Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how does netflix operation is reflected in specific ratios that you woul use to measure the company effectiveness and how are the financials ( income

how does netflix operation is reflected in specific ratios that you woul use to measure the company effectiveness and how are the financials ( income statement, balance sheet and cash flow statements ) impacted.

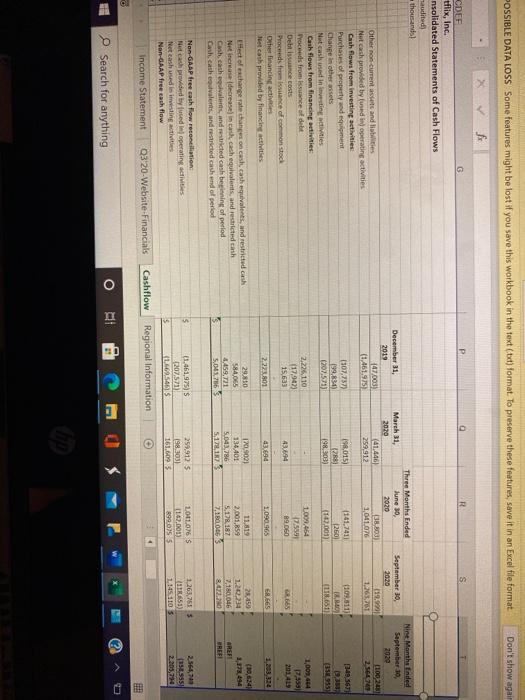

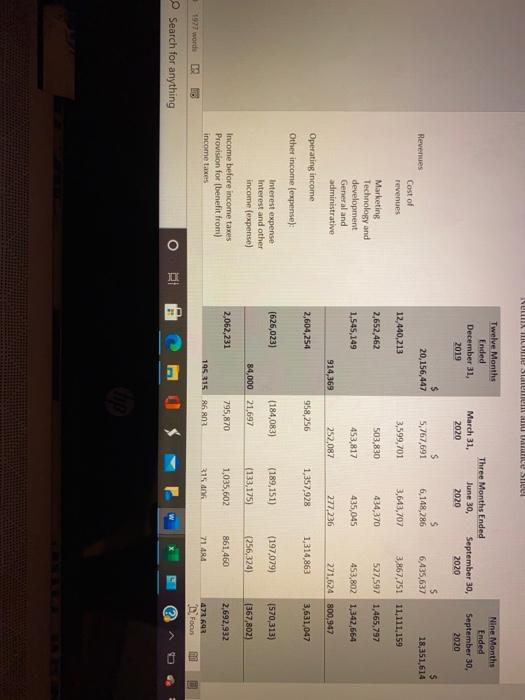

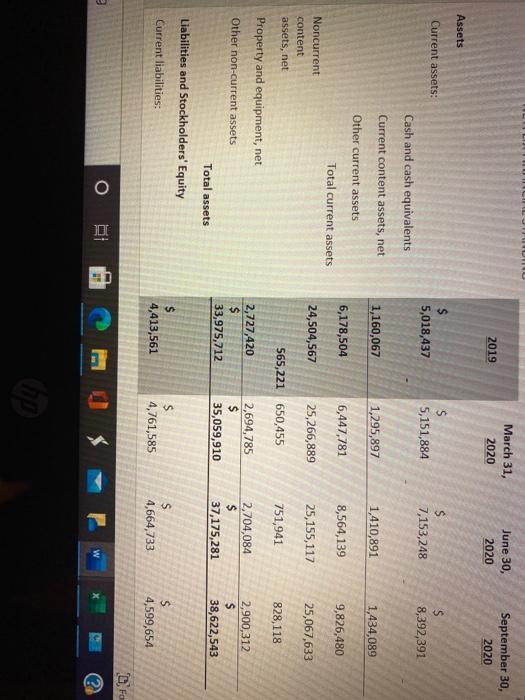

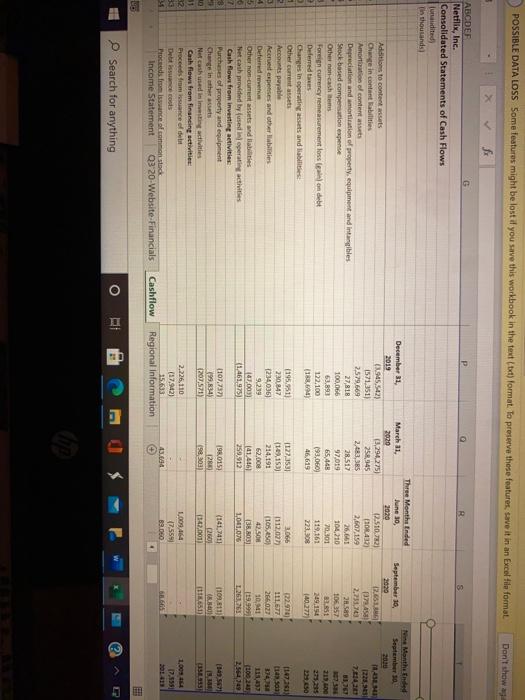

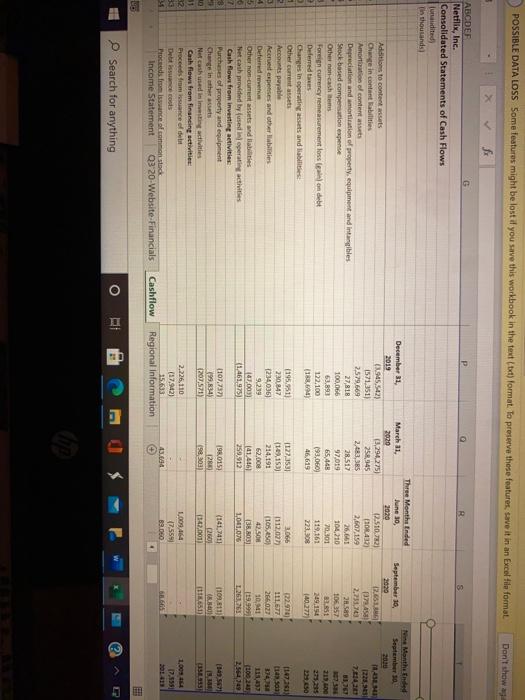

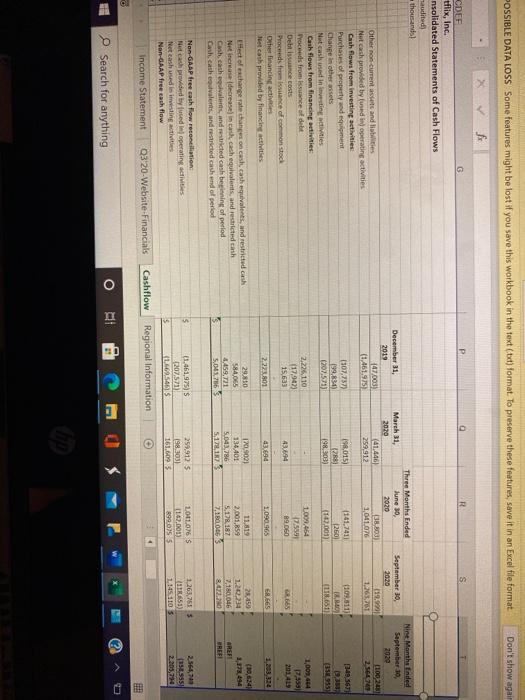

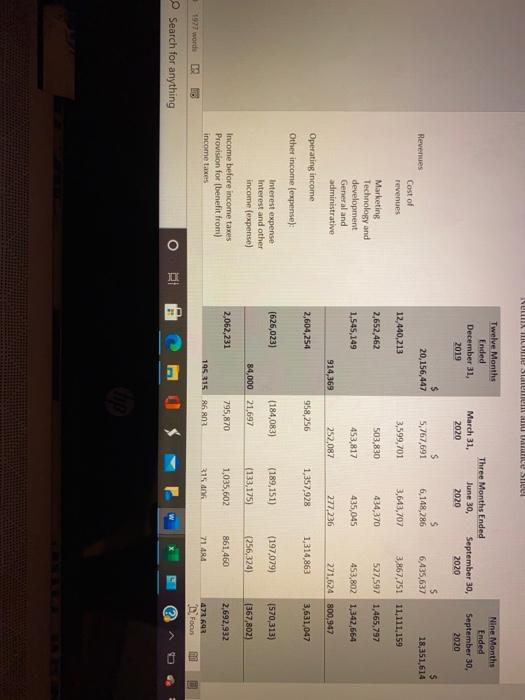

POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the text (txt) format. To preserve these features, save it in an Excel file format Don't show as G R ABCDEF Netflix, Inc. Consolidated Statements of Cash Flows Lidited) in thousands September 10, 2020 Montended September 10 December 31 2019 (945.542) 1571,351) 2,579,669 22.81 100,066 63.890 122.100 March 11, 2020 (3,294,275) 25,345 2,483,35 28.517 97,019 65,468 (93,060) Three Month Ended June 30, 2020 2.51072) FOR 4121 2.607.159 26.661 104,210 70.301 11.161 223. 372.458 2.751,43 28.589 106357 33.95 249.154 1223, 761410 1,261 219 100 23.00 Addition to content assets Change in contant abilities Amoroso contains Depreciation and interation of property, equipment and intangibles Stock based compensation expense Other non-cashem Foreign currency measurement loss ladebt Deferred to Changes in operating assets and abilities Other current Accounts payable Accued expenses and other abilities Defendre Other non-comment assets and liabilities het cash provided by used in operating activities Cash flows from investing activities Purchases of property and equipment Change in the acts Net cash edining activities Cash flows from financing activities Broceeds from suance of the Dit issuance costs Proceeds froissance of common stock Income Statement Q3 20-Website-Financials 3,066 1112,02 (105.450) 3 - 5 1195.951) 230.847 1234.036) 9239 102.003 (1.461.975) 1127,3531 11.09.153) 214,191 62.00 (41.446) 259,912 147.25) 1a sau 374 111,677 26607 10,11 119.99 1263,263 35.8031 1,041,00 1200 240 2564349 7 8 (140 51 (107.737 99,834) (207.571) 19.015) 128 198 303 (141,7411 (260 11:42.0011 1109 211 ON 1651 31 32 2,226, 110 (17.942) 1,003,464 7.555 39.050 17.155 Cashflow Regional Information Search