Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- How had Chevron tried to mitigate the political risks of the project ? - How the current pandemic COVID-19 affect Chevron ? Discuss. Could

- How had Chevron tried to mitigate the political risks of the project ?

- How the current pandemic COVID-19 affect Chevron ? Discuss.

Could you please help me answer these two questions? please provide me with a detailed answer and don't take it from other experts because I referred to similar answers but they don't seem correct .

Thanks in advance.

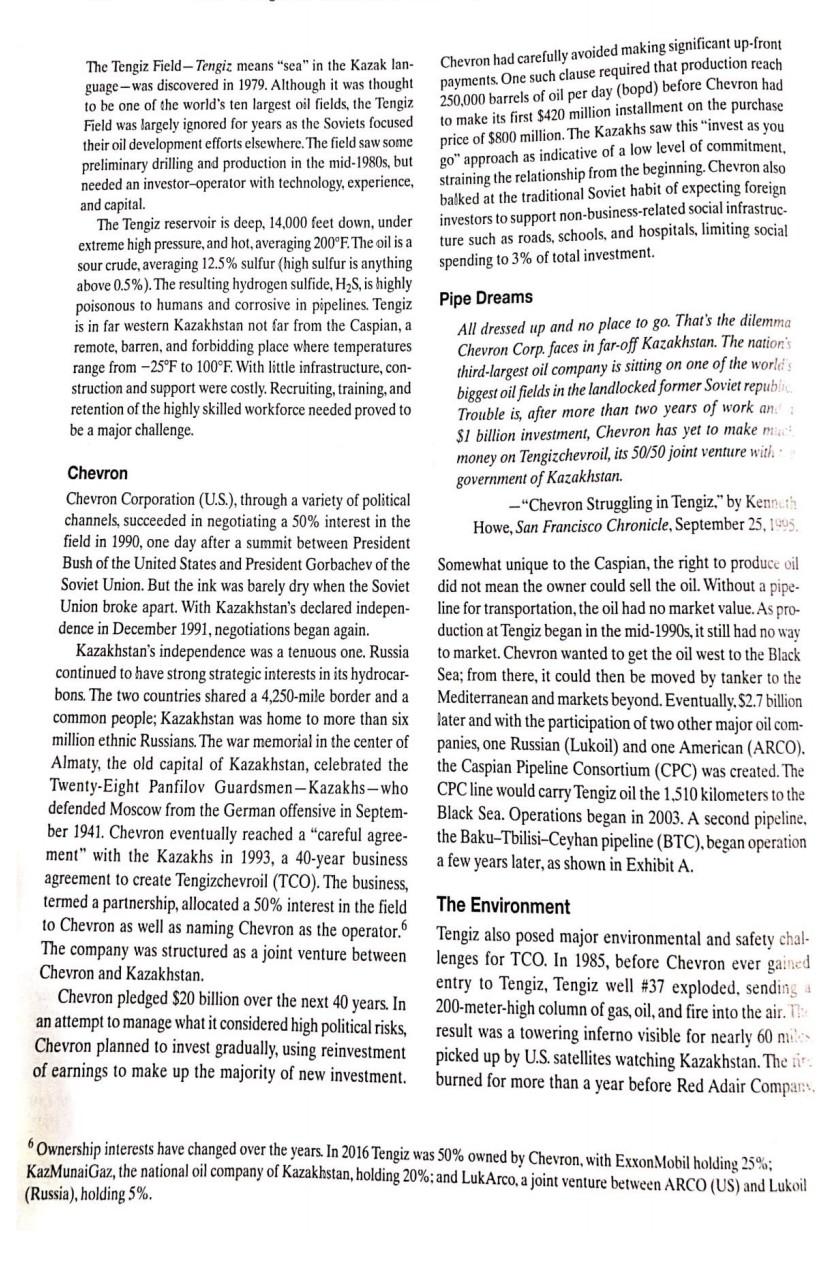

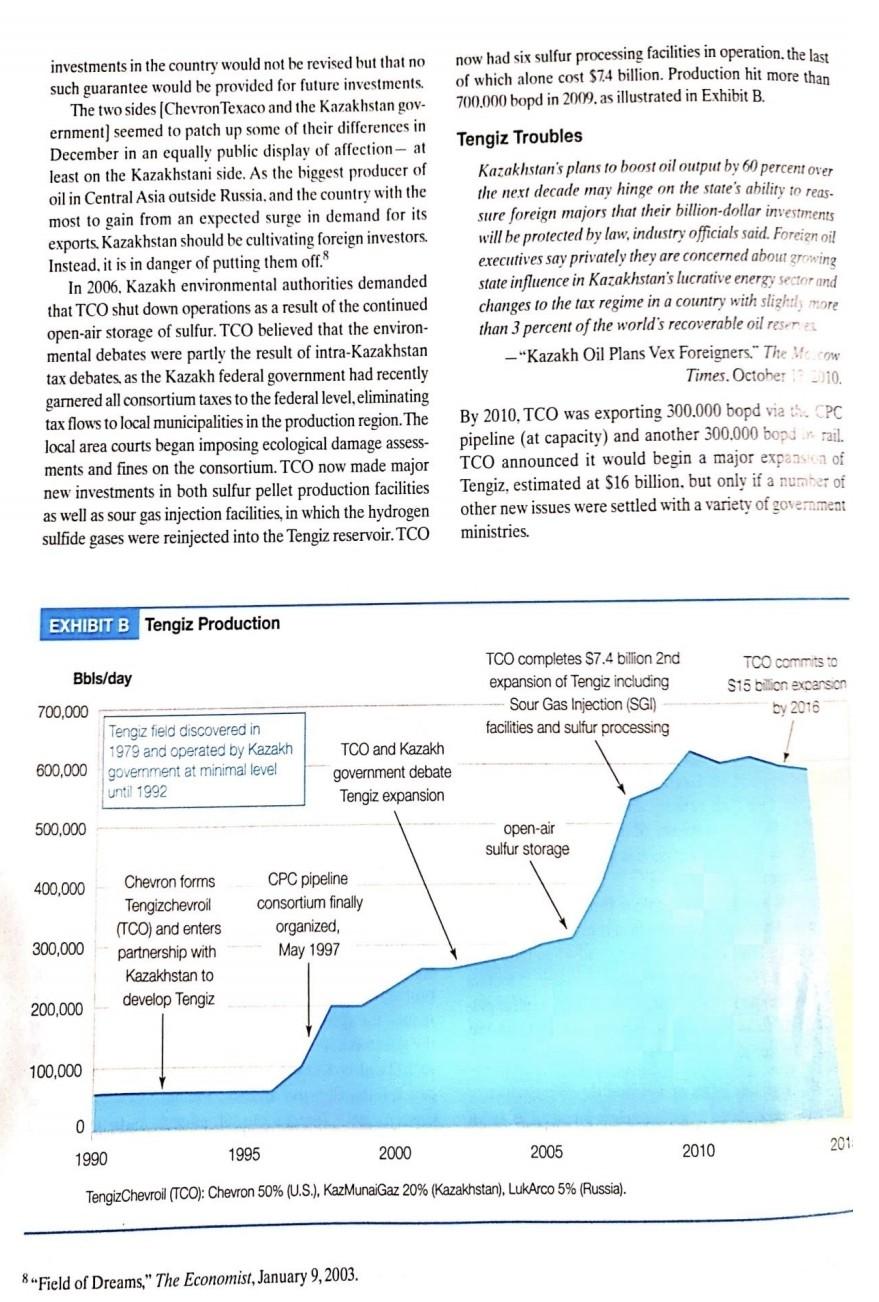

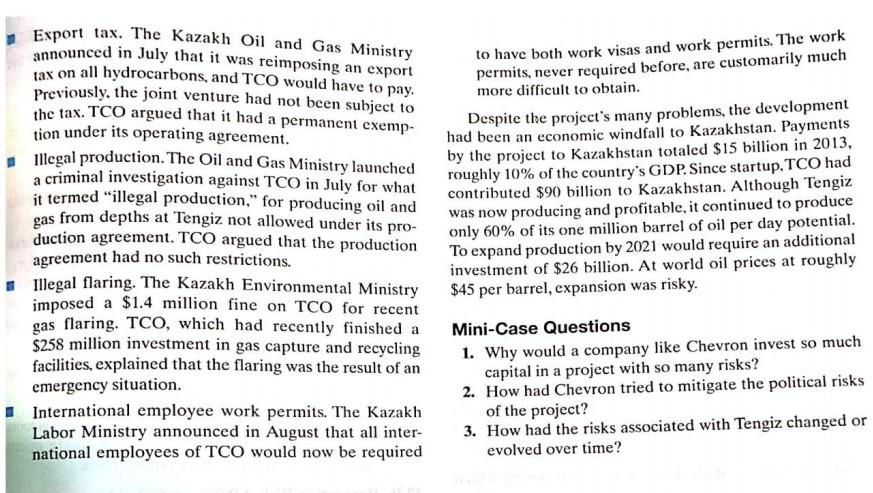

Mini-Case Tengiz The Definition of Political Risks not reached its potential. TCO's owner/investors worried The problem is that money has to be invested. What dif- about continuing political risks and the prospects of invest- ference is it to me if it is Americans, Omanis , Russians? ing another $26 billion. The main thing is that oil comes out. Tengiz - Kazakh President Nursultan Nazarbayev Chevron Corp. said Monday that its joint venture with Although Kazakhstan borders the Caspian Sea, it and Kazakhstan to develop one of the world's largest oil fields the Sea are land-locked, making it the world's largest could produce 700,000 barrels of oil a day and involve a joint investment of $20 billion over 40 years. Earlier land-locked country. Sparsely populated, it has a popula- tion of only 18 million. Kazakhstan, however, has enor- this month, Chevron and the former Soviet republic mous reserves of crude oil and natural gas, representing announced a preliminary agreement to develop the Ten- its economic future. A 1993 foreign direct investment in giz and Korolev fields, estimated to be even bigger than Alaska's Prudhoe Bay. Kazakhstan created Tengiz, one of the largest oil-producing operations in the world. Yet more than 20 years and - "Chevron to Pump Billions into Tengiz," The Los innumerable political challenges later, the field had still Angeles Times, May 19, 1992. The Tengiz Field-Tengiz means "sca" in the Kazak lan- guage-was discovered in 1979. Although it was thought to be one of the world's ten largest oil fields, the Tengiz Field was largely ignored for years as the Soviets focused their oil development efforts elsewhere. The field saw some preliminary drilling and production in the mid-1980s, but needed an investor-operator with technology, experience, and capital. The Tengiz reservoir is deep, 14,000 feet down, under extreme high pressure, and hot, averaging 200F The oil is a sour crude, averaging 12.5% sulfur (high sulfur is anything above 0.5%). The resulting hydrogen sulfide, HS, is highly poisonous to humans and corrosive in pipelines. Tengiz is in far western Kazakhstan not far from the Caspian, a remote, barren, and forbidding place where temperatures range from -25F to 100F. With little infrastructure, con- struction and support were costly. Recruiting, training, and retention of the highly skilled workforce needed proved to be a major challenge. Chevron had carefully avoided making significant up-front payments. One