How do you solve for this? How do you solve for a common sized income statement?

How do you solve for this? How do you solve for a common sized income statement?

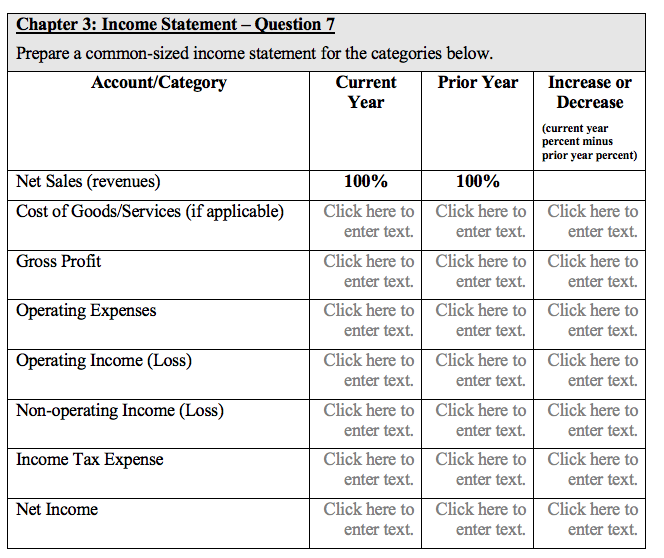

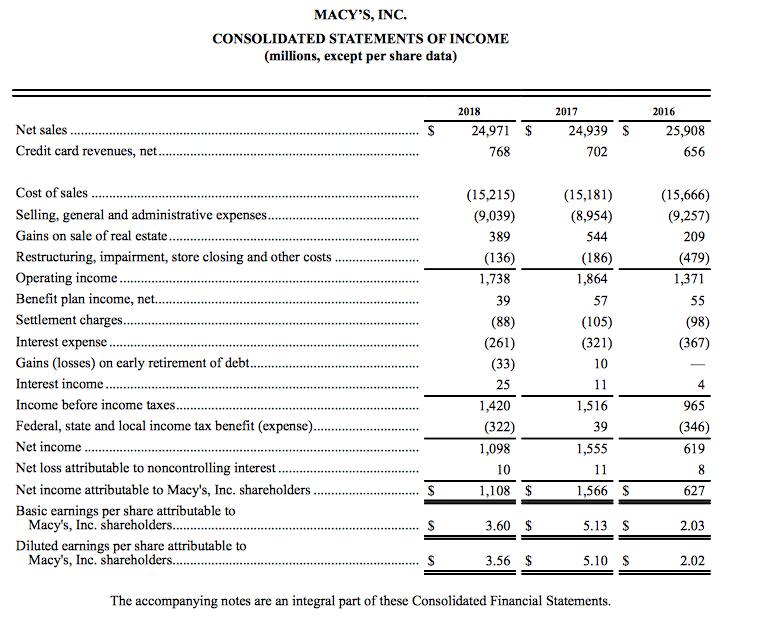

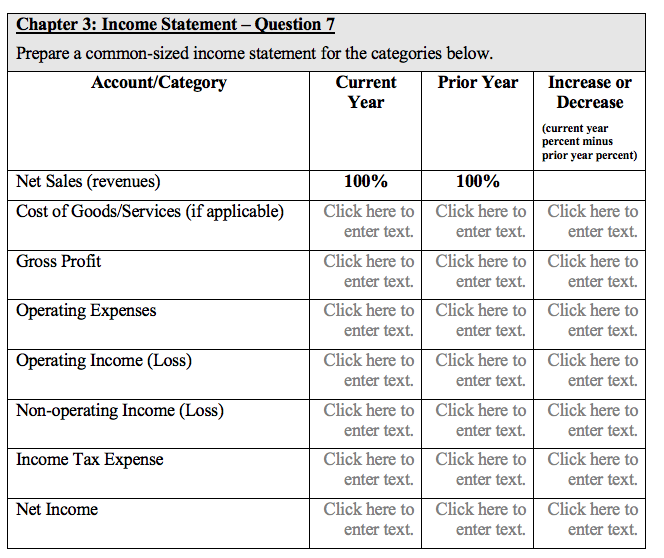

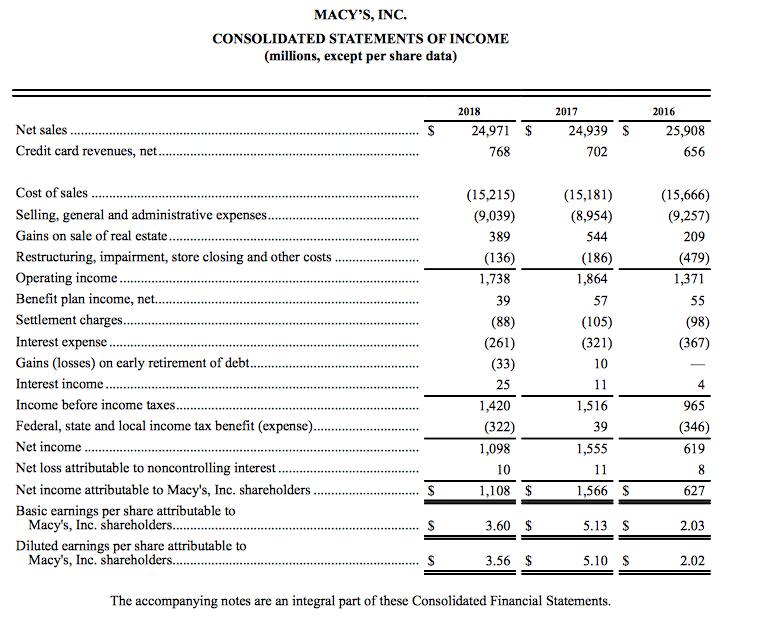

Chapter 3: Income Statement - Question 7 Prepare a common-sized income statement for the categories below. Account/Category Current Prior Year Year Increase or Decrease (current year percent minus prior year percent) 100% | Net Sales (revenues) Cost of Goods/Services (if applicable) Click here to enter text. Click here to enter text. Gross Profit 100% Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Operating Expenses Operating Income (Loss) Non-operating Income (Loss) Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Click here to enter text. Income Tax Expense Net Income Click here to enter text. Click here to enter text. MACY'S, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share data) 2018 24,971 768 Net sales ............. Credit card revenues, net................ $ 2017 24,939 $ 702 2016 25,908 656 (15,215) (9,039) 389 (136) 1,738 39 (88) (261) (33) (15,181) (8,954) 544 (186) 1,864 (15,666) (9,257) 209 (479) 1,371 55 (98) (367) (105) (321) 10 Cost of sales ......... Selling, general and administrative expenses. Gains on sale of real estate... Restructuring, impairment, store closing and other costs ........ Operating income. Benefit plan income, net....................... Settlement charges.................. Interest expense.. Gains (losses) on early retirement of debt...................... Interest income.... Income before income taxes. Federal, state and local income tax benefit (expense).......... Net income Net loss attributable to noncontrolling interest ..................... Net income attributable to Macy's, Inc. shareholders ......... Basic earnings per share attributable to Macy's, Inc. shareholders. ********************* Diluted earnings per share attributable to Macy's, Inc. shareholders...... 25 11 1,516 1,420 (322) 1,098 10 1,108 $ 965 (346) 619 1,555 11 1,566 S 027 $ 3.60 $ 5.13 $ 2.03 $ 3.56 $ 5.10 $ 2.02 The accompanying notes are an integral part of these Consolidated Financial Statements

How do you solve for this? How do you solve for a common sized income statement?

How do you solve for this? How do you solve for a common sized income statement?