for anything TE 2 POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the text (txt) format. To preserve these features, save it in an Excel file format Don't show agair f G R CDEF tflix, Inc. nsolidated Statements of Cash Flows audited) thousands December 31, 2019 147.003 (1.461.975 Three Months Ended March 31, June 30 2020 2020 (41.446) 38.803) 259,912 1,041,076 September 30, 2020 119.99 126,701 Nint Month Ende September 30, 2020 (10924 2.56741 19.015) 109.511) 34 567 (307,737) 199.834) (141,7411 1260) (169.001) 198,103) (118,651) (31955 Other non current at and liabilities Nutcash provided by used in operating activities Cash flows from investing activities Purchases of property and equipment Change in other assets Nutcash used in investing wetities Cash flows from financing wivities: Proceeds from Issuance of debt Debtisce costs Proceeds from stance of coon stock Other Financing activities Net cash provided by financing activities 2.226110 (17.94 15,633 1003464 17.559 19.060 1,003,44 7,950 43.6 GREES 2.22 4309 1.0902365 CHL6S 1,203 324 (10,6241 Effect of exchange rate changes on cash cash equivalents, and restricted Net increase decrease in cash equivalents, and restricted cash Cash cash values, and restricted cash beginning of period Cash.cathevalents, and restricted cash and of period 290510 584,065 4,459,721 5.047863 12005001 134401 5.043.786 113 11,819 2,005,59 5.178.187 71 BLOG 1,20,234 210046 REF RE 3 5 Non GAAP free cash flow reconciliation Nutcach provided by used in operating activities Net cash used in iting activities Non-GAAP free cash flow (1.461,975) 207.571) (1.5461 259,912 5 198,303 161.6095 2011.076 5 1147,00) 899.0255 1.263,7515 LARASI) 1145 110 1335551 2,205,794 Income Statement Q3 20-Website Financials Cashflow Regional Information FEE O TI E Search for anything NULLU MICUL SUL ULU SULUI Twelve Months Ended December 31, 2019 March 31, 2020 Three Months Ended June 30, September 30, 2020 2020 Nine Months Ended September 30, 2020 $ 20,156,447 S 5,767,691 S 6,148,286 5 18,351,614 Revenues 6,435,637 Cost of revenues 12,440,213 3,599,701 3,643,707 3,867,751 11,111,159 2,652.462 503,830 434,370 527,597 1.465,797 Marketing Technology and development General and administrative 1,545,149 453,817 435,045 453,802 1,342,664 914,369 252,087 277.236 271,624 800,947 Operating income 2,604,254 958,256 1,357,928 1,314,863 3,631,047 Other income (expense): Interest expense Interest and other income (expense) (626,023) (184,083) (189,151) (197,079) (570,313) 84,000 21,697 (133.175) (256,324) (367,802) 2,062,231 795,870 1,035,602 861,460 Income before income taxes Provision for benefit from) income taxes 2,692,932 195.815 86 na 315 406 71.44 1927 word 29 472.643 DF Search for anything 02 Other income (expense) (626,023) (184,083) (189,151) (197,079) (570,313) Interest expense Interest and other income (expense) 84,000 21,697 (133,175) (256,324) (367,802) 2,062,231 795,870 1,035,602 861,460 2,692,932 Income before income taxes Provision for (benefit from) income taxes 315,406 195,315 86,803 S 709,067 $ 1,866,916 71,484 S 789,976 473,693 $ 2,219,239 Net income 720,196 Earnings per share: 4.26 S S Basic S 1.61 $ 1.57 S 1.63 S 159 S 1.79 $ 1.74 4.13 $ $ Diluted Weighted average common shares outstanding: 437,799 439,352 440,569 441,526 440,486 Basic 451,765 452,494 453,945 455,088 453,846 Diluted Focus LO ? O 10 nything File Home Insett Draw Review View Help Grammarly 5 4,761,58S s 4,664,733 4,413,561 s 4,599,654 674,347 545,488 446,668 541,298 Design Layout References Mailings Total assets Liabilities and Stockholders' Equity Current liabilities: Current content liabilities Accounts payable Accrued expenses and other Isabilities Deferred revenue Short-term debt Total current liabilities Non current content liabilities 843,04 1,061,090 986,595 1,259,124 924,745 986,753 1,029,261 1.040,202 498,809 199,161 499,517 6,855,696 7,853.775 7,626,418 7,939,795 3,334,323 3,206,051 3,208,164 2.925,574 14,759,260 14,170,692 15,294,998 15,547,616 Long term debt Other non-cutrent liabilities 1,444,276 1.420,148 1,710,948 1.875,235 Total liabilities 26,393,555 26,650,616 27,810,528 28,289,220 2,793,929 2,935,532 3,127 813 3.303.482 (23,521) (47,054) (34,072) (1,147) Stockholders' equity Common stock Accumulated other comprehensive income (loss) Retained earnings Total stockholders equity Total liabilities and stockholders' equity 4,811,749 5,520,816 6,241,012 7,030,988 7,587,157 8.409,294 $ 35,059,910 9.334,753 $ 37,175,281 103323123 $ 38,622,543 33,975,712 O Page 7 of 10.1977 19 die 8 Search for anything 5 E O 12 3 March 31, 2020 June 30, 2020 2019 September 30, 2020 Assets Current assets: $ 5,018,437 S 5,151,884 $ 7,153,248 $ 8,392,391 Cash and cash equivalents Current content assets, net 1,160,067 1,295,897 1,410,891 1,434,089 Other current assets 6,178,504 6,447,781 8,564,139 Total current assets 9,826,480 24,504,567 Noncurrent content