Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do you solve The New Heritage Doll Company case? Please show all equations and steps to solve them so that I can understand the

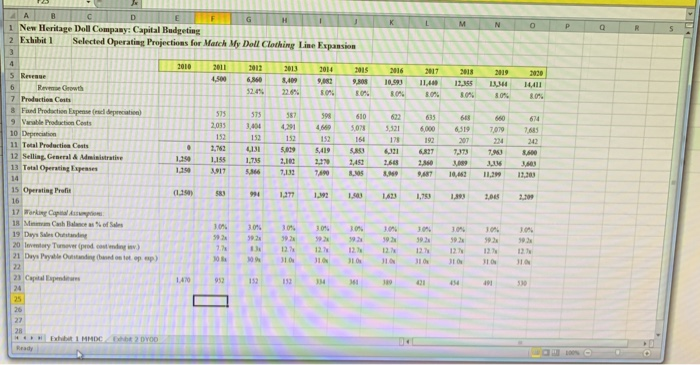

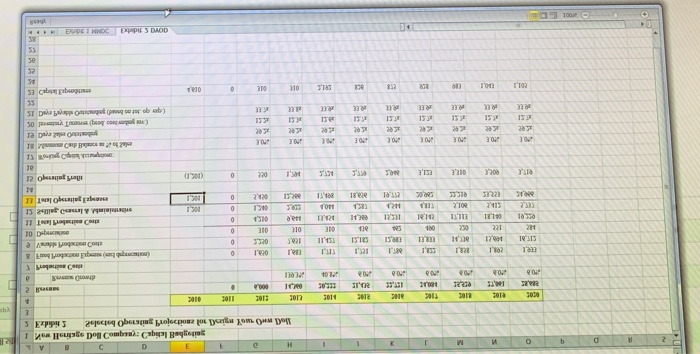

How do you solve The New Heritage Doll Company case? Please show all equations and steps to solve them so that I can understand the math involved.