such clause required that production reach 250,000 barrels of oil per day (bopd) before Chevron had to make its first $420 million installment on the purchase price of $800 million. The Kazakhs saw this "invest as you go" approach as indicative of a low level of commitment, straining the relationship from the beginning. Chevron also balked at the traditional Soviet habit of expecting foreign investors to support non-business-related social infrastruc- ture such as roads, schools, and hospitals, limiting social spending to 3% of total investment. Pipe Dreams All dressed up and no place to go. That's the dilemma Chevron Corp. faces in far-off Kazakhstan. The nation's third-largest oil company is sitting on one of the world's biggest oil fields in the landlocked former Soviet republic Trouble is, after more than two years of work ana $1 billion investment, Chevron has yet to make me money on Tengizchevroil, its 50/50 joint venture with government of Kazakhstan. -"Chevron Struggling in Tengiz." by Kennuth Howe, San Francisco Chronicle, September 25, 1995, Chevron Chevron Corporation (U.S.), through a variety of political channels, succeeded in negotiating a 50% interest in the field in 1990, one day after a summit between President Bush of the United States and President Gorbachev of the Soviet Union. But the ink was barely dry when the Soviet Union broke apart. With Kazakhstan's declared indepen- dence in December 1991, negotiations began again. Kazakhstan's independence was a tenuous one. Russia continued to have strong strategic interests in its hydrocar- bons. The two countries shared a 4,250-mile border and a common people; Kazakhstan was home to more than six million ethnic Russians. The war memorial in the center of Almaty, the old capital of Kazakhstan, celebrated the Twenty-Eight Panfilov Guardsmen-Kazakhs-who defended Moscow from the German offensive in Septem- ber 1941. Chevron eventually reached a "careful agree- ment" with the Kazakhs in 1993, a 40-year business agreement to create Tengizchevroil (TCO). The business, termed a partnership, allocated a 50% interest in the field to Chevron as well as naming Chevron as the operator. The company was structured as a joint venture between Chevron and Kazakhstan. Chevron pledged $20 billion over the next 40 years. In an attempt to manage what it considered high political risks, Chevron planned to invest gradually, using reinvestment of earnings to make up the majority of new investment. Somewhat unique to the Caspian, the right to produce oil did not mean the owner could sell the oil. Without a pipe- line for transportation, the oil had no market value. As pro- duction at Tengiz began in the mid-1990s, it still had no way to market. Chevron wanted to get the oil west to the Black Sea; from there, it could then be moved by tanker to the Mediterranean and markets beyond. Eventually, $2.7 billion later and with the participation of two other major oil com- panies, one Russian (Lukoil) and one American (ARCO). the Caspian Pipeline Consortium (CPC) was created. The CPC line would carry Tengiz oil the 1,510 kilometers to the Black Sea. Operations