hotel in Smith planned on housekeeping staff ining a standard time Amarillo, Texas Built in 1980, it is part of Lone Star Lodging. of 30 minutes per room with a wage rate of $7.00 per hour. a privately owned hotel chain headquartered in suburban The head houck ceperk wage was budgeted at $9 50per Houston, Texas. Lone Star Lodging operates a network of hour and usully works 40 hours. With a smull staff, the head 207 hotch in four states Texas, New Mexico, Oklahoma and housekeeper also clean rooms. Her productivity appears lower Arkansas. About half of the hotch are owned and operated by (that is, clean fewer room) becaine of her supervisory duties the company. (mspections and employee training) and the need to complete the room inventory form. Accordingdy during dow periods, the PRESENT SITUATION head homekeeper may work fewer hours. Smith anticipated having one person staffing the front desk at all hours. With the Renovated two years ago, the hold competes with 16 other exception of the general manager employees do not get paid economy-lodging hotch in a market that is more competitive vacation time. Further with high turnover most employees de than most. However when thinking about its market share. not receive benefits (healthcare and retirement contributions). company management actually considers three nearby hotels Table 4 shows the monthly budget Smith developed to be the hotel's direct competitors. Sales data on regional and to submit to corporate accounting as his required annual local competitors for the past five years are regularly obtained band get. A description of accounts is given in the Appendix. from an industry benchmarking firm (see "Table 1). In the Next week is Smith's operations review meeting with hospitality industry, average sales price is average daily rate Victoria Jennings Having gathered all the data needed (ADR), defined as the total room revenue divided by the for a comprehense variance analysis, he would like your number of rooms rented. Another industry-standard metric. help doing the calculations, interpreting the numbers, and occupancy, fe presents capacity utilization. Occupancy is defined preparing his report and presentation.Table 1: Local and Regional Competitor Sales Data Local Compdifors Metropolitan Area Rooms ADR Occupancy Rooms ADR Occupancy Year Rented (USS) Rentals (USS 20 12 95.099 60.77 58.72 181,361 47 53 5611 20 13 104013 64.70 58.16 196,073 54.78 59.15 2014 100.651 65.86 55 86 215,797 5904 6280 20 15 94.268 67.67 51.55 218, 162 62.73 59.35 20 16 79.391 62.40 43.41 192 519 55.73 5181 Note: ADR i avenge dilly nae and is meswed as wood revenue divided by the number of room remed (ie, sies price). Compancy is measured as boms rented divided by the coul member of rooms available x 100 Table 2 2017 Profit-and-Loss Summary for the Amarillo Property Panel A: Summary Statistics and Revenues Budget Actual Rooms Available 45.990 45.990 Rooms Rented 27.376 25.435 Occupancy 59-5% $53% Average Daily Rate (ADR) 43.79 44.65 Revenue per Available Room (RevPAR) 26.07 24.69 REVENUES Room Rentals $ 1.200.138 $ 1,136.619 Revenue Allowance (1.280) (1.060) Total Room Revenue $ 1,198.258 $ 1,135.559 Internet Access 4.900 5.534 Vouchers 5.000 1.262 Laundry 1310 1,240 Vending 3.900 1.708 Total Other 15.110 11744 TOTAL REVENUE $ 1.213.968 $ 1.147.303 Note All moctar whenare cpresemed in US dollarsTable 2:2017 Profit-and-Loss Summary for the Amarillo Property Panel B: Expenses Budget Actual EXPENSES General Manager 28,800 27.434 Front Desk Staff 72,000 82,089 Total Front Office 100,80D 109,523 Head Housekeeper 19.000 22,226 Housekeepers and Laundry 81.816 82.556 Total Housekeeping S 100,816 S 104,782 Maintenance Wages 20,700 23.577 Regional Maintenance Support 3,180 6,452 Incentive Pay (Staff) Bonus Expense, General Manager 2.520 1.346 Payroll Tax Expense 19.381 21.130 Total Other-Personnel Payroll 