assets, net 25,266,889 25,155,117 25,067,633 565,221 650,455 751,941 828,118 Property and equipment, net Other non-current assets 2,727,420 $ 33,975,712 2,694,785 $ 35,059,910 2,704,084 $ 37,175,281 2,900,312 S 38,622,543 Total assets Liabilities and Stockholders' Equity Current liabilities: $ 4,413,561 $ 4,761,585 S 4,664,733 S 4,599,654 DFO e O D w ? POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the text (txt) format. To preserve these features, save it in an Excel file format Don't show as G R ABCDEF Netflix, Inc. Consolidated Statements of Cash Flows Lidited) in thousands September 10, 2020 Montended September 10 December 31 2019 (945.542) 1571,351) 2,579,669 22.81 100,066 63.890 122.100 March 11, 2020 (3,294,275) 25,345 2,483,35 28.517 97,019 65,468 (93,060) Three Month Ended June 30, 2020 2.51072) FOR 4121 2.607.159 26.661 104,210 70.301 11.161 223. 372.458 2.751,43 28.589 106357 33.95 249.154 1223, 761410 1,261 219 100 23.00 Addition to content assets Change in contant abilities Amoroso contains Depreciation and interation of property, equipment and intangibles Stock based compensation expense Other non-cashem Foreign currency measurement loss ladebt Deferred to Changes in operating assets and abilities Other current Accounts payable Accued expenses and other abilities Defendre Other non-comment assets and liabilities het cash provided by used in operating activities Cash flows from investing activities Purchases of property and equipment Change in the acts Net cash edining activities Cash flows from financing activities Broceeds from suance of the Dit issuance costs Proceeds froissance of common stock Income Statement Q3 20-Website-Financials 3,066 1112,02 (105.450) 3 - 5 1195.951) 230.847 1234.036) 9239 102.003 (1.461.975) 1127,3531 11.09.153) 214,191 62.00 (41.446) 259,912 147.25) 1a sau 374 111,677 26607 10,11 119.99 1263,263 35.8031 1,041,00 1200 240 2564349 7 8 (140 51 (107.737 99,834) (207.571) 19.015) 128 198 303 (141,7411 (260 11:42.0011 1109 211 ON 1651 31 32 2,226, 110 (17.942) 1,003,464 7.555 39.050 17.155 Cashflow Regional Information Search for anything TE 2 POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the text (txt) format. To preserve these features, save it in an Excel file format Don't show agair f G R CDEF tflix, Inc. nsolidated Statements of Cash Flows audited) thousands December 31, 2019 147.003 (1.461.975 Three Months Ended March 31, June 30 2020 2020 (41.446) 38.803) 259,912 1,041,076 September 30, 2020 119.99 126,701 Nint Month Ende September 30, 2020 (10924 2.56741 19.015) 109.511) 34 567 (307,737) 199.834) (141,7411 1260) (169.001) 198,103) (118,651) (31955 Other non current at and liabilities Nutcash provided by used in operating activities Cash flows from investing activities Purchases of property and equipment Change in other assets Nutcash used in investing wetities Cash flows from financing wivities: Proceeds from Issuance of debt Debtisce costs Proceeds from stance of coon stock Other Financing activities Net cash provided by financing activities 2.226110 (17.94 15,633 1003464 17.559 19.060 1,003,44 7,950 43.6 GREES 2.22 4309 1.0902365 CHL6S 1,203 324 (10,6241 Effect of exchange rate changes on cash cash equivalents, and restricted Net increase decrease in cash equivalents, and restricted cash Cash cash values, and restricted cash beginning of period Cash.cathevalents, and restricted cash and of period 290510 584,065 4,459,721 5.047863 12005001 134401 5.043.786 113 11,819 2,005,59 5.178.187 71 BLOG 1,20,234 210046 REF RE 3 5 Non GAAP free cash flow reconciliation Nutcach provided by used in operating activities Net cash used in iting activities Non-GAAP free cash flow (1.461,975) 207.571) (1.5461 259,912 5 198,303 161.6095 2011.076 5 1147,00) 899.0255 1.263,7515 LARASI) 1145 110 1335551 2,205,794 Income Statement Q3 20-Website Financials Cashflow Regional Information FEE O TI E Search for anything NULLU MICUL SUL ULU SULUI Twelve Months Ended December 31, 2019 March 31, 2020 Three Months Ended June 30, September 30, 2020 2020 Nine Months Ended September 30, 2020 $ 20,156,447 S 5,767,691 S 6,148,286 5 18,351,614 Revenues 6,435,637 Cost of revenues 12,440,213 3,599,701 3,643,707 3,867,751 11,111,159 2,652.462 503,830 434,370 527,597 1.465,797 Marketing Technology and development General and administrative 1,545,149 453,817 435,045 453,802 1,342,664 914,369 252,087 277.236 271,624 800,947 Operating income 2,604,254 958,256 1,357,928 1,314,863 3,631,047 Other income (expense): Interest expense Interest and other income (expense) (626,023) (184,083) (189,151) (197,079) (570,313) 84,000 21,697 (133.175) (256,324) (367,802) 2,062,231 795,870 1,035,602 861,460 Income before income taxes Provision for benefit from) income taxes 2,692,932 195.815 86 na 315 406 71.44 1927 word 29 472.643 DF Search for anything 02 Other income (expense) (626,023) (184,083) (189,151) (197,079) (570,313) Interest expense Interest and other income (expense) 84,000 21,697 (133,175) (256,324) (367,802) 2,062,231 795,870 1,035,602 861,460 2,692,932 Income before income taxes Provision for (benefit from) income taxes 315,406 195,315 86,803 S 709,067 $ 1,866,916 71,484 S 789,976 473,693 $ 2,219,239 Net income 720,196 Earnings per share: 4.26 S S Basic S 1.61 $ 1.57 S 1.63 S 159 S 1.79 $ 1.74 4.13 $ $ Diluted Weighted average common shares outstanding: 437,799 439,352 440,569 441,526 440,486 Basic 451,765 452,494 453,945 455,088 453,846 Diluted Focus LO ? O 10 nything File Home Insett Draw Review View Help Grammarly 5 4,761,58S s 4,664,733 4,413,561 s 4,599,654 674,347 545,488 446,668 541,298 Design Layout References Mailings Total assets Liabilities and Stockholders' Equity Current liabilities: Current content liabilities Accounts payable Accrued expenses and other Isabilities Deferred revenue Short-term debt Total current liabilities Non current content liabilities 843,04 1,061,090 986,595 1,259,124 924,745 986,753 1,029,261 1.040,202 498,809 199,161 499,517 6,855,696 7,853.775 7,626,418 7,939,795 3,334,323 3,206,051 3,208,164 2.925,574 14,759,260 14,170,692 15,294,998 15,547,616 Long term debt Other non-cutrent liabilities 1,444,276 1.420,148 1,710,948 1.875,235 Total liabilities 26,393,555 26,650,616 27,810,528 28,289,220 2,793,929 2,935,532 3,127 813 3.303.482 (23,521) (47,054) (34,072) (1,147) Stockholders' equity Common stock Accumulated other comprehensive income (loss) Retained earnings Total stockholders equity Total liabilities and stockholders' equity 4,811,749 5,520,816 6,241,012 7,030,988 7,587,157 8.409,294 $ 35,059,910 9.334,753 $ 37,175,281 103323123 $ 38,622,543 33,975,712 O Page 7 of 10.1977 19 die 8 Search for anything 5 E O 12 3 March 31, 2020 June 30, 2020 2019 September 30, 2020 Assets Current assets: $ 5,018,437 S 5,151,884 $ 7,153,248 $ 8,392,391 Cash and cash equivalents Current content assets, net 1,160,067 1,295,897 1,410,891 1,434,089 Other current assets 6,178,504 6,447,781 8,564,139 Total current assets 9,826,480 24,504,567 Noncurrent content assets, net 25,266,889 25,155,117 25,067,633 565,221 650,455 751,941 828,118 Property and equipment, net Other non-current assets 2,727,420 $ 33,975,712 2,694,785 $ 35,059,910 2,704,084 $ 37,175,281 2,900,312 S 38,622,543 Total assets Liabilities and Stockholders' Equity Current liabilities: $ 4,413,561 $ 4,761,585 S 4,664,733 S 4,599,654 DFO e O D w cash flow

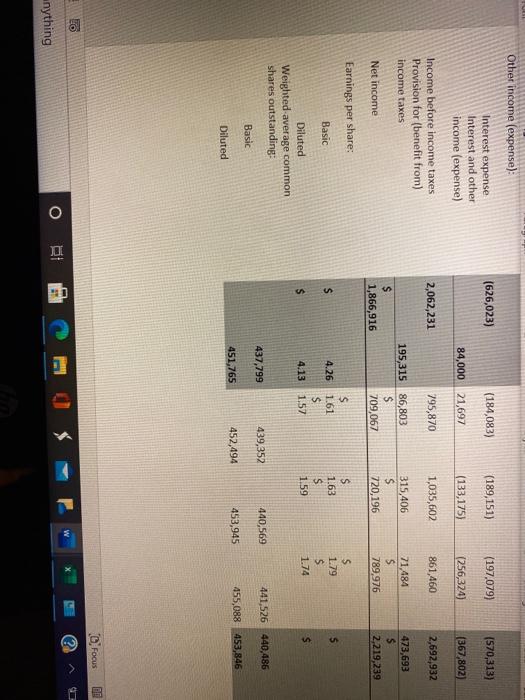

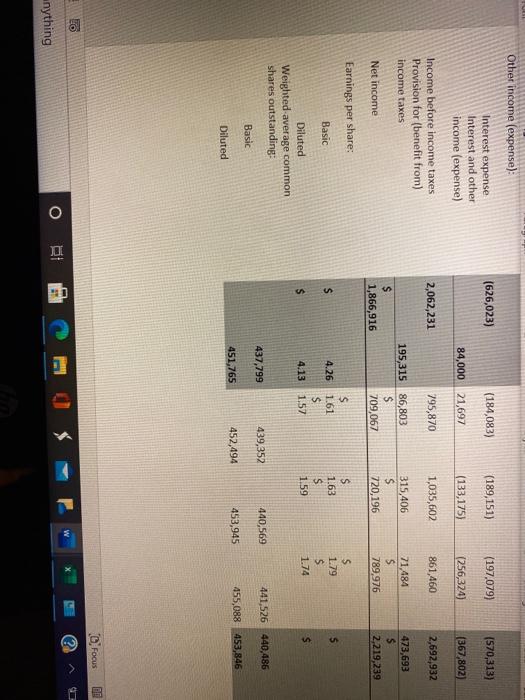

income statement

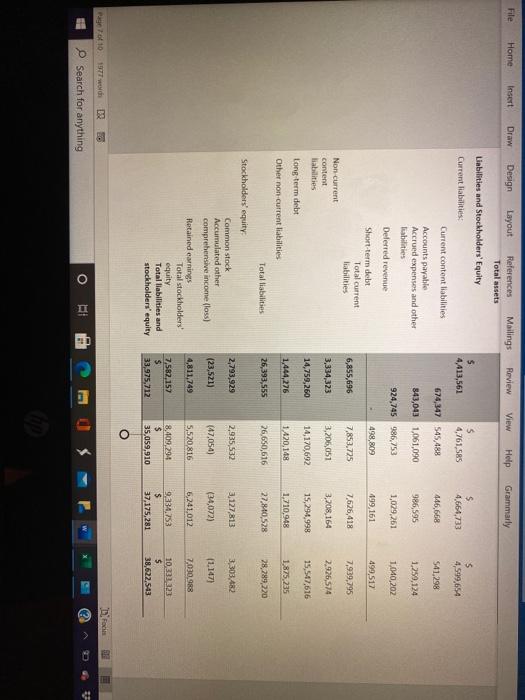

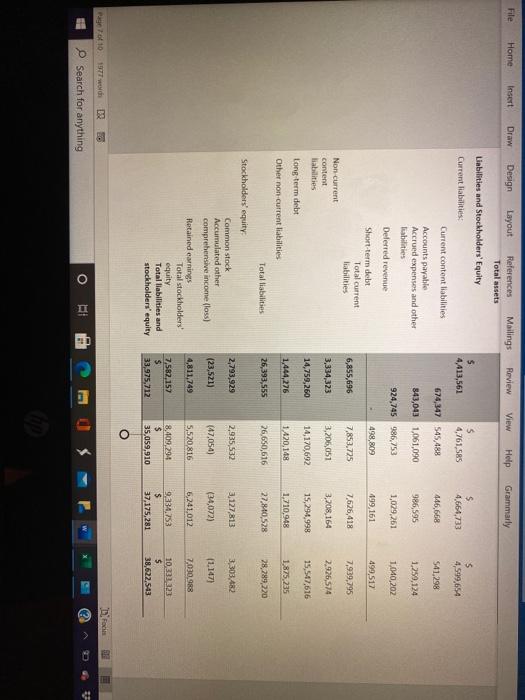

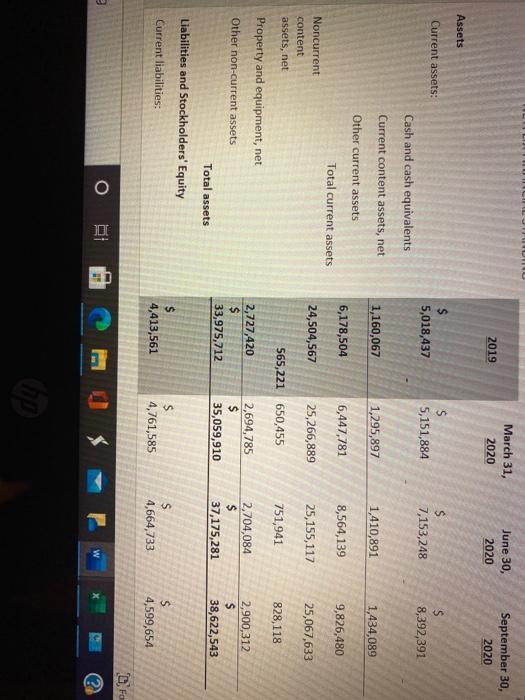

balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started