Answered step by step

Verified Expert Solution

Question

1 Approved Answer

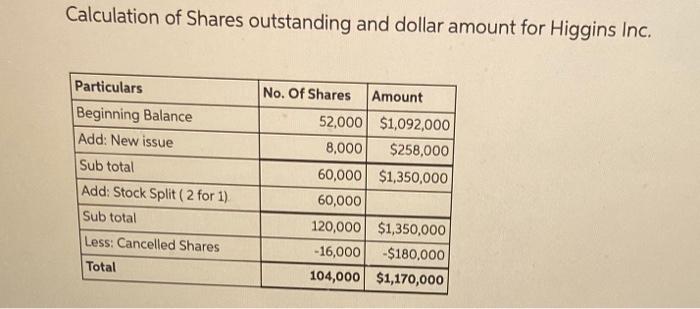

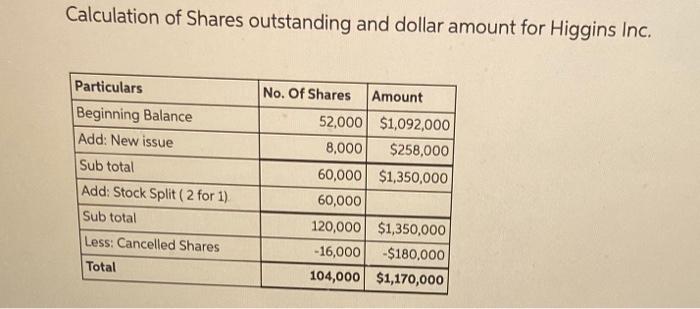

how does 16,000 shared amount to $180,000? On January 1,20X1, Higgins, Inc., reported 52,000 common shares, outstanding, at $1,092,000 plus retained earnings of $250,000. On

how does 16,000 shared amount to $180,000?

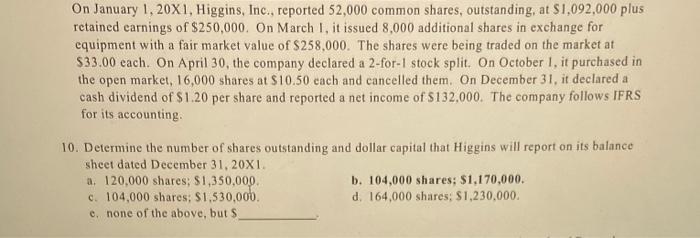

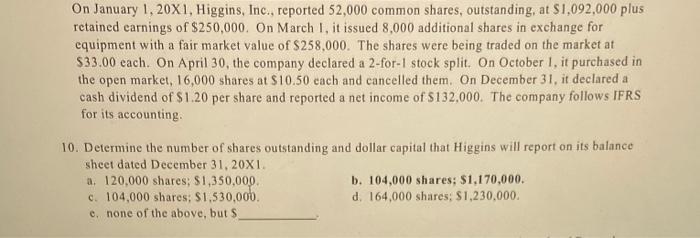

On January 1,20X1, Higgins, Inc., reported 52,000 common shares, outstanding, at $1,092,000 plus retained earnings of $250,000. On March I, it issued 8,000 additional shares in exchange for equipment with a fair market value of $258,000. The shares were being traded on the market at $33.00 each. On April 30, the company declared a 2-for-1 stock split. On October 1 , it purchased in the open market, 16,000 shares at $10.50 each and cancelled them. On December 31, it declared a cash dividend of $1.20 per share and reported a net income of $132,000. The company follows IFRS for its accounting. 10. Determine the number of shares outstanding and dollar capital that Higgins will report on its balance sheet dated December 31,20X1. a. 120,000 shares; $1,350,000. b. 104,000 shares; $1,170,000. c. 104,000 shares; $1,530,000. d. 164,000 shares; $1,230,000. e. none of the above, but $ Calculation of Shares outstanding and dollar amount for Higgins Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started