45,781 52,714 Gross Payroll $ 247.397 267,019 Vacation Expense 5,700 3,494 Holiday Expense 1,620 1,690 Staff Incentives 640 639 Employee Relocation Expense 0 1,506 Employee Training 2,260 $76 Workers Compensation 18,000 17.588 Health Insurance 28,800 20,005 Retirement Plan Contribution Expense 720 841 Group Life Insurance 672 613 Total Benefits Expense $ 58.412 46.952 Total Personnel Costs $ 305,809 $ 313,971 Supplies, Cleaning Chemicals 6,083 Supplies, Linens 13,916 Supplies, Other 18.064 Total Supplies S 26,007 38,063 Memberships and Subscriptions 300 Travel 3.360 4,141 Meals 921 Total Travel and Meals 4,500 S 5,062 Note: All monetary values are represented in U.S. dollars.Table 2:2017 Profit-and-Loss Summary for the Amarillo Property Panel B: Expenses (continual) Budget Actual Bad Debt Expense 350 Cash Shortage and Excess 113 Bank Deposit Shortage and Excess 27 Credit Card Chargeback 619 Credit Card Fees 14.568 14,376 Guest Vouchers 1,200 540 Refunded Rentals 1000 1887 Total Other Expense 16,768 17,912 Other External Services 600 722 Total Miscellaneous Operating Expenses 21,868 23.696 Property Marketing 6.000 4,807 Building 1,800 1,913 Landscaping 9,900 10,524 Contracts 8,100 8,460 Laundry 6,000 2,713 Rooms (floors, doors, windows) 2.400 5,610 HVAC 4,800 3,219 Pool 1,600 2,447 Electrical and Fire 4.320 5,852 Plumbing 3,300 5,243 Supplies 3,600 4.160 Unclassified (including petty cash) 900 2.41 1 Total R&M 46,720 52,552 Electricity 42,000 36,144 Natural Gas 16,800 13,428 Water 31,000 21.919 Total Energy $ 91,800 $ 71,491 Garbage Collection 3,720 3,494 Sewer 18,900 16,160 Salt (Water Softener) 2,100 1,740 Telephone 12,000 10,524 Satellite Television Fees 15,000 13,413 Utility Fees 900 802 Total Other Utilities 52.620 46,133 TOTAL EXPENSES 550.824 550.711 PROFIT 663.144 596.590 Note: All monetary values are represented in U.S. dollars.Table 3: Employee Information by Job Type Hours Employee ID Hourly Worked Wage Rate General Manager 44215 2.040.0 $13.45 Front Desk Employees 251256 2,077.1 488442 (front desk supervisor) $8.98 2,087.5 743796 $9.72 1.610.1 $8.45 766468 1.520.0 871219 $8.55 1.425.1 9805 1 1 $8.60 517.1 $8.30 Head Housekeeper 134076 2,291.3 $9.70 Housekeepers 172931 1.462.2 $8. 15 215403 1.627.8 $8. 10 219100 1.249.2 $8. 10 264365 1.117.2 306002 $7.60 322777 1,188.0 $7.65 1,151.5 $7.55 352605 423.6 586120 $7.40 43.7 $7.30 693453 245.7 $7.35 696487 155.5 $7.25 724731 73.4 729577 $7.25 511.1 $7.60 748933 1 11.6 772040 $7.25 121.4 805364 $7.30 282.4 $7.30 828589 125.4 $7.25 863038 63.6 8821 12 $7.25 21.9 $7.25 885651 235.4 901105 $7.30 124.2 91 1934 $7.25 320.0 $7.35 Maintenance Staff 289183 1.966.3 $11.99 166365 ( regional support) 367.4 $17.56 Note: Due to the rounding, the total cost is different from income statement amounts. All monetary values are represented in U.S. dollars.Table 4: Jack Smith's Monthly Budget Worksheet Item Jan Feb Mar Apr May Jun Jul Aug Sep Od Nov Dec Total Rooms Available 3.906 3.528 3.906 3.780 3.906 3.780 3.906 3.906 Rooms Rented 3,780 3.906 2,247 2,100 2,210 3,780 3.906 2.484 45.990 2.195 2.390 2,297 2,730 2,303 1,890 2.239 2,291 27.376 Occupancy $7.5% $9.5% 56.6% 65.7% 56.2% 63.2% ADR $42.00 58.8% 69.9% $40.00 60.9% $40.00 48.4% $44.00 $42.00 59.2% $48.00 58.7% 59.5% $48.00 $50.00 RevPAR $24.14 $46.00 $23.79 $44.00 $38.00 $22.61 $42.00 $28.89 $43.79 $23.58 $30.31 $28.19 $34.91 $27.99 $21 26 $22.49 $24.62 $26.07 Revenues Room Rentals $94.374 $84,000 $88, 400 $109,296 $92.190 $114,720 $110,256 $136,500 $105,938 Revenue Allowance $83.160 $85,082 $96,222 $1,200,138 KO 100 100 Total Room Revenue $94.294 140 160 160 $83,920 SK8, 320 $109,196 130 100 RO $92,090 $114.580 $110,096 $136,340 $105,808 70 1.2 80 $8 3,060 $85,002 $96,152 $1,198,858 Internet Access $402 $376 $396 Vouchers $445 $393 $428 $41 1 $489 410 384 $412 $338 404 454 $401 $410 401 $4.900 437 420 499 Laundry 421 345 409 41 