began in 2003. A second pipeline, the Baku-Tbilisi-Ceyhan pipeline (BTC), began operation a few years later, as shown in Exhibit A. The Environment Tengiz also posed major environmental and safety chal- lenges for TCO. In 1985, before Chevron ever gained entry to Tengiz, Tengiz well #37 exploded, sending a 200-meter-high column of gas, oil, and fire into the air. Th: result was a towering inferno visible for nearly 60 min picked up by U.S. satellites watching Kazakhstan. The ti burned for more than a year before Red Adair Company Ownership interests have changed over the years. In 2016 Tengiz was 50% owned by Chevron, with ExxonMobil holding 25%; KazMunaiGaz, the national oil company of Kazakhstan, holding 20%; and LukArco, a joint venture between ARCO (US) and Lukoil (Russia), holding 5%. EXHIBIT A The Caspian Sea and Pipelines to Markets UKRAINE RUSSIA KAZAKHSTAN CPC Pipeline Black Sea Tengiz Caspian Sea GEORGIA Caspian Pipeline Consortium (CPC) Pipeline would be 980 miles in length from the Caspian Sea to the Russian Black Sea port of Novorossiysk. Largely linking existing pipeline segments, it was by far the most expeditious pipe for Tengiz oil. It would be under Russian control. Baku-Tbilisi-Ceyhan (BTC) Pipeline extended 1,000 miles from Baku, Azerbaijan, on the Caspian, through Georgia, and across Turkey, to the Mediterranean port of Ceyhan. Constructed intentionally to bypass Russia, it was constructed by a consortium of companies and countries. Requiring five years for construction, it opened in 2005. Unused capacity made it one of the promising pipes for Kashagan oil. AZERBAIJAN TURKEY ARMENIA BTC Pipeline TURKMENISTAN SYRIA IRAQ IRAN the world's leading expert on oil fires based in Houston, capped it. The environmental impacts were significant. In the following years as oil and gas developments were dictated by Moscow, the Kazakhs worried that their most precious delicacy, caviar, the eggs of the sturgeon found in the Caspian and Black seas, could be put at risk.? Any sug- gestion of oil and gas development near the Caspian, home of the most famous beluga sturgeon and caviar, faced seri- ous public opposition. Baku, devastated by oil develop- ment in the late 19th century and lying just across the Caspian, served as a reminder of how damaging unregu- lated oil development could be. Baku was now considered one of the world's dirtiest cities. Sulfur was a continuing problem. Production of oil and gas produced massive quantities of sulfur, requiring exten- sive processing. By early 2001, Tengiz had 4.5 million tons of sulfur spread out in football-field-sized cakes 7.5 meters thick. Chevron spent more than $40 million on a sulfur pel- let processing facility in 2001 to expand marketability, but with mixed success. ago, fifteen years ago when contracts were written, people didn't understand the complexities. - Richard Matzke, Chevron Texaco Vice Chairman of the Board, 2007 In 2002, after more than $2 billion in development, already the largest foreign investment in any former Soviet state, the project needed to enter a second costly stage: sour gas reinjection. This would require massive new