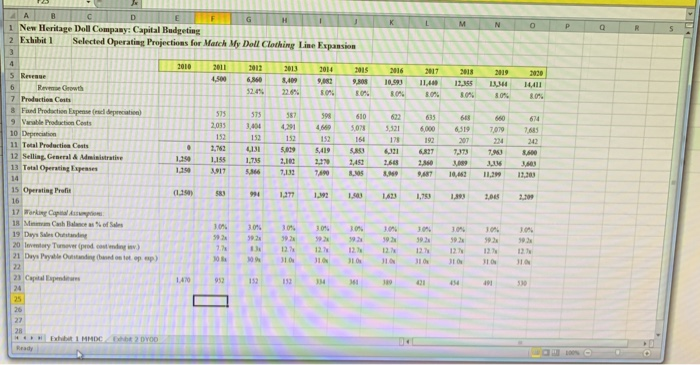

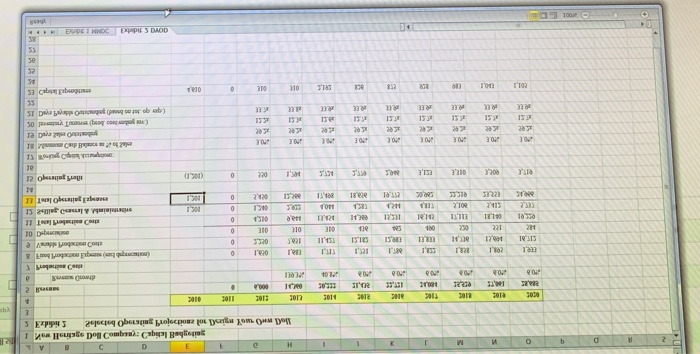

New Heritage Doll Company (NHDC) is a mid-sized, privately-owned U.S. doll manufacturing and retailing company. Emily Harris, the company's product division VP, is currently evaluating project proposals for the upcoming capital budgeting meeting. Ms. Harris has assembled your team to advise her on two of the more promising proposals: Match My Doll Clothing line extensions (MMDC) and Design Your Own Doll (DYOD). Specifically, she is interested in answers to the following questions: 1. Describe and contrast the business cases for MMDC and DYOD. Which do you regard 2. Use the operating projections for each projeet to compute a net present value (NPV) for 3. Compute the internal rate of retum (IRR), payback period, and profitability index (PI) for as the more compelling business opportunity? each. Which project creates more value? each project. How should these metrics affect the deliberations? When and how would you use each? Do they provide infomation useful to the analysis beyond what NPV tells you? What additional information does Ms. Harris need to complete her analyses and compare the two projects? What specifie questions should she ask each of the project sponsors? 4. If Harris is forced to recommend one project over the other, which should she recommend? Why? 5. 1New Heritage Doll Company: Capital Budgeting 2 Exhibit 1Selected Operating Projections for Match My Doll Clothing Line Expansion 015 2916 017015 2019 2020 2010 20112012 2013 20142015 S Revraue 7 Productien Cents 8 Fand Prodaction Expeise (eacl depreciate) ee Growth 618 2,035 : 3,004 4291 | 4se9 5,078 5,521 | ,000 ans 242 152 152 152 12 164 17 19 10 Depreciabon 11 Total Predacties Cests 12 Selliag. Ceneral & Admisistratise 13 Tetal Operating Expenses 14 s Operating Profit 14 1 18|Mnmn Cash Balnce "s % of Sdes 19 Days Sales Oustandng 10% 30% 30% 30% 30% 3on, 'on. Jon. 'on. 'n 92 02 9229 92 392 92 92 12.7 12.72 12 17 12 1,470 952 152 | 132 | 334 | HI in 421 434 491 530 25 8 A c102 1105 ocot e10 ces ott D05 I ar nett att REE REE rett REE rett zlEE..tt st 80 New Heritage Doll Company (NHDC) is a mid-sized, privately-owned U.S. doll manufacturing and retailing company. Emily Harris, the company's product division VP, is currently evaluating project proposals for the upcoming capital budgeting meeting. Ms. Harris has assembled your team to advise her on two of the more promising proposals: Match My Doll Clothing line extensions (MMDC) and Design Your Own Doll (DYOD). Specifically, she is interested in answers to the following questions: 1. Describe and contrast the business cases for MMDC and DYOD. Which do you regard 2. Use the operating projections for each projeet to compute a net present value (NPV) for 3. Compute the internal rate of retum (IRR), payback period, and profitability index (PI) for as the more compelling business opportunity? each. Which project creates more value? each project. How should these metrics affect the deliberations? When and how would you use each? Do they provide infomation useful to the analysis beyond what NPV tells you? What additional information does Ms. Harris need to complete her analyses and compare the two projects? What specifie questions should she ask each of the project sponsors? 4. If Harris is forced to recommend one project over the other, which should she recommend? Why? 5. 1New Heritage Doll Company: Capital Budgeting 2 Exhibit 1Selected Operating Projections for Match My Doll Clothing Line Expansion 015 2916 017015 2019 2020 2010 20112012 2013 20142015 S Revraue 7 Productien Cents 8 Fand Prodaction Expeise (eacl depreciate) ee Growth 618 2,035 : 3,004 4291 | 4se9 5,078 5,521 | ,000 ans 242 152 152 152 12 164 17 19 10 Depreciabon 11 Total Predacties Cests 12 Selliag. Ceneral & Admisistratise 13 Tetal Operating Expenses 14 s Operating Profit 14 1 18|Mnmn Cash Balnce "s % of Sdes 19 Days Sales Oustandng 10% 30% 30% 30% 30% 3on, 'on. Jon. 'on. 'n 92 02 9229 92 392 92 92 12.7 12.72 12 17 12 1,470 952 152 | 132 | 334 | HI in 421 434 491 530 25 8 A c102 1105 ocot e10 ces ott D05 I ar nett att REE REE rett REE rett zlEE..tt st 80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started