8 50 5.000 50 50 80 Vending 200 200 150 150 200 200 100 150 50 240 300 50 1.310 600 600 600 Total Other $1.013 300 $959 160 150 $999 $1.218 $1.174 3.900 $1.664 $1.631 $1.787 $1.533 $1.083 $1.020 $1.028 $15.110 Total Revenue $95.307 584.879 $89.319 $110,414 $93,264 $116,244 $111,727 $138,127 $107.341 $84.143 $86,022 $97,180 $1,213,968 Note All monetary values are represented in U.S. dollars.Table 4: Jack Smith's Monthly Budget Worksheet (continued) Item Feb Mar Apr May Jun Jul Sep Oct Nov Dec Total Expenses General Manager $2,400 $2,400 $2,400 $2,400 $2.400 Front Desk Staff $2.400 $2,400 $2.400 $2.400 6.000 $2.400 6.000 6.000 $2.400 6.000 $2.400 $28,800 Total Front Office $8,400 6.000 6.000 $8.400 $8,400 6.000 $8, 400 6.000 6.000 $8, 400 $8, 400 6.000 $8, 400 6.000 6.000 $8.400 $8.400 72.000 $8.400 $8.400 $8.400 $100,800 Head Housekeeper $1,583 $1,583 $1,584 $1,583 $1,583 Housekeepers $1.584 6,698 $1,583 $1,583 6,183 6,568 7.527 $1,584 $1,583 Total Housekeeping $7,865 $7,350 $7,735 6,516 7,198 $1,583 $1,584 6,873 $19,000 $8,694 $7,683 8,388 6.894 $8,365 5.448 $8,040 $9.555 6.670 6.853 $8,061 $6.615 81,816 $7.837 $8 019 $1 00,816 Maintenance Wages $1,725 $1, 725 $1,725 $1, 725 $1,725 $1,725 Regional Maintenance $1,725 265 $1,725 $1 725 265 $1,725 265 265 $1,725 $1,725 265 265 $20,700 Incentive Pay (staff) 265 265 265 265 265 265 3,1 80 Bonus Expense, GM 210 210 210 Payroll Taxes 210 210 210 1.605 210 1.594 210 1.675 1.589 210 210 Total Other Personnel $3,805 1.647 210 $3,761 1.620 $3,794 1.749 2,520 1.622 $3,875 $3,789 1.499 1.603 $3,847 $3,820 1.618 $3.949 $3.822 $3.699 $3,803 $45,781 Gross Payroll $20,486 $19,927 $20,346 $21,385 $20,288 $22,320 $20,700 $19,130 $20.456 $20.655 $247,397 Vacation Expense $475 $475 $475 $475 $475 Holiday Expense $475 $475 $475 $475 135 135 $475 135 $475 135 $475 $5,700 Staff Incentives 135 135 35 35 135 35 35 135 90 90 1.620 Employee Relocation 90 90 35 35 35 35 640 Employee Training 720 140 140 140 140 140 Workers Compensation 140 140 1.500 1,500 140 140 1.500 2.260 Health Insurance 2.400 1.500 2.400 1.500 2.400 1.500 2,400 1.500 2.400 1,500 2.400 1,500 1,500 18,000 Retirement Plan Contr. 2.400 60 2,400 60 2.400 60 2,400 60 2,400 2.400 Group Life Insurance 60 60 28,800 60 60 60 60 Total Benefits Expense $5,381 56 60 60 720 $4.801 $4.801 56 $4.801 $4.856 $4.856 $4.856 $4.856 672 $4.801 $4.801 $4.801 $4.801 $58.412 Total Personnel Costs $25,867 $24,728 $25,147 $26,186 $25,144 $25,885 $25,532 $27,176 $25,501 $23,931 $25.257 $25.456 $305.809 Total Supplies $2,135 $2,100 $2,360 $2,085 $2,271 $2,1 82 $2,594 $2,1 88 $1,796 $2,127 $2,1 76 $26.007 Note: All monetary values are represented in U.S. dollars.Table 4: Jack Smith's Monthly Budget Worksheet (continued) Item Jan Feb Mar Apr May Jun Jul Sep Oct Nov Dec Total Expenses (continued) Membership & Subs. SO $300 $300 Travel 280 280 280 280 2 80 280 280 2 80 3.360 Meals 70 70 70 70 70 70 70 70 70 70 70 70 840 Total Travel & Meals $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $350 $650 $4.500 Bad Debt Expense Cash Shortage/Excess Bank Deposit Short/Exc. 0 Credit Card Chargeback Credit Cards (40% cc) 1,144 1,1 19 1.395 1.341 1.658 1.288 1.032 14,568 Guest Vouchers 98 97 96 105 101 120 83 98 100 1,200 Refunded Rentals 82 81 80 87 100 69 84 1.000 Total Other Expense $1,324 $1, 187 $1,249 $1,525 $1,296 $1,587 $1,525 $1,162 $1 212 $1.350 $16,768 Other External Services $50 $50 $50 $50 $50 $50 $50 $600 Total Misc. Operating $1,724 $1,649 $1,925 $1,696 $1,987 $1,925 $2.277 $1.873 $1.562 $1.612 $2.050 $21.868 Property Marketing $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $6.000 Building $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $1,800 Landscaping 825 825 825 825 825 $25 $25 825 9.900 Contracts 675 675 675 675 675 675 675 675 675 8,100 Laundry 500 500 500 500 500 500 500 500 500 500 500 6.000 Rooms 200 200 200 200 200 200 200 200 