Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How does the market value of debt differ from book value? Eastman Chemical Company, a leading international chemical company and maker of plastics such as

How does the market value of debt differ from book value?

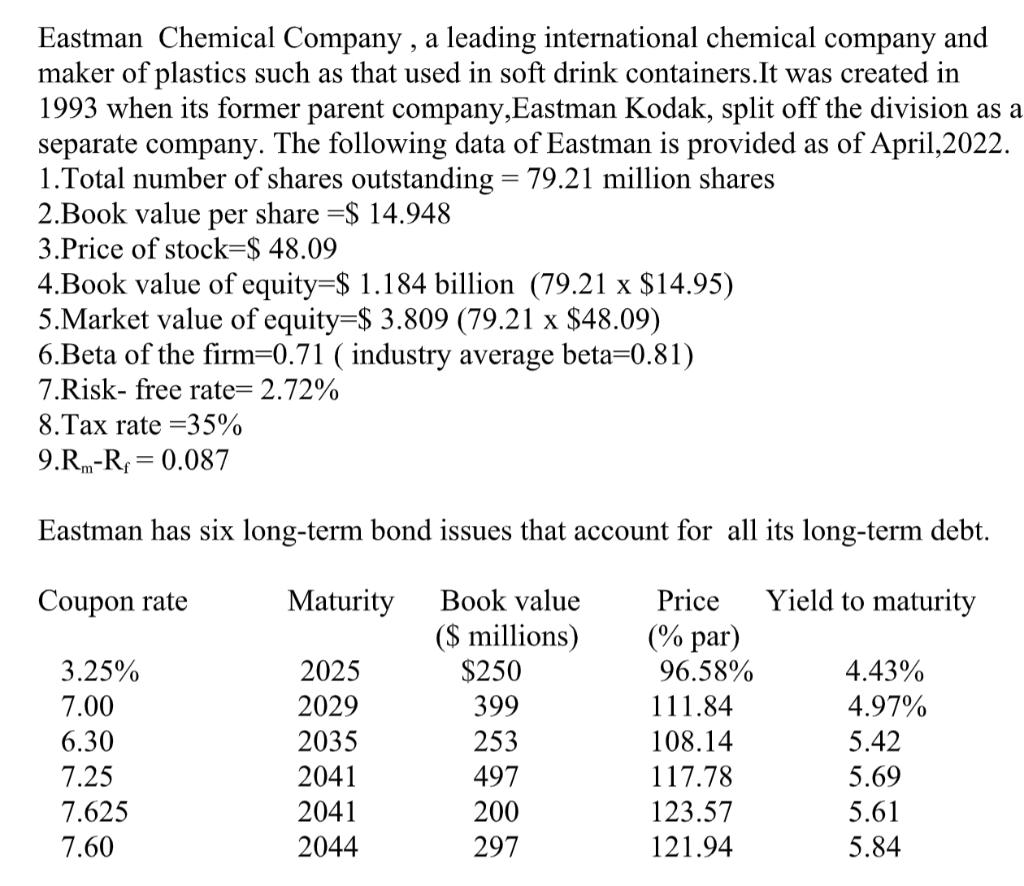

Eastman Chemical Company, a leading international chemical company and maker of plastics such as that used in soft drink containers. It was created in 1993 when its former parent company,Eastman Kodak, split off the division as a separate company. The following data of Eastman is provided as of April,2022. 1.Total number of shares outstanding = 79.21 million shares 2.Book value per share =$14.948 3.Price of stock-$48.09 4.Book value of equity=$ 1.184 billion (79.21 x $14.95) 5.Market value of equity-$ 3.809 (79.21 x $48.09) 6.Beta of the firm=0.71 ( industry average beta=0.81) 7.Risk- free rate= 2.72% 8.Tax rate 35% 9.Rm-R = 0.087 Eastman has six long-term bond issues that account for all its long-term debt. Coupon rate Price Yield to maturity Book value ($ millions) (% par) 96.58% 111.84 108.14 117.78 123.57 121.94 3.25% 7.00 6.30 7.25 7.625 7.60 Maturity 2025 2029 2035 2041 2041 2044 $250 399 253 497 200 297 4.43% 4.97% 5.42 5.69 5.61 5.84

Step by Step Solution

★★★★★

3.36 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

The market value of debt is the total value of all outstanding debt securities held by a corporation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started