capital investments to reinject natural gas back into the reservoir. Growing Tension In 2002 Chevron proposed financing the planned expansion of Tengiz production with the reinvestment of oil exports as part of its continuing "invest as you go" strategy. Kazakhstan objected. In addition to slowing the rate of production growth, the reinvestment would dramatically reduce the consortium's taxable profits and payments to the government, and the government needed the money. In 2003, after Kazakh courts confirmed fines against the consortium, Chevron agreed to finance new production capacity with foreign capital, as well as to guarantee Kazakh tax authorities a minimum of $200 million per year regardless of consortium profitability. As part of the agreement, President Nazarbayev passed a new foreign investment law that guaranteed that existing foreign I don't think any of us understood the complexities of what we were about to get ourselves involved in. What the Kazakh government is worried about is fixing some of the issues that were relatively unknown when some of these projects began. The production of oil and gas in the Caspian is very complex, very difficult . Ten years During the 1970s the Soviet government had regularly conducted nuclear tests in Kazakhstan now had six sulfur processing facilities in operation, the last of which alone cost $74 billion. Production hit more than 700,000 bopd in 2009. as illustrated in Exhibit B. investments in the country would not be revised but that no such guarantee would be provided for future investments. The two sides (Chevron Texaco and the Kazakhstan gov- ernment seemed to patch up some of their differences in December in an equally public display of affection- at least on the Kazakhstani side. As the biggest producer of oil in Central Asia outside Russia and the country with the most to gain from an expected surge in demand for its exports. Kazakhstan should be cultivating foreign investors. Instead, it is in danger of putting them off. In 2006. Kazakh environmental authorities demanded that TCO shut down operations as a result of the continued open-air storage of sulfur. TCO believed that the environ- mental debates were partly the result of intra-Kazakhstan tax debates, as the Kazakh federal government had recently garnered all consortium taxes to the federal level, eliminating tax flows to local municipalities in the production region. The local area courts began imposing ecological damage assess- ments and fines the consortium. TCO now made major new investments in both sulfur pellet production facilities as well as sour gas injection facilities, in which the hydrogen sulfide gases were reinjected into the Tengiz reservoir. TCO Tengiz Troubles Kazakhstan's plans to boost oil output by 60 percent over the next decade may hinge on the state's ability to reas. sure foreign majors that their billion-dollar investments will be protected by law, industry officials said. Foreign oil executives say privately they are concerned about growing state influence in Kazakhstan's lucrative energy sector and changes to the tax regime in a country with slightly more than 