Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on

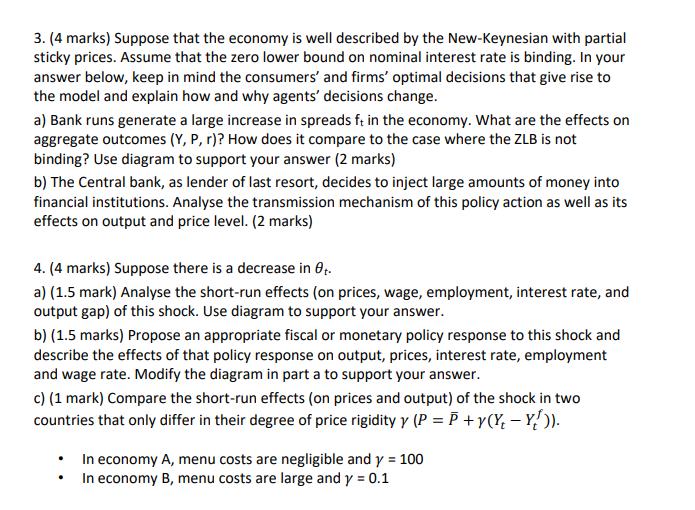

3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on nominal interest rate is binding. In your answer below, keep in mind the consumers' and firms' optimal decisions that give rise to the model and explain how and why agents' decisions change. a) Bank runs generate a large increase in spreads ft in the economy. What are the effects on aggregate outcomes (Y, P, r)? How does it compare to the case where the ZLB is not binding? Use diagram to support your answer (2 marks) b) The Central bank, as lender of last resort, decides to inject large amounts of money into financial institutions. Analyse the transmission mechanism of this policy action as well as its effects on output and price level. (2 marks) 4. (4 marks) Suppose there is a decrease in 8t. a) (1.5 mark) Analyse the short-run effects (on prices, wage, employment, interest rate, and output gap) of this shock. Use diagram to support your answer. b) (1.5 marks) Propose an appropriate fiscal or monetary policy response to this shock and describe the effects of that policy response on output, prices, interest rate, employment and wage rate. Modify the diagram in part a to support your answer. c) (1 mark) Compare the short-run effects (on prices and output) of the shock in two countries that only differ in their degree of price rigidity y (P= P +y(Y - Y)). In economy A, menu costs are negligible and y = 100 In economy B, menu costs are large and y = 0.1 3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on nominal interest rate is binding. In your answer below, keep in mind the consumers' and firms' optimal decisions that give rise to the model and explain how and why agents' decisions change. a) Bank runs generate a large increase in spreads ft in the economy. What are the effects on aggregate outcomes (Y, P, r)? How does it compare to the case where the ZLB is not binding? Use diagram to support your answer (2 marks) b) The Central bank, as lender of last resort, decides to inject large amounts of money into financial institutions. Analyse the transmission mechanism of this policy action as well as its effects on output and price level. (2 marks) 4. (4 marks) Suppose there is a decrease in 8t. a) (1.5 mark) Analyse the short-run effects (on prices, wage, employment, interest rate, and output gap) of this shock. Use diagram to support your answer. b) (1.5 marks) Propose an appropriate fiscal or monetary policy response to this shock and describe the effects of that policy response on output, prices, interest rate, employment and wage rate. Modify the diagram in part a to support your answer. c) (1 mark) Compare the short-run effects (on prices and output) of the shock in two countries that only differ in their degree of price rigidity y (P = P + y(Y - Y)). In economy A, menu costs are negligible and y = 100 In economy B, menu costs are large and y = 0.1 3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on nominal interest rate is binding. In your answer below, keep in mind the consumers' and firms' optimal decisions that give rise to the model and explain how and why agents' decisions change. a) Bank runs generate a large increase in spreads ft in the economy. What are the effects on aggregate outcomes (Y, P, r)? How does it compare to the case where the ZLB is not binding? Use diagram to support your answer (2 marks) b) The Central bank, as lender of last resort, decides to inject large amounts of money into financial institutions. Analyse the transmission mechanism of this policy action as well as its effects on output and price level. (2 marks) 4. (4 marks) Suppose there is a decrease in 8t. a) (1.5 mark) Analyse the short-run effects (on prices, wage, employment, interest rate, and output gap) of this shock. Use diagram to support your answer. b) (1.5 marks) Propose an appropriate fiscal or monetary policy response to this shock and describe the effects of that policy response on output, prices, interest rate, employment and wage rate. Modify the diagram in part a to support your answer. c) (1 mark) Compare the short-run effects (on prices and output) of the shock in two countries that only differ in their degree of price rigidity y (P = P + y(Y - Y)). In economy A, menu costs are negligible and y = 100 In economy B, menu costs are large and y = 0.1 3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on nominal interest rate is binding. In your answer below, keep in mind the consumers' and firms' optimal decisions that give rise to the model and explain how and why agents' decisions change. a) Bank runs generate a large increase in spreads ft in the economy. What are the effects on aggregate outcomes (Y, P, r)? How does it compare to the case where the ZLB is not binding? Use diagram to support your answer (2 marks) b) The Central bank, as lender of last resort, decides to inject large amounts of money into financial institutions. Analyse the transmission mechanism of this policy action as well as its effects on output and price level. (2 marks) 4. (4 marks) Suppose there is a decrease in 8t. a) (1.5 mark) Analyse the short-run effects (on prices, wage, employment, interest rate, and output gap) of this shock. Use diagram to support your answer. b) (1.5 marks) Propose an appropriate fiscal or monetary policy response to this shock and describe the effects of that policy response on output, prices, interest rate, employment and wage rate. Modify the diagram in part a to support your answer. c) (1 mark) Compare the short-run effects (on prices and output) of the shock in two countries that only differ in their degree of price rigidity y (P = P + y(Y - Y)). In economy A, menu costs are negligible and y = 100 In economy B, menu costs are large and y = 0.1 3. (4 marks) Suppose that the economy is well described by the New-Keynesian with partial sticky prices. Assume that the zero lower bound on nominal interest rate is binding. In your answer below, keep in mind the consumers' and firms' optimal decisions that give rise to the model and explain how and why agents' decisions change. a) Bank runs generate a large increase in spreads ft in the economy. What are the effects on aggregate outcomes (Y, P, r)? How does it compare to the case where the ZLB is not binding? Use diagram to support your answer (2 marks) b) The Central bank, as lender of last resort, decides to inject large amounts of money into financial institutions. Analyse the transmission mechanism of this policy action as well as its effects on output and price level. (2 marks) 4. (4 marks) Suppose there is a decrease in 8t. a) (1.5 mark) Analyse the short-run effects (on prices, wage, employment, interest rate, and output gap) of this shock. Use diagram to support your answer. b) (1.5 marks) Propose an appropriate fiscal or monetary policy response to this shock and describe the effects of that policy response on output, prices, interest rate, employment and wage rate. Modify the diagram in part a to support your answer. c) (1 mark) Compare the short-run effects (on prices and output) of the shock in two countries that only differ in their degree of price rigidity y (P = P + y(Y - Y)). In economy A, menu costs are negligible and y = 100 In economy B, menu costs are large and y = 0.1

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Evolution of central banking system Despite the fact that central banks have existed since ancient times the modern notion of a centralized financial system dates back to the seventeenth centur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started