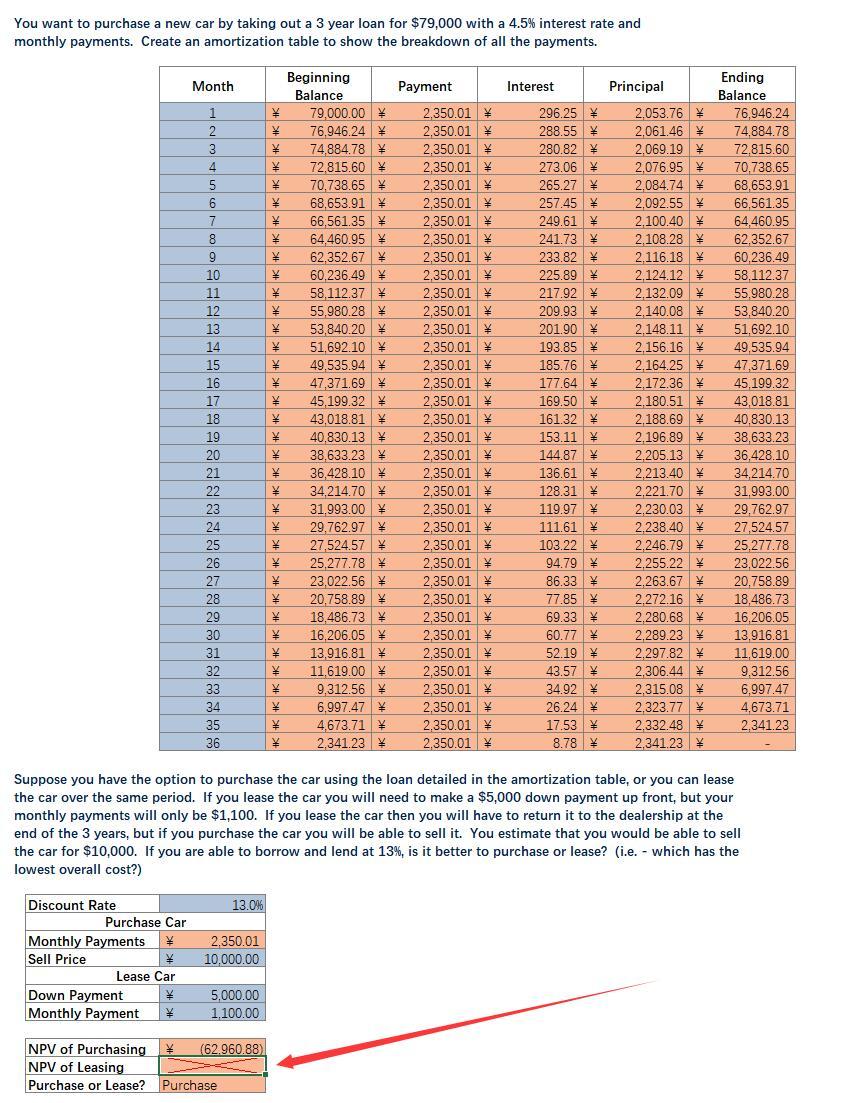

How get this number? Plz give me the excel process, thank you.

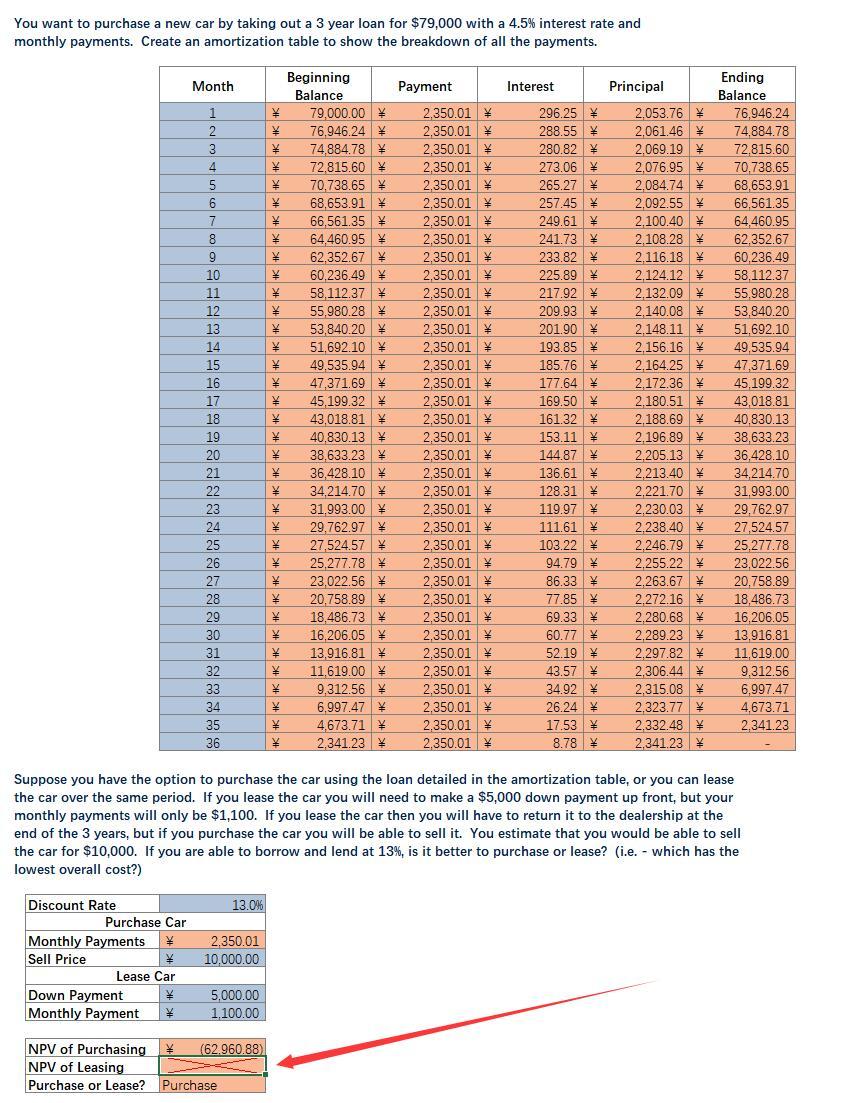

You want to purchase a new car by taking out a 3 year loan for $79,000 with a 4.5% interest rate and monthly payments. Create an amortization table to show the breakdown of all the payments. Month Interest \ V V 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 Beginning Balance 79,000.00 76.946.24 74,884.78 72.815,60 70,738.65 68,653.91 66,561.35 64,460.95 62.352.67 60.236.49 58,112.37 55,980.28 53,840.20 51,692.10 49,535.94 47,371.69 45,199.32 43,018.81 . 40.830.13 38,633.23 36,428.10 34,214.70 31.993.00 29,762.97 27.524.57 25,277.78 \ 23,022.56 20.758.89 18,486.73 16,206.05 13,916.81 11,619.00 9,312.56 6.997.47 4,673.71 2.341.23 Payment 2.350.01 2.350.01 2.350.01 2.350.01 2,350.01 2,350.01 | 2,350.01 2,350.01 2,350.01 * 2.350.01 2.350.01 2.350.01 2,350.01 2,350.01 2.350.01 2,350.01 2,350.01 2.350.01 2.350.01 2.350.01 2,350.01 2.350.01 2.350.01 2.350.01 2.350.01 2.350.01 2.350.01 2,350.01 2,350.01 2.350.01 2.350.01 2.350.01 2.350.01 2.350.01 2.350.01 2,350.01 296.25 288.55 280.82 273.06 265.27 257,45 249.61 241.73 | 233.82 225.89 217.92 209.93 201.90 193.85 185.76 177.64 169.50 161.32 153.11 144.87 136.61 128.31 119.97 111.61 103.22 94.79 86.33 77.85 69.33 60.77 52.19 43.57 34.92 26.24 17.53 8.78 Principal 2,053.76 2,061.46 2.069.19 2.076.95 2,084.74 2,092.55 2.100.40 \ 2. 108.28 2.116.18 2.124.12 2.132.09 2.140.08 2.148.11 2.156.16 2.164.25 2.172.36 2.180.51 2.188.69 2.196.89 2.205.13 2,213.40 2,221.70 2.230.03 2,238.40 2.246.79 2.255.22 2.263.67 2.272.16 2.280.68 2,289.23 2.297.82 2,306.44 2.315.08 2,323.77 2.332.48 2.341.23 Ending Balance 76,946.24 74,884.78 72.815.60 70.738.65 68,653.91 66,561.35 64,460.95 62,352.67 60,236.49 58,112.37 55.980.28 53,840.20 51,692.10 49,535.94 47.371.69 45,199.32 43,018.81 40.830.13 38,633.23 36,428.10 34,214.70 31,993.00 29,762.97 27,524.57 25,277.78 23,022.56 20.758.89 18,486.73 16,206.05 13,916.81 11,619.00 9,312.56 6,997.47 4,673.71 2,341.23 V V V \ V Suppose you have the option to purchase the car using the loan detailed in the amortization table, or you can lease the car over the same period. If you lease the car you will need to make a $5,000 down payment up front, but your monthly payments will only be $1,100. If you lease the car then you will have to return it to the dealership at the end of the 3 years, but if you purchase the car you will be able to sell it. You estimate that you would be able to sell the car for $10,000. If you are able to borrow and lend at 13%, is it better to purchase or lease? (i.e. - which has the lowest overall cost?) 13.0% 2,350.01 Discount Rate Purchase Car Monthly Payments Sell Price Lease Car Down Payment Monthly Payment 10,000.00 5,000.00 1,100.00 NPV of Purchasing (62.960.88) NPV of Leasing Purchase or Lease? Purchase