200 2.400 HVAC 400 400 400 400 400 400 400 400 400 400 4,800 Pool 600 600 100 1,600 Electrical & Fire 360 360 360 360 360 360 360 360 360 360 360 360 Plumbing 275 275 275 275 275 275 275 275 275 275 3,300 Supplies 300 300 300 300 300 300 300 300 300 300 300 Unclassified (petty cash) 75 75 75 75 75 75 75 75 75 75 75 75 900 Total R&M $3,760 $3,760 $3,760 $3.760 $4,060 $3,760 $4.360 $4.360 $3.860 $3,760 $3.760 $3,760 $46.720Table 4: Jack Smith's Monthly Budget Worksheet (continued) Item Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total Expenses (continued) Electricity $3.500 $3.500 $3.500 $3.500 $3.500 $3.500 $3.500 Natural Gas $3.500 1,400 $3.500 1,400 $3.500 1,400 $3.500 $3.500 1.400 1.400 $42,000 1.400 Water 1.400 2.750 2.750 1.400 2.750 1.400 1.400 2.750 2.750 1.400 1.400 2.750 2.750 16,800 Total Energy $7.650 2.750 $7.650 $7.650 2.750 2.750 $7.650 $7.650 2.750 $7.650 2.750 33.000 $7.650 $7.650 $7.650 $7.650 $7.650 $7.650 $91.800 Garbage Collection $310 $310 $310 $310 $310 $310 Sewer $310 1,575 $310 $310 1,575 1,575 1,575 $310 1,575 $310 $310 1,575 1.575 1,575 $3.720 Salt (water softener) 1,575 0 350 1.575 0 350 1,575 1,575 18,900 Telephone 0 350 1,000 0 1,000 350 1,000 0 1,000 350 1,000 0 2,100 Satellite TV Fees 1.000 350 1.000 1.250 1,000 1.000 1,250 1.250 1,000 1.000 1.250 1.250 1,000 12,000 Utility Fees 1.250 75 1.250 1,250 75 1.250 75 1,250 1.250 75 75 75 1.250 15,000 Total Other Utilities 75 75 $4.210 75 $4.560 $4.210 75 75 $4.560 75 900 $4.210 $4.560 $4.210 $4.560 $4.210 $4.560 $4.210 $4.560 $52.620 TOTAL EXPENSES $45,846 $44.780 $45.016 $46.941 $45.345 $46.613 $46.359 $49.116 $45.782 $43,758 $45,116 $46.153 $550.824 PROFIT $49.461 $40.099 $44.303 $63.474 $47.919 $69.631 $65.367 $8901I $61.559 $40.386 $40.906 $51.028 $663.144APPENDIX. ACCOUNT DESCRIPTIONS Staff Incentives. Amounts paid for anything that incentives hotel staff. For example, many general managers provide REVENUE ACCOUNTS pizza parties on employee birthdays, or lunch on busy days. Room Rentals. Revenue derived from room rentals. It is the Employee Relocation Expense. Amounts paid to reimburse average daily rate times rentals. employees who relocate to a new property. This amount is Revenue Allowance. Revenue allowances are refunds offered usually zero, and the company only pays to relocate a general manager (a rare event). at the property at time of departure. Internet Access. Revenue derived from the sale of daily Employee Training. Amounts paid for employee training. guest Wi-Fi/Internet access. Training is provided for general managers and managers-in- training Vouchers. Revenue from guests paying for their stay with Workers Compensation. The amounts charged to workers' quest vouchers. compensation are based on expected insurance claim plus Laundry. Revenue from customer use of coin-operated any expenses that develop over time. Amounts are actuarial laundry equipment (washer and dryer ). estimates and, while budgeted by the general manager, the manager does not determine the amounts. Vending. Revenue received from customer purchases at on- site vending machines. Health Insurance. Amounts paid for employee group health insurance. Since benefits are provided after 6 months of EXPENSE ACCOUNTS service, most staff do not participate in the insurance plan. (This is because employee turnover in low-skill, hospitality General Manager. Wages paid to the general manager. Managers receive free, on-site housing and utilities (electric, jobs is very high; at the Amarillo property, turnover for housekeeping staff was 211% in the prior year.) telephone, cable TV) Retirement Plan Contribution Expense. Amounts paid by Front Desk Staff. Wages paid to employees working the front the company for employee retirement contributions. As with desk for customer check-in. health insurance, few employees are with the hotel long Total Housekeeping. Wages paid to employees that clean the enough to participate in the plan, and contributions are often rooms and clean laundry. solely for the general manager (where job tenure averages about 2.8 years). Maintenance Wages. Wages paid to an on-site maintenance worker Group Life Insurance. Expenses related to the provision of group life insurance. As with the prior two benefits plans, Regional Maintenance Support. Wages for the regional group life insurance is typically only provided to the general maintenance person when on-site. manager. Incentive Pay [Staff]. Amounts paid to motivate employees. Supplies. Expenses for all supplies. In prior years, supplies This is usually zero were listed in one category, but after the 2017 budget was Bonus Expense, General Manager. Bonus expense paid to prepared, the company developed several sub-accounts for the general manager when specific performance targets are supplies Supplies at most hotels include guest amenities met. Bonus amounts are fixed for each goal, and 90% of (soap, shampoo and hand cream), cleaning chemicals (carpet general managers receive their full bonus (bonuses are highly and floor cleaners and surface cleaners), postage, uniforms, achievable ). freight, coffee and linens. Payroll Tax Expense. Amounts paid for payroll taxes. It is Memberships and Subscriptions. Amounts paid for 85% of amounts paid to employees. memberships (such as for the local chamber of commerce). Vacation Expense. Amounts accrued to pay for the general Travel. Amounts paid to reimburse employees who travel for manager's vacation. company business. Most of the time the only reimbursement is for personal use of the car to make the daily cash deposit at Holiday Expense. Amounts accrued to pay for the general the bank (mileage multiplied by the IRS-approved mileage manager's paid holidays. reimbursement rate ). Off-site travel is rare as regional managers visit properties for performance reviews and support.Meals. Reimbursement for meal expenses. Expenses are Other External Services. Amounts paid to any third-party typically incurred when a general manager is out of town providers that are not related to maintenance. Security for a meeting (such as the national or a regional meeting) or services is the most common expense related to this account. doing part-time duty as a relief general manager (from time to time a manager may be terminated and it may take some Property Marketing. Amounts spent by the general manager weeks or months to find a replacement). Meal expenses are for local advertising and marketing Marketing activities relatively fare. include newspaper advertising coupon book lets, billboards, direct mail, sponsoring a community athletic club, and so on. Bad Debt Expense. Amounts recorded to this account reflect credit transactions that have been "written off." Since most Building. Repairs and maintenance expenses related to the transactions are handled in cash or with a credit card, had building- debt expense is uncommon. Landscaping. Amounts paid for lawn care, new shrubbery. Cash Shortage and Excess. These amounts arise when the tree trimming, and so on. actual cash on hand differs from the amount that should be Contracts. Amounts paid to third parties that provide on hand, according to the property's financial records. Since services to the hotel. This would include, for example. there are multiple employees handling cash, the amounts are service contracts for the laundry equipment and pest control not easily traced to a specific person. Discrepancies can occur (e.g- termites, bed bugs and rodents ). from providing the incorrect change for a cash transaction, receiving an amount less than billed, and so on. Laundry. Repairs and maintenance expenses related to the laundry equipment (washer, dryer, folder). Bank Deposit Shortage and Excess. These amounts arise when the bank deposit does not match the amount that Rooms (floors, doors, windows, et cetera]. All expenses was supposed to have been deposited. When a discrepancy related to the repair and maintenance of the guest rooms occurs, the bank's amount is taken as the correct amount (carpets, walls, windows and light fixtures, except those because of counting machines and good video surveillance items accounted for elsewhere [ such as plumbing and at banks. If the general manager makes random, counting climate control equipment] ). mistakes, these discrepancies should be small and should HVAC. Repair and maintenance expenses related to heating. average out to zero. A persistent shortage is a strong signal that cash is being misappropriated. The general manager ventilation and air conditioning units. In most properties, is the only person to make the daily bank deposit, so any including the case property HVAC is handled by in-wall. all-in-one units. shortage or excess is the responsibility of one person. Credit Card Chargeback. Amounts refunded to credit card Pool. All amounts paid for maintaining the swimming pool. companies. These occur because of fraudulent credit card This would include paint, chemicals, pump repairs, diving inc and customer complaints (ie., the firm grants a refund board repairs, upkeep of the surface and fences surrounding several days after the visit). the pool, and so on. Credit Card Fees. Amounts paid to credit card companies for Electrical and Fire. All costs related to the repair and processing credit cards. Typically, this averages about 3% of maintenance of electrical and fire safety equipment. the transaction cost. At most properties, more than 70% of Plumbing. All expenses related to repairs and maintenance transactions are settled in cash. of plumbing and related fixtures (c.g- showers, bathtubs and toilets ). Quest Vouchers. Guests who received a voucher for compensation are able to ine that voucher for a free night's Supplies. Amounts paid for supplies related to repairs and stay at any branded hotel in the network. The hotel who maintenance (c. g., duct tape, silicone and nails). hosts a guest with a voucher records the revenue, the property that issued the guest voucher is charged for the Unclassified (including petty cash). This category is for guest visit, and its expense is recorded to this account. all expenses related to repairs and maintenance that are not classified in any of the other accounts for repairs and Refunded Rentals. These amounts are for customer refunds maintenance. that occur off-property, often weeks after a guest's visit. Almost always, these refunds are handled by the customer Electricity. Amounts paid for electricity. Electricity is used service staff at the corporate headquarters. Functionally, it is in guest rooms (outlets, lighting air conditioner, etc.) in the lobby, for exterior lighting (parking lot, corridors), and in the no different in financial impact than a revenue allowance. laundry room.Natural Gas. Amounts paid for natural gas. Natural gas is used for the bader ( water) and dryer (laundry). Rooms are heated using electricity. Water. Amounts paid for water. Water is used in guest rooms, the washing machine, the pool, and for watering the lawn. Garbage Collection. Garbage is picked up twice a week by a licensed waste hauler from waste containers located at a corner of the property. Garbage is usually limited to a handful of providers, some of which are national firms. Sewer Amounts paid to the city for hook-up to the city sewer system Salt Water Softener). Amounts paid for sah used in a water softener Telephone. All costs related to telephone equipment repairs and monthly telecommunications fees. Satellite Television Subscription Fees. Expenses for subscription of television programming delivered by a satellite provider Utility Fees. Amounts paid to utilities firms for connection and service fees