3 percent of the world's recoverable oil reseras - "Kazakh Oil Plans Vex Foreigners." The cow Times. October 2010 By 2010, TCO was exporting 300.000 bopd via th. CPC pipeline (at capacity) and another 300.000 bopdrail. TCO announced it would begin a major expansion of Tengiz, estimated at $16 billion, but only if a number of other new issues were settled with a variety of government ministries. EXHIBIT B Tengiz Production Bbls/day TCO completes $7.4 billion 2nd expansion of Tengiz including Sour Gas Injection (SGI) facilities and sulfur processing TCO commits to $15 billion expansion by 2016 700,000 Tengiz field discovered in 1979 and operated by Kazakh 600,000 government at minimal level until 1992 TCO and Kazakh government debate Tengiz expansion 500,000 open-air sulfur storage 400,000 Chevron forms Tengizchevroil (TCO) and enters partnership with Kazakhstan to develop Tengiz CPC pipeline consortium finally organized, May 1997 300,000 200,000 100,000 0 1990 1995 201 2000 2005 2010 TengizChevroil (TCO): Chevron 50% (U.S.), KazMunaiGaz 20% (Kazakhstan), LukArco 5% (Russia). "Field of Dreams," The Economist, January 9, 2003. the tax. TCO argued that it had a permanent exemp- Export tax, The Kazakh Oil and Gas Ministry announced in July that it was reimposing an export jax on all hydrocarbons, and TCO would have to pay. Previously, the joint venture had not been subject to tion under its operating agreement. illegal production. The Oil and Gas Ministry launched a criminal investigation against TCO in July for what it termed "illegal production," for producing oil and gas from depths at Tengiz not allowed under its pro- duction agreement. TCO argued that the production agreement had no such restrictions. Illegal flaring. The Kazakh Environmental Ministry imposed a $1.4 million fine on TCO for recent gas flaring. TCO, which had recently finished a $258 million investment in gas capture and recycling facilities, explained that the flaring was the result of an emergency situation. International employee work permits. The Kazakh Labor Ministry announced in August that all inter- national employees of TCO would now be required to have both work visas and work permits. The work permits, never required before, are customarily much more difficult to obtain. Despite the project's many problems, the development had been an economic windfall to Kazakhstan. Payments by the project to Kazakhstan totaled $15 billion in 2013, roughly 10% of the country's GDP. Since startup. TCO had contributed $90 billion to Kazakhstan. Although Tengiz was now producing and profitable, it continued to produce only 60% of its one million barrel of oil per day potential. To expand production by 2021 would require an additional investment of $26 billion. At world oil prices at roughly $45 per barrel, expansion was risky. Mini-Case Questions 1. Why would a company like Chevron invest so much capital in a project with so many risks? 2. How had Chevron tried to mitigate the political risks of the project? 3. How had the risks associated with Tengiz changed